Sharing some The Edge articles related to S-REITs:

Corporate Watch: CapitaLand Financial: The ties that bind REITs and fundsQUOTE

Goola Warden

Stories by Goola Warden (goola.warden@bizedge.com)

7 September 2020

The Edge Singapore

EDGESI

English

© 2020 The Edge Publishing Pte Ltd. All Rights Reserved.

CapitaLand’s fund management business was one bright spot in an otherwise dreary results reporting season for the property behemoth. Fee income from its REITs and private funds rose 44% y-o-y to $146.4 million in 1HFY2020 ended June. To put that in context, CapitaLand’s total fee income in 1HFY2020 was $307 million, up 11.6% y-o-y.

In 1HFY2020, the CapitaLand group reported revenue of $2.03 billion, down 4.9% y-o-y. It also reported Ebit of $596.8 million, down 71.1% y-o-y; operating profit after tax and minority interest of $261.2 million, down 27.7% y-o-y; and Patmi of $96.6 million, down 89% y-o-y. The drastic declines in Ebit and Patmi were caused by revaluation losses for CapitaLand Mall Trust (CMT) and CapitaLand Commercial Trust (CCT), announced in July.

Indeed, fees from fund management are a modest but growing part of CapitaLand’s business. Fee income represents higher return on investment and return on equity as property investment is capital-intensive. Fee income also depends on AUMs, but tends to be relatively asset-light. And despite its modest size, most fee income goes to the bottomline and hence it is likely to be a larger portion of Ebit and operating Patmi.

CapitaLand is the largest fund manager in Asia Pacific and ranked 9th globally in 2019, according to the Fund Manager Survey jointly conducted by the Asian Association for Investors in Non-Listed Real Estate Vehicles, the European Association for Investors in Non-Listed Real Estate Vehicles and the National Council of Real Estate Investment Fiduciaries in the United States.

As at June 30, total AUM at CapitaLand stood at around $134.7 billion. Of this, $74.5 billion is from a combination of private funds ($24.8 billion) and REITs and business trusts ($49.7 billion). CapitaLand announced last year that it has a target of $100 billion in AUMs from its private funds and REITs to be attained in five years.

While fee income from CapitaLand’s REITs and funds remained resilient in 1HFY2020, it will be be a challenge for 2HFY2020 to match the $191.5 million fee income recorded in 2HFY2019.

In 2HFY2019, this included the merger of Ascendas Hospitality Trust with Ascott Residence Trust (ART), the largest transaction last year, not counting CapitaLand’s own merger with Ascendas Singbridge which was completed in 1HFY2019. In addition, Ascendas REIT (A-REIT) acquired a US portfolio of 28 properties, Nucleos and FM Global which cost $1.8 billion and raised $1.32 billion through a rights issue to fund the acquisition in November. CapitaLand China Retail Trust (CRCT) also raised around $273.4 million to partly fund the $505.4 million acquisition of three malls — CapitaMall Xuefu and CapitaMall Aidemengdun in Harbin, Heilongjiang province, as well as CapitaMall Yuhuating in Changsha, Hunan province.

“We did $3.8 billion of equity fund raising of which $1.92 billion was by the REITs, CRCT, Ascendas India Trust, Ascendas REIT, and a placement by CapitaLand Commercial Trust,” recounts Jonathan Yap, president of CapitaLand Financial, in a recent interview. CCT raised $220 million in a placement in July 2019 to partially pay for Frankfurt Main Airport Center. CCT’s acquisition of a 94.9% stake in the building cost EUR251.5 million or $387.1 million at that time. Lastly, Ascendas India Trust (a-iTrust) had also raised $150 million to part fund a business park in Bangalore.

In the face of Covid-19, real estate transactions have been muted in 1HFY2020. Similarly, CapitaLand had announced fewer deals. Ascendas REIT acquired a 25% stake in Galaxis for $103 million; CRCT divested CapitaMall Erqi in Zhengzhou for $151 million; and in January, CCT and CMT announced a merger. The deal is structured such that CMT acquires each CCT for 0.72 CMT units plus 25.9 cents to form CapitaLand Integrated Commercial Trust. The long stop date is Sept 30.

