Outline ·

[ Standard ] ·

Linear+

EPF DIVIDEND, EPF

|

MGM

|

Oct 18 2024, 06:06 PM Oct 18 2024, 06:06 PM

|

|

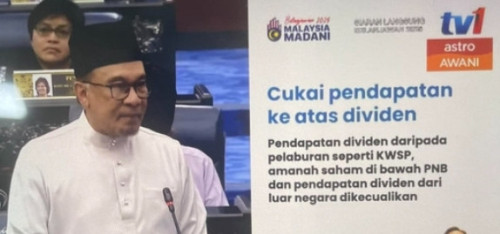

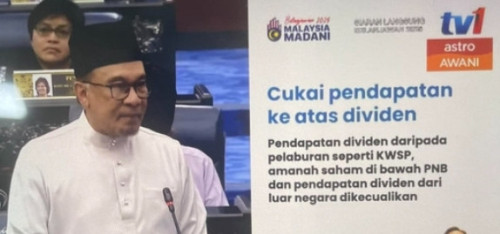

QUOTE(Rinth @ Oct 18 2024, 05:59 PM) govt consider to exempt this 2% for govt related dividend such as EPF asnb etc.... Means for now is all kena untill govt confirm exempt govt related dividend... If both epf n asmx kena tax, just transfer earlier to your loved one. |

|

|

|

|

|

MGM

|

Oct 18 2024, 06:47 PM Oct 18 2024, 06:47 PM

|

|

QUOTE(batman1172 @ Oct 18 2024, 06:04 PM) The word used is consideration (pertimbangan) to exempt from epf and pnb and foreign dividends.  |

|

|

|

|

|

MGM

|

Oct 18 2024, 10:24 PM Oct 18 2024, 10:24 PM

|

|

QUOTE(nexona88 @ Oct 18 2024, 10:17 PM) You guys keep harping about the 2% tax thingy for EPF But missed out another big news point today..

EPF intergenerational wealth transfer https://www.thestar.com.my/news/nation/2024...o-be-introducedCan transfer both ways btw parents n children? |

|

|

|

|

|

MGM

|

Oct 18 2024, 11:31 PM Oct 18 2024, 11:31 PM

|

|

QUOTE(nexona88 @ Oct 18 2024, 10:45 PM) No details on that part.. Need EPF official announcement But from the minimum news information that posted... It's more likely from Parents to Children first... Directly... Like those i-suri style... Husband to Wife 😁 Hopefully it also means can transfer epf balance to nominees upon passing. Then no need ASMx. This post has been edited by MGM: Oct 18 2024, 11:32 PM |

|

|

|

|

|

MGM

|

Oct 19 2024, 09:23 AM Oct 19 2024, 09:23 AM

|

|

Set up family office in Forest city to reduce tax?

|

|

|

|

|

|

MGM

|

Oct 19 2024, 05:54 PM Oct 19 2024, 05:54 PM

|

|

QUOTE(ronnie @ Oct 19 2024, 03:49 PM) before you die do the transfer... not after hahaha So this is already stated? pls show more official info. |

|

|

|

|

|

MGM

|

Nov 16 2024, 06:36 AM Nov 16 2024, 06:36 AM

|

|

MY public healthcare is good but now too stretched financially. Soon govt can't tahan will start reducing subsidy. Unless we have a good govt that can turn the DEBT tide.

|

|

|

|

|

|

MGM

|

Nov 22 2024, 11:55 AM Nov 22 2024, 11:55 AM

|

|

QUOTE(furuku89 @ Nov 22 2024, 11:21 AM) Most of them offer coverage up to 200K per policy. There are 5 companies providing 5 conventional and 5 takaful insurance options, so I purchased all 10 critical illness (CI) policies. Yesterday, I met with my insurance agent to add an additional CI coverage of 550K for an annual premium of RM 3,600. Then, I added 10 more policies from iLindungi totaling 1.6M (inclusive of 300K early stage and 300K life), for only RM 5,131 in annual premiums. Dont need medical test? |

|

|

|

|

|

MGM

|

Nov 25 2024, 04:56 PM Nov 25 2024, 04:56 PM

|

|

QUOTE(furuku89 @ Nov 22 2024, 01:27 AM) Today I had just max out my critical illness coverage with 10 policies from iLindungi, and I found it quite affordable compared to agents. Even my agent mentioned it's inexpensive, and it's not possible to get a quotation lower than KWSP. Am I making the right decision? Was told these policies r not autorenewable. |

|

|

|

|

|

MGM

|

Nov 26 2024, 01:57 PM Nov 26 2024, 01:57 PM

|

|

QUOTE(furuku89 @ Nov 26 2024, 01:02 PM) I've adjusted my coverage to include 5 yearly renewable policies, but I decided not to purchase the 5 one-year term policies because I find term coverage quite mafan. This change maintains a total coverage of 1 million at the age 35 smoker rate, costing RM 3,682 per annum, which is 50% cheaper than what my current agent offers. I'm staying with my current agent but have added the iLindungi scheme to my coverage. Which 5 yearly renewable policies, Life+Medical, Critical Illness? |

|

|

|

|

|

MGM

|

Nov 27 2024, 07:49 AM Nov 27 2024, 07:49 AM

|

|

QUOTE(TruboXL @ Nov 26 2024, 01:09 PM) Just do app clear data and login again Thanks, did that yesterday n it worked. Today all cant access again web portal(old & new) n app. Blody hexl handling trillion but IT tak boleh pakai. Ptui.     |

|

|

|

|

|

MGM

|

Nov 27 2024, 08:00 AM Nov 27 2024, 08:00 AM

|

|

|

|

|

|

|

|

MGM

|

Nov 27 2024, 09:30 AM Nov 27 2024, 09:30 AM

|

|

QUOTE(dudester @ Nov 27 2024, 09:25 AM) Got my kids to create their EPF account. To take advantage of I-Saraan 15% special incentive, do they need to Self Deposit or is there a way i can Send/Transfer to their account? M2u>Pay>Payee>EPF>i-Saraan |

|

|

|

|

|

MGM

|

Nov 27 2024, 05:00 PM Nov 27 2024, 05:00 PM

|

|

QUOTE(batman1172 @ Nov 27 2024, 04:23 PM) Any reason convert already cannot opt out? Sounds familiar, once u become one of them...... |

|

|

|

|

|

MGM

|

Dec 13 2024, 07:29 AM Dec 13 2024, 07:29 AM

|

|

QUOTE(Sihambodoh @ Dec 13 2024, 01:09 AM) Those aged 53 this year planning to retire in 2025 has just been fucuked by EPF? Those above 55 can still withdraw all right? |

|

|

|

|

|

MGM

|

Jan 2 2025, 01:17 PM Jan 2 2025, 01:17 PM

|

|

QUOTE(leanman @ Jan 2 2025, 11:58 AM) So far i have seen it will be reflected into the account within 2 days (no need working days) U mean t+1 via iAkaun? |

|

|

|

|

|

MGM

|

Jan 4 2025, 05:45 PM Jan 4 2025, 05:45 PM

|

|

Aiyah Just wait another 4 weeks.

|

|

|

|

|

|

MGM

|

Jan 13 2025, 09:18 AM Jan 13 2025, 09:18 AM

|

|

QUOTE(romuluz777 @ Jan 13 2025, 06:54 AM) Can start to tikam now  Please dont, dont want to come in to read worthless post. |

|

|

|

|

|

MGM

|

Jan 23 2025, 08:32 AM Jan 23 2025, 08:32 AM

|

|

QUOTE(Wedchar2912 @ Jan 22 2025, 10:42 PM) See... EPF is very good and is also thinking for those in the T20 and above... This is why the EPF, with their all-knowing thought process and benevolent intentions, decided that the new limit should be RM 1.3 million before one can withdraw the excess, starting three years from this year.Your calculation indicated 24 years to go up by 60%.... while EPF's calculation just needed 4 years to go up by 30%....    This new limit doesnt apply to those age >55 right? |

|

|

|

|

|

MGM

|

Feb 9 2025, 09:31 AM Feb 9 2025, 09:31 AM

|

|

Did some rough calculation, have 20% each in epf & ASMx, the ASMx dividend is enuf for yearly expenses. Will let epf accumulates since there is zero cost in nomination. The wonder of compounded returns.

|

|

|

|

|

Oct 18 2024, 06:06 PM

Oct 18 2024, 06:06 PM

Quote

Quote

0.0563sec

0.0563sec

0.23

0.23

7 queries

7 queries

GZIP Disabled

GZIP Disabled