Outline ·

[ Standard ] ·

Linear+

Savings Account in Malaysia

|

GrumpyNooby

|

Mar 2 2021, 09:21 PM Mar 2 2021, 09:21 PM

|

|

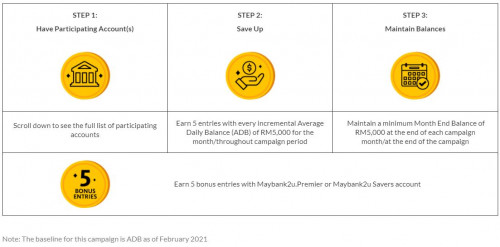

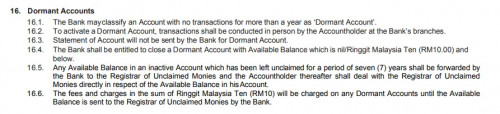

Save More & You will Gain More! Stand to Win Cash Prizes & Other Rewards!  Be in the running to win a total of RM75,000 when you ‘Save More’ with selected Maybank accounts! OR Maybank2u.Premier account holders could Earn Higher Returns when you grow your savings and perform selected services!* Campaign Period (Save More): 1 March - 31 July 2021 Campaign Period (Maybank2u.Premier : Earn Higher Returns): 1 March - 31 July 2021 Save More Campaign Prizes How to Win? How to Win? Participating Accounts Participating Accounts1. Maybank2u.Premier 2. Maybank2u Savers 3. Kawanku Savings Account 4. Basic Savings Account 5. Personal Saver Account 6. Golden Savers Savings Account Terms and Conditions of Save More Campaignhttps://www.maybank2u.com.my/iwov-resources...c_save_more.pdfCampaign link: https://www.maybank2u.com.my/maybank2u/mala...vemore0221.page?

|

|

|

|

|

|

GrumpyNooby

|

Mar 3 2021, 10:53 AM Mar 3 2021, 10:53 AM

|

|

Important Notice: Notice on Revision to Terms and Conditions Governing the CIMB Bank AirAsia Savers Account and BIG Loyalty Program (“the Program”) effective 3 March 2021Dear Valued CIMB Bank AirAsia Savers Account Accountholders, Please note the change in the name of the Program to “CIMB Bank AirAsia Savers Account and BIG Rewards Program” and the attended changes in terminology, from ‘BIG Loyalty Program’ to ‘BIG Rewards Program’. The amended terms and conditions in relation to the revised name of the Program and changes in terminology shall take effect on 3 March 2021. To view the amended terms and conditions governing the Program , please visit: https://www.cimb.com.my/en/personal/day-to-...rs-account.htmlThank you. The Management CIMB Bank Berhad Notice link: https://www.cimb.com.my/en/personal/importa...conditions.html

|

|

|

|

|

|

cybpsych

|

Mar 13 2021, 08:09 AM Mar 13 2021, 08:09 AM

|

|

Revision of AFFIN BANK Deposit Product Interest Structure Effective 01 April 20219 March 2021With effective 01 April 2021, will be revising of AFFIN BANK Deposit Product interest rate structure from simple calculation method to incremental method. The current Deposit product will be revised as below :  Revision of Deposit Rates Effective 31 March 202110 March 2021 Revision of Deposit Rates Effective 31 March 202110 March 2021We wish to inform that effective 31 March 2021, the revised deposit rates are as follows: Revision of Deposit Rates Effective 31 March 2021For more information, contact our Call Centre at 03-8230 2222, visit your nearest AFFIN BANK branch or log on to www.affinonline.com

|

|

|

|

|

|

cybpsych

|

Apr 2 2021, 07:01 PM Apr 2 2021, 07:01 PM

|

|

PB Journey Wealth Builders Programme [ PBB | T&Cs ]

|

|

|

|

|

|

BeadsCrazee

|

May 15 2021, 10:18 AM May 15 2021, 10:18 AM

|

Getting Started

|

QUOTE(GrumpyNooby @ Jan 8 2021, 05:04 PM) Anyone gotten the bonus interest for this campaign? This post has been edited by BeadsCrazee: May 15 2021, 10:18 AM |

|

|

|

|

|

axxer

|

May 26 2021, 03:16 PM May 26 2021, 03:16 PM

|

|

Finally got my new debit card for my new hlb basic saving account. I've opened it remotely via the apply@hlb android app. Pretty convenient because doesn't need to visit physical branch at all, debit card also came by postage. Just need to have an existing account with other bank for verification purpose (they didn't mention this) so cannot create a new account with them if doesn't have an existing account with other bank first.