25 private funds and counting

As at June 30, CapitaLand was managing 25 private funds with AUM of $15.9 billion. Last year, CapitaLand raised just under $1.9 billion through three private funds, CREDO I China, CapitaLand Asia Partners (CAP 1) and Ascendas China Commercial Fund 3.

CREDO I, which raised US$750 million ($1.02 billion), is a debt fund which invests in offshore US dollar-denominated subordinated instruments for real estate in China’s first- and second-tier cities such as Beijing, Chengdu, Chongqing, Dongguan, Guangzhou, Hangzhou, Hong Kong, Nanjing, Shanghai, Shenzhen, Suzhou, Tianjin, Wuhan, Wuxi, and Xi’an.

CAP I has a broader remit. Its mandate is to invest in selected developed market cities such as Osaka, Tokyo, Singapore, Beijing, Shanghai, Guangzhou and Shenzhen. So far, CAP I has acquired two buildings in Shanghai, Innov Center in Shanghai’s Yangpu District at a price that takes into account an agreed property value of RMB3.1 billion ($621 million), and Pufa Tower in Lujiazui CBD, Pudong.

“It’s a discretionary fund. We bought two assets in Shanghai and one in Singapore at what we believe to be a good price,” Yap says. The Singapore commercial property was acquired at around $200 million he adds. “The asset needs work to be done on it, and it is not fully stable, hence it doesn’t make sense for a REIT. The investors like to be below the radar and that’s why they don’t buy REITs and we need to respect their desire to be below the radar,” Yap explains.

All in, CAP I raised over $700 million. Around $500 million was raised in the main fund, which holds the two Shanghai properties. “We have a ‘sidecar’ arrangement,” Yap says. This is a “side” investment vehicle where some of the investors in the main CAP I fund put in more money into the sidecar where the Singapore asset is parked. “Our first close was enough for the two Shanghai properties plus a small amount for the Singapore property. We are working on a second close for CAP I but held back because of Covid as prospective investors were not able to travel for due diligence. Nonetheless, sidecar arrangements remain possible for investors who are familiar with the markets they are investing into,” Yap elaborates.

Raffles City The Bund

In its 1HFY2020 results presentation, CapitaLand announced that increasing leasing activities are taking place at Raffles City The Bund and Raffles City Chongqing — both glamorous projects on or near famous sites. Raffles City The Bund is in the North Bund, which is across the Huangpu River from Oriental Pearl Tower and Lujiazui, and is the main asset in Raffles City China Investment Partners III (RCCIP III). RCCIP III has AUM of US$1.5 billion and a life of eight years from 2016. Co-investors include Singapore’s GIC and the Canadian Pension Plan Investment Board.

How will CapitaLand get to AUM of $100 billion? “It’s about growing the existing REITs and private funds. The pool of capital is there and the platform is there; but it’s also about raising new funds. Ultimately, when investors invest with us, it is for our execution capabilities. So we would start in sectors and geographies where we have a competitive advantage in capabilities and execution which means commercial offices, logistics assets, business parks, data centres,” Yap explains.

While CapitaLand focuses on its four key markets of Singapore, China, India and Vietnam, there is also a clear demand for markets like the UK, US, Australia and Japan. “It is matching what investors want and those markets where we have an on-the-ground presence.”

CapitaLand’s capital partners and investors in its private funds include sovereign wealth funds, pension funds, family offices, institutional investors, endowment funds. “These are possible co-investors we can partner with, on the private fund side,” Yap explains.

Local precinct plans

On Nov 21, 2019, both CapitaLand and City Developments (CDL) announced redevelopment plans for the Liang Court site. In May, the duo formed a 50:50 joint venture to acquire the mall at the Liang Court site from PGIM Real Estate Asia Retail Fund for $400 million. The acquisition paved the way for the redevelopment of the entire plot.

