Bird,

Your advise is completely useless for a noob. Study what? Look for what detail? to a noob, he may be looking at entirely different thing and come to a different conclusion altogether from what you intended.

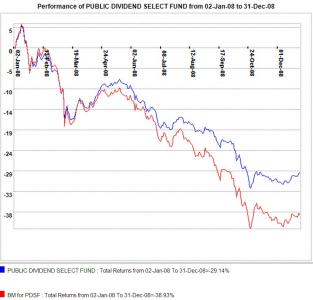

I also apologise for recommending PCSF. I was being an arsehole. It is the worse fund in the entire Pub-mut inventory. I just realise how dangerous my jest can affect a noob investor, I sincerely apologise.

To those who ask which fund to buy, you will actually get the answer if you just browse through a few pages back. It was discussed already. Funds are not like stock, their characteristic does not change frequently. And it is also futile to time their entry and exit point. Using technical analysis like Moving average, cross-over and stochastic bounce, relative strength index etc is mute and poor choice of instrument to assess unit trust.

For unit trust, actually their measure of performance is quite simple. Look for those that out-perform relative to their benchmark in terms of ROI while keeping their volatility aka standard deviation lower than the benchmark, These are already hallmark of superior unit trust fund. In the market, with hundreds of unit trust available, not many can do these continuously. It is the job of superior fund manager to do that and it is the job of investors like me to find them, invest through them, pay them their due i.e., annual management fee.

So, for noob like Sarah & Vit, to simplify things, download a copy of the latest public mutual quarterly fund review from their website, and select funds that have at least four morning star rating and above. Why do I say that? It is because Morningstar actually study the same parameters as I said above and ranked them. So they already have done the research on your behalf, free of charge. Use that, they are a good guide and a good start.

Once you have short-listed the funds, then read their fund fact sheet which is a two-page summary of the characteristic of the fund, whether the fund manager uses aggressive style, or more moderate risk taker; where geographically she invest; what asset class she invest in, etc. Spend some time to read those, do a little homework. I am teaching you how to fish rather than just feeding you fish.

Thank you for reading this. Happy investing.

Xuzen out.

, u r the master.

Dec 8 2013, 06:05 PM

Dec 8 2013, 06:05 PM

Quote

Quote

0.0327sec

0.0327sec

0.96

0.96

7 queries

7 queries

GZIP Disabled

GZIP Disabled