QUOTE(yehlai @ Jun 26 2012, 03:17 AM)

No lock in means the rate is prone to change.

Like from -2.4 to -2.3%

Since -2.4% is one of the best offer of all time, so it's better off to lock it?

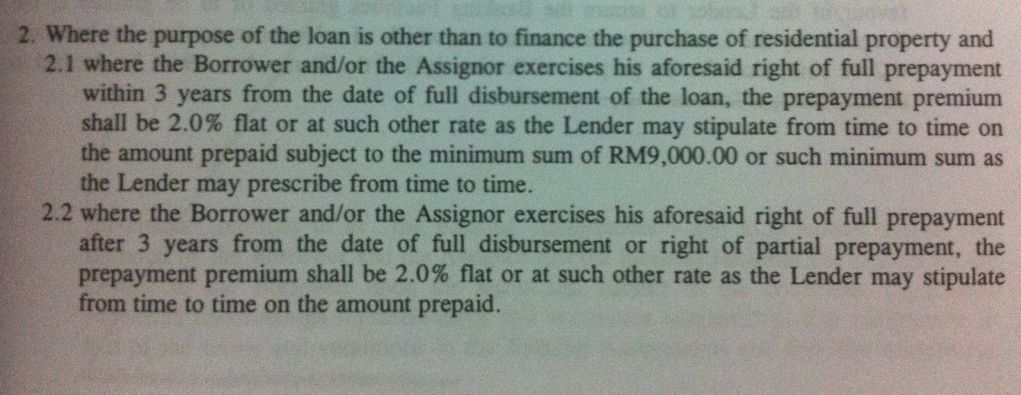

Incorrect. Lock in is about the period in which you will get penalise or pay a penalty for fully settling your loan (with cash or with loan from another bank, etc). It is not about locking in the -2.4 or-2.5.

Totally different thing.

Added on June 27, 2012, 10:30 amQUOTE(tikaram @ Jun 26 2012, 11:09 AM)

Is this confirm? " only applicable for Islamic loan only" & " conventional loan will be remained unchanged"

if it is confirm.

What is the strategy for new property buyer? getting islamic loan or conventional loan? & why?

Can give one example for below? it possible some computation, ok?

" The only different is your stamp duty for the loan will have to pay more because of the Selling Price after the end of the loan tenure in Islamic loan agreement is higher. "

why do you need to do so? SOme people already getting Loan from foreigner bank (at -2.3 or -2.4) without any lock in period.

Added on June 27, 2012, 10:50 amBack to this topic , has anyone got updated information on the impact on this no-lock in period or removal of lock in period for existing loan that is still under lock in period.

I guess for those with loan that is already lapse the lock in period, this has no impact at all. For new loan, if bank is forced not to impose the lock in period, then do expect some sort of counter reaction from them, either charging management fees, or not providing very good rate, etc. Now some loan without lock in and still can get -2.4, i guess this is a reflection of the competitivenes sof the current market.

This post has been edited by spydermind: Jun 27 2012, 10:50 AM

Jun 26 2012, 05:02 PM

Jun 26 2012, 05:02 PM

Quote

Quote

0.0248sec

0.0248sec

0.61

0.61

5 queries

5 queries

GZIP Disabled

GZIP Disabled