QUOTE(Colaboy @ Feb 21 2012, 03:03 PM)

The 4 Important area to cover in your personal life insurance policy!

1)Medical Plan - Previous Pruhealth vs brand new Pruvalue med

OR

OR

Been sometime since i last update my post here. . . . Well company had remove the previous Pruflexi med plan in replace of the new Pruvalue med. As a consumer you still have the option of either Pruhealth / Pruvalue med. So which card is better or suite you best?? There is no doubt that a medical card is a MUST to have for anybody even if you are cover under your company medical insurance . . . below will be my personal opinion & base on my experience as an agent for nearly a decade now. Majority people purchase their 1st insurance policy will seek for medical coverage as no 1 priority compare to life, 36 CI or PA as i notice. This is true & very important to understand the terms & condition because the insurance cost for medical coverage will be nearly 40% or sometimes even higher of the total premium you have paid.

1 thing i like about Pruhealth is the plan is very straight forward. Choose between plan PHL100 - PHL400 according to your suitability & budget. Plan 500 & 600 are specially for attached rider PRUmedic auto upgrade only. If you feel that the annual coverage is not enough you could always attach PRUannual limit waiver / PRUmedic overseas rider.

This plan is very suitable for working adults which currently hold an existing medical plan (bought many years ago) & feel their existing plan coverage is not enough or currently working & under cover by group medical plan provided from company. You could choose the deductible RM3,000 or RM10,000 option to further reduce your insurance premium while having a great coverage for yourself.

As for Pruvalue med, it is either 1MIL, 1.5MIL or 2MIL coverage. This plan does not have an annual limit as Pruhealth & even if used up the coverage limit Prudential still pays 80% out of the total bills. It's highly recommended for child policy or young working adult which are seeking for their 1st insurance policy.

Other important areas to take note on a medical plan:

*the term coverage (example expiry on age 70, 80 or 100)

*any co-insurance involve or limitation during admition or for specific illnesses treatment

*what items is excluded (usually agent will tell you all the included )

)

*what is the renewal term

*the insurance charge for now & maybe next 20-30 years

For further information you'll require to check with your servicing agent or the policy itself.

2)36 Critical Illnesses

Okie, let’s move on to the critical illnesses coverage. In Malaysia, the critical illnesses coverage comes in 3 dozens- that’s 36 illnesses. I have no idea why is that so. This product is somehow like a jackpot with a choice of 36 terminal illnesses. Hit either one, and you will be “rewarded” with the total sum. Say if your critical illnesses policy has a coverage of RM 500,000, that’s the full amount you will be compensated upon diagnosed from a specialist.

While if your critical illnesses policy is insured for RM 25,000, that’s too bad. That amount of RM 25,000 is all you are going to get to get you through the tough period. A simple rule of thumb guide is 1 shall have a minimum of 2-4 years of their annual expenses as a 36 CI coverage.

Below are the TOP 4 critical illnesses & their cost of treatment which account more than 60% from the claims statistic.

(I) Heart Attack - RM30,000 - RM100,000

(II) Stroke - RM50,000 - RM150,000

(III) Cancer - RM30,000 - RM300,000. Chemotherapy can also range from RM2,000 to RM6,000 per session

(IV) Kidney Failure - RM150,000 & above. Haemodialysis is estimated at RM2,000 / monthly

1) Stroke

2) Heart Attack

3) Kidney Failure

4) Cancer

5) Coronary Artery By-Pass Surgery

6) Serious Coronary Artery Disease

7) Angioplasty And Other Invasive Treatments For Coronary Artery Disease*

8) End-Stage Liver Failure

9) Fulminant Viral Hepatitis

10) Coma

11) Benign Brain Tumor

12) Paralysis Of Limbs

13) Blindness

14) Deafness

15) Third Degree Burns

16) HIV Infection Due To Blood Transfusion

17) Full-Blown AIDS

18) End-Stage Lung Disease

19) Encephalitis

20) Major Organ / Bone Marrow Transplant

21) Loss Of Speech

22) Brain Surgery

23) Heart Valve Surgery

24) Loss Of Independent Existence

25) Bacterial Meningitis

26) Major Head Trauma

27) Chronic Aplastic Anemia

28) Motor Neuron Diseases

29) Parkinson’s Disease

30) Alzheimer’s Disease / Severe Dementia

31) Surgery To Aorta

32) Multiple Sclerosis

33) Primary Pulmonary Arterial Hypertension

34) Medullary Cystic Disease

35) Cardiomyopathy

36) Systemic Lupus Erythematosus (SLE) With Severe Kidney Complications

3)Life Insurance

Over the years, I've seen that there is a lot of confusion around this topic - from what type of insurance is best to how much you need and where to get it. With that in mind, below are the five most common mistakes people make when it comes to life insurance. Hopefully, through this list, you'll be able to get a better understanding of how life insurance works and why it's a good tool for you and your family. At the end of the day, we all just want to know that our loved ones will be taken care of after we're gone.

