QUOTE(fruitie @ May 30 2022, 08:46 PM)

You think the story ended? Nightmare continues.

Unless they didn't bother to Google, they will know how strong this company is.

I'm also giving up already.

Nightmare continues..

So what happened just now, she told me, her manager is sending an email to my corporate email address (as provided on the form which I'm puzzled why this is requested on the form but never mind), he just needs me to confirm "yes". I was like just a yes won't be too troublesome for me. I agreed and replied almost instantly.

Then, she messaged me that they have received my email reply. She continued with, we need your employee ID tag photo?! I

, why? That email address is not enough to prove I'm working in this company? She said if you provide this photo, then we can waive the bank statement and employment verification. Sounds like a good deal, just a photo and can waive two stuff. I sent in for sure. Then, my name on the ID tag is not as per my IC, I cannot control this because company allows my nickname to be printed on ID tag.

She said then it is not accepted. I need to show them my full name as per IC and company's name.

Is there any way I can show to them?

Finally, I got my staff to prepare a copy of my employment confirmation letter. I sent over and no news after that, maybe after working hours already.

I told her, "Your bank's VI requirement is so low that any of my VS cards (not even VI) in other banks have higher requirement than this and nobody has questioned me until this extent." Honestly, it seems they don't trust their customers, but still hoping people will apply for their cards, then make their their life miserable. I begin to admire my patience now.

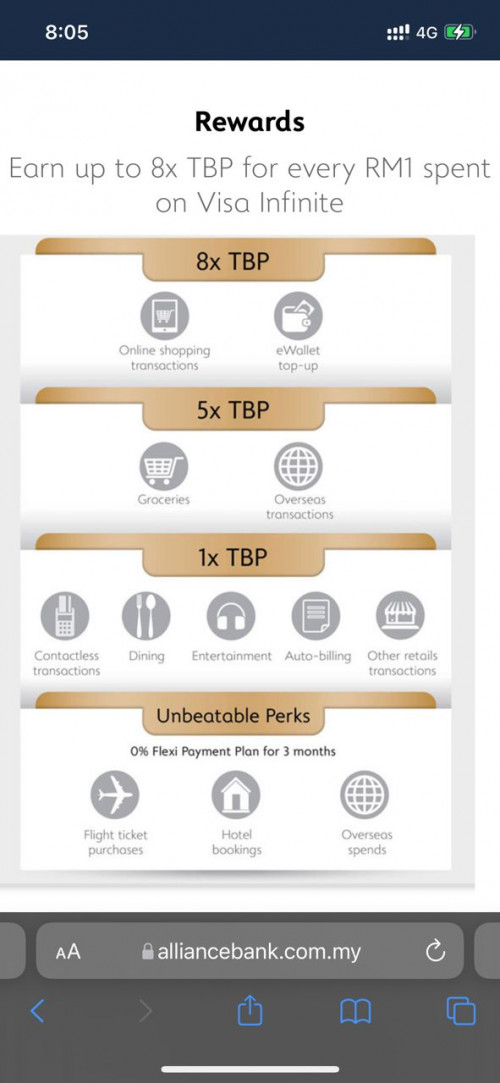

What makes you wanna go for their VI then? I thought after they changed the TBP to only the 1st 3k reloading to ewallet entitled x8 TBP, this VI macam not so good liao.

Unless got lots of online transaction apart from ewallet, then this VI is still tempting lah!

I got mine “attached” with my house loan with Alliance. So I didnt know applying CC from Alliance is so troublesome.

Anyway, for my house loan application with them, i just submitted the common required documents. And Voila, ironically, among few banks, ONLY Alliance bank approved mine🤣, with the LEAST documents required, as other banks still request for extra documents.

Dec 29 2021, 06:37 PM

Dec 29 2021, 06:37 PM

Quote

Quote

0.0923sec

0.0923sec

0.63

0.63

7 queries

7 queries

GZIP Disabled

GZIP Disabled