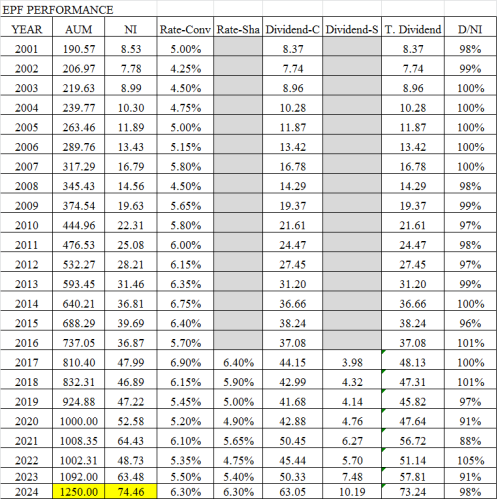

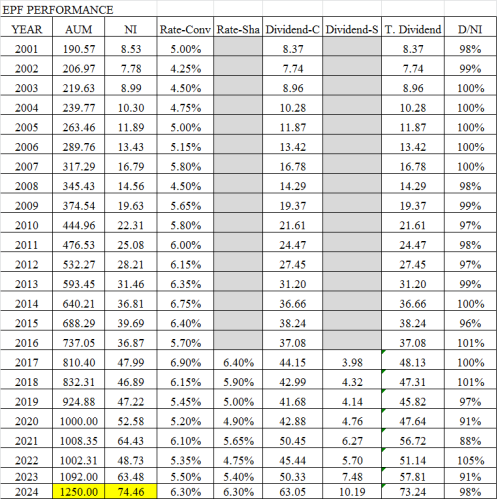

QUOTE(kechung @ Mar 4 2025, 08:24 AM)

In fact 98% payout is not exactly correct. because 74.46b is the total investment income, not the net income.

The net income can be more or less than 74.46b depend on the amt of other income & total expenses.

However, most likely other income cannot cover total expenses hence payout can be even higher.

Unfortunately this year they didn't published the net income figure & AUM for 2024.

So if payout was 98% then

2020 would be 5.6 instead of 5.2, +0.4%

2021 6.8 instead of 6.1, +0.7%.

2022 5.0 not 5.35, - 0.35%

2023 5.9 not 5.50, +0.4%

Should get extra 1.15% for 2021 to 2023.

Feb 9 2025, 10:33 PM

Feb 9 2025, 10:33 PM

Quote

Quote

0.5040sec

0.5040sec

0.48

0.48

7 queries

7 queries

GZIP Disabled

GZIP Disabled