Mistake #1 - Having no life insurance at all

Many people simply overlook the importance of life insurance. It doesn't appear to be something they need and it can be viewed as an added expense. But take a second to stop and consider all the important people in your life. If you weren't there, how would they be impacted financially? It's not fun to think about, but by "playing dead" you can begin to understand that life insurance is a critical tool to ensuring your family feels financially supported should anything happen to you. For instance, if you have any outstanding debts or other financial obligations, a life insurance policy will help to ensure that those burdens do not fall entirely on your family members. Remember, it is also important to get life insurance sooner rather than later because the cost can increase exponentially as you age.

Mistake #2 - Relying solely on employer-provided workplace life insurance

Life insurance provided by your workplace is an excellent benefit and can serve as a good starting point for your base coverage. But remember any life insurance provided automatically as a benefit is just that - a starting point. You can purchase additional coverage through your employer or on your own to help fill the gap.

Mistake #3 - Only considering term life insurance

Term life insurance provides a "death" or "survivor" benefit, which is the amount beneficiaries receive if you pass away, for a certain period of time (15, 20 or 30 years are common increments), after which the coverage ends. An alternative solution would be to adopt cash value life insurance, which similarly provides a death benefit, but will grow over the years as long as you continue to fund the policy. Furthermore, cash value life insurance can help with financial obligations in a tax-advantaged way, whether it is paying for college, a business venture or retirement. These policies are generally more expensive, but can make a lot of sense if you are able to commit to regularly funding the policy.

Mistake #4 - Leaving retirement savings vulnerable

If you do not have any/enough life insurance, your family is likely to look to your retirement savings for financial support. This may seem like a safe solution for finding additional resources, but I would advise against using funds saved specifically for retirement for another purpose. If you are the higher earner in the family, your spouse may have been relying on those savings for his or her own retirement. Similarly, if your spouse is forced to liquidate or take large loans from the retirement account, it will hurt the potential long-term investment gains that would have benefitted your family down the road.

Mistake #5 - Guessing on how much life insurance you need

CHECK out our latest PRUWealth ==> provide High coverage + Loyalty Bonus & Loyalty Booster + Flexible cash flow/return

+ most important Pay up to 400% of your coverage if accidental death occuring out of Malaysia

RM1,000,000 ==> RM4,000,000 p.m for quotation - everyone can afford to have a high coverage now

4)Personal Accident

Most people will have two types of insurance cover: life insurance and health insurance. The purpose of life insurance is to cover the risk of early death and the purpose of health insurance is to act as a cushion against hospitalisation expenses. However, personal accident cover is equally important as compared to life and health cover. Firstly, it will provide financial support to the policyholder if he is disabled after an accident. Secondly, the magnitude of the mishap doesn't matter. Even minor ones like falling off a bicycle and breaking an arm, or fracturing a leg while playing football are covered by the policy. For merely RM150 yearly, 1 shall be easily covered for RM100,000.

I really need Prudential expert here to help answer my question.1)Medical Plan - Previous Pruhealth vs brand new Pruvalue med

OR

OR

Been sometime since i last update my post here. . . . Well company had remove the previous Pruflexi med plan in replace of the new Pruvalue med. As a consumer you still have the option of either Pruhealth / Pruvalue med. So which card is better or suite you best?? There is no doubt that a medical card is a MUST to have for anybody even if you are cover under your company medical insurance . . . below will be my personal opinion & base on my experience as an agent for nearly a decade now. Majority people purchase their 1st insurance policy will seek for medical coverage as no 1 priority compare to life, 36 CI or PA as i notice. This is true & very important to understand the terms & condition because the insurance cost for medical coverage will be nearly 40% or sometimes even higher of the total premium you have paid.

1 thing i like about Pruhealth is the plan is very straight forward. Choose between plan PHL100 - PHL400 according to your suitability & budget. Plan 500 & 600 are specially for attached rider PRUmedic auto upgrade only. If you feel that the annual coverage is not enough you could always attach PRUannual limit waiver / PRUmedic overseas rider.

