hi..the visa infinite card has monthly cap/ceiling for points accumalation?

Credit Cards Alliance Bank Credit Card, Cash Back Platinum and VI

Credit Cards Alliance Bank Credit Card, Cash Back Platinum and VI

|

|

Oct 13 2020, 11:33 PM Oct 13 2020, 11:33 PM

Return to original view | IPv6 | Post

#1

|

Junior Member

559 posts Joined: May 2006 From: 1,234 |

hi..the visa infinite card has monthly cap/ceiling for points accumalation?

|

|

|

|

|

|

Oct 18 2020, 02:16 PM Oct 18 2020, 02:16 PM

Return to original view | IPv6 | Post

#2

|

Junior Member

559 posts Joined: May 2006 From: 1,234 |

QUOTE(Darkmage12 @ Oct 18 2020, 02:15 AM) no cap. i got ans from the sa. anyway, i also realise points not available for petrol. do take note. d) TBP will not be awarded for petrol (except for Platinum Card) and government agency transactions This post has been edited by 47100: Oct 18 2020, 02:18 PM |

|

|

Oct 18 2020, 02:49 PM Oct 18 2020, 02:49 PM

Return to original view | IPv6 | Post

#3

|

Junior Member

559 posts Joined: May 2006 From: 1,234 |

QUOTE(Darkmage12 @ Oct 18 2020, 02:45 PM) VI is definately better. grocer has 5x https://www.alliancebank.com.my/promotions/...8-Cashback.aspx |

|

|

Oct 18 2020, 08:20 PM Oct 18 2020, 08:20 PM

Return to original view | IPv6 | Post

#4

|

Junior Member

559 posts Joined: May 2006 From: 1,234 |

|

|

|

Nov 3 2021, 11:18 PM Nov 3 2021, 11:18 PM

Return to original view | IPv6 | Post

#5

|

Junior Member

559 posts Joined: May 2006 From: 1,234 |

|

|

|

Nov 13 2021, 10:09 AM Nov 13 2021, 10:09 AM

Return to original view | IPv6 | Post

#6

|

Junior Member

559 posts Joined: May 2006 From: 1,234 |

QUOTE(jimhorn @ May 5 2021, 02:21 PM) Yeah shouldn't have any problem. I don't think there's a cap for points earned. Only limit is your credit limit i asked before this to CS, there is no annual cap on points earned like other bank cc. hence, the theoretical limit will be ur credit limit. which kinda like unlimited if you pay and reload pay and reload … anyway high chance it will be flagged as suspicious so be careful on repetitive transactions |

|

|

|

|

|

Dec 21 2021, 10:53 AM Dec 21 2021, 10:53 AM

Return to original view | IPv6 | Post

#7

|

Junior Member

559 posts Joined: May 2006 From: 1,234 |

|

|

|

Jan 16 2022, 04:16 PM Jan 16 2022, 04:16 PM

Return to original view | IPv6 | Post

#8

|

Junior Member

559 posts Joined: May 2006 From: 1,234 |

QUOTE(guanteik @ Jan 16 2022, 02:27 PM) If you're huge spender = go for Infinite because your TBP are unlimited. Plus the feeling of redeeming something be it Enrich or merchandize AT ONE SHOT is gives a greater feeling than just the pathetic cashback monthly. i Agree Not sure about others, or this is just me. infinite for the timeless bonus, just keep collecting .. |

|

|

Feb 16 2022, 10:57 AM Feb 16 2022, 10:57 AM

Return to original view | IPv6 | Post

#9

|

Junior Member

559 posts Joined: May 2006 From: 1,234 |

QUOTE(!@#$%^ @ Feb 16 2022, 10:35 AM) i applied infinite thru the website, someone from the bank called and emailed, i sign the papers scan back to them..all done without any meetup. approved and got the card by citilink, you need to sign the courier. This post has been edited by 47100: Feb 16 2022, 10:57 AM |

