QUOTE(alex4843 @ Aug 9 2013, 11:24 PM)

hello peeps,

I just came across this info, and i found out that this idea actually work and logical.

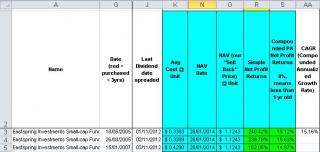

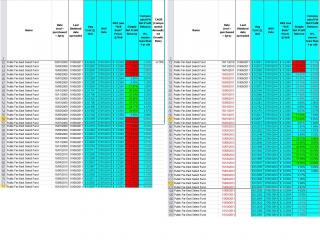

To sell off when a fund is going to declare distribution and reap the capital gain. and then buy back. After all, we will still get the distributed unit .

is this what the Unit trust Pro doing?

"this idea actually work and logical"?I just came across this info, and i found out that this idea actually work and logical.

To sell off when a fund is going to declare distribution and reap the capital gain. and then buy back. After all, we will still get the distributed unit .

is this what the Unit trust Pro doing?

er.. have U calculated the cost & time to execute? Done it hands-on? worth the hassle?

NEXT!

This post has been edited by wongmunkeong: Aug 9 2013, 11:43 PM

Aug 9 2013, 11:27 PM

Aug 9 2013, 11:27 PM

Quote

Quote

0.0633sec

0.0633sec

0.45

0.45

7 queries

7 queries

GZIP Disabled

GZIP Disabled