The CDL-CapitaLand joint venture will be developing two residential towers comprising a total of 700 residential units, and an 11,530 sq m retail mall. Together, these two components should have a gross development value of more than $1 billion based on current residential prices and retail mall valuations. The rest of the commercial GFA will be made up of a hotel and a serviced residence block held under CDL Hospitality Trusts (CDL-HT) and ART respectively.

“We can play the precinct game a lot better because scale gives us the opportunity to see what is not the most obvious,” Yap suggests. Although Singapore is a small market, there are big opportunities, he adds.

Other precinct plays could involve Bugis Junction, Bugis+ and Bugis Village. “They come as a Bugis precinct and we make sure the three properties are managed in a manner they are cohesive and exist as a single solution,” Yap says.

Elsewhere, he cites International Business Park and Jurong East as the next region that could offer redevelopment potential. “We need to engage the authorities before coming up with a plan,” he says. “We are trying to go beyond ownership and tenure to figure out what makes sense as a whole so that for all stakeholders there is mutual win across the board.”

During a results briefing in August, CapitaLand CEO Lee Chee Koon said the group is interested in further developing its data centre portfolio, which was acquired through its merger with Ascendas-Singbridge. “The challenge around data centres is it’s highly regulated because of the power it consumes and it’s not so easy to grow rapidly. We have a team and newly appointed CEO responsible to look at this asset class and hope to be able to share more good news once we build up a more substantive asset class,” says Lee.

At present, CapitaLand has four data centres in Singapore — three under Ascendas REIT (Telepark, Kim Chuan Telecommunications Complex and 38A Kim Chuan Road) and one under CapitaLand’s balance sheet (9 Tai Seng Drive). The Tai Seng Drive centre offers scalable solutions such as colocation services and is built-to-suit which offers design customisation. It is also a move-in-ready white space with its own power and cooling units and a 24/7 operations team.

CapitaLand will stick with its strategy of finding value, creating value and unlocking value. “I don’t think our strategy changed with Covid-19. What may change is our approach,” Yap says. For instance, retail as a human requirement does not disappear but the approach is different.

For example, CapitaLand is harnessing offline and online opportunities such as the implementation of eCapitaMalls, and seizing larger precinct opportunities to meet challenges including the cross-selling of services such as warehousing and retail space.

“Covid actually validates CapitaLand’s strategy,” Yap concludes.

The Edge Publishing Pte Ltd

Capital: Cover Story: With new mandate, ParkwayLife REIT readies for next growth phaseQUOTE

All stories by Goola Warden(goola.warden@bizedge.com)

24 August 2020

The Edge Singapore

EDGESI

English

© 2020 The Edge Publishing Pte Ltd. All Rights Reserved.

The hospital and nursing home REIT is eyeing new markets, game-changing acquisitions and the renewal of a longer master lease

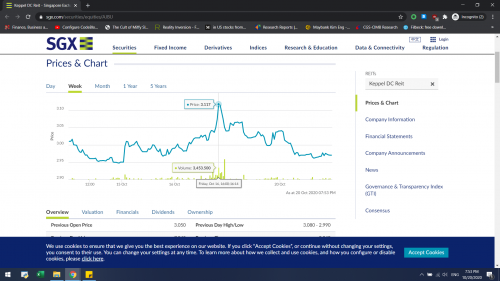

ParkwayLife REIT (PLife REIT) has consistently been one of the top-five performing REITs among Singapore-listed REITs or S-REITs, along with Keppel DC REIT, Mapletree Industrial Trust, Mapletree Logistics Trust and Ascendas REIT.

Since its IPO at $1.28 cents in 2007, PLife REIT has returned more than $1.35 to unitholders during the past 13 years. And despite the Covid-19 pandemic, PLife REIT continues to trade at a premium to net asset value (NAV) of 1.85 times as at Aug 17.

With investors waiting on the sidelines to enter PLife REIT, its recently approved general mandate provides an opportunity to invest for those who felt that its yields were too low and premium to NAV too high. The general mandate also means an opportunity for growth.

