- ended -

This post has been edited by V12Kompressor: Mar 5 2013, 03:19 PM

Hong Leong Income Builder & Income Riders, Innovative and Flexible

Hong Leong Income Builder & Income Riders, Innovative and Flexible

|

|

Dec 5 2011, 08:56 PM, updated 13y ago Dec 5 2011, 08:56 PM, updated 13y ago

Show posts by this member only | Post

#1

|

Senior Member

2,141 posts Joined: Sep 2008 From: Muddy Banks |

- ended -

This post has been edited by V12Kompressor: Mar 5 2013, 03:19 PM |

|

|

|

|

|

Dec 5 2011, 09:38 PM Dec 5 2011, 09:38 PM

Show posts by this member only | Post

#2

|

Senior Member

28,187 posts Joined: Mar 2007 From: Underworld |

From where? HLA?

|

|

|

Dec 5 2011, 09:42 PM Dec 5 2011, 09:42 PM

Show posts by this member only | Post

#3

|

|

VIP

9,137 posts Joined: Jun 2007 From: Wouldn't be around much, pls PM other mods. |

What's the difference with the previous Cash Builder? https://forum.lowyat.net/index.php?showtopic=1231190

|

|

|

Dec 5 2011, 10:13 PM Dec 5 2011, 10:13 PM

Show posts by this member only | Post

#4

|

All Stars

11,954 posts Joined: May 2007 |

dont understand wat u say?

|

|

|

Dec 5 2011, 11:15 PM Dec 5 2011, 11:15 PM

Show posts by this member only | Post

#5

|

Junior Member

401 posts Joined: Sep 2010 |

|

|

|

Dec 5 2011, 11:18 PM Dec 5 2011, 11:18 PM

Show posts by this member only | Post

#6

|

Senior Member

2,736 posts Joined: Dec 2006 |

how much $$ is ur commission if we take ur plan?

|

|

|

|

|

|

Dec 6 2011, 12:08 AM Dec 6 2011, 12:08 AM

Show posts by this member only | Post

#7

|

Senior Member

2,141 posts Joined: Sep 2008 From: Muddy Banks |

QUOTE(Bonescythe @ Dec 5 2011, 09:38 PM) yup. Product is very new and the HLA webpage isn't updated yet as of now. QUOTE(b00n @ Dec 5 2011, 09:42 PM) What's the difference with the previous Cash Builder? https://forum.lowyat.net/index.php?showtopic=1231190 This is a new scheme to replace the HL Cash Builder (CB). Basically, it let the policy owner the flexibility to choose the amount of GYI he/she wish to receive and when he/she wish to receive. Secondly, the maturity period is longer than CB (CB is only up to 35 years). Basically this is a better plan to hedge against any unwanted events (TPD & early death) compared with CB depending on the riders taken. This plan also allow the policy owner to attach up to 50 riders (medic card, PA rider, CIR, etc) for an even more comprehensive protection. I am still working out a few plan which will yield the best return rate, so no figures will be given out for now. This scheme is very new and the reason why I opened this thread is to provide a reference on this scheme for the time to come. In future, everyone can refer to this thread for advices, POVs from a different perspective and to discuss about this plan when they have an interest with it. |

|

|

Dec 6 2011, 12:51 AM Dec 6 2011, 12:51 AM

Show posts by this member only | Post

#8

|

Junior Member

177 posts Joined: Oct 2011 |

QUOTE(V12Kompressor @ Dec 6 2011, 12:08 AM) yup. Product is very new and the HLA webpage isn't updated yet as of now. Is this endowment plan?This is a new scheme to replace the HL Cash Builder (CB). Basically, it let the policy owner the flexibility to choose the amount of GYI he/she wish to receive and when he/she wish to receive. Secondly, the maturity period is longer than CB (CB is only up to 35 years). Basically this is a better plan to hedge against any unwanted events (TPD & early death) compared with CB depending on the riders taken. This plan also allow the policy owner to attach up to 50 riders (medic card, PA rider, CIR, etc) for an even more comprehensive protection. I am still working out a few plan which will yield the best return rate, so no figures will be given out for now. This scheme is very new and the reason why I opened this thread is to provide a reference on this scheme for the time to come. In future, everyone can refer to this thread for advices, POVs from a different perspective and to discuss about this plan when they have an interest with it. GE had lot of these plans...so whats the big difference HLA offered? p/s : Bond yield higher than endowment plan |

|

|

Dec 6 2011, 10:56 AM Dec 6 2011, 10:56 AM

Show posts by this member only | Post

#9

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

LOL, a saving plan mature only when reach 90 years old?

I certain not suit to it. I don't think I can live up to 90, even can already blur blur until forget what is insurance plan that I had. If I really care about insurance, death benefit, I would rather get a whole life term policy to cover death and TPD. Just my personal preference, as personal view there is no logic to have a saving plan mature only when reach 90. Added on December 6, 2011, 10:58 amTS, there is too little info provided for details discussion. No mentioned about sum assured, and details of it. Only stated 5.5% on GYI. How about the principal lump sum? Added on December 6, 2011, 11:00 am QUOTE(V12Kompressor @ Dec 5 2011, 08:56 PM) [color=red] This is TPD due to accident only, what about TPD due to sickness/disease? An innovative and flexible participating whole life plan up to age 90 with Guaranteed Yearly Income (GYI). Guaranteed Yearly Income from year 1 up to age 90 payable from end of 1st year onwards up to age 90. GYI can be withdrawn OR deposited with the company to accumulate interest (5.5% as of today) from time to time. 9 or 12 year commitment Short term premium payment commitment, long term coverage. [High Death & TPD coverage 100% of Outstanding GYI or *9 times of GYI or *Cash Surrender Value, whichever is highest. *Additional 300% coverage on accidental TPD In an event of TPD due to accident, an additional 300% of Guaranteed TPD shall be payable Guaranteed Maturity Benefit of 9 times of GYI a maturity benefit of 9 times of GYI payable upon maturity. When getting old, the chance of TPD due to sickness is way way higher than accident. All the post only mentioned GYI, not touch on principal amount/premium already paid. Added on December 6, 2011, 11:03 amI think it is much better to put all the number in a table, just like most saving plan brochure out there. 9x GYI can be confusing, and people do not know how much they are getting. This post has been edited by cherroy: Dec 6 2011, 11:03 AM |

