bursa station is cheap and has stocks and futures with all time frame and indicator.

Bursa Traders Thread V1, Coook cooook cooook !

Bursa Traders Thread V1, Coook cooook cooook !

|

|

Oct 2 2012, 07:00 PM Oct 2 2012, 07:00 PM

|

Senior Member

1,227 posts Joined: Sep 2004 |

bursa station is cheap and has stocks and futures with all time frame and indicator.

|

|

|

|

|

|

Oct 2 2012, 07:44 PM Oct 2 2012, 07:44 PM

|

Senior Member

1,784 posts Joined: Mar 2009 From: PJ lamansara... :D |

|

|

|

Oct 2 2012, 08:15 PM Oct 2 2012, 08:15 PM

|

Senior Member

4,093 posts Joined: Jul 2011 |

|

|

|

Oct 2 2012, 08:26 PM Oct 2 2012, 08:26 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

Chef Long : I like the ECM interface (Jupiter's interface is exactly the same too) and since I don't use indicators, tradesignum charts also good enough for me.

numbertwo : Nice of you to share. Quinn: Tried Bursa Station before. Very canggih but the free ones from ECM/Jupiter is more than enough for me. Nothing beats free yes? I know, I am being a bloody cheepskate. |

|

|

Oct 2 2012, 08:35 PM Oct 2 2012, 08:35 PM

|

Senior Member

4,093 posts Joined: Jul 2011 |

QUOTE(Boon3 @ Oct 2 2012, 08:26 PM) Chef Long : I like the ECM interface (Jupiter's interface is exactly the same too) and since I don't use indicators, tradesignum charts also good enough for me. Eh.. if I go FCPO , will you call me chelf short ah? numbertwo : Nice of you to share. Quinn: Tried Bursa Station before. Very canggih but the free ones from ECM/Jupiter is more than enough for me. Nothing beats free yes? I know, I am being a bloody cheepskate. do you have the chart of FCPO? no ideas what news affect FCPO drop so so so much... now i only know FCPO per point RM25.. and our Muslim friend can only trade FCPO but cannot trade FKLI... FCPO is much more volatile compare with FKLI... want to trade FCPO or not? |

|

|

Oct 2 2012, 08:42 PM Oct 2 2012, 08:42 PM

|

Senior Member

593 posts Joined: Feb 2009 |

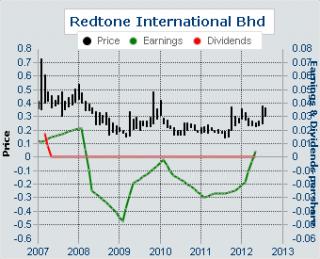

Referring to the Stock Analysis Chart closed on 2nd October 2012

Indicators 1 ) Trendline - Broke above the downtrendline (Bullish) 2) Support/Resistance - formed Higher Low ( Bullish) 3) MACD -Bullish Crossover ( Bullish) 4) RSI - Trending up from 50%( Slightly Bullish) 5) STO - Broke above 80% ( Slightly Bullish) 6) Ichimoku - a) Broke Above support cloud (Bullish). b) Conversion line below the base line (Bearish). c) Price above the baseline ( Bullish) Conclusion: Bullish - E ( Entry) : 0.345 S ( Stop Loss) : 0.315 P ( Profit) :0.375 RRR (Risk to Reward Ratio) = 1 (Average) Next Resistance at 0.355 / 0.365 / 0.38 Support at 0.34 / 0.32 /0.31/ 0.3 |

|

|

|

|

|

Oct 2 2012, 08:47 PM Oct 2 2012, 08:47 PM

|

Senior Member

4,093 posts Joined: Jul 2011 |

anyway why no ppl discuss about Kulim? |

|

|

Oct 2 2012, 08:50 PM Oct 2 2012, 08:50 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

Edwin: How about putting the name of the stock? Have to click the chat to see the name.

