hmm, the platinum and infinite, both 8x also. redemption rate also same? interesting!

Credit Cards Alliance Bank Credit Card, Cash Back Platinum and VI

Credit Cards Alliance Bank Credit Card, Cash Back Platinum and VI

|

|

Oct 1 2020, 03:35 PM Oct 1 2020, 03:35 PM

Return to original view | Post

#1

|

Senior Member

1,692 posts Joined: Feb 2017 |

hmm, the platinum and infinite, both 8x also. redemption rate also same? interesting!

|

|

|

|

|

|

Oct 2 2020, 09:25 AM Oct 2 2020, 09:25 AM

Return to original view | Post

#2

|

Senior Member

1,692 posts Joined: Feb 2017 |

|

|

|

Oct 6 2020, 05:00 PM Oct 6 2020, 05:00 PM

Return to original view | Post

#3

|

Senior Member

1,692 posts Joined: Feb 2017 |

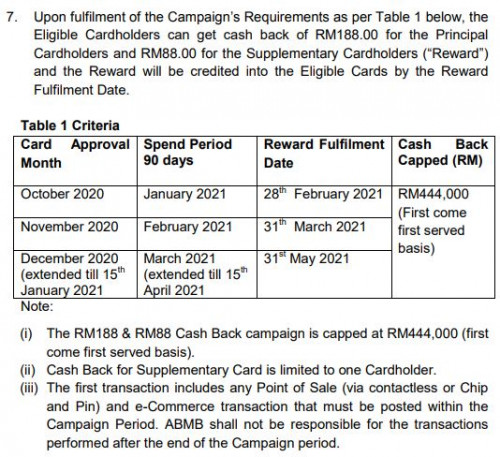

QUOTE(KiNd3rbU3no @ Oct 6 2020, 02:37 PM) https://www.alliancebank.com.my/Alliance/me...ampaign-TnC.pdf got ur card already? very fast huh!!?? Anyone trying to get the RM188 cash back ? Seems like e-wallet top up is not eligible ? or consider all spending ?  |