|

|

Dec 6 2011, 11:52 PM Dec 6 2011, 11:52 PM

|

Senior Member

2,141 posts Joined: Sep 2008 From: Muddy Banks |

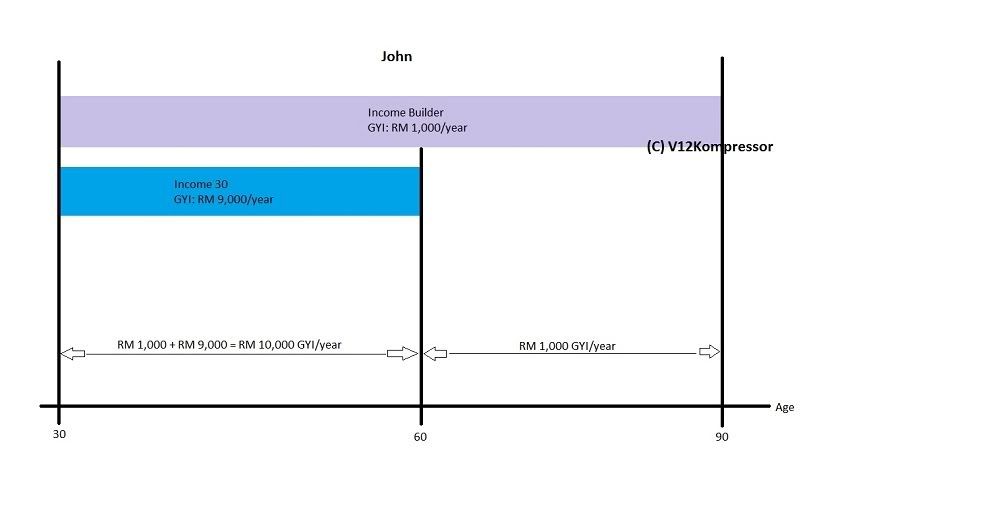

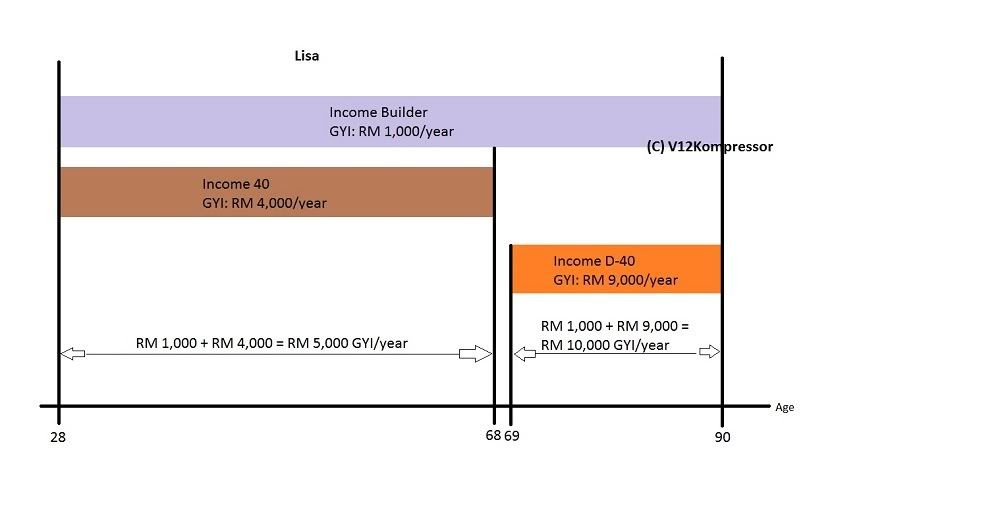

QUOTE(Violet Ling @ Dec 6 2011, 12:51 AM) Yes, this is an endownment plan. I'll explain further by replying Cherroy's post below; QUOTE(cherroy @ Dec 6 2011, 10:56 AM) LOL, a saving plan mature only when reach 90 years old? I certain not suit to it. I don't think I can live up to 90, even can already blur blur until forget what is insurance plan that I had. If I really care about insurance, death benefit, I would rather get a whole life term policy to cover death and TPD. Just my personal preference, as personal view there is no logic to have a saving plan mature only when reach 90. True. Nobody wants a plan which matures at such long period. Hence, the Riders which comes exclusively with this scheme comes in action. There are basically six riders for this Income Rider plan, namely 1) Income 20 2) Income 30 3) Income 40 4) Income D-20 5) Income D-30 6) Income D-40 For Rider 1,2,3 it will start to pay the Guaranteed Yearly Income (GYI) from the first year of inception till a specific period. Scenario A: John is 30 this year. He wants to get guaranteed RM 10,000 per year for the next 30 years. Hence, the plan which suits him would be Income Builder + Income 30 Rider. The Income Builder will give a GYI of RM 1,000 per year right up to John reaches the age of 90 and the Income 30 Rider will give a GYI of RM9,000 till John reaches the age of 60.  Rider 4,5 and 6 only kicks in after a year of a specific year right till the age 90. Scenario B: Lisa is 28 this year. She wish to receive a GYI of RM 5,000 per year when she is still employed and RM10,000 per year when she retires from her job. Hence, the plan which suits her would be Income Builder + Income 40 + Income D-40 Rider. The Income Builder will give a GYI of RM 1,000 per year right up to Lisa's age 90. The Income 40 will give an additional RM 4,000 for the next 40 years and when she retires at age 68, the D-40 GYI of RM 9,000 kicks in when she reach the age of 69 right up to Lisa's age of 90.  QUOTE Added on December 6, 2011, 10:58 amTS, there is too little info provided for details discussion. No mentioned about sum assured, and details of it. Only stated 5.5% on GYI. How about the principal lump sum? Yea, more info will be added from time to time because this is a very new product. As for the sum assured, I'll take Scenario A as example; lets say John TPD due to accident when he is age 40 (after GYI at end of 10th year is paid out). Assuming the Cash Surrender Value upon TPD is RM 28,000; SUM ASSURED = 100% of the outstanding GYI or 9 times of GYI or Cash Surrender Value, whichever is highest = (50 x 1000) or (9 x 1000) or 28,000 = RM 50,000 or RM 9,000 or 28,000 SUM ASSURED = RM 50,000 since RM 50,000 is highest among all. In addition to the RM 50,000; the Income 30 also grants another 100% of Outstanding GYI TPD benefit and an additional amount equivalent to 300% of Guaranteed TPD benefit. Age when TPD = 40 Rider Term = 60 GYI = RM 9,000 60 - 40 = 20 years of outstanding GYI 20 x 9,000 = RM 180,000 Additional 300% due to TPD due to accident; 180,000 x 300% = 540,000 540,000 + 180,000 = RM 720,000 Therefore, when TPD due to accident, total you will get is RM 50,000 + RM 720,000 = RM 770,000 QUOTE Added on December 6, 2011, 11:00 am This is TPD due to accident only, what about TPD due to sickness/disease? When getting old, the chance of TPD due to sickness is way way higher than accident. The additional 300% only payable in event of TPD due to accident. If TPD due to sickness/disease, the amount payable will be RM 180,000 + RM 50,000 (from Scenario A above). QUOTE All the post only mentioned GYI, not touch on principal amount/premium already paid. I still couldn't tabulate the premium table due to some software hiccups in the office. Will do when I have proper access to it. Added on December 6, 2011, 11:03 amI think it is much better to put all the number in a table, just like most saving plan brochure out there. 9x GYI can be confusing, and people do not know how much they are getting. Please hang on for this. Basically for this plan, all you got to do is to ask yourself how much do you wish to earn for the next X amount of time, where X is the next 20 years, 30 years or 40 years. From what I know so far, if one wish to get GYI of RM 10,000 for the next 20 years (Income Builder + Income 20), the premium will be around RM 27,000 per year. In addition to the GYI RM 10,000, there will be a cash dividend of RM 2,000 payable very year. Of course, the premium paid will also determined by age and gender factor so it may vary. This post has been edited by V12Kompressor: Dec 6 2011, 11:53 PM |

|

|

Dec 7 2011, 12:56 AM Dec 7 2011, 12:56 AM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(V12Kompressor @ Dec 6 2011, 11:52 PM) Basically for this plan, all you got to do is to ask yourself how much do you wish to earn for the next X amount of time, where X is the next 20 years, 30 years or 40 years. From what I know so far, if one wish to get GYI of RM 10,000 for the next 20 years (Income Builder + Income 20), the premium will be around RM 27,000 per year. In addition to the GYI RM 10,000, there will be a cash dividend of RM 2,000 payable very year. Of course, the premium paid will also determined by age and gender factor so it may vary. LOL, Rm27,000 premium pa. Assuming 9 year commitment. As stated 9-12 years commitment). 27k x 9 years =243k 20 years 10k = 200k + cash dividend 2k pa = 240k I better off with put 243K earn 3% FD interest and pay myself 10k per year. As said we need to compile the table to see the clear picture, if not even we talk so much also useless one without those details. Added on December 7, 2011, 12:58 amDon't just keep on stressing GYI, how much you want every year, it is the premium that matter the most. This post has been edited by cherroy: Dec 7 2011, 12:58 AM |

|

|

Dec 29 2011, 11:43 AM Dec 29 2011, 11:43 AM

|

Newbie

1 posts Joined: Aug 2011 |

QUOTE(cherroy @ Dec 7 2011, 12:56 AM) LOL, Rm27,000 premium pa. I guess, on top of the 243k that you're taking in as your initial capital the 240k is a return that you'll get, so in total you're getting 243k + 240k after X number of years...Assuming 9 year commitment. As stated 9-12 years commitment). 27k x 9 years =243k 20 years 10k = 200k + cash dividend 2k pa = 240k I better off with put 243K earn 3% FD interest and pay myself 10k per year. As said we need to compile the table to see the clear picture, if not even we talk so much also useless one without those details. Added on December 7, 2011, 12:58 amDon't just keep on stressing GYI, how much you want every year, it is the premium that matter the most. May I clarify what's X? |

|

|

Dec 29 2011, 01:28 PM Dec 29 2011, 01:28 PM

|

Junior Member

364 posts Joined: Mar 2008 |

I don't like Insurance Investment product as its brings 4% profit (Allianz) only compare to Bond, MM, Equity or Stock.

|

|

|

|

|

|

Dec 29 2011, 02:03 PM Dec 29 2011, 02:03 PM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(fabs @ Dec 29 2011, 11:43 AM) I guess, on top of the 243k that you're taking in as your initial capital the 240k is a return that you'll get, so in total you're getting 243k + 240k after X number of years... 243K is your premium paid.May I clarify what's X? They do not say paying back fully your premium paid + guaranteed GYI + cash dividend. GYI /= your return GYI = the money they return/pay back to you every year , not return on the premium paid. GYI can be including your initial premium + return. GYI is similar to guaranted cash back endowment plan. Just instead of using cash back, now they use GYI. It just said you paid 243K for 9 years, then every year you get RM10k + cash dividend , until x years. Above just interpretation of the info provided in this thread/forumers. I do not know the exact plan details, as there is not enough info provided in this thread, so I could be wrong in the above interpretation. |

|

|

Dec 29 2011, 03:30 PM Dec 29 2011, 03:30 PM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

This is a typical sales thread disguised as a discussion thread. Many of those around here lately...

|

|

|

Dec 29 2011, 07:16 PM Dec 29 2011, 07:16 PM

|

Senior Member

2,406 posts Joined: Jul 2010 From: bandar Sunway |

hmm recently i heard a saving product from Hong Leong(dont know its HLA or HLB), which seems to be targeted to only HLB top clients since I found no information about this product on HLB website.supposed to be offering 19% pa interest,and if financial performance is good additional bonus.however the catch is you have to deposit a lump sum of min $100,000 yearly.

|

|

|

Dec 29 2011, 09:29 PM Dec 29 2011, 09:29 PM

|

Junior Member

487 posts Joined: Aug 2011 |

Agents fishing for water fish again.