Redtone was one my rader last week. I am guessing that Redtone earnings should continue to be good. It's earnings should be out next month. |

|

|

Oct 2 2012, 08:54 PM Oct 2 2012, 08:54 PM

|

Senior Member

593 posts Joined: Feb 2009 |

QUOTE(Boon3 @ Oct 2 2012, 08:50 PM) Edwin: How about putting the name of the stock? Have to click the chat to see the name. Sorry.. Terlupa letak..Redtone was one my rader last week. I am guessing that Redtone earnings should continue to be good. It's earnings should be out next month. It is REDTONE..

Company Earning U Turn from Loss to Profit.. This post has been edited by edwin32us: Oct 2 2012, 08:59 PM |

|

|

Oct 2 2012, 08:57 PM Oct 2 2012, 08:57 PM

|

Senior Member

593 posts Joined: Feb 2009 |

|

|

|

Oct 2 2012, 09:01 PM Oct 2 2012, 09:01 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(kueyteowlou @ Oct 2 2012, 08:47 PM) anyway why no ppl discuss about Kulim? What do you want to discuss about Kulim? Be more straight. FCPO? Me not terror trader, so I don't know how to trade it. News: http://www.palmoilhq.com/PalmOilNews/asian...market-for-now/ Crude Palm Oil Hits Three-Year Low; ‘Bear Market for Now’ Crude palm oil futures on Malaysia’s derivatives exchange fell for a fifth-consecutive session Tuesday, hitting the lowest level in three years, reflecting tepid demand and rising supplies. The benchmark December contract at Bursa Malaysia Derivatives ended 8.5% lower at 2,255 ringgit a metric ton after tumbling as much as 8.7% to MYR2,250/ton, the lowest since November 2009. Rising supplies of the commodity weighed on prices, trade participants said. "We're talking about September production rising 20%-30% on month, surging inventories. It is very much a bear market for now, so people are just selling," a senior trading executive at a Kuala Lumpur-based foreign brokerage said. He tipped palm oil to extend declines toward MYR2,200/ton. Trading executives said end-September palm oil stockpiles might have risen to 2.25 million-2.3 million tons due to a seasonal surge in production. September shipments of palm oil from Malaysia, the world's biggest producer after Indonesia, were little-changed from August. Cargo surveyors Intertek Agri Services and SGS (Malaysia) Bhd. pegged outbound sales at 1.43 million-1.44 million tons. Meanwhile, palm oil importers in India are seeking to renegotiate contracts after prices plunged to their lowest levels in almost three years, two trading executives said Tuesday. In the cash market, refined palm olein for October was offered at $775/ton, while cash CPO was offered at MYR2,200/ton. Open interest on the BMD was 172,057 lots, versus 165,613 lots Monday. One lot is equivalent to 25 tons. A total of 49,867 lots of CPO were traded versus 38,550 lots Monday. Ending BMD Crude Palm Oil (CPO) futures prices in MYR/ton: Month Close Previous Change High Low Oct'12 2,083 2,300 -217 2,250 2,140 Nov'12 2,175 2,392 -217 2,345 2,175 Dec'12 2,255 2,464 -209 2,430 2,250 Jan'13 2,360 2,528 -168 2,495 2,36 This post has been edited by Boon3: Oct 2 2012, 09:07 PM |

|

|

Oct 2 2012, 09:08 PM Oct 2 2012, 09:08 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Oct 2 2012, 09:36 PM Oct 2 2012, 09:36 PM

|

Senior Member

1,784 posts Joined: Mar 2009 From: PJ lamansara... :D |

FCPO short at ~2800 , how much hv u guys made ??