The reason why PLife REIT has done so well is partly because it is in a defensive and a growth sector — healthcare. ParkwayLife REIT is unique among S-REITs in that it owns three hospitals in Singapore, and 48 nursing homes in Japan. But it has also had the same management team for a long time.

Among them is Yong Yean Chau, CEO of PLife REIT’s manager, who joined the company in 2008, and has overseen its performance for 12 of the past 13 years.

“We stressed to investors we need to recognise that our end goal is to make sure DPU is sustainable and gives a growth story. But the priority is sustainability of distributions and that drives our strategies including capital management,” he tells The Edge Singapore in a recent interview.

“We see acquisition as a means to achieve an end and not the end goal. It must serve to add to the resilience of cash flow and increase DPU, and is not for increasing our assets under management,” he adds pointedly.

This approach sets PLife REIT apart from many S-REITs, where sponsors and managers have encouraged acquisitions to increase AUM, arguing often that size matters.

To recap, PLife REIT listed in August 2007, with a gearing ratio of 4%. Within two years, it had acquired its first Japanese nursing home portfolio. As at June 30, PLife REIT owns Mount Elizabeth Hospital, Gleneagles Hospital and Parkway East Hospital. In Japan, PLife REIT has over the years acquired 48 nursing homes, and a pharmaceutical product distributing and manufacturing facility in Chiba Prefecture. It also owns strata-titled units in MOB Specialist Clinics Kuala Lumpur in Malaysia.

In his unassuming manner, Yong says the reason for the REIT’s performance is a focused strategy in three key areas. “We adopt a very targeted approach in investing and we have a clustering approach where we focus on growing within a market, for example Japan, where we have reached a stage where we can enjoy scale and cost savings,” he explains.

Secondly, the REIT manager works proactively with the nursing home operators if there is a need for asset enhancement initiatives (AEI) to improve revenue and bottom line. Yong is careful about choosing these nursing home operators. “With stronger operators, our tenant default risk will be much lower and over time rentals would increase,” he says.

The third principle is, of course, capital management. PLife REIT uses long-term debt and natural hedges in Japan to mitigate forex risk, and adopts cash flow hedges so that DPU remains stable.

While its gearing ratio is around 38%, PLife REIT has the highest interest cover ratio (ICR) of 15.8 times. This is a new metric required by the Monetary Authority of Singapore (MAS). In 1HFY2020 ended June, PLife REIT’s revenue from the Singapore hospitals was $34.6 million, 1.8% higher than in 1HFY2019, while the Japanese nursing homes recorded revenue of $24.5 million, up 10.4% from 1HFY2019. These took total revenue — including a small contribution from Malaysia — to $60.1 million, up 5.1% from a year ago. In its first full year after IPO, PLife REIT reported revenue of $53.9 million, of which only $5.2 million was from the Japanese properties.

The nursing home operators have signed long master leases for PLife REIT’s Japanese assets. For instance, in December 2019, when PLife REIT acquired three nursing rehabilitation facilities with experienced operators for JPY3.7 billion ($46.3 million), they came with long-dated master lease agreements of 20 years. The acquisition lengthened its Japanese WALE (weighted average lease expiry) to 11.56 years as at June 30.

Most of the Japanese properties come with an “up only” rental review provision. This usually means that the rent payable can only be reviewed upwards, and not downwards. Of the 48 Japanese nursing homes, 40 properties comprising 81.8% of Japanese gross rental income have market revisions with downside protection; seven properties have revisions every two-three years subject to lessor-lessee lease agreements; P-Life Matsudo is on a fixed rent for 10 years, and one property has rents linked to the Consumer Price Index (CPI), which measures inflation.

Overall, 95% of PLife REIT’s Singapore and Japan portfolios have downside revenue protection and 59% of the total portfolio is pegged to a CPI-linked revision formula.