|

|

Feb 18 2022, 01:00 AM Feb 18 2022, 01:00 AM

Return to original view | IPv6 | Post

#10

|

Junior Member

559 posts Joined: May 2006 From: 1,234 |

|

|

|

Feb 20 2022, 03:07 PM Feb 20 2022, 03:07 PM

Return to original view | IPv6 | Post

#11

|

Junior Member

559 posts Joined: May 2006 From: 1,234 |

too many ppl abusing the x8 on ewallet reload 😂😂😂

|

|

|

Feb 20 2022, 05:15 PM Feb 20 2022, 05:15 PM

Return to original view | IPv6 | Post

#12

|

Junior Member

559 posts Joined: May 2006 From: 1,234 |

QUOTE(guanteik @ Feb 20 2022, 03:53 PM) Well, to an extend, the abuse is not the right word because eventually the consumer still have to pay the statement end of the month. EWallet companies have also implemented fraud where customers make frequent withdrawal resulted in permanent banning, therefore your statement can’t be true. yes I agree abuse is a strong word but I don’t think you will disagree there are certain group of people really whack this TBP to the max. some people can transfer within family or friend and withdraw it out. or paid it out. A lot of the businesses are already moving to eWallet. Even some e-commerce are accepting both eWallet payment and conventional credit card payments, the preference still on the eWallet. E.g. free shipping with Shopee eWallet as compared to using CC payment direct. The ground about this Alliance CC is on the eWallet reloads, and online payments. While the whole country has moved to the new form of payment, these banks aren’t. I’d prefer they increase the eligibility of this card application, or even increase the AF to filter out genuine and qualified spenders while maintaining their initial benefits offered instead of cutting the largest chuck of benefits used by most consumers. Note: I’m an extreme heavy user of eWallets therefore my comment in this post is solely my opinion! In any angle , the bank will not benefit. It is abuse to bank if we just deposit and withdraw. bank have to “pay” the TBP to consumer. surely they will remove or reduce the benefit if they see no healthy ROI since the card launching.. we already saw this in other banks, so in future I won’t be surprise they go down to cap at rm1000. some bank totally remove the points when reloading into e-wallet. Probably alliance will do the same in future too. then we can decide to cut to stay. is market driven decision anyway. |

|

|

Feb 20 2022, 05:20 PM Feb 20 2022, 05:20 PM

Return to original view | IPv6 | Post

#13

|

Junior Member

559 posts Joined: May 2006 From: 1,234 |

QUOTE(LuckyBai @ Feb 20 2022, 03:13 PM) But it sounded like credit used to topup ewallet the people no need to pay back to the bank or the bank cannot offer their users for other bank portlios like BT or Instalment ... That doesn't make sense.. u are probably right, the team designing this card probably on a hot stone because they can’t hit what they plan, therefore “optimising” this card feature ..Anyhow, the bank should just admit that they cannot get the data they wanted such as the spending patterns, categories .. So is the bank finding themselves disconnecting with their users or the bank is now officially not establishing connections on the ground with their users of this change?? |

|

|

|

|

|

Feb 25 2022, 11:16 AM Feb 25 2022, 11:16 AM

Return to original view | IPv6 | Post

#14

|

Junior Member

559 posts Joined: May 2006 From: 1,234 |

|

|

|

Mar 7 2022, 11:17 AM Mar 7 2022, 11:17 AM

Return to original view | IPv6 | Post

#15

|

Junior Member

559 posts Joined: May 2006 From: 1,234 |

QUOTE(Gatsby IT @ Mar 7 2022, 11:12 AM) True frequent withrawal can raise suspicion , I am now thinking bigpay 1k per month per card(each family member) 😂 since the money can practically stay inside and only transfer out every 10months or move to my IBKR invesment account directly . do note same card to reload into diff e-wallet account will raise red flag too. Btw u have idea for supplementary card , they share the same first 3k 8x point threshold ? If I sub card to my mum we both share the first 3k or each first 3k hmmm . however I have no clue on the threshold limit. the CS dont tell. |

|

|

Mar 21 2022, 10:00 AM Mar 21 2022, 10:00 AM

Return to original view | IPv6 | Post

#16

|

Junior Member

559 posts Joined: May 2006 From: 1,234 |

|

|

|

Apr 15 2022, 09:01 AM Apr 15 2022, 09:01 AM

Return to original view | IPv6 | Post

#17

|

Junior Member

559 posts Joined: May 2006 From: 1,234 |

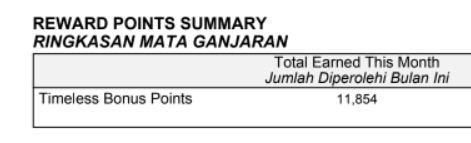

QUOTE(jimhorn @ Apr 13 2022, 11:59 AM) Good to hear that man. Hopefully they will automatically credit back the missing points for those who didn't get it after the new changes just checking my latest statement dated 12/4 for VIi made a reload:  and i got rewards below:  does this mean have wait next round statement? Tried to call CS but officer tell me credit dept line full queue This post has been edited by 47100: Apr 15 2022, 09:01 AM |

|

|

May 12 2022, 03:50 PM May 12 2022, 03:50 PM

Return to original view | IPv6 | Post

#18

|

Junior Member

559 posts Joined: May 2006 From: 1,234 |

anyone got unauthorised transaction for apple?

APPLE.COM/BILL ITUNES.COM IRL MYR 19.90 i did not tie the CC to the apple ID but somehow it got charged. i immediately called Cs blocked the card. |

|

|

Jun 11 2022, 02:05 PM Jun 11 2022, 02:05 PM

Return to original view | IPv6 | Post

#19

|

Junior Member

559 posts Joined: May 2006 From: 1,234 |

|

|

|

Jul 14 2022, 04:46 PM Jul 14 2022, 04:46 PM

Return to original view | IPv6 | Post

#20

|

Junior Member

559 posts Joined: May 2006 From: 1,234 |

|

| Change to: |  0.0379sec 0.0379sec

1.49 1.49

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 17th December 2025 - 04:20 PM |