Till now, many agents are just product pushers, 2 days ago this HLA agent promoted this cash builder to me, she was promoting it like the BESTEST SINCE SLICED BREAD, then she excused herself when i ask her to factor in inflation and how does she expect me to survive on that kacang putih GYI amount and did she herself bought the plan? let me repeat my post from the other thread. QUOTE(lunchtime @ Dec 21 2011, 02:45 AM) Those who bought these cash builder / wealth builder plans and other similar 'save 6/8/10 years' plans, thinking its a great savings plan for your retirement, I wish you all the best in your retirement years. Hope you have other backup plans as well. Do remember to keep in touch with the agent till the day you die because you are gonna to And as for the agent who sold these plans, after year 7 of the policies sold, do a disappearing act, save your skin. Make damn sure you are no longer reachable by year 11. For those in the dark, here's a bit more, Year 1 commission paid to agents who sold you these so called savings plan is a min 17.5% of your premium paid to the cash/wealth builder plans. Now agent CONsult you to 'save' $500 per month, 17.5% or $87.50 per month goes into agent's pocket, this excludes overriding commission paid to agency managers and what have you expenses of the insurance company. Easily 60-70% of your premium paid is gone for all these expenses. That's $350 per month gone. So you actual start savings with close to ZERO ringgit. And this will go on for 6 years on a reducing basis. (Now you know why the minimum period for such plans is 6 years.) Ever wonder why agents tell you NEVER TO WITHDRAW within the 1st 6 years? Cuz in your so called savings plan, its EMPTY/KOSONG. Notice that if you surrender with 1-3 years, its ZERO meaning NO MONEY BACK. Now ask yourself this when the GOVT increases the service tax from 5% to 6% or when your local mamak increase your fav teh tarik from $1 to $1.30, you bising like no tomorrow, the hell with the govt, fxxk this mamak, i never coming back again, but when your agent CONsult you a so called savings plan which quietly eat 60-70% of your so called savings premium, why you never bising? If these cash / wealth builder are so good, why take 30 years to mature? Why lock your own money and subject it to others placing terms & conditions on your own money? Ever heard of APL and how much it can charge you interest for late premium payments? Nice for some companies to charge you interest on your own money, just nice. And use your brain for a moment, can an insurance company ever paid interest higher than a bank on the capital sum with a guarantee? If yes, why isn't there a queue at every insurance company with people signing up such cash wealth builder plan? Why do insurance companies still need the agents to CONsult you? Similar to buying iphone 4s, so damn good that people auto queue, you see any agents CONsult the queue? By the way, why isn't Warren Buffett and Jim Rogers queuing as well for the great savings plan? Now look at this from another thread, save 28000 per year, get back 8400 till Year 30. Ask yourself and use some sense, 1) how much is your salary today? close to $28000 per year? 2) how much is your expenses today? close to $28000 per year? 3) can you live on $8400 per year? If you cannot afford $28000 premium per year, that's means the you can only lower premiums which directly meaning your GYI is lower as well. Say you can afford $6000 premium per year, your GYI is probably around $1800 per year. Now, in your retirement, can you survive on $1800 per year? What a great reCONmend from your best buddy agent for your retirement. You only want to meet your INSURANCE agent, SLL or otherwise, for PROTECTION policies and CLAIMS, and not for any other reasons apart from these. HAHAHAHAHAHA |

|

|

Jan 2 2012, 02:13 AM Jan 2 2012, 02:13 AM

|

Senior Member

2,141 posts Joined: Sep 2008 From: Muddy Banks |

QUOTE(cherroy @ Dec 7 2011, 12:56 AM) LOL, Rm27,000 premium pa. oops, sorry for the late reply Assuming 9 year commitment. As stated 9-12 years commitment). 27k x 9 years =243k 20 years 10k = 200k + cash dividend 2k pa = 240k I better off with put 243K earn 3% FD interest and pay myself 10k per year. As said we need to compile the table to see the clear picture, if not even we talk so much also useless one without those details. rarely comes in here (F.B.I. House) and was busy since last month is the final month for cash builder. I am still amidst of exploring and creating the most comprehensive plan so please be patient. That Rm27k premium per year, like you said is plain ridiculous. lol QUOTE(Peter_APIIT @ Dec 29 2011, 01:28 PM) I don't like Insurance Investment product as its brings 4% profit (Allianz) only compare to Bond, MM, Equity or Stock. True enough. Each type of investment plans has their respective pros and cons. These type of plan are most suited for those who is not game for high risk high return type of investment. QUOTE(ryan18 @ Dec 29 2011, 07:16 PM) hmm recently i heard a saving product from Hong Leong(dont know its HLA or HLB), which seems to be targeted to only HLB top clients since I found no information about this product on HLB website.supposed to be offering 19% pa interest,and if financial performance is good additional bonus.however the catch is you have to deposit a lump sum of min $100,000 yearly. TBH, that's not interest. Guaranteed Yearly Income and Cash Dividend cannot be classified as Interest. Interest can only be used by banks for their products but not Insurance related returns. And you can also choose to put RM10,000 yearly, not necessarily minimum 100k per year. Anyway, that plan has already ended now. QUOTE(lunchtime @ Dec 29 2011, 09:29 PM) Agents fishing for water fish again. I couldn't comprehend why most people here are so curious and some to the extend of making a ruckus about the agent's commission part. When you people are queuing up for an iPhone, the SA who serviced you also get commission out of your RM2,400 paid. When you're buying a car, lets say a BMW 3 series, the SA also get RM 28,000 out of the price you paid. Even something as basic as buying clothes from your favourite departmental store and the promoter also get some commission out of your purchase. Why you never bising? Just because we have the capability to earn a huge cheque within a short period of time and you want to call us scammers, liars and scoundrels? Till now, many agents are just product pushers, 2 days ago this HLA agent promoted this cash builder to me, she was promoting it like the BESTEST SINCE SLICED BREAD, then she excused herself when i ask her to factor in inflation and how does she expect me to survive on that kacang putih GYI amount and did she herself bought the plan? let me repeat my post from the other thread. From the wall of text you've posted, I do have cases of client wanted to terminate their cash builder after the first year of inception and after some calculations done, their Surrender Value is not ZERO as you have said. APL and interest for late premium payments will only happen if you happen to be commit yourself into the plan. I wouldn't approach and sign someone who need to take huge chunk out of their yearly paycheck to pay for the premium. These type of plans are meant for those with excessive cash reserves in their bank accounts who wish to yield a little more higher returns than the conventional FD. This post has been edited by V12Kompressor: Jan 2 2012, 02:18 AM |

|

|

Jan 3 2012, 12:21 AM Jan 3 2012, 12:21 AM

|

Junior Member

487 posts Joined: Aug 2011 |

QUOTE(V12Kompressor @ Jan 2 2012, 02:13 AM) oops, sorry for the late reply that's because we know and understand what we are buying. when i pay 2400 for an iphone, i get 2400 worth of phone on the spot, likewise for my BMW. what you are promoting is different, its suppose to be an investment / savings program but unlike any real investment / savings account, the same value of $X money (premium) i put in today cannot be take out tomorrow, it will be $X - (80% x $X). How do you justify this as savings /investment? rarely comes in here (F.B.I. House) and was busy since last month is the final month for cash builder. I am still amidst of exploring and creating the most comprehensive plan so please be patient. That Rm27k premium per year, like you said is plain ridiculous. lol True enough. Each type of investment plans has their respective pros and cons. These type of plan are most suited for those who is not game for high risk high return type of investment. TBH, that's not interest. Guaranteed Yearly Income and Cash Dividend cannot be classified as Interest. Interest can only be used by banks for their products but not Insurance related returns. And you can also choose to put RM10,000 yearly, not necessarily minimum 100k per year. Anyway, that plan has already ended now. I couldn't comprehend why most people here are so curious and some to the extend of making a ruckus about the agent's commission part. When you people are queuing up for an iPhone, the SA who serviced you also get commission out of your RM2,400 paid. When you're buying a car, lets say a BMW 3 series, the SA also get RM 28,000 out of the price you paid. Even something as basic as buying clothes from your favourite departmental store and the promoter also get some commission out of your purchase. Why you never bising? Just because we have the capability to earn a huge cheque within a short period of time and you want to call us scammers, liars and scoundrels? From the wall of text you've posted, I do have cases of client wanted to terminate their cash builder after the first year of inception and after some calculations done, their Surrender Value is not ZERO as you have said. APL and interest for late premium payments will only happen if you happen to be commit yourself into the plan. I wouldn't approach and sign someone who need to take huge chunk out of their yearly paycheck to pay for the premium. These type of plans are meant for those with excessive cash reserves in their bank accounts who wish to yield a little more higher returns than the conventional FD. in the case of these cash builder policies or similiar endowment policies, you are promoting it as an investment/ savings plan knowing full well it will never beat inflation and poor returns aka your marketing gimmick "Want better than FD ar?" have you thought of the people who bought these policies for their retirement / education / savings? they placed their hope, future on your words and your promise and at the end the day, many many years down the road, they discover your marketing gimmick. by that time, its too late for them, retirement / education and savings dreams all down the drain. how would you feel when someone did this to you? have you no gulit? the only reason your colleagues and you heavily market such policies and die die defend your actions is the huge premiums involved. why don't you heavily market whole life or term life? is it because of the lower premiums and lower commissions? let me quote you "earn a huge cheque within a short period of time" "scammers, liars and scoundrels?" answered as below QUOTE(gark @ Dec 29 2011, 03:30 PM) This is a typical sales thread disguised as a discussion thread. Many of those around here lately... This post has been edited by lunchtime: Jan 3 2012, 12:24 AM |