This plan is very suitable for working adults which currently hold an existing medical plan (bought many years ago) & feel their existing plan coverage is not enough or currently working & under cover by group medical plan provided from company. You could choose the deductible RM3,000 or RM10,000 option to further reduce your insurance premium while having a great coverage for yourself.

As for Pruvalue med, it is either 1MIL, 1.5MIL or 2MIL coverage. This plan does not have an annual limit as Pruhealth & even if used up the coverage limit Prudential still pays 80% out of the total bills. It's highly recommended for child policy or young working adult which are seeking for their 1st insurance policy.

Other important areas to take note on a medical plan:

*the term coverage (example expiry on age 70, 80 or 100)

*any co-insurance involve or limitation during admition or for specific illnesses treatment

*what items is excluded (usually agent will tell you all the included

*what is the renewal term

*the insurance charge for now & maybe next 20-30 years

For further information you'll require to check with your servicing agent or the policy itself.

2)36 Critical Illnesses

Okie, let’s move on to the critical illnesses coverage. In Malaysia, the critical illnesses coverage comes in 3 dozens- that’s 36 illnesses. I have no idea why is that so. This product is somehow like a jackpot with a choice of 36 terminal illnesses. Hit either one, and you will be “rewarded” with the total sum. Say if your critical illnesses policy has a coverage of RM 500,000, that’s the full amount you will be compensated upon diagnosed from a specialist.

While if your critical illnesses policy is insured for RM 25,000, that’s too bad. That amount of RM 25,000 is all you are going to get to get you through the tough period. A simple rule of thumb guide is 1 shall have a minimum of 2-4 years of their annual expenses as a 36 CI coverage.

Below are the TOP 4 critical illnesses & their cost of treatment which account more than 60% from the claims statistic.

(I) Heart Attack - RM30,000 - RM100,000

(II) Stroke - RM50,000 - RM150,000

(III) Cancer - RM30,000 - RM300,000. Chemotherapy can also range from RM2,000 to RM6,000 per session

(IV) Kidney Failure - RM150,000 & above. Haemodialysis is estimated at RM2,000 / monthly

1) Stroke

2) Heart Attack

3) Kidney Failure

4) Cancer

5) Coronary Artery By-Pass Surgery

6) Serious Coronary Artery Disease

7) Angioplasty And Other Invasive Treatments For Coronary Artery Disease*

8) End-Stage Liver Failure

9) Fulminant Viral Hepatitis

10) Coma

11) Benign Brain Tumor

12) Paralysis Of Limbs

13) Blindness

14) Deafness

15) Third Degree Burns

16) HIV Infection Due To Blood Transfusion

17) Full-Blown AIDS

18) End-Stage Lung Disease

19) Encephalitis

20) Major Organ / Bone Marrow Transplant

21) Loss Of Speech

22) Brain Surgery

23) Heart Valve Surgery

24) Loss Of Independent Existence

25) Bacterial Meningitis

26) Major Head Trauma

27) Chronic Aplastic Anemia

28) Motor Neuron Diseases

29) Parkinson’s Disease

30) Alzheimer’s Disease / Severe Dementia

31) Surgery To Aorta

32) Multiple Sclerosis

33) Primary Pulmonary Arterial Hypertension

34) Medullary Cystic Disease

35) Cardiomyopathy

36) Systemic Lupus Erythematosus (SLE) With Severe Kidney Complications

3)Life Insurance

Over the years, I've seen that there is a lot of confusion around this topic - from what type of insurance is best to how much you need and where to get it. With that in mind, below are the five most common mistakes people make when it comes to life insurance. Hopefully, through this list, you'll be able to get a better understanding of how life insurance works and why it's a good tool for you and your family. At the end of the day, we all just want to know that our loved ones will be taken care of after we're gone.

Mistake #1 - Having no life insurance at all

Many people simply overlook the importance of life insurance. It doesn't appear to be something they need and it can be viewed as an added expense. But take a second to stop and consider all the important people in your life. If you weren't there, how would they be impacted financially? It's not fun to think about, but by "playing dead" you can begin to understand that life insurance is a critical tool to ensuring your family feels financially supported should anything happen to you. For instance, if you have any outstanding debts or other financial obligations, a life insurance policy will help to ensure that those burdens do not fall entirely on your family members. Remember, it is also important to get life insurance sooner rather than later because the cost can increase exponentially as you age.

