Outline ·

[ Standard ] ·

Linear+

Singapore REITS, S-REITS

|

wongmunkeong

|

Oct 20 2022, 11:15 AM Oct 20 2022, 11:15 AM

|

Barista FIRE

|

QUOTE(prophetjul @ Oct 20 2022, 11:11 AM) .. and of all the REITs, Lippo shown in one of them pix having the highest gearing ratio.. Lippo and the Riadys, been there (long time back), done with that XD IMHO, second to Eagle Hospitality Trust. Thank gawd avoided that bullet |

|

|

|

|

|

wongmunkeong

|

Oct 20 2022, 11:23 AM Oct 20 2022, 11:23 AM

|

Barista FIRE

|

QUOTE(prophetjul @ Oct 20 2022, 11:18 AM) Any idea why FLCT is performing so badly. Seems like a reasonable Reit? It's down from $1.40ish to $1.10 presently. That's a big fall for an index share. sorry gold bro, no idea as i don't follow FLCT. if no fundamental issues, must be animal spiritis aka crazy market throwing out baby with bath water. |

|

|

|

|

|

wongmunkeong

|

Nov 9 2022, 11:18 AM Nov 9 2022, 11:18 AM

|

Barista FIRE

|

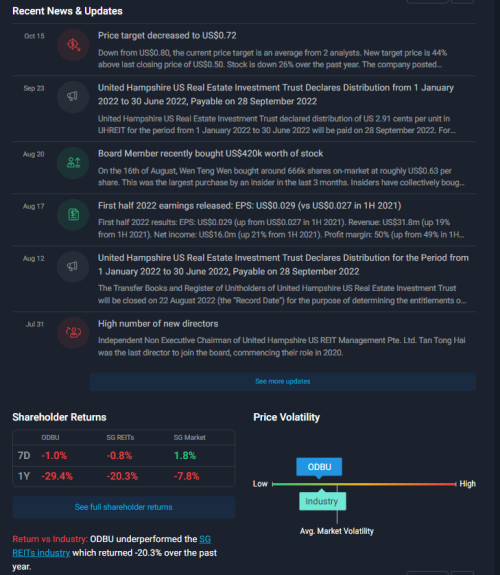

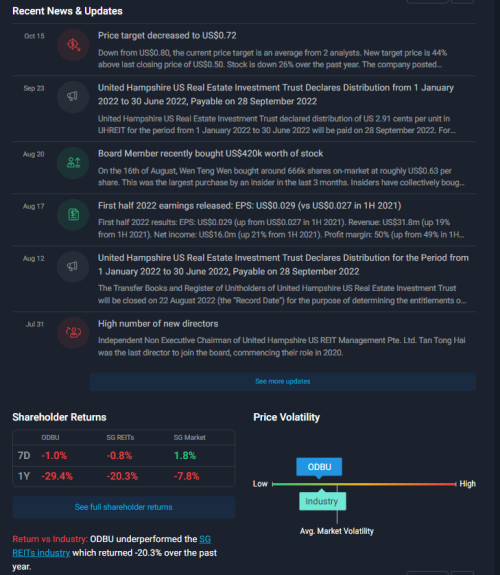

QUOTE(prophetjul @ Nov 9 2022, 10:33 AM) wongmunkeongAny thoughts on Utd Hampshire? Any reason not to add more ?  me? hehe i small time investor only - just took a nibble at USD0.51 in mid Oct based on my simpleton notes why i nibbled: a. Allocation needed to USD REITs for planned cashflow b. 50%Sponsor UOB (mum/pop is bank wor) c. DY% expected 11.62%+pa BUT high D/E 39% although retail groceries and needed biz properties I'll be nibbling again in Mar/Apr 2023 if the above is still good and if D/E doesn't go nuts - i tend to space my buy splurges every 6 or more months, U know - for time-diversification. Other than this REIT, i'll be nibbling at MInT too + some non REITs US stocks. CN - see first if the political will is there or not. PS: from SimplyWall Street https://simplywall.st/stocks/sg/real-estate...nt-trust-shares    This post has been edited by wongmunkeong: Nov 9 2022, 12:13 PM This post has been edited by wongmunkeong: Nov 9 2022, 12:13 PM |