|

|

Jan 3 2012, 01:31 AM Jan 3 2012, 01:31 AM

|

Senior Member

2,141 posts Joined: Sep 2008 From: Muddy Banks |

If you dont like what you're seeing here, then just turn away. Likewise, I'll do the same by ignore you to prevent any further derailment of the topic which serves no purpose of understanding the product even more. |

|

|

Jan 4 2012, 09:16 AM Jan 4 2012, 09:16 AM

|

Junior Member

487 posts Joined: Aug 2011 |

QUOTE(V12Kompressor @ Jan 3 2012, 01:31 AM) If you dont like what you're seeing here, then just turn away. Likewise, I'll do the same by ignore you to prevent any further derailment of the topic which serves no purpose of understanding the product even more. if this is a thread for reference and understand, then you should be open for discussions about the product, the marketing scheme, the consequences of the product and the conduct of most agents marketing such schemes rather than you trying to avoid what has been said and posted. given the number of postings and other threads about how clients lose money or agents misrepresented the product or how such cash builder /endowments fail to even match inflation / FD in this section, your cup isn't holding water very well. hahahahaha |

|

|

Jan 5 2012, 05:58 PM Jan 5 2012, 05:58 PM

|

Junior Member

365 posts Joined: Aug 2009 |

May b ate some Fool Lunch

|

|

|

Jan 7 2012, 03:38 PM Jan 7 2012, 03:38 PM

|

Newbie

1 posts Joined: Dec 2011 |

Agreed with V12Kompressor...

|

|

|

Jan 17 2012, 06:55 PM Jan 17 2012, 06:55 PM

|

Junior Member

45 posts Joined: Nov 2006 |

My friend offered me the income buider plan which gives us a return of 30%.

I was like really? i dun really know about it. he showed me the plan and all, and i was quite amaze but , 30 % is a lot. is it true guys? |

|

|

Jan 17 2012, 07:39 PM Jan 17 2012, 07:39 PM

|

All Stars

11,954 posts Joined: May 2007 |

QUOTE(kaziri @ Jan 17 2012, 06:55 PM) My friend offered me the income buider plan which gives us a return of 30%. 30% 1 year dividend?I was like really? i dun really know about it. he showed me the plan and all, and i was quite amaze but , 30 % is a lot. is it true guys? if put 10 yr then 300% dividend? |

|

|

Jan 28 2012, 09:06 AM Jan 28 2012, 09:06 AM

|

Junior Member

37 posts Joined: Nov 2010 |

after sourcing around and even myself becoming an agent, i think mnulife is giving a much more higher benefits.

It incorporated endowment + fd (4.5% daily rest, no penalty upon withdrawal) + life coverage (min 100k) with just a minimum premium of 500/month. but talking about 30% 1 year? i think i wanna change to h.l.a already... lol |

|

|

Feb 6 2012, 05:33 PM Feb 6 2012, 05:33 PM

|

Junior Member

145 posts Joined: Feb 2012 |

Don't just look at the 30% return on Year 1 but the whole plan as a whole.

Have anyone workout the effective ROI? ROI for 20 years? ROI for 30 years? ROI for 40 years? Added on February 6, 2012, 5:37 pm QUOTE(cherroy @ Dec 29 2011, 02:03 PM) 243K is your premium paid. No Selling HERE!They do not say paying back fully your premium paid + guaranteed GYI + cash dividend. GYI /= your return GYI = the money they return/pay back to you every year , not return on the premium paid. GYI can be including your initial premium + return. GYI is similar to guaranted cash back endowment plan. Just instead of using cash back, now they use GYI. It just said you paid 243K for 9 years, then every year you get RM10k + cash dividend , until x years. Above just interpretation of the info provided in this thread/forumers. I do not know the exact plan details, as there is not enough info provided in this thread, so I could be wrong in the above interpretation. I know enough to answer any questions regarding this product, feel free to ask. No Selling HERE! Added on February 6, 2012, 5:38 pm QUOTE(kaziri @ Jan 17 2012, 06:55 PM) My friend offered me the income buider plan which gives us a return of 30%. Don't just look at the 30% return on Year 1 but the whole plan as a whole.I was like really? i dun really know about it. he showed me the plan and all, and i was quite amaze but , 30 % is a lot. is it true guys? This post has been edited by AskChong: Feb 6 2012, 05:38 PM |

|

|

Feb 16 2012, 02:23 PM Feb 16 2012, 02:23 PM

|

Senior Member

4,334 posts Joined: Nov 2004 From: Shadow Striker |

i dont reli get this =.=

|

|

|

Feb 17 2012, 02:43 PM Feb 17 2012, 02:43 PM

|

Junior Member

103 posts Joined: Dec 2009 |

Still not understand what you trying to say about ..

people care about money and interest , and not all theory~ how much invest and how many interest will get .. |

|

|

Feb 17 2012, 06:21 PM Feb 17 2012, 06:21 PM

|

Junior Member

41 posts Joined: Nov 2011 |

In my opinion, when we talk about investment, the important point is to compare the return rate of one particular investment to the other. The frequent asked questions are as below:

1) How much I have to pay? 2) How much I can receive in return? 3) How long it will spend? 4) Base on the above, what is the compound annual growth rate? May I use scenario B as an example? QUOTE(V12Kompressor @ Dec 6 2011, 11:52 PM) Scenario B: Based on scenario B, assuming Lisa took up the plan as mentioned and she lives very healthy throughout her life and she R.I.P at her age of 90.Lisa is 28 this year. She wish to receive a GYI of RM 5,000 per year when she is still employed and RM10,000 per year when she retires from her job. Hence, the plan which suits her would be Income Builder + Income 40 + Income D-40 Rider. The Income Builder will give a GYI of RM 1,000 per year right up to Lisa's age 90. The Income 40 will give an additional RM 4,000 for the next 40 years and when she retires at age 68, the D-40 GYI of RM 9,000 kicks in when she reach the age of 69 right up to Lisa's age of 90. So, assuming Lisa has to pay RM27,000.00 premium for 9 years (as mentioned in earlier thread) to enjoy the benefits mentioned above, how much Lisa has to pay? Lisa needs to pay: RM27,000.00 x 9 years = RM243,000.00 After that, what will Lisa received up to 90 years old? Lisa receive: First 40 year (28 to 68) x RM5,000 = RM200,000.00 + next 21 years (69 to 90 inclusive) x RM10,000 + RM210,000.00 = RM410,000.00 Therefore, The cost: RM243,000.00 The return: RM167,000.00 (RM410,000.00 – RM243,000.00) Time spend: 9 years Compound annual growth rate: 5.98% (for 9 years) If I am not mistaken, you cannot claim your return of RM167,000.00 at one time after the 9th year but can only claim it throughout 61 years (am I right?? Need advise). Therefore, if we calculate the compound annual growth rate based on 61 years (because you can only fully collected your return after 61 years), guess what is the compound annual growth rate? Is 0.86% If we take the factor of inflation into consideration, that means in Lisa's case, she is using today’s RM27,000.00 per year "to buy" RM10,000 return per year at 40 years later… (because she can only receive RM10,000 per year at that time) By that time, what you except to buy with RM833.33 a month (RM10,000.00 / 12) ??? A cup of Kopi-o? A roti-canai??? Worth it?? Make your own judgment. This post has been edited by Kokolat: Feb 17 2012, 08:43 PM |

|

|

Mar 13 2012, 10:56 AM Mar 13 2012, 10:56 AM

|

Senior Member

4,334 posts Joined: Nov 2004 From: Shadow Striker |

an agent came to me and let me know of this.

deposit 3k per year. thats around 250 per month. deposit for 6 years. will get 500 annually until age 90 i will get back 500 as 'reward' per year starting from year 1 and if not withdrawal of the 500 every year, can get 5.25% return from the 500. this is accumulated. so first year is 500X5.25% (=A). next year will be (A+500)X5.25% (=B), third year (B+500)x5.25% and so forth the 500 will be paid annually upo to age 90 for the 3k, will be given some dividend depending on economy, so he said. the rate is better than fc but usually no more than 7% i did some calculations but just needed some view from you guys... calculate calculate... seems like... doable to me? but i sense something is wrong somewhere... hope u guys can enlighten me thanks |

|

|

Mar 13 2012, 11:26 AM Mar 13 2012, 11:26 AM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(Petre @ Mar 13 2012, 10:56 AM) an agent came to me and let me know of this. You commit 18k total.deposit 3k per year. thats around 250 per month. deposit for 6 years. will get 500 annually until age 90 i will get back 500 as 'reward' per year starting from year 1 and if not withdrawal of the 500 every year, can get 5.25% return from the 500. this is accumulated. so first year is 500X5.25% (=A). next year will be (A+500)X5.25% (=B), third year (B+500)x5.25% and so forth the 500 will be paid annually upo to age 90 for the 3k, will be given some dividend depending on economy, so he said. the rate is better than fc but usually no more than 7% i did some calculations but just needed some view from you guys... calculate calculate... seems like... doable to me? but i sense something is wrong somewhere... hope u guys can enlighten me thanks Every year you get back Rm500 pa. You need 36 years to get back the original 18K you commit! If one is 30 years old, mean when 66 years old time, you get back the original 18k, disregard how much potential non-guaranteed dividend/bonus first Sound good? |