The hlb connect android app is horrible though, looks ancient ugly with its own stupid keyboard. Mbb mae looks better miles ahead. Can't even use password manager to create long secure password. Smh

|

|

|

|

|

|

jack2

|

May 30 2021, 03:00 AM May 30 2021, 03:00 AM

|

|

QUOTE(axxer @ May 26 2021, 03:16 PM) Finally got my new debit card for my new hlb basic saving account. I've opened it remotely via the apply@hlb android app. Pretty convenient because doesn't need to visit physical branch at all, debit card also came by postage. Just need to have an existing account with other bank for verification purpose (they didn't mention this) so cannot create a new account with them if doesn't have an existing account with other bank first. The hlb connect android app is horrible though, looks ancient ugly with its own stupid keyboard. Mbb mae looks better miles ahead. Can't even use password manager to create long secure password. Smh Yes. If you transfer large amount via connect, you will know what is the next issue. |

|

|

|

|

|

axxer

|

May 30 2021, 08:41 PM May 30 2021, 08:41 PM

|

|

QUOTE(jack2 @ May 30 2021, 03:00 AM) Yes. If you transfer large amount via connect, you will know what is the next issue. I'm opening the account solely for online spending like online subscription, shopee, gplay, iTunes, Netflix etc so will only have +-100 per transaction. Definitely wont be any large transfer for sure. |

|

|

|

|

|

cybpsych

|

Jun 1 2021, 12:48 PM Jun 1 2021, 12:48 PM

|

|

There's more to bank on with the new AmOnline, whether you are home or at office! Open a new Savings Account or Current Account anytime, anywhere, directly on the app and receive 1,000 BonusLink points or the chance to win a total of RM677,000 in cash prizes! To learn more, visit https://www.ambank.com.my/AmOStay safe!     |

|

|

|

|

|

Human Nature

|

Jul 17 2021, 07:03 PM Jul 17 2021, 07:03 PM

|

|

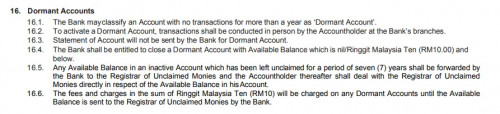

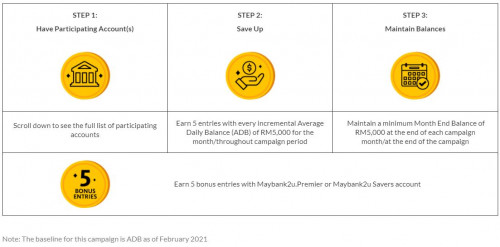

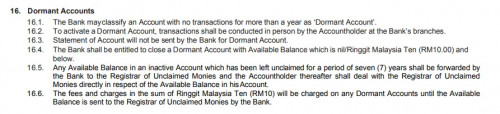

According to the T&C from Ambank below on dormant account, the RM10 fee is one time charge or is RM10 every year? I have an account with 0 balance and RM10 min deposit. It has been declared as dormant and RM10 has been deducted. This RM10 deduction comes from the RM10 min balance correct? So if I do nothing, will there be further fee incurred? Thanks  |

|

|

|

|

|

cybpsych

|

Jul 17 2021, 08:57 PM Jul 17 2021, 08:57 PM

|

|

QUOTE(Human Nature @ Jul 17 2021, 07:03 PM) According to the T&C from Ambank below on dormant account, the RM10 fee is one time charge or is RM10 every year? I have an account with 0 balance and RM10 min deposit. It has been declared as dormant and RM10 has been deducted. This RM10 deduction comes from the RM10 min balance correct? So if I do nothing, will there be further fee incurred? Thanks  should annual recurring fee All fees and charges expanded by the Bank for the maintenance and operation of the Dormant Account will be charged on the Dormant Account until the Available Balance is RM10 or below https://www.ambank.com.my/eng/rates-fees-charges |