Mistake #2 - Relying solely on employer-provided workplace life insurance

Life insurance provided by your workplace is an excellent benefit and can serve as a good starting point for your base coverage. But remember any life insurance provided automatically as a benefit is just that - a starting point. You can purchase additional coverage through your employer or on your own to help fill the gap.

Mistake #3 - Only considering term life insurance

Term life insurance provides a "death" or "survivor" benefit, which is the amount beneficiaries receive if you pass away, for a certain period of time (15, 20 or 30 years are common increments), after which the coverage ends. An alternative solution would be to adopt cash value life insurance, which similarly provides a death benefit, but will grow over the years as long as you continue to fund the policy. Furthermore, cash value life insurance can help with financial obligations in a tax-advantaged way, whether it is paying for college, a business venture or retirement. These policies are generally more expensive, but can make a lot of sense if you are able to commit to regularly funding the policy.

Mistake #4 - Leaving retirement savings vulnerable

If you do not have any/enough life insurance, your family is likely to look to your retirement savings for financial support. This may seem like a safe solution for finding additional resources, but I would advise against using funds saved specifically for retirement for another purpose. If you are the higher earner in the family, your spouse may have been relying on those savings for his or her own retirement. Similarly, if your spouse is forced to liquidate or take large loans from the retirement account, it will hurt the potential long-term investment gains that would have benefitted your family down the road.

Mistake #5 - Guessing on how much life insurance you need

CHECK out our latest PRUWealth ==> provide High coverage + Loyalty Bonus & Loyalty Booster + Flexible cash flow/return

+ most important Pay up to 400% of your coverage if accidental death occuring out of Malaysia

RM1,000,000 ==> RM4,000,000 p.m for quotation - everyone can afford to have a high coverage now

4)Personal Accident

Most people will have two types of insurance cover: life insurance and health insurance. The purpose of life insurance is to cover the risk of early death and the purpose of health insurance is to act as a cushion against hospitalisation expenses. However, personal accident cover is equally important as compared to life and health cover. Firstly, it will provide financial support to the policyholder if he is disabled after an accident. Secondly, the magnitude of the mishap doesn't matter. Even minor ones like falling off a bicycle and breaking an arm, or fracturing a leg while playing football are covered by the policy. For merely RM150 yearly, 1 shall be easily covered for RM100,000.

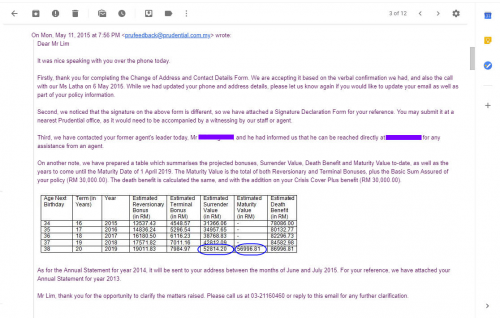

In April 1999, I have bought an endowment plan (Policy Number: 2029****), type of Assurance is PruSave Assurance With Profits. In year 2015, I have emailed to complaint department due to no active agent is serving me in this policy. During that time, the staff has attached me the summarises table of the estimated Reversionary Bonus, estimated Terminal Bonus, estimated Surrender Value, estimated Maturity Value.

In end of March 2019, my policy suppose to be matured in 1 week time, I logged in to pruaccessplus online to check my policy, and noticed the status had been changed to CEASED. I did call the customer service, and been told that my policy still in force until 1 April 2019.