|

|

Mar 13 2012, 01:57 PM Mar 13 2012, 01:57 PM

|

Senior Member

1,151 posts Joined: Aug 2008 |

QUOTE(Petre @ Mar 13 2012, 10:56 AM) an agent came to me and let me know of this. if you look properly, i think the ROI not included the amount of premium u paid over 3 years...deposit 3k per year. thats around 250 per month. deposit for 6 years. will get 500 annually until age 90 i will get back 500 as 'reward' per year starting from year 1 and if not withdrawal of the 500 every year, can get 5.25% return from the 500. this is accumulated. so first year is 500X5.25% (=A). next year will be (A+500)X5.25% (=B), third year (B+500)x5.25% and so forth the 500 will be paid annually upo to age 90 for the 3k, will be given some dividend depending on economy, so he said. the rate is better than fc but usually no more than 7% i did some calculations but just needed some view from you guys... calculate calculate... seems like... doable to me? but i sense something is wrong somewhere... hope u guys can enlighten me thanks |

|

|

Mar 13 2012, 02:20 PM Mar 13 2012, 02:20 PM

|

Junior Member

487 posts Joined: Aug 2011 |

Cash builder is a very POOR WAY to save for retirement as it yields are poor. And to make things worse, the sum assured is very low in relation to the premium paid.

Why would anyone want to use a cash builder or any similar endowment policy aka save 5 years, save 10 years for a savings plan? Agents promoting such plans should be shot. Do you people know how low is the yield ? FD rates are even better. Do you know how much commission the agent is making from your monthly premiums? Minimum 17.5% before bonus from the premiums paid. You put in 100, agent take 17.50. You understand? Do you know how low the sum assured is? You can easily buy 5x more coverage with whole life policy with the same premium paid for endowment. Now ask yourself, can you survive on $500 per year? I don't about you but I need at least $300000 per year. Now imagine how much premium I have to paid for cash builder. This post has been edited by lunchtime: Mar 13 2012, 02:48 PM |

|

|

Mar 13 2012, 03:46 PM Mar 13 2012, 03:46 PM

|

Senior Member

4,334 posts Joined: Nov 2004 From: Shadow Striker |

QUOTE(cherroy @ Mar 13 2012, 11:26 AM) You commit 18k total. first of all thanks for the reply. Every year you get back Rm500 pa. You need 36 years to get back the original 18K you commit! If one is 30 years old, mean when 66 years old time, you get back the original 18k, disregard how much potential non-guaranteed dividend/bonus first Sound good? how i saw it (or made to understand) was like this: 1st year put 3k get back 500. thats around 16.7%. plus the 5.25% from the 500 if not withdrawal. plus interest for the 3k 2nd year add 3k get back 500. thats around 16.7%. plus the 5.25% from the 500 if not withdrawal. plus interest for the 3k 7th year no need to top up, let the 18k (plus whatever interest it already accumulated in the 6 years) run its course), and get 500, also getting 5.25% to all the 500s (assuming no withdrawal). well it does sound too good or am i doing the calculations wrongly here? pls help QUOTE(walle @ Mar 13 2012, 01:57 PM) thanks for the reply. can i say its 500 for every 3k invested? pls enlighten me QUOTE(lunchtime @ Mar 13 2012, 02:20 PM) Cash builder is a very POOR WAY to save for retirement as it yields are poor. And to make things worse, the sum assured is very low in relation to the premium paid. thanks for the reply Why would anyone want to use a cash builder or any similar endowment policy aka save 5 years, save 10 years for a savings plan? Agents promoting such plans should be shot. Do you people know how low is the yield ? FD rates are even better. Do you know how much commission the agent is making from your monthly premiums? Minimum 17.5% before bonus from the premiums paid. You put in 100, agent take 17.50. You understand? Do you know how low the sum assured is? You can easily buy 5x more coverage with whole life policy with the same premium paid for endowment. Now ask yourself, can you survive on $500 per year? I don't about you but I need at least $300000 per year. Now imagine how much premium I have to paid for cash builder. assuming its only about 3k per year for 6 years, 500 every year (first 6 year, 500 return from 3k) and 7th year onwards no need to top up... sounds too good? or am i missing something here? thanks for the helpl This post has been edited by Petre: Mar 13 2012, 03:46 PM |

|

|

Mar 13 2012, 03:59 PM Mar 13 2012, 03:59 PM

|

Junior Member

51 posts Joined: Mar 2012 |

bought that plan few yr ago......

|

|

|

Mar 13 2012, 04:13 PM Mar 13 2012, 04:13 PM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(Petre @ Mar 13 2012, 03:46 PM) first of all thanks for the reply. Based on your input, as I do not know the plan, so I explain based on the input provided. how i saw it (or made to understand) was like this: 1st year put 3k get back 500. thats around 16.7%. plus the 5.25% from the 500 if not withdrawal. plus interest for the 3k 2nd year add 3k get back 500. thats around 16.7%. plus the 5.25% from the 500 if not withdrawal. plus interest for the 3k 7th year no need to top up, let the 18k (plus whatever interest it already accumulated in the 6 years) run its course), and get 500, also getting 5.25% to all the 500s (assuming no withdrawal). well it does sound too good or am i doing the calculations wrongly here? pls help thanks for the reply. can i say its 500 for every 3k invested? pls enlighten me thanks for the reply assuming its only about 3k per year for 6 years, 500 every year (first 6 year, 500 return from 3k) and 7th year onwards no need to top up... sounds too good? or am i missing something here? thanks for the helpl It is not 16.7% pa. It is not put 3k get 500. The 500 comes from your 3K. It is not the like give you 500, while you still have 3k principal intact that can be withdraw. It is not the like FD. As said you put 18k then you get back Rm500 every year until 90. So you need to wait until 36 years before 18k recouped. Only after 36 years, you start to "reap" extra "profit". If it is a 16.7% pa return, I can assure you that you will see miles long rich people to queue up to buy up this plan. This post has been edited by cherroy: Mar 13 2012, 04:31 PM |

|

|

Mar 13 2012, 04:13 PM Mar 13 2012, 04:13 PM

|

Senior Member

4,334 posts Joined: Nov 2004 From: Shadow Striker |

|

|

|

Mar 13 2012, 04:16 PM Mar 13 2012, 04:16 PM

|

Junior Member

51 posts Joined: Mar 2012 |

not really sure about the details....agent told me every yr get income and after dunno how many yr can get how many hundred % return........

This post has been edited by dkhau: Mar 13 2012, 04:17 PM |

|

|

Mar 13 2012, 05:36 PM Mar 13 2012, 05:36 PM

|

Junior Member

487 posts Joined: Aug 2011 |

You ask that agent of yours, can you withdrawal your 6k after year 2. Bet you he will tell you sorry this is long term savings, can withdraw only after 6 years.

You know why? Cuz in your account, there is very little money left after paying the commission and fees and charges. How can there be 16.7% return? Your 3k is not even there in your account. That $500 is really your money paid back to you. Ask your agent to stop twisting facts and stop the creative selling. Use a financial calculator, work out the IRR. About the hundred % returns, given 30 years time frame, any instruments with compoundong interest will give hundred % returns, just that this cash builder and similar endowment policies gives the lowest returns. even bond funds give better return. And why would anyone in their right mind save money with an insurance company? This post has been edited by lunchtime: Mar 13 2012, 05:47 PM |

|

|

Mar 17 2012, 11:33 PM Mar 17 2012, 11:33 PM

|

All Stars

10,061 posts Joined: Dec 2004 From: Sheffield |

QUOTE(Petre @ Mar 13 2012, 03:46 PM) first of all thanks for the reply. see how they catch you therehow i saw it (or made to understand) was like this: 1st year put 3k get back 500. thats around 16.7%. plus the 5.25% from the 500 if not withdrawal. plus interest for the 3k 2nd year add 3k get back 500. thats around 16.7%. plus the 5.25% from the 500 if not withdrawal. plus interest for the 3k 7th year no need to top up, let the 18k (plus whatever interest it already accumulated in the 6 years) run its course), and get 500, also getting 5.25% to all the 500s (assuming no withdrawal). well it does sound too good or am i doing the calculations wrongly here? pls help thanks for the reply. can i say its 500 for every 3k invested? pls enlighten me thanks for the reply assuming its only about 3k per year for 6 years, 500 every year (first 6 year, 500 return from 3k) and 7th year onwards no need to top up... sounds too good? or am i missing something here? thanks for the helpl 1st year total 3k investment - 500 return 2nd year total 6k investment - 500 return 3rd year total 9k investment - 500 return 4th year total 12k investment - 500 return 5th year total 15k investment - 500 return 6th year total 18k investment - 500 return now u see the trend? they show you the 3k every year, but the subsequent year what happen to your 3k / 6k / 9k / 12k / 15k before that?And as mentioned, please calculate how long it takes for you to get back your 18k. Sadly, alot of people are still blinded by it and sign up. If it is 16.67% return per annum, the big bosses themselves are signing up with millions of fund already. This post has been edited by bearbear: Mar 17 2012, 11:35 PM |

|

|

Mar 19 2012, 01:51 PM Mar 19 2012, 01:51 PM

|

Newbie

1 posts Joined: Mar 2012 |

Thanks V12Kompressor for sharing... (sometimes it is a bit sad to see flamers around)