|

|

|

|

|

wongmunkeong

|

Nov 9 2022, 04:32 PM Nov 9 2022, 04:32 PM

|

Barista FIRE

|

QUOTE(Hansel @ Nov 9 2022, 04:28 PM) Frankly,.. bro, I don't believe these sensitivity analysis. Firstly,... the analysis is only for the floating rate loans, and this effect will be negated as more refinancing of the fixed-rate loans become due. Secondly, wouldn't you think the 'debt/loan movements' are too dynamic to allow for a calculation like this ? I don'r know how to count using the sensitivity analysis. counting sensitivity - need to use emotional damage quotient XD yeah, i'm lost too This post has been edited by wongmunkeong: Nov 9 2022, 04:32 PM |

|

|

|

|

|

wongmunkeong

|

Nov 12 2022, 08:58 PM Nov 12 2022, 08:58 PM

|

Barista FIRE

|

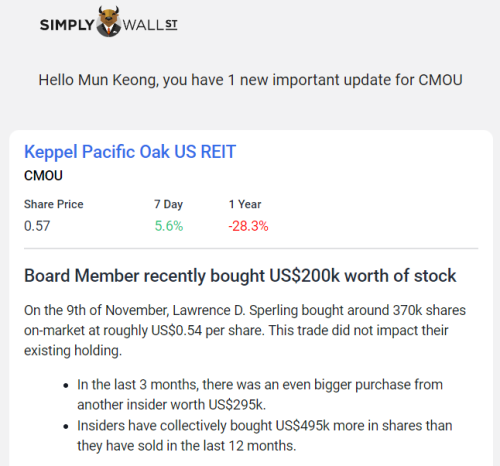

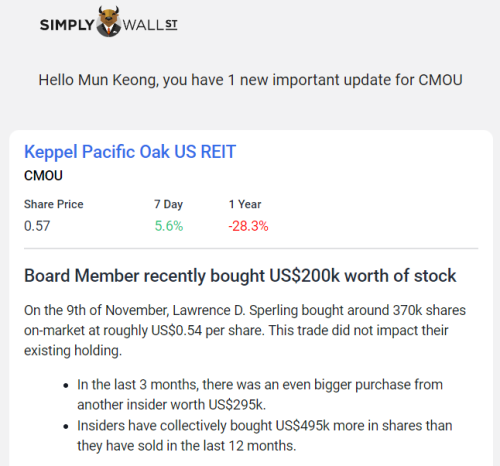

Just a quickie sharing on Keppel Pacific Oak US REIT  |

|

|

|

|

|

wongmunkeong

|

Nov 20 2022, 07:41 AM Nov 20 2022, 07:41 AM

|

Barista FIRE

|

https://www.reitasiapac.com/moodys-downgrad...-to-b3-from-b2/Moody’s Downgrades Lippo Mall Indonesia Retail Trust’s Rating To B3 From B2 Nov 19m 2022 – Moody’s Investors Service has downgraded the corporate family rating of LMIR Trust and the backed senior unsecured bond issued by LMIRT Capital Pte. Ltd., a wholly-owned subsidiary of LMIR Trust, to B3 from B2. The outlook on all ratings remains negative. The downgrade was triggered by Moody’s expectations that LMIR Trust’s rising refinancing pressure amid a tight funding environment and uncertainty surrounding the pace of recovery from the pandemic in an environment of inflation and slower growth, LMIR said in a statement.