|

|

Oct 6 2020, 05:07 PM Oct 6 2020, 05:07 PM

Return to original view | Post

#4

|

Senior Member

1,692 posts Joined: Feb 2017 |

|

|

|

Oct 11 2020, 07:49 PM Oct 11 2020, 07:49 PM

Return to original view | Post

#5

|

Senior Member

1,692 posts Joined: Feb 2017 |

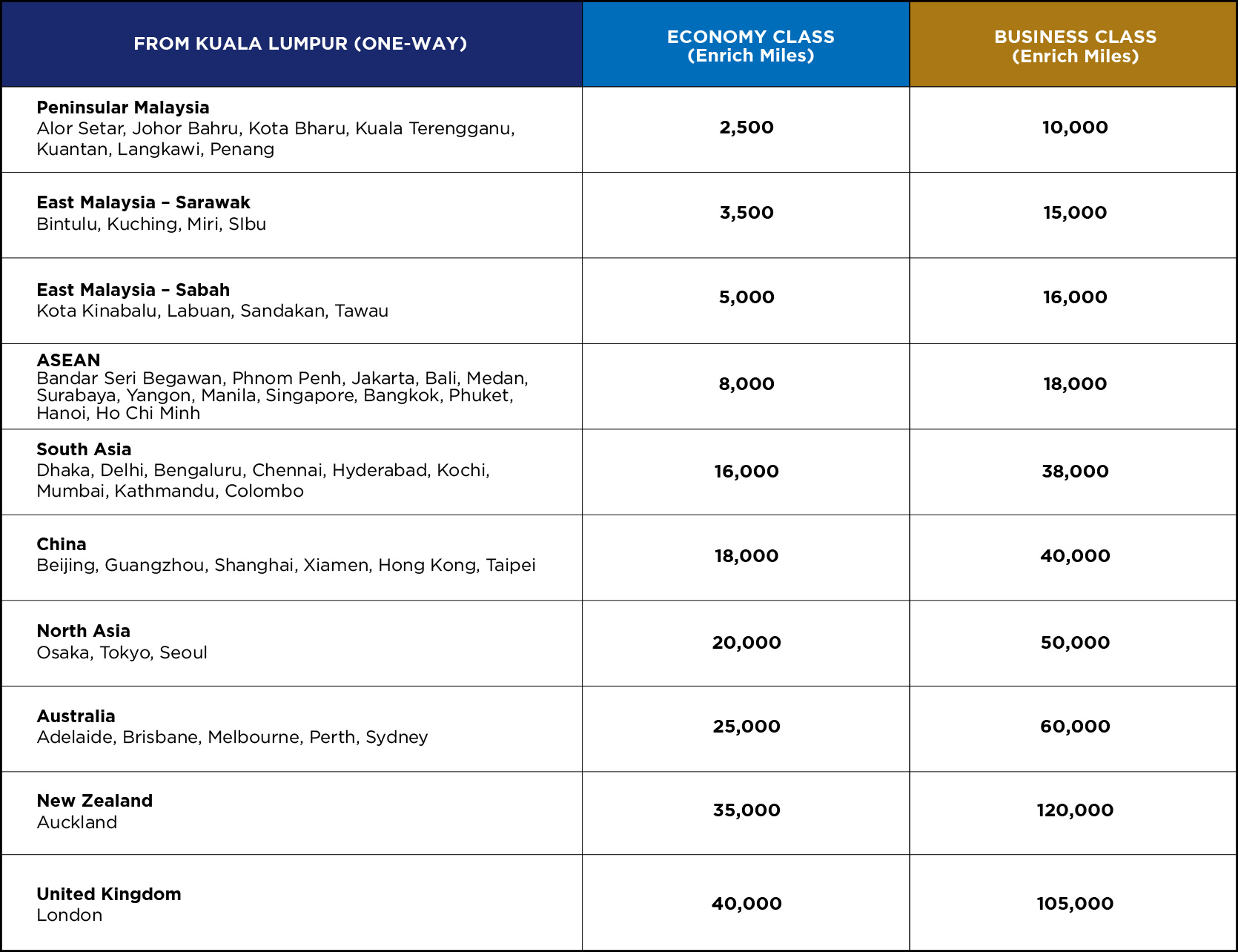

QUOTE(-kytz- @ Oct 11 2020, 05:03 PM) Affin Duo seems similar to Alliance's new Visa Plat/Infinite for online transactions and e-wallet payments but the 8x points from Alliance seems to give much more value (in terms of air miles) than the RM80/month cashback Please discuss QUOTE(!@#$%^ @ Oct 11 2020, 06:18 PM) example u spend RM41,250 scenario in 1 year,in affinduo u get RM960 / year in alliance u get 55000 miles, 50k for ur return airticket to japan / australia. then 5k miles for ur airticket tax reimbursement. take note the airticket cost abt RM2,000 so let's say u use affinduo, and u get to earn RM960 a year, then u go buy airasia ticket RM960 include tax to japan. then i must say u could have take better flight!!! This post has been edited by TheLegend27: Oct 11 2020, 07:50 PM |

|

|

Oct 12 2020, 11:15 AM Oct 12 2020, 11:15 AM

Return to original view | Post

#6

|

Senior Member

1,692 posts Joined: Feb 2017 |

QUOTE(charlesj @ Oct 12 2020, 10:28 AM) Misleading comparison. but affin duo really cap ma. problem is if u ended up travel with airasia using RM960, then really rugi lo. take note that TBP no expiry date. worse case devaluation happen u got grace period to change to EM. then EM have another 3 years since conversion.As affinduo is capped at RM80/month = RM2667 spending a month. 1 year = RM2667 x12 = RM32,000 Spending RM32k on Alliance will get you 42,700 Enrich miles. Which gives <RM800 with sunway. I do agree Enrich miles can give us more "value" if we opt to redeem flights. Unfortunately we can hardly fly during covid plus the uncertainty of MAS, many will opt for Cash in this scenario. also travel to japan just cost u 40,000 miles only. so again argument still valid. haha. refer chart below.  This post has been edited by TheLegend27: Oct 12 2020, 11:17 AM |

|

|

|

|

|

Oct 13 2020, 10:40 AM Oct 13 2020, 10:40 AM

Return to original view | Post

#7

|

Senior Member

1,692 posts Joined: Feb 2017 |

QUOTE(charlesj @ Oct 13 2020, 10:12 AM) Spot on! This is the true value for playing air miles. economy also worth more than that le. if u are those saving type and only take airasia for cheap airfare, then it is good to redeem EM economy. it equivalent to the cash u spent on airasia for MAS economy seat.As I mentioned always (ok, not in this thread), if you are redeeming economy, you rather go collect CB. The only concern for now is the sustainability for Enrich. Pray hard for them to overcome it. |

|

|

Oct 18 2020, 05:05 PM Oct 18 2020, 05:05 PM

Return to original view | Post

#8

|

Senior Member

1,692 posts Joined: Feb 2017 |

|

|

|

Oct 22 2020, 01:47 PM Oct 22 2020, 01:47 PM

Return to original view | Post

#9

|

Senior Member

1,692 posts Joined: Feb 2017 |

QUOTE(syling88 @ Oct 22 2020, 01:34 PM) QUOTE(Joey_Chin12 @ Oct 22 2020, 01:34 PM) 富贵险中求。this is the only time can "leverage" ur miles with maximum return during this pandemic. when time is peace, RM1 might not even land u a mile. |

|

|

Oct 22 2020, 05:08 PM Oct 22 2020, 05:08 PM

Return to original view | IPv6 | Post

#10

|

Senior Member

1,692 posts Joined: Feb 2017 |

QUOTE(hakkai0810 @ Oct 22 2020, 04:55 PM) ya, seems like alliance use this rule to approve / reject the application. If your existing CL more than 20x of your salary will get rejected. thats what the agent told me previously. But other bank like OCBC, CITI , UOB are approving cc to me ic. how many card limit allow? overall? how many times of our salary? |

|

|

Oct 22 2020, 10:14 PM Oct 22 2020, 10:14 PM

Return to original view | Post

#11

|

Senior Member

1,692 posts Joined: Feb 2017 |

|

|

|

Oct 28 2020, 09:21 AM Oct 28 2020, 09:21 AM

Return to original view | Post

#12

|

Senior Member

1,692 posts Joined: Feb 2017 |

|

|

|

Oct 28 2020, 10:45 AM Oct 28 2020, 10:45 AM

Return to original view | Post

#13

|

Senior Member

1,692 posts Joined: Feb 2017 |

|

|

|

|

|

|

Oct 28 2020, 11:03 AM Oct 28 2020, 11:03 AM

Return to original view | Post

#14

|

Senior Member

1,692 posts Joined: Feb 2017 |

|

|

|

Oct 28 2020, 11:38 AM Oct 28 2020, 11:38 AM

Return to original view | Post

#15

|

Senior Member

1,692 posts Joined: Feb 2017 |

QUOTE(gordonchin @ Oct 28 2020, 11:30 AM) No lah intend to keep only 1 card in fact. To get miles back on my spending. i can imagine u have 2 supp, plus u 3. just boost alone, RM5k x 3 = RM15,000. u will have 120,000pts equivalent to 20,000 miles. 1 years is 240,000 miles!!!!! family trip already!!!Applied this because M2P rejected me |

|

|

Nov 13 2020, 05:21 PM Nov 13 2020, 05:21 PM

Return to original view | Post

#16

|

Senior Member

1,692 posts Joined: Feb 2017 |

QUOTE(Darren @ Nov 13 2020, 04:45 PM) https://www.alliancebank.com.my/promotions/...atshot-01112020 if principal VI. then supplementary also VI. if spend RM800, got cashback RM188 lo, if u got supp, another RM88 bonus.anyone applying alliance card under this campaign? the cashback only apply for visa infinate and visa platinum? or the principal must be visa infinate and supplementary card visa platinum? somehow i get confuse with this campaign and the staff who call me oso blur blur..... totally speechless.... btw, the cashback for principal and supplementary card is require rm800 per card or accumulated rm800 by both card combine? the cashback requirement oso confusing.... |

|

|

Nov 14 2020, 09:26 AM Nov 14 2020, 09:26 AM

Return to original view | Post

#17

|

Senior Member

1,692 posts Joined: Feb 2017 |

QUOTE(Darren @ Nov 13 2020, 06:45 PM) Are u sure about this? ic. possible. but nowadays spending 800 like nothing. topup bigpay 1k can already each card. then withdraw out.Just now I try call alliance bank contact centre. The staff told me the I can apply for principal o principal+supp If I apply principal only, I can get rm188 after spending rm800 If I apply principal + supp, I can get rm188 + rm88 for rm800 spending for each of the card. Mean u need to spend rm1600. That why I feel so confusing. What the point I apply supp card to get rm88 cashback for rm800 spending when I can ask my wife to apply principal card for rm188 cashback for same usage. |

|

|

Nov 14 2020, 10:45 AM Nov 14 2020, 10:45 AM

Return to original view | Post

#18

|

Senior Member

1,692 posts Joined: Feb 2017 |

|

|

|

Nov 16 2020, 09:40 AM Nov 16 2020, 09:40 AM

Return to original view | Post

#19

|

Senior Member

1,692 posts Joined: Feb 2017 |

|

|

|

Nov 16 2020, 09:41 AM Nov 16 2020, 09:41 AM

Return to original view | Post

#20

|

Senior Member

1,692 posts Joined: Feb 2017 |

|

| Change to: |  0.0316sec 0.0316sec

0.65 0.65

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 10th December 2025 - 08:39 AM |