I personally found the plan you shared attractive in some way... So I would like to just share my thoughts as well. Advantages: 1) I can save, and it comes with a protection. The protection can work for me in many ways, because I have my own software business, and I bought office and condos. But, I do not like Life plan, which solely just take my money over a long period. So, I would prefer a saving plan with higher surrender value. (I don't quite care about dividen, it is non-guaranteed anyway) 2) Give me abit of financial control, as I am quite a big spender, I can easily take home a sales of 100k, but I couldnt save 100k. So, it force me to save some money for retirement. 3) I dont like the way ppl spend EPF money. So, I took up this plan to save some portion of my EPF contribution, a place that is flexible, and I can have full control with. 4) I can assign trustee, it serve as a risk management as well. Disadvantages: 1) Need to save this amount for at least 10-15 years. Calculated. 2) Can only save if have excessive cash. But if we manage our cash the proper way, you should save before you spend. 3) Not quite attractive, if I have a huge money ready for big investment, or high turnover investment. (provided that you dont care about risk, or you have high return to cover your risk) 4) Not suitable for ppl who wanted to get rich fast out of this. You are saving, not investing. If you dont save now, you have nothing later. Conclusion: I dont't adjust myself to this plan. I find values from this plan that fit me. |

|

|

Mar 19 2012, 05:14 PM Mar 19 2012, 05:14 PM

|

Junior Member

193 posts Joined: Mar 2005 |

What are the underlying assets that the income builder plan invests in?

|

|

|

Mar 20 2012, 05:26 PM Mar 20 2012, 05:26 PM

|

Junior Member

84 posts Joined: Mar 2005 From: Sri Gombak |

I am HLA agent too. Let me state an example for you all for clearer understanding about the Income Builder EG: Female, Age 27 Save with HLA Income Builder for 6 year Saving: RM5,186 per year or RM453 per month Total saving in 6 years: RM31,116 Guaranteed Yearly Income: RM1,000 per year up to 40 year (Female, Age 66 by then) 2 options available for the Guaranteed yearly income: 1) Accumulates with HLA with compounding interest 5.5% (by age 66 Female will have RM195,039 as retirement fund based on Scenario A return of 6.5% with HLA) 2) Withdraw yearly income - RM1,000 cheque sent to Female yearly (by age 66 Female will still have RM58,434 as retirement fund based on Scenario A return of 6.5% with HLA) Main Benefit: Short saving period, long term guaranteed return. PS: Of course if you comparing with EPF, RM195k sure not enough for retirement. But bare in mind, you only save for 6 years here, just treat this as a reserve fund. Unlike EPF which you save month by month, until age you can withdraw EPF. That of course will become alot of money Best regards to all and happy saving, Flora |

|

|

Mar 20 2012, 08:49 PM Mar 20 2012, 08:49 PM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(flora02 @ Mar 20 2012, 05:26 PM) I am HLA agent too. Let me state an example for you all for clearer understanding about the Income Builder EG: Female, Age 27 Save with HLA Income Builder for 6 year Saving: RM5,186 per year or RM453 per month Total saving in 6 years: RM31,116 Guaranteed Yearly Income: RM1,000 per year up to 40 year (Female, Age 66 by then) 2 options available for the Guaranteed yearly income: 1) Accumulates with HLA with compounding interest 5.5% (by age 66 Female will have RM195,039 as retirement fund based on Scenario A return of 6.5% with HLA) 2) Withdraw yearly income - RM1,000 cheque sent to Female yearly (by age 66 Female will still have RM58,434 as retirement fund based on Scenario A return of 6.5% with HLA) Main Benefit: Short saving period, long term guaranteed return. PS: Of course if you comparing with EPF, RM195k sure not enough for retirement. But bare in mind, you only save for 6 years here, just treat this as a reserve fund. Unlike EPF which you save month by month, until age you can withdraw EPF. That of course will become alot of money Best regards to all and happy saving, Flora I suggest some company come out with another shorter save plan like 3 years with Rm10k per year? Can claim even shorter saving period. |

|

|

Mar 20 2012, 10:27 PM Mar 20 2012, 10:27 PM

|

Junior Member

487 posts Joined: Aug 2011 |

QUOTE(flora02 @ Mar 20 2012, 05:26 PM) I am HLA agent too. Let me state an example for you all for clearer understanding about the Income Builder EG: Female, Age 27 Save with HLA Income Builder for 6 year Saving: RM5,186 per year or RM453 per month Total saving in 6 years: RM31,116 Guaranteed Yearly Income: RM1,000 per year up to 40 year (Female, Age 66 by then) 2 options available for the Guaranteed yearly income: 1) Accumulates with HLA with compounding interest 5.5% (by age 66 Female will have RM195,039 as retirement fund based on Scenario A return of 6.5% with HLA) 2) Withdraw yearly income - RM1,000 cheque sent to Female yearly (by age 66 Female will still have RM58,434 as retirement fund based on Scenario A return of 6.5% with HLA) Main Benefit: Short saving period, long term guaranteed return. PS: Of course if you comparing with EPF, RM195k sure not enough for retirement. But bare in mind, you only save for 6 years here, just treat this as a reserve fund. Unlike EPF which you save month by month, until age you can withdraw EPF. That of course will become alot of money Best regards to all and happy saving, Flora |

|

|

Mar 22 2012, 04:27 PM Mar 22 2012, 04:27 PM

|

Junior Member

84 posts Joined: Mar 2005 From: Sri Gombak |

QUOTE(lunchtime @ Mar 20 2012, 10:27 PM) Added on March 22, 2012, 4:43 pm QUOTE(cherroy @ Mar 20 2012, 08:49 PM) Rm195,039, a guaranteed return? RM195,039 is not guaranteed. The only thing that is guaranteed in this plan is the GUARANTEED YEARLY INCOME which is the RM1,000 per year x 40 years. and this RM195,039 includes Guaranteed yearly income, accumulated interests (5.5% at Scenario A), Yearly Dividend (Scenario A) **For those who wondering what is Scenario A - Its an assumption on the dividend payout and compounding rate from Hong Leong Assurance company performance - Hong Leong Assurance attain Scenario A every year for all previous and current saving product. QUOTE(cherroy @ Mar 20 2012, 08:49 PM) I suggest some company come out with another shorter save plan like 3 years with Rm10k per year? That'll be real difficult for 1 to meet the retirement fund amount if you only require to save 3 years of money.Can claim even shorter saving period. Unless this 3 years you can save at least RM100k per year (total RM300k), perhaps. By 30years later (with compounding interest and non withdrawal) the account will have around 350% in total of what you save in, that makes the account RM1,050,000. Should be enough for 15 years of retirement. But 3 years saving plan really sound attractive to everyone. Added on March 22, 2012, 5:24 pm QUOTE(lunchtime @ Mar 13 2012, 02:20 PM) Cash builder is a very POOR WAY to save for retirement as it yields are poor. And to make things worse, the sum assured is very low in relation to the premium paid. Why would anyone want to use a cash builder or any similar endowment policy aka save 5 years, save 10 years for a savings plan? Agents promoting such plans should be shot. Do you people know how low is the yield ? FD rates are even better. And we agent just work for a living, same like you. I bet you wouldn't like people to say what you're working as now is a crime and you should be shot. Its not nice to give such comment in the public. Please respect others. QUOTE(lunchtime @ Mar 13 2012, 02:20 PM) Do you know how much commission the agent is making from your monthly premiums? Minimum 17.5% before bonus from the premiums paid. You put in 100, agent take 17.50. You understand? No we don't get that much QUOTE(lunchtime @ Mar 13 2012, 02:20 PM) Do you know how low the sum assured is? You can easily buy 5x more coverage with whole life policy with the same premium paid for endowment. Completely agree with you on the lower sum assured. But you cant compare an apple with orange. Life insurance and Cash Builder is completely different thing. We will not recommend Cash builder to client that needs a Life protection, same on the other hand, for saving purpose, we cannot recommend Life insurance to them. Life insurance dont save them much money in the end. But it protects the family as a whole if the bread winner no longer around. Its totally different thing. Please dont compare a saving plan with a life insurance plan.QUOTE(lunchtime @ Mar 13 2012, 02:20 PM) Now ask yourself, can you survive on $500 per year? I don't about you but I need at least $300000 per year. Now imagine how much premium I have to paid for cash builder. I am just imagining how much you have to save now to make sure you can retire for another 15 years after age 55.$300000 x 15 = RM4,500,000 As for Fixed deposit (which you say the returns is so much better), at age 25 you have to save RM1,400,000 with rate 4% and let it be compounding for 30 years. By age 55 you will have your retirement fund ready RM4,500,000 This is just pure example. Of course with Cash Builder don't require 1 to save as much to attain this retirement figure. I hope i don't offense you in anyway and hope this clears your doubt. Peace. This post has been edited by flora02: Mar 22 2012, 05:24 PM |