|

|

|

|

|

|

wongmunkeong

|

Dec 2 2022, 12:15 PM Dec 2 2022, 12:15 PM

|

Barista FIRE

|

QUOTE(tadashi987 @ Dec 2 2022, 10:39 AM) shud i sell  QUOTE(TOS @ Dec 2 2022, 11:37 AM) Let's tag the usual suspects.  prophetful Hansel wongmunkeong cherroy prophetful Hansel wongmunkeong cherroyI personally think with interest rates going to peak, it might be easier for them to refinance loans, so things may not be that bad. Current yields are around to 8-9% p.a. which may be enticing for current investors to buy, but in your case, your yield will probably be around 7% p.a., so you will have to "wait" to recover the loses. It highly depends on interest rate environments. If the rates start to turn downwards, then you can reap capital gains. But if inflation failed to be tamed, the loses will compound. Another risk is that if they start doing rights placement and various equity fund raisings, then your money will be stuck for a long time due to dilutions and stagnating or even decreasing DPUs. hehe this wan simple, i can help to reach clarity: No sunk cost fallacy - assuming U dont hold those stocks, will U want to hold now - ie U like the biz, management, etc? IF Yes - sit and monitor IF No - sell sell sell! <'ala Cwazy Kramer> This post has been edited by wongmunkeong: Dec 2 2022, 12:20 PM |

|

|

|

|

|

wongmunkeong

|

Dec 11 2022, 10:58 AM Dec 11 2022, 10:58 AM

|

Barista FIRE

|

Sasseur Asset Management’s CFO Was Probed By MAS For Personal Securities Trading https://www.reitasiapac.com/sasseur-asset-m...rities-trading/ Whew finally details.. ya ya, holding Sasseur XD |

|

|

|

|

|

wongmunkeong

|

Sep 5 2023, 11:15 AM Sep 5 2023, 11:15 AM

|

Barista FIRE

|

omg.. luckily i ran fast - profited from BHG & EC (net net, including dividends)  thank gawd for dumb luck QUOTE(TOS @ Sep 4 2023, 09:18 PM) Updates from EC World https://links.sgx.com/FileOpen/ECW_Update%2...t&FileID=771544*Pursuant to the terms of the Offshore Facilities, in the event that the Offshore Interest Reserve is not topped up by the ECW Group within five business days of its release, the ECW Group would then have a cure period of ten business days to remedy its breach and top up the Offshore Interest Reserve. QUOTE(prophetjul @ Sep 5 2023, 07:58 AM) Dead man walking company. QUOTE(prophetjul @ Sep 5 2023, 08:43 AM) Another Dead man walking company. That's 2 in Chinese based Reits now. QUOTE(TOS @ Sep 5 2023, 10:10 AM) There should be a third one, BHG Retail Trust, but they are lucky to refinance all their loans last year till 1H 2025. An interesting read: https://sg.style.yahoo.com/why-refinancing-...-054700513.htmlThe original article is behind a paywall: https://www.theedgesingapore.com/capital/re...ts-takes-longer |

|

|

|

|

|

wongmunkeong

|

Sep 12 2023, 08:30 AM Sep 12 2023, 08:30 AM

|

Barista FIRE

|

QUOTE(prophetjul @ Sep 12 2023, 08:23 AM) WoW! Dropping like dominos! usually, there's more than "1 or 2 cockroaches", even if only 1 or 2 spotted  EC World needs fumigation hehe This post has been edited by wongmunkeong: Sep 12 2023, 08:31 AM |

|

|

|

|

|

wongmunkeong

|

Sep 12 2023, 03:29 PM Sep 12 2023, 03:29 PM

|

Barista FIRE

|

QUOTE(prophetjul @ Sep 12 2023, 08:32 AM) i had this EC World for quite some time. Good performance and dividends in early days. Suddenly the sponsor, who is the main tenant cannot pay their rents? WHAT GIVES? Just liquidate the assets and give the money back to the shareholders. More value there! yeah - i hope Sasseur doesnt do an EC XD |

|

|

|

|

Oct 20 2022, 11:15 AM

Oct 20 2022, 11:15 AM

Quote

Quote

0.0408sec

0.0408sec

0.72

0.72

7 queries

7 queries

GZIP Disabled

GZIP Disabled