General mandate wins favour

Since its IPO in 2007, the number of PLife REIT units outstanding has stood at 605.02 million. That is because PLife REIT was the only REIT that did not have a general mandate to issue new units. However, as gearing inched towards 38.2%, PLife REIT held an AGM in June to ask unitholders to approve a general mandate. Under the general mandate, the REIT can issue units up to 20% of the units outstanding in a given year. In a pro-rata situation which would involve equity fund raising or rights issue, the REIT can issue up to 50% of units outstanding in a calendar year. As expected, unitholders voted overwhelmingly in favour of a general mandate.

“Over the last few years, investors and different stakeholders have asked when we were going to do the first equity issuance. Since IPO, we have not done equity issuance because we started off with a gearing of 4% and there was no need to tap equity. In Japan, cheap cost of debt also meant it did not make sense to fund acquisitions with equity,” Yong explains. “We may not activate the general mandate, but it gives us the flexibility.”

Following a well-defined growth strategy, Yong is looking to expand into a third market, with PLife REIT well anchored in Singapore and Japan contributing to 41% of revenue. Earlier this year, at the height of Covid-19 pandemic in Asia, one of PLife REIT’s Japanese properties reported a confirmed Covid-19 case. The operator stepped in quickly to quarantine the staff and residents. Subsequent testing showed them negative. Operations have stabilised, but PLife REIT retained $850,000 as part of the $1.7 million set aside to help tenants contain and manage Covid-19.

“As a landlord, besides cash flow and rental relief, we look at how we can help tenants to contain and manage the current situation,” Yong says. “That explains why a third key market is important over the longer term and why a lot of focus is on development and establishing a foothold in it,” he explains.

More likely than not, PLife REIT’s third market is likely to be a developed market with a focus on an operator with strong credit metrics. “The operator is a particular focus and must be strong, and preferably with the opportunity for further synergies, someone we can potentially partner with, not only for acquisitions but for a pipeline,” Yong says.

Yong outlines a few conditions for potential moves into a third country. Ideally, the lease should be long, with downside protection such as a inflation-linked increase in rental every year. “In Europe, we see a lot of lease structures that are downside protected, that come with CPI-related increases. The occupancy cost should not be too high though,” Yong adds.

Since DPU sustainability is key to the strategy of PLife REIT, asset valuation and DPU accretion would also be a focus. “During Covid-19, all these measures are important for sustainability of revenue. It is also important not to be too urgent in search for growth, but to focus on the fundamentals. The last thing to do is to buy overvalued assets. We took pains to build [our portfolio] over the last 12–13 years and diversifying to a third market serves to strengthen the resilience of our cash flow,” Yong explains.

“Developing a third key market is mission-critical, while looking at incremental acquisitions in Japan to give yield accretion in the next 1–2 years. The general mandate came in, and that would enable us to come up with a more optimal capital structure,” he adds.

Mount Elizabeth Novena

The most interesting part of having a general mandate would be to make a transformational acquisition. PLife REIT’s sponsor is IHH Healthcare, which is dual-listed in Singapore and Malaysia and owns Mount Elizabeth Novena which opened in 2012. As at December 2019, Mount Elizabeth Novena has a valuation of RM3.9 billion ($1.27 million).

When asked about Mount Elizabeth Novena, Yong says: “The hospital remains a good potential pipeline subject to agreement in terms of pricing and valuation, and is something PLife REIT would be keen to look at, but would depend on whether the sponsor is ready to sell the asset.”

And despite plans for a third market, Singapore will still remain a core market, Yong confirms. “PLife REIT’s strategy is to buy a good yield-accretive asset, and this would be a good potential, but it would depend on IHH Healthcare. Hopefully, over dialogue we can work something out,” he adds.

As it stands, PLife REIT’s debt headroom is around $250.1 million based on its Dec 31, 2019, valuation of $1.96 billion. If Mount Elizabeth Novena is added to the REIT’s assets, debt headroom could rise to as high as $732 million, assuming transaction price is around $1.4 billion. For a lower gearing of around 42–43%, debt headroom would be correspondingly lower. PLife REIT is trading at around 1.85 times its NAV of $1.91, and has a yield of 3.8% based on its annualised DPU of 13.44 cents.