|

|

Mar 23 2012, 10:04 AM Mar 23 2012, 10:04 AM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(flora02 @ Mar 22 2012, 04:27 PM) RM195,039 is not guaranteed. The only thing that is guaranteed in this plan is the GUARANTEED YEARLY INCOME which is the RM1,000 per year x 40 years. and this RM195,039 includes Guaranteed yearly income, accumulated interests (5.5% at Scenario A), Yearly Dividend (Scenario A) **For those who wondering what is Scenario A - Its an assumption on the dividend payout and compounding rate from Hong Leong Assurance company performance - Hong Leong Assurance attain Scenario A every year for all previous and current saving product. That'll be real difficult for 1 to meet the retirement fund amount if you only require to save 3 years of money. Unless this 3 years you can save at least RM100k per year (total RM300k), perhaps. By 30years later (with compounding interest and non withdrawal) the account will have around 350% in total of what you save in, that makes the account RM1,050,000. Should be enough for 15 years of retirement. But 3 years saving plan really sound attractive to everyone. Added on March 22, 2012, 5:24 pm And we agent just work for a living, same like you. I bet you wouldn't like people to say what you're working as now is a crime and you should be shot. Its not nice to give such comment in the public. Please respect others. No we don't get that much Completely agree with you on the lower sum assured. But you cant compare an apple with orange. Life insurance and Cash Builder is completely different thing. We will not recommend Cash builder to client that needs a Life protection, same on the other hand, for saving purpose, we cannot recommend Life insurance to them. Life insurance dont save them much money in the end. But it protects the family as a whole if the bread winner no longer around. Its totally different thing. Please dont compare a saving plan with a life insurance plan. I am just imagining how much you have to save now to make sure you can retire for another 15 years after age 55. $300000 x 15 = RM4,500,000 As for Fixed deposit (which you say the returns is so much better), at age 25 you have to save RM1,400,000 with rate 4% and let it be compounding for 30 years. By age 55 you will have your retirement fund ready RM4,500,000 This is just pure example. Of course with Cash Builder don't require 1 to save as much to attain this retirement figure. I hope i don't offense you in anyway and hope this clears your doubt. Peace. QUOTE Main Benefit: Short saving period, long term guaranteed return. Many fulltime agent make a living through commission from the premium, what is so not nice to tell? As long as the agent explain properly and clearly, and no misleading statement to start with, what is wrong with that? 3 years attractive? Seems someone don't understand 15 years, 6 years, 3 years saving is the same one. In fact 15 years can be more affordable than 6 years. For eg. if 15 years annual premium Rm 2000 6 years annual premium Rm 5000 3 years annual premium RM 10,000 All are the same, shorter period of premium /= better, in fact it can be worst depended on situation. For eg. a 6 year premium plan. Paid 2 years, suddenly something happen and face financial difficult, cannot afford to pay for following years, means pre-mature surrender and surrender cash value can be less than premium paid. There is no such thing shorter period of saving one. Just how it being structured. Compared FD with Cash builder? Can cash builder money inside lump sum being withdrawn at age 45 when you emergency required time compared to FD? FD anytime I emergency needed time, or whenever I needed time, I can use the money, can cash builder does it? If not, then why compared with FD? |

|

|

Mar 27 2012, 12:13 PM Mar 27 2012, 12:13 PM

|

Junior Member

84 posts Joined: Mar 2005 From: Sri Gombak |

QUOTE(cherroy @ Mar 23 2012, 10:04 AM) Then why you come out the statement of Agree totally. Many fulltime agent make a living through commission from the premium, what is so not nice to tell? As long as the agent explain properly and clearly, and no misleading statement to start with, what is wrong with that? QUOTE(cherroy @ Mar 23 2012, 10:04 AM) 3 years attractive? Seems someone don't understand Yes what you saying here is somewhat true but not 100%. If there are really 3 years plan, the comparison table might be like this.15 years, 6 years, 3 years saving is the same one. In fact 15 years can be more affordable than 6 years. For eg. if 15 years annual premium Rm 2000 6 years annual premium Rm 5000 3 years annual premium RM 10,000 All are the same, shorter period of premium /= better, in fact it can be worst depended on situation. For eg. a 6 year premium plan. Paid 2 years, suddenly something happen and face financial difficult, cannot afford to pay for following years, means pre-mature surrender and surrender cash value can be less than premium paid. There is no such thing shorter period of saving one. Just how it being structured. 15 years annual premium Rm 3000 6 years annual premium Rm 5000 3 years annual premium RM 8,800 To get the same Guaranteed Yearly Income, this should roughly be what the premium payment amount looks like. QUOTE(cherroy @ Mar 23 2012, 10:04 AM) Compared FD with Cash builder? Can cash builder money inside lump sum being withdrawn at age 45 when you emergency required time compared to FD? FD anytime I emergency needed time, or whenever I needed time, I can use the money, can cash builder does it? If not, then why compared with FD? Of course you can get back your lumpsum of money (aka 100% withdrawal) at any period of time, but we will advise the client when should be the best time of withdrawal. When client sign up for this plan, its meant for retirement or education purpose. Unlike FD, which has more flexibility like you mention, and of course returns are lower. Why dont then you compare FD with property returns? of course property returns are higher, but izzit flexible? definitely not. Can you treat FD as a retirement fund? 1 must have really strong discipline when come to this. I am sure alot of people will withdraw their EPF before age 55 if there's a need of emergency & nothing stopping them to do so. But what will happen to these people is they will have RM0 retirement fund in the end. And force to work after retirement age. All plans have pros and cons. Our plan serve its purpose well. |

|

|

Mar 27 2012, 02:50 PM Mar 27 2012, 02:50 PM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(flora02 @ Mar 27 2012, 12:13 PM) Of course you can get back your lumpsum of money (aka 100% withdrawal) at any period of time, but we will advise the client when should be the best time of withdrawal. When client sign up for this plan, its meant for retirement or education purpose. Unlike FD, which has more flexibility like you mention, and of course returns are lower. Why dont then you compare FD with property returns? of course property returns are higher, but izzit flexible? definitely not. Can you treat FD as a retirement fund? 1 must have really strong discipline when come to this. I am sure alot of people will withdraw their EPF before age 55 if there's a need of emergency & nothing stopping them to do so. But what will happen to these people is they will have RM0 retirement fund in the end. And force to work after retirement age. All plans have pros and cons. Our plan serve its purpose well. QUOTE(flora02 @ Mar 20 2012, 05:26 PM) Main Benefit: Short saving period, long term guaranteed return. PS: Of course if you comparing with EPF, RM195k sure not enough for retirement. But bare in mind, you only save for 6 years here, just treat this as a reserve fund. Unlike EPF which you save month by month, until age you can withdraw EPF. That of course will become alot of money Best regards to all and happy saving, Flora QUOTE(flora02 @ Mar 22 2012, 04:27 PM) |

|

|

Mar 28 2012, 01:06 AM Mar 28 2012, 01:06 AM

|

Junior Member

83 posts Joined: Jan 2009 From: mummty's tummy..^^ |

there is always scenario A and B in the quotation,

however even in bear market, scenario B hv higher interest than fixed deposit + protection and etc such as waiver if u included in ur saving plan. however, for the pass 8 years even in bear market, Hong Leong declare the dividend at Scenario A, That makes most of my client return to me for new transaction. there is always criticizer for products as there was many competitors and rumors spreading in the industry. Hong Leong save the advertising fee for better return to agents, consultants and also client =) For better understanding, pls find experienced client =) i believe there will be more positive than negative, i wont expect all positive, as many times, is not the product or agency prob but the agent. As conclusion, to evaluate the plan pls find a respective agent in charge or consultant for the best evaluating =) |

|

|

Mar 28 2012, 09:30 AM Mar 28 2012, 09:30 AM

|

Junior Member

487 posts Joined: Aug 2011 |

Simply put, there are better and cheaper ways to save money than cash builder.

By the way, cash builder is just a name created by HLA, basically cash builder is just like any other endowment plans marketed by the insurance industry. Nothing to shout about. |

|

|

Mar 28 2012, 10:14 AM Mar 28 2012, 10:14 AM

|

All Stars

14,899 posts Joined: Apr 2005 From: Kuala Lumpur & Selangor |

QUOTE(flora02 @ Mar 27 2012, 12:13 PM) Of course you can get back your lumpsum of money (aka 100% withdrawal) at any period of time, but we will advise the client when should be the best time of withdrawal. Are you sure about that?Means if I save until the 9th year and then suddenly my mother is sick and I need money for medical, I can withdraw 100% of my cash saved in cash builder? |

|

|

Mar 28 2012, 10:32 AM Mar 28 2012, 10:32 AM

|

Junior Member

487 posts Joined: Aug 2011 |

QUOTE(Icehart @ Mar 28 2012, 10:14 AM) Are you sure about that? 100%??? in your dreams lor.. can withdraw some but have to pay interest to insurance company for the monies withdrawn.Means if I save until the 9th year and then suddenly my mother is sick and I need money for medical, I can withdraw 100% of my cash saved in cash builder? save your money with A, withdraw some of your own money to use, have to pay interest to A. (BTW there are valid reasons for it, but i will leave that to the insurance agents here to explain the reasons) |

|

|

Mar 28 2012, 04:34 PM Mar 28 2012, 04:34 PM

|

Junior Member

92 posts Joined: Sep 2011 |

QUOTE(Icehart @ Mar 28 2012, 10:14 AM) Are you sure about that? you have to pay interest to the company when u using your OWN money. You dont need to pay other's ppl money to save for your money. If you want force saving, pay the same commission amout to your parents and save in their bank account.Means if I save until the 9th year and then suddenly my mother is sick and I need money for medical, I can withdraw 100% of my cash saved in cash builder? |

|

|

Mar 30 2012, 04:57 PM Mar 30 2012, 04:57 PM

|

Junior Member

193 posts Joined: Mar 2005 |

|

|

|

Apr 14 2012, 12:10 PM Apr 14 2012, 12:10 PM

|

Newbie

3 posts Joined: Apr 2012 |

Hi please confirm my understanding.