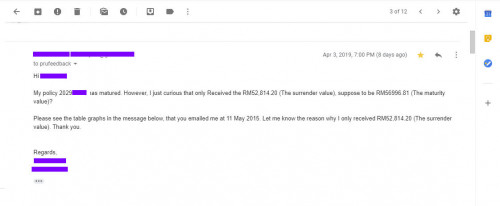

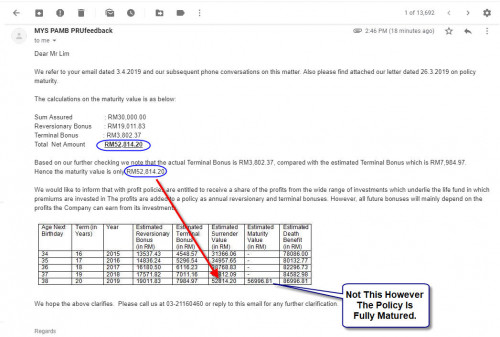

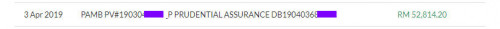

In 3 April 2019, finally received the lamp sum amount for the policy's maturity. But noticed Prudential is given me the Surrender Value instead of the Maturity value which the staff sent me the summarises table of value from year 2015 to year 2019. Then I emailed to Prudential complaint department, the other staff (beside the old staff which emailed me early in 2015 was resigned from Prudential), said (In phone and in her email reply) she cannot explain why the actual Terminal Bonus is half less than the estimated Terminal Bonus, while the actual Reversionary Bonus is exactly the same as the estimated Reversionary Bonus.

The only reason she told me is the value/ bonus depend of fund performance. But I just wondering why only the actual Terminal Bonus is huge different than the estimated Terminal Bonus, but not the Reversionary Bonus? She told me the old staff leave already, also do not know how the old staff he manage to calculate the estimated Maturity Value (In the phone call). This is was a real case scenario I faced with Prudential.

Already emailed to the Prudential complaint department, they cannot explain why Prudential given Surrender Value but not Maturity Value. Below is another email I sent to them this morning, still waiting their reply,

QUOTE

Hi,

Are you able to check with the calculation team, why the actual terminal bonus is about the half of the estimated terminal bonus. But other like the actual reversionary bonus is exactly same as the estimated reversionary bonus?

Would you able to explain to me why before 1 April 2019, my policy already CEASED status? Does it effects the early terminal bonus or any cause that make the terminal bonus half lower than estimated terminal bonus?

Hi,

1. Can explain why the actual Terminal Bonus is half less than the estimated Terminal Bonus?

2. You told me Prudential got calculation team, can show me how they calculate the actual Terminal Bonus, based on what criteria and formulas?

3. In the table summarize list from year 2015 to year 2019 sent by Des***, the estimated Terminal Bonus is getting more, but year 2019 the actual Terminal Bonus is far less than year 2019 estimated Terminal Bonus, can explain?

4. If you said the actual Terminal Bonus is effected by fund performance or company investment return, but why the estimated and actual Reversionary Bonus are same exact amount?

5. Also, why the added up Reversionary Bonus, Terminal Bonus, Sum Assured amount is exactly same as the estimated Surrender Value but not the estimated Maturity Value?

6. You told me, you don't know how Desmond got this Maturity Value calculated, and you not yet answer me how he able to get the estimated Maturity Value until today? He must be based in some complex computation and shouldn't be he self simply guessed Value?

Have you send my inquiry to internal team or calculation team to investigate? Please do not simply reply by follow the letter head result to me without further investigation and proper results with explanation to me?

Refer my original post at here https://forum.lowyat.net/topic/4764904Are you able to check with the calculation team, why the actual terminal bonus is about the half of the estimated terminal bonus. But other like the actual reversionary bonus is exactly same as the estimated reversionary bonus?

Would you able to explain to me why before 1 April 2019, my policy already CEASED status? Does it effects the early terminal bonus or any cause that make the terminal bonus half lower than estimated terminal bonus?

Hi,

1. Can explain why the actual Terminal Bonus is half less than the estimated Terminal Bonus?

2. You told me Prudential got calculation team, can show me how they calculate the actual Terminal Bonus, based on what criteria and formulas?

3. In the table summarize list from year 2015 to year 2019 sent by Des***, the estimated Terminal Bonus is getting more, but year 2019 the actual Terminal Bonus is far less than year 2019 estimated Terminal Bonus, can explain?

4. If you said the actual Terminal Bonus is effected by fund performance or company investment return, but why the estimated and actual Reversionary Bonus are same exact amount?

5. Also, why the added up Reversionary Bonus, Terminal Bonus, Sum Assured amount is exactly same as the estimated Surrender Value but not the estimated Maturity Value?

6. You told me, you don't know how Desmond got this Maturity Value calculated, and you not yet answer me how he able to get the estimated Maturity Value until today? He must be based in some complex computation and shouldn't be he self simply guessed Value?

Have you send my inquiry to internal team or calculation team to investigate? Please do not simply reply by follow the letter head result to me without further investigation and proper results with explanation to me?

Apr 12 2019, 09:24 AM

Apr 12 2019, 09:24 AM

Quote

Quote 0.0541sec

0.0541sec

1.23

1.23

7 queries

7 queries

GZIP Disabled

GZIP Disabled