Assuming PLife REIT would need to raise around $700 million for a 50:50 debt-equity split which would involve either equity fund raising or a rights issue, the acquisition could still be accretive due to low cost of debt as well as PLife REIT’s DPU yield and P/NAV premium.

“We are 38% geared and with our low trading yield, we want to make sure any assets we buy are good assets. We have been hesitant in doing equity fund raising because we want to show the market we will only tap your money if it’s put to good use. From various feedback, investors are comfortable for us to have a general mandate. It allows us to have the flexibility and speeds up capitalising some of the opportunities there may be in the market,” Yong says.

“To be defensive, one should not be over-geared. We are looking at low 40s at most. But not to 45%. We will remain conservative. Around 40% should be optimal. Especially during Covid-19, all the more we don’t want to over-gear, running the risk in case there are asset devaluations,” Yong cautions.

Master lease renewal

PLife REIT’s formula of the rental income for its three Singapore hospitals is tied to CPI and includes downside protection. It comprises whichever is higher: A base rent of $30 million plus 3.8% of the hospital’s revenue or [1+(CPI+1%)] multiplied by total rent payable for the preceding year. Where CPI is negative, it will be deemed as zero. The first year’s rent was $45 million.

The 14th year minimum rent is set at 1.17% above the rent payable for the 13th year on the CPI+1% formula for the period Aug 23 to Aug 22, 2021.

The initial lease term of 15 years for the three Singapore hospitals ends in August 2022. The master lessee, Parkway Hospital Singapore, a subsidiary of Parkway Pantai owned by IHH Healthcare, has the option to extend the lease for a further 15 years.

When asked if a new lease would be signed, Yong is keeping his cards close to his chest. “We engaged two valuers to help us to make sure the rates we negotiate are fair. Negotiations are underway. I don’t want to run the risk of painting too optimistic or too pessimistic a picture.” At any rate, whatever the new lease structure is, the proposal has to be approved by unitholders since it is an interested party transaction and the sponsor and manager — IHH Healthcare — cannot vote.

“It is important to stress that between sponsor and PLife REIT, we’ve enjoyed a very good working relationship over many years. When tenants’ performance improves, it benefits us, and it’s in the interests of both parties to continue this relationship,” Yong says.

And it is not just about a new lease. According to Yong, the three hospitals have been operating for many years and are quite dated. “It’s important for us and IHH, while looking at reasonable rates, to rejuvenate the assets to make them more efficient for the operators,” Yong continues. “If we can put together a package where it helps to improve the efficiency of the hospitals, that also benefits PLife REIT.”

Among the various strategies would be an IHH-funded AEI which would need landlord approval. The other model is for the REIT to help pay for the funding at certain ROIs. “The end objective is to make sure the model is a sustainable one,” Yong says.

UOB Kay Hian is pretty upbeat about the lease renewal. “The lease structure with rental escalation of CPI + 1% would be maintained. Improved profitability for private healthcare operators provides an opportunity for ParkwayLife REIT to negotiate for higher base rents.The extension of lease could be finalised by end-2020/early-2021,” UOB Kay Hian says in a recent report.

While medical tourism took a dip this year, the three hospitals were used for overruns from Covid-19. During 1HFY2020, occupancy rates hovered around 90%, similar to the levels of the past 10 years. Looking past the pandemic, Yong sees demographic trends working in the favour of the REIT with an ageing population in Japan.

More importantly, PLife REIT is the only healthcare REIT listed on the SGX to date suitable for both retail and institutional investors because of its transparency and conservative management.

The Edge Publishing Pte Ltd

This post has been edited by TOS: Sep 20 2020, 09:43 PM

Aug 7 2020, 11:15 PM

Aug 7 2020, 11:15 PM

Quote

Quote

0.7957sec

0.7957sec

0.58

0.58

7 queries

7 queries

GZIP Disabled

GZIP Disabled