I got this table from melvinology * com: Year Deposit Income Surrender ---- ------- ------ ------- 1 12060 2000 10228 2 12060 2000 19729 3 12060 2000 31351 4 12060 2000 44153 5 12060 2000 58156 6 12060 2000 72777 7 0 2000 76745 8 . . 80936 9 . . 85359 10 . . 90046 . . . . 30 . . 259612 Based on this table, I then calculated the 'profit' and ROI for 10 years: Cash builder ------------ 10 years investment = 12060 * 6 = 72360 Surrender value after 10 years = 90046 Profit = 17686 10 year ROI = 17686/72360 = 0.2444 Fixed Deposit ------------ Assume 3% pa, and investment is instant rather than over 6 years. Principle = 72360 Surrender = 72360 * (1.03^10) = 97246 Profit = 24886 ROI = 24886/72360 = 0.3439 Am I correct here? Thanks in advance. |

|

|

Apr 14 2012, 12:53 PM Apr 14 2012, 12:53 PM

|

Senior Member

16,872 posts Joined: Jun 2011 |

ROI is lower than FD right?

|

|

|

Apr 14 2012, 12:55 PM Apr 14 2012, 12:55 PM

|

Senior Member

546 posts Joined: Sep 2010 |

|

|

|

Apr 14 2012, 03:09 PM Apr 14 2012, 03:09 PM

|

Newbie

3 posts Joined: Apr 2012 |

|

|

|

Apr 14 2012, 04:36 PM Apr 14 2012, 04:36 PM

|

Senior Member

603 posts Joined: Nov 2010 |

QUOTE(ummonkwatz @ Apr 14 2012, 12:10 PM) Based on this table, I then calculated the 'profit' and ROI for 10 years: Wrong. What you did there was the income planner was 6 entries per year of 12060, while for FD you just dumped 1 lump sum of 72360 right on its 1st year! Of course the lump sum win big time! Cash builder ------------ 10 years investment = 12060 * 6 = 72360 Surrender value after 10 years = 90046 Profit = 17686 10 year ROI = 17686/72360 = 0.2444 Fixed Deposit ------------ Assume 3% pa, and investment is instant rather than over 6 years. Principle = 72360 Surrender = 72360 * (1.03^10) = 97246 Profit = 24886 ROI = 24886/72360 = 0.3439 Am I correct here? Thanks in advance. Now if you followed the FD the same style as the cash builder to get a more accurate comparison you get: FD 3% ------------ 10 years investment = 12060 * 6 = 72360 Year deposit surrender 1 12060 12,421.80 2 12060 25,216.25 3 12060 38,394.54 4 12060 51,968.18 5 12060 65,949.02 6 12060 80,349.29 7 0 82,759.77 8 0 85,242.57 9 0 87,799.84 10 0 90,433.84 Surrender value after 10 years = 90433.84 Profit = 18073.84 10 year ROI = 18073.84/72360 = 0.249 NOW THIS IS WHAT A DO IT YOURSELF INCOME BUILDER WILL LOOK LIKE USING FD! Its like the same results but without an agent. The question is are you disciplined enough to do it yourself? Results are damn close. Let's just take the performance as a tie. Which still makes FD better doesn't it? At the end of the year term you can cash it out instantly wihtout some agent begging "Don;t cash out, you'll lose everything you just built". Even at 10 years agents will tell you if you fully cash out you have to start all over again. |

|

|

Apr 14 2012, 06:17 PM Apr 14 2012, 06:17 PM

|

Newbie

3 posts Joined: Apr 2012 |

@Rice_Owl84: Agreed, I just took short cut to calculate which is not fair for the Cash Builder. But another thing is the income bit, which I totally omitted (this bit not sure - is it included in the surrender value?)

If include income, then Cash Builder > FD? Looks like it. Also, seems like you don't lose much even if you pull out early. But the surrender figure may be based on very high projected interest rate (4.5-6.5%). This post has been edited by ummonkwatz: Apr 14 2012, 06:17 PM |

|

|

Apr 18 2012, 03:26 PM Apr 18 2012, 03:26 PM

|

Senior Member

1,764 posts Joined: Sep 2008 |

i have done an analysis and here's the finding

https://docs.google.com/spreadsheet/ccc?key...MjNRR29STEh4cnc In summary, the HL Cash Builder performance is similar to FD, but with insurance which you don't get in FD. And it's for long term, FD is for emergency. If you want maximum profit with minimum risk. Go for Reit. Currently most of my reits are performing at 6.5% on average. The prices of REIT doesn't fluctuate like other shares, they only move like +/- 1 cent a day if any. But at double the interest you can get from FD, it's calculated risk. Added on April 18, 2012, 3:30 pmof course you don't put all your money in one basket Added on April 18, 2012, 3:30 pmof course you don't put all your money in one basket This post has been edited by Vincent Pang: Apr 18 2012, 03:30 PM |

|

|

Apr 18 2012, 08:02 PM Apr 18 2012, 08:02 PM

|

Junior Member

487 posts Joined: Aug 2011 |

You people factor in inflation for your calculations?

|

|

|

Apr 19 2012, 11:06 AM Apr 19 2012, 11:06 AM

|

Senior Member

1,764 posts Joined: Sep 2008 |

|

|

|

Apr 19 2012, 05:13 PM Apr 19 2012, 05:13 PM

|

Senior Member

814 posts Joined: Jan 2003 From: Under the Sun. |

QUOTE(Vincent Pang @ Apr 18 2012, 03:26 PM) i have done an analysis and here's the finding It's a good visual for the data compiled. I had used cash flow method to calculated the returns. The IRR is at 2.02% p.a. Did I missed or calculated wrongly? How much do I get upon maturity or surrender? bsc the calculation doesn't include any, if included the returns will be slightly higher.https://docs.google.com/spreadsheet/ccc?key...MjNRR29STEh4cnc In summary, the HL Cash Builder performance is similar to FD, but with insurance which you don't get in FD. And it's for long term, FD is for emergency. If you want maximum profit with minimum risk. Go for Reit. Currently most of my reits are performing at 6.5% on average. The prices of REIT doesn't fluctuate like other shares, they only move like +/- 1 cent a day if any. But at double the interest you can get from FD, it's calculated risk. Added on April 18, 2012, 3:30 pmof course you don't put all your money in one basket Added on April 19, 2012, 5:29 pm QUOTE(Petre @ Mar 13 2012, 10:56 AM) an agent came to me and let me know of this. Also after calculating the returns is at 2.80% p.a. Assumption made is commitment starts at the age of 20. Do you get back lump sum or surrender value at the age of 90?deposit 3k per year. thats around 250 per month. deposit for 6 years. will get 500 annually until age 90 i will get back 500 as 'reward' per year starting from year 1 and if not withdrawal of the 500 every year, can get 5.25% return from the 500. this is accumulated. so first year is 500X5.25% (=A). next year will be (A+500)X5.25% (=B), third year (B+500)x5.25% and so forth the 500 will be paid annually upo to age 90 for the 3k, will be given some dividend depending on economy, so he said. the rate is better than fc but usually no more than 7% i did some calculations but just needed some view from you guys... calculate calculate... seems like... doable to me? but i sense something is wrong somewhere... hope u guys can enlighten me thanks This post has been edited by countdown: Apr 19 2012, 09:15 PM |

|

|

Apr 21 2012, 11:46 AM Apr 21 2012, 11:46 AM

|

Senior Member

3,970 posts Joined: Nov 2007 |

Sure its 2.xx %? Why didn't factor in the GYI for the 10years? Since its guaranteed I thing it should be factored in.

Currently got agent selling this to me, hope get more details before I commit.. |

|

|

Apr 26 2012, 11:11 AM Apr 26 2012, 11:11 AM

|

Junior Member

76 posts Joined: Feb 2008 |

Anything that is more than this?? What if i'm a business owner and i wish to bought it with my company money as a director benefit?? will it deductible from the Tax?? Kindly advice as one of the agent approach me quite attractive on their interest.

|

|

|

Apr 30 2012, 12:14 AM Apr 30 2012, 12:14 AM

|

Junior Member

37 posts Joined: Nov 2010 |

QUOTE(pisces88 @ Apr 21 2012, 11:46 AM) Sure its 2.xx %? Why didn't factor in the GYI for the 10years? Since its guaranteed I thing it should be factored in. the GYI