|

|

|

|

|

|

Oct 2 2012, 10:22 PM Oct 2 2012, 10:22 PM

|

Senior Member

633 posts Joined: May 2006 |

|

|

|

Oct 2 2012, 10:40 PM Oct 2 2012, 10:40 PM

|

Senior Member

4,093 posts Joined: Jul 2011 |

QUOTE(edwin32us @ Oct 2 2012, 08:57 PM) Bearish Engulfing need bigger white candle right?Look at the small little hammer and the volume bar.. so after 2days confirmation.. it is actually quite good.. aiya.. male chicken a lot.. just a case study ... this is after the happening... QUOTE(Boon3 @ Oct 2 2012, 09:01 PM) Ahem. no matter bull bear.. u sama can cari duit mah.. What do you want to discuss about Kulim? Be more straight. FCPO? Me not terror trader, so I don't know how to trade it. News: http://www.palmoilhq.com/PalmOilNews/asian...market-for-now/ Crude Palm Oil Hits Three-Year Low; ‘Bear Market for Now’ Crude palm oil futures on Malaysia’s derivatives exchange fell for a fifth-consecutive session Tuesday, hitting the lowest level in three years, reflecting tepid demand and rising supplies. The benchmark December contract at Bursa Malaysia Derivatives ended 8.5% lower at 2,255 ringgit a metric ton after tumbling as much as 8.7% to MYR2,250/ton, the lowest since November 2009. Rising supplies of the commodity weighed on prices, trade participants said. "We're talking about September production rising 20%-30% on month, surging inventories. It is very much a bear market for now, so people are just selling," a senior trading executive at a Kuala Lumpur-based foreign brokerage said. He tipped palm oil to extend declines toward MYR2,200/ton. Trading executives said end-September palm oil stockpiles might have risen to 2.25 million-2.3 million tons due to a seasonal surge in production. September shipments of palm oil from Malaysia, the world's biggest producer after Indonesia, were little-changed from August. Cargo surveyors Intertek Agri Services and SGS (Malaysia) Bhd. pegged outbound sales at 1.43 million-1.44 million tons. Meanwhile, palm oil importers in India are seeking to renegotiate contracts after prices plunged to their lowest levels in almost three years, two trading executives said Tuesday. In the cash market, refined palm olein for October was offered at $775/ton, while cash CPO was offered at MYR2,200/ton. Open interest on the BMD was 172,057 lots, versus 165,613 lots Monday. One lot is equivalent to 25 tons. A total of 49,867 lots of CPO were traded versus 38,550 lots Monday. Ending BMD Crude Palm Oil (CPO) futures prices in MYR/ton: Month Close Previous Change High Low Oct'12 2,083 2,300 -217 2,250 2,140 Nov'12 2,175 2,392 -217 2,345 2,175 Dec'12 2,255 2,464 -209 2,430 2,250 Jan'13 2,360 2,528 -168 2,495 2,36 you dont have to be terror.. since u know tape reading.. you should know how to read it what.. Kulim is talk male chicken.. sudah reverse lo... still can go higher ah? |

|

|

Oct 2 2012, 10:43 PM Oct 2 2012, 10:43 PM

|

Senior Member

4,093 posts Joined: Jul 2011 |

this blog is seriously good blog..

look at it comment on AirAsia.. http://www.intellecpoint.com/2012/10/airas...ld-we-have.html |

|

|

Oct 2 2012, 10:49 PM Oct 2 2012, 10:49 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Oct 2 2012, 11:16 PM Oct 2 2012, 11:16 PM

|

Senior Member

8,651 posts Joined: Sep 2005 From: lolyat |

QUOTE(kueyteowlou @ Oct 2 2012, 10:43 PM) this blog is seriously good blog.. I love what he wrote, read in further and his portfolio return is top notch look at it comment on AirAsia.. http://www.intellecpoint.com/2012/10/airas...ld-we-have.html |

|

|

Oct 2 2012, 11:32 PM Oct 2 2012, 11:32 PM

|

Senior Member

4,093 posts Joined: Jul 2011 |

@Boon,

update you a little bit on FCPO.. can we catch this falling knife like JCY? and also.. is there any teruk falling for Plantation Stocks?  |

|

|

Oct 2 2012, 11:42 PM Oct 2 2012, 11:42 PM

|

Senior Member

4,093 posts Joined: Jul 2011 |

i know most of the people dont know how to read indicators... let me show u the plain chart.. clearer.. FKLI all time high.. if someone have a nice charting software.. perhaps you can help me to use Fibonacci Projection to show me how high will it goes.. |

|

Topic ClosedOptions

|

| Change to: |  0.0314sec 0.0314sec

0.32 0.32

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 2nd December 2025 - 03:11 AM |