|

|

|

|

|

Human Nature

|

Jul 17 2021, 09:05 PM Jul 17 2021, 09:05 PM

|

|

QUOTE(cybpsych @ Jul 17 2021, 08:57 PM) should annual recurring fee All fees and charges expanded by the Bank for the maintenance and operation of the Dormant Account will be charged on the Dormant Account until the Available Balance is RM10 or below https://www.ambank.com.my/eng/rates-fees-chargesIf that particular account is already zero balance? Is the bank allowed to take money from another savings account or FD? |

|

|

|

|

|

MUM

|

Jul 17 2021, 09:07 PM Jul 17 2021, 09:07 PM

|

|

QUOTE(Human Nature @ Jul 17 2021, 09:05 PM) If that particular account is already zero balance? Is the bank allowed to take money from another savings account or FD? i think clause 16.4 will be applied... |

|

|

|

|

|

Human Nature

|

Jul 17 2021, 09:12 PM Jul 17 2021, 09:12 PM

|

|

QUOTE(MUM @ Jul 17 2021, 09:07 PM) i think clause 16.4 will be applied... Yeah, i don’t mind that clause. I want to close the account but it is a joint account requiring both sides to sign. But having problem to get the other side to follow me to bank. If the bank can touch my other account or FD then problem. This post has been edited by Human Nature: Jul 17 2021, 09:12 PM |

|

|

|

|

|

MUM

|

Jul 17 2021, 09:23 PM Jul 17 2021, 09:23 PM

|

|

QUOTE(Human Nature @ Jul 17 2021, 09:12 PM) Yeah, i don’t mind that clause. I want to close the account but it is a joint account requiring both sides to sign. But having problem to get the other side to follow me to bank. If the bank can touch my other account or FD then problem. looking and interpreting this clause.... i think it will be auto close..... what do you interpret? https://www.ambank.com.my/ambank/SiteAssets...ServicesEng.pdf Attached thumbnail(s)

|

|

|

|

|

|

cybpsych

|

Jul 17 2021, 09:31 PM Jul 17 2021, 09:31 PM

|

|

QUOTE(Human Nature @ Jul 17 2021, 09:05 PM) If that particular account is already zero balance? Is the bank allowed to take money from another savings account or FD? iinm, per account basis treatment. |

|

|

|

|

|

Human Nature

|

Jul 17 2021, 09:38 PM Jul 17 2021, 09:38 PM

|

|

QUOTE(MUM @ Jul 17 2021, 09:23 PM) looking and interpreting this clause.... i think it will be auto close..... what do you interpret? https://www.ambank.com.my/ambank/SiteAssets...ServicesEng.pdfLet me write to the bank with clause 23.3 and also it has been dormant for more than 1 year, that I agree for the bank to close. Hopefully the bank doesn't point out that it is a joint account that needed all parties to agree. Will try this. |

|

|

|

|

|

Human Nature

|

Jul 19 2021, 03:49 PM Jul 19 2021, 03:49 PM

|

|

I contacted customer service to ask about the dormant account and lo and behold, it is actually either one to sign. Meaning the branch lied to me when I wanted to close the SA last time.

To answer some of my questions earlier:

- The RM10 dormant fees is charged every year

- Will not claw from other SA/FD if the balance is zero.

|

|

|

|

|

|

jeffseaw

|

Jul 21 2021, 03:24 PM Jul 21 2021, 03:24 PM

|

|

QUOTE(cybpsych @ Jun 1 2021, 12:48 PM) There's more to bank on with the new AmOnline, whether you are home or at office! Open a new Savings Account or Current Account anytime, anywhere, directly on the app and receive 1,000 BonusLink points or the chance to win a total of RM677,000 in cash prizes! To learn more, visit https://www.ambank.com.my/AmOStay safe!     Anyone successful open saving account? I've been trying everyday for a week, still not able to open the account. |

|

|

|

|

|

Lancer07

|

Jul 23 2021, 10:08 AM Jul 23 2021, 10:08 AM

|

|

Thanks for sharing, will consider it

|

|

|

|

|

Mar 2 2021, 09:21 PM

Mar 2 2021, 09:21 PM

Quote

Quote

0.0302sec

0.0302sec

1.18

1.18

6 queries

6 queries

GZIP Disabled

GZIP Disabled