QUOTE(crixalisrox @ Jul 16 2025, 02:24 PM)

damn i learned something new. But is it worth to do it with the currency lost and 1% bank fee?

Personally i try to minimize oversea CC usage because i always think that currency spread & fees is higher.

Lets take SGD for sample calculation

Visa rate with 1% bank fees

1 SGD = 3.361925 MYR (https://www.visa.com.my/support/consumer/travel-support/exchange-rate-calculator.html)

1 SGD = 3.302 MYR (Midvalley rate)

1k SGD spend = rm60 different in currency exchange.

rm3362 * 10TBP = 33620 points = 2k Enrich Miles

Probably still got some advantage but not much? correct me if im wrong since this is my first time doing this

Hmm for this is very personal, some people prefer cash and money sitting in bank account is better. But if you are just referring to "value" itself. I think spending by card is slightly better?

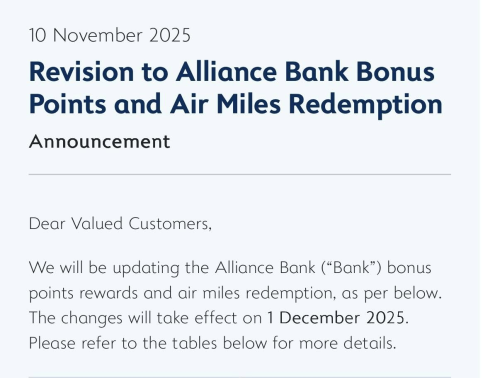

Exanple visa rate is 1%, alliance bank takes 1.25% so total will be 2.25% of your bill. Means RM 1000 bill will become RM 1022.50. But 1022.50 will gain you around 680 enrich point by new revision rate of Alliance VI, while enrich point worth around 0.8-20 sen and we take median as 1.4 sen per point it worths around RM 94 or as low as RM 54.

Some may think its worth, some may think why shouldn't it keel that 22.50 in my bank account instead? So if you don't mind spending a bit more, then card is not really that bad in term of value.

Its all about your financial and spending behaviour.

Nov 15 2024, 09:41 AM

Nov 15 2024, 09:41 AM

Quote

Quote

0.0241sec

0.0241sec

0.29

0.29

7 queries

7 queries

GZIP Disabled

GZIP Disabled