Outline ·

[ Standard ] ·

Linear+

EPF DIVIDEND, EPF

|

theevilman1909

|

Feb 22 2020, 06:14 PM Feb 22 2020, 06:14 PM

|

|

QUOTE(Azury36 @ Feb 22 2020, 05:27 PM) Lol so much different between last year and this year. I think the Gov pushing so hard to get 5.45% which more than it should be What rate u think is the "real" one.. I mean without "some adjustments" 😈 |

|

|

|

|

|

theevilman1909

|

Feb 23 2020, 12:56 PM Feb 23 2020, 12:56 PM

|

|

QUOTE(ginateo99 @ Feb 23 2020, 12:50 PM) 5.45% is not great but reasonable Well looking at the market performance.. I would says is really did good on the rate.. But for next year.. I doubt would even sustain at 5% Would hit around 4+ |

|

|

|

|

|

theevilman1909

|

Feb 23 2020, 04:11 PM Feb 23 2020, 04:11 PM

|

|

QUOTE(Dd2318 @ Feb 23 2020, 01:12 PM) Remuneration of the kwsp mgmt shud be in line with % performance... Otherwise, every year simply quote 'tough environment' = gaji buta. Agreed.. It would make them work harder... |

|

|

|

|

|

theevilman1909

|

Feb 27 2020, 09:57 PM Feb 27 2020, 09:57 PM

|

|

So next question..

maintain old contribution rate or follow the latest EPF contribution cut rate 😋

|

|

|

|

|

|

theevilman1909

|

Feb 28 2020, 09:41 AM Feb 28 2020, 09:41 AM

|

|

QUOTE(GrumpyNooby @ Feb 27 2020, 10:02 PM) It's voluntary. Not first time doing this move by the government. If my old memory is still good, this should be the 3rd time. I'll stick to my original contribution even though next year dividend could slide to below 5%. Actually I'm confused.. Want to maintain or follow the new rule... That's why I'm asking around.. I'm getting mix response.... Some says Yes. Some says maintain old rate.. |

|

|

|

|

|

theevilman1909

|

Feb 28 2020, 09:48 AM Feb 28 2020, 09:48 AM

|

|

QUOTE(GrumpyNooby @ Feb 28 2020, 09:44 AM) It depends on your current cash flow and retirement goal. It's very subjective and nobody can help you except yourself/your spouse/your financial/wealth planner. Well if I get the extra.. Sure would spend it... So guess I better maintain at old rate... HR here I come with my borang 😁 |

|

|

|

|

|

theevilman1909

|

Jan 17 2024, 06:52 PM Jan 17 2024, 06:52 PM

|

|

EPF 2023 Dividend - TIKAM list

Above 6%

virtualgay - 6.88% | 6.44%

yungkit14 - 6.50%

TheEvilMan1909 - 6.45%

leo_kiatez - 6.43%

ikanbilis - 6.30%

CommodoreAmiga - 6.25%

oks911 - 6.25%

mroys - 6.25%

fuzzy - 6.20%

tehoice - 6.15% (+- 0.05%)

kiwifruit - 6.1%

Kens88` - 6.1%

romuluz777 - 6.088%

sj - 6.05

Netcrawler - 6.05

nexona88 - 6% +/-

tifosi - 6%

Pseudomonas - 6% (upper limit 6.5%)

Cubalagi - 6%

Jenn77 - 6%

kechung - 6%

Below 6%

gashout 5.95%

Gamenoob 5.92%

poweredbydiscuz - 5.85%

handsome ankle - 5.85%

prophetjul 5.83%

Rinth - 5.8%

ronnie - 5.5%

|

|

|

|

|

|

theevilman1909

|

Jan 17 2024, 10:04 PM Jan 17 2024, 10:04 PM

|

|

QUOTE(Asali @ Jan 17 2024, 08:52 PM) Highest rate so far 👍 |

|

|

|

|

|

theevilman1909

|

Jan 18 2024, 10:23 AM Jan 18 2024, 10:23 AM

|

|

QUOTE(batman1172 @ Jan 17 2024, 03:47 PM) my unit trust agent got 50+ also tell me EPF money not my money. it belongs to govt. not sure true or not. Don't ever trust those UT agents. Their main aim is to sell their own products & tell bad / negative of others. |

|

|

|

|

|

theevilman1909

|

Jan 18 2024, 12:25 PM Jan 18 2024, 12:25 PM

|

|

QUOTE(Ankle @ Jan 18 2024, 11:10 AM) Rough and approximate calculation how I came to tikam amount 3Q earnings so far 48b Assume 4Q is average of last 3 quarters = 16b gross total earnings is 64b say kwsp pays out 4 or 5b less from gross total earnings = 60b pay out to syariah is 6.5b out of about 125b principal = 5.2 pct pay out to conventional is 53.5b out of about 895b principal = 5.9 pct So we looking at 5.8 or 5.9 rates? Then some saying can get 6.5% All tcss 😁 |

|

|

|

|

|

theevilman1909

|

Jan 18 2024, 12:48 PM Jan 18 2024, 12:48 PM

|

|

QUOTE(Ankle @ Jan 18 2024, 12:44 PM) At the end of the day we can only for cast or make an educated guess. It depends on realised earnings minus liabilities , write down if any , impairments etc even creative accounting. Dont take it seriously, we here also tcss  Wait for the official announcement with abated breath ! Ours rate is. More targeted one 😁 |

|

|

|

|

|

theevilman1909

|

Jan 18 2024, 04:06 PM Jan 18 2024, 04:06 PM

|

|

QUOTE(drifters @ Jan 18 2024, 10:39 AM) When is the latest to deposit Voluntary Contribution to be able to get FULL Dividend for month of February? I would deposit on 25th, but if you want take risk. can deposit on 29th  |

|

|

|

|

|

theevilman1909

|

Jan 18 2024, 06:26 PM Jan 18 2024, 06:26 PM

|

|

QUOTE(Ankle @ Jan 18 2024, 05:58 PM) same here on 25th boom boom boom .... maybe 50k first another 50k after result of dividend is known maybe 100k one tembakan see how mood on 25th ....  many saying can get 6.5% this time  so prepared your another 50k early |

|

|

|

|

|

theevilman1909

|

Jan 18 2024, 10:42 PM Jan 18 2024, 10:42 PM

|

|

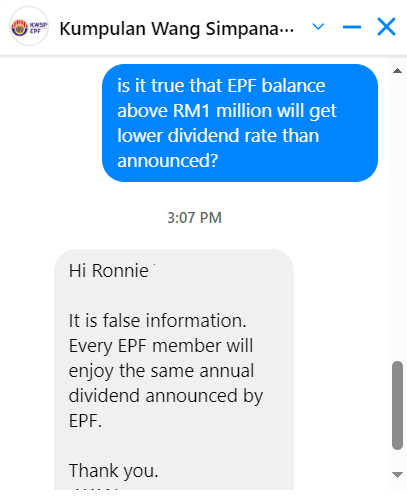

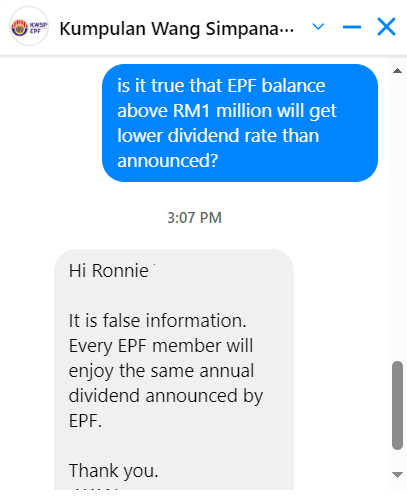

QUOTE(ronnie @ Jan 18 2024, 10:13 PM) Answer from KWSP FB  Thanks for confirming that 👍 |

|

|

|

|

|

theevilman1909

|

Jan 19 2024, 12:49 PM Jan 19 2024, 12:49 PM

|

|

|

|

|

|

|

|

theevilman1909

|

Jan 19 2024, 04:43 PM Jan 19 2024, 04:43 PM

|

|

EPF rules is dividend payment til 100yo

so they already somehow calculate Malaysian lifespan which rarely above 100yo

|

|

|

|

|

|

theevilman1909

|

Jan 19 2024, 04:47 PM Jan 19 2024, 04:47 PM

|

|

QUOTE(batman1172 @ Jan 19 2024, 03:00 PM) Better assume die at 110. I think chances of living above 110 is rare. That’s why safe withdrawal rate for epf is half the dividends assuming inflation rate is 3.5%. why do you think EPF stop accepting contribution at 75 & dividend payment till 100? because 100 is already the max possible for ordinary Malaysian |

|

|

|

|

|

theevilman1909

|

Jan 19 2024, 05:37 PM Jan 19 2024, 05:37 PM

|

|

QUOTE(MUM @ Jan 19 2024, 04:55 PM) So we need to at least have EPF money for survival till 80yo minimal 🙏 Extra is bonus & could be useful for next of kin (make sure EPF nominations is updated to latest one) |

|

|

|

|

|

theevilman1909

|

Jan 19 2024, 10:14 PM Jan 19 2024, 10:14 PM

|

|

QUOTE(Rinth @ Jan 19 2024, 03:56 PM) 90yo edi pretty good enough edi....after that dun think can walk/travel easily edi...basically that time your $$ is useless to you edi.. The children enjoying the EPF money or whoever in the nomination of EPF 👌 |

|

|

|

|

|

theevilman1909

|

Jan 20 2024, 10:34 AM Jan 20 2024, 10:34 AM

|

|

QUOTE(batman1172 @ Jan 20 2024, 08:22 AM) I don’t understand. If one contributes average a thousand a month assuming no increment and bonus for 30 years, won’t that hit 1m? Not many contribute 1k monthly... Even one does, the previous Perihatin government gave approvals for EPF withdrawal. So much of the money already gone @ reduced drastically 🙏 |

|

|

|

|

Feb 22 2020, 06:14 PM

Feb 22 2020, 06:14 PM

Quote

Quote

0.0504sec

0.0504sec

0.74

0.74

7 queries

7 queries

GZIP Disabled

GZIP Disabled