Outline ·

[ Standard ] ·

Linear+

Fund Investment Corner v3, Funds101

|

wongmunkeong

|

Apr 17 2018, 09:53 PM Apr 17 2018, 09:53 PM

|

Barista FIRE

|

QUOTE(MUM @ Apr 17 2018, 09:01 PM) please see why "that" post was posted? was it posted in response/reply/query to a particular post? btw,...just found these funds (available from FSM) that had been giving double digit returns annualised as of today's data...  and majority those are the "dark horses" that our "traders of mutual funds" are throwing/dropping. PS: Clarifications - i agree those are generally good funds but since our "traders" prefer to buy high, sell low - how lar..  This post has been edited by wongmunkeong: Apr 17 2018, 09:54 PM This post has been edited by wongmunkeong: Apr 17 2018, 09:54 PM |

|

|

|

|

|

wongmunkeong

|

Jul 20 2018, 09:18 AM Jul 20 2018, 09:18 AM

|

Barista FIRE

|

QUOTE(Ramjade @ Jul 20 2018, 07:57 AM) Eunittrust money market fund is forced at 0.5 NAV. Dividend will be credited on a monthly basis without drop in NAV. Mat salleh people use etf indexing. Their 4 funds basically consist of one home fund usually s&p500 world index etf which is 50% heavy in US One bond fund. er.. i think U better read Dave Ramsey's book first, since forumer stated he's following the 7 baby steps, before commenting generically. small caps & others of it's ilk in S&P500? U kidding right? |

|

|

|

|

|

wongmunkeong

|

Jul 20 2018, 09:54 AM Jul 20 2018, 09:54 AM

|

Barista FIRE

|

QUOTE(SgtScoop @ Jul 20 2018, 09:28 AM) I'm okay with dips along the way. It's part of the business. As long as the line keeps moving upwards in the long term, I'll be happy. Since I'm new to this, I'm wondering if, in general, now is a good or bad time to buy small caps or if I should just ignore all that and get on with investing. My apologies for butting in butt..  the best time to invest is 10 to 20 years ago, ALWAYS  Just like the best time to plant trees  Consistency & clarity of action is the key. |

|

|

|

|

|

wongmunkeong

|

Jul 20 2018, 10:18 AM Jul 20 2018, 10:18 AM

|

Barista FIRE

|

-deleted-

nevermind - chicken, duck, cat talking

This post has been edited by wongmunkeong: Jul 20 2018, 10:23 AM

|

|

|

|

|

|

wongmunkeong

|

Jan 29 2021, 01:13 PM Jan 29 2021, 01:13 PM

|

Barista FIRE

|

QUOTE(WhitE LighteR @ Jan 29 2021, 10:16 AM) of course in demand, coz there is no other alternative easily accessable to the general public. malaysia investment industry damn scared of competition. to Gov, all of us need to be "protected from our own stupidity" thanks to ppl mis-selling +ppl too lazy to read/think and same ppl complaining to Gov / EPF when some of their investment (or worse all-in) go tits-up. negative feedback loop until even TD Ameritrade is on Sus! list of BNM. Dang changgih man... sigh.. This post has been edited by wongmunkeong: Jan 29 2021, 01:13 PM |

|

|

|

|

|

wongmunkeong

|

Jan 4 2023, 10:51 AM Jan 4 2023, 10:51 AM

|

Barista FIRE

|

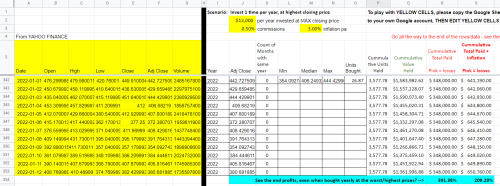

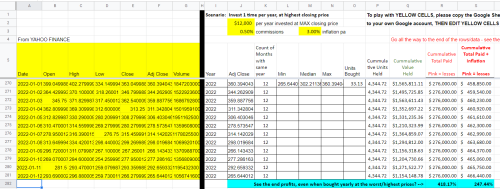

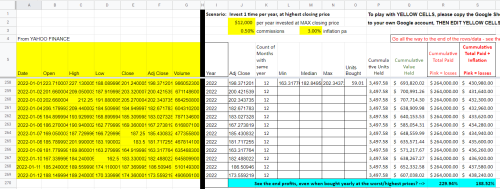

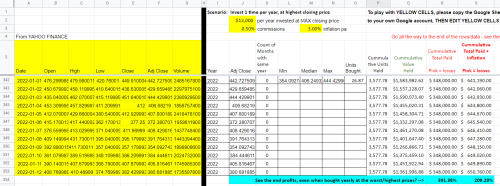

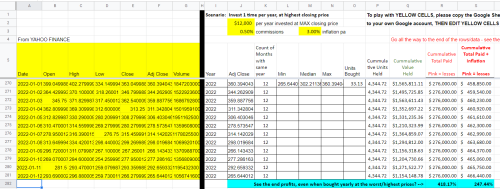

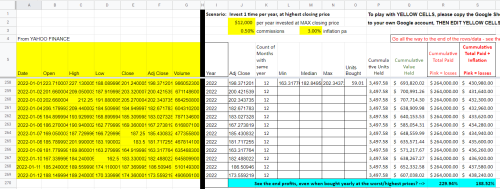

Just sharing & adding to the knowledge of lazy & statistical investing into broad based funds (ETFs used for easy data update and your own testing by downloading from Yahoo Finance) https://docs.google.com/spreadsheets/d/17L9...dit?usp=sharingSummary: If we consistently invest, even the same amount yearly, into a broad based fund, EVEN IF CURSED LUCK buying at the highest cost every single year, in the long term (20+ years data used), we still make profits even ending on a badly down year of 2022. Thus the key is ability to HODL (ie. have good cash flow planning), consistency & long-term outlook (ie. NOT quarterly). Imagine how much better if we bought at median or even sometimes, lows, especially when there's FEAR? Snapshot of SPY 1994-2022 Invested Yearly at Highest  Snapshot of QQQ 2000-2022 Invested Yearly at Highest  Snapshot of IWM 2001-2022 Invested Yearly at Highest  This post has been edited by wongmunkeong: Jan 4 2023, 10:51 AM This post has been edited by wongmunkeong: Jan 4 2023, 10:51 AM |

|

|

|

|

Apr 17 2018, 09:53 PM

Apr 17 2018, 09:53 PM

Quote

Quote

0.0941sec

0.0941sec

0.89

0.89

7 queries

7 queries

GZIP Disabled

GZIP Disabled