QUOTE(Wedchar2912 @ Mar 1 2025, 10:07 PM)

yeah, concur. the limit is not supposed to be static; expect it to increase... simplisticly, it will keep on increasing by 100K or something along the line of 6% thereabout.

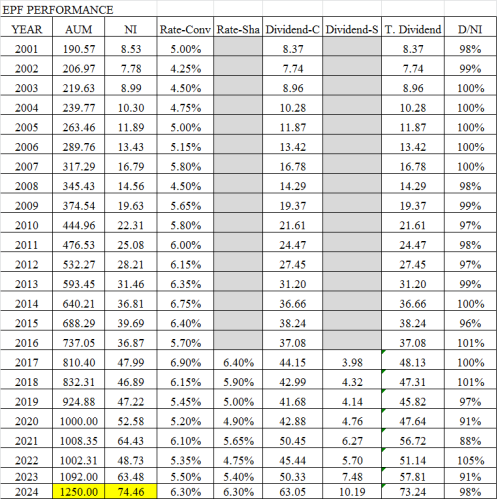

However, for consideration. If you are planning to work till 55, your salary deduction + employer contribution + 5 to 6% div, the yearly 100K limit increase may not matter much. Especially if you expect have 1 to 1.3 million in EPF by 2028. ie, your balance in epf will keep on going up really.

Plus, 43 + 4 years = 47 is not far from 50 years old. At 50, you can take out all from Account 2. That gives you some leeway.

Regardless, I fully agree with you that this limit increase is super annoying. super... (my point: what makes EPF thinks it is their duty to dictate to someone with 1.0 million in epf what to do with their money)

I must admit I assumed and treated the >1mil EPF as CASA, and that’s where my annoyance lies when they change the limit arbitrarily, and progressively up to equal to voluntary contribution. To me it means if you put in 100k per year it must stay inside until you retire.

In my own now silly assumption I was planning to park a some money for my kids tertiary education and for opportune market investment times, but after putting some to chase the 1m, now they say hotel California. These moneys are for all intents and purposes NOT a for 55 year old reaping.

Personally I think that the statutory 25% of our income deducted for fixed income retirement savings is more than enough honestly. For young people, I personally think you should consider to take some risks for better returns in business or stock market. Otherwise you benefit the country and it’s masters by allowing EPF to make 30% and giving you 6.3% and then we jump around for joy.

Lastly the actual population affected by this is 0.13+0.12 out of 16.22 which is actually the 1.5% “wealthiest”.

Why does EPF need to care so much for such a group? Except it is not, and there is a unspoken motive here.

This post has been edited by lee82gx: Mar 2 2025, 09:47 AM

Dec 20 2024, 09:10 AM

Dec 20 2024, 09:10 AM

Quote

Quote

0.0503sec

0.0503sec

0.57

0.57

7 queries

7 queries

GZIP Disabled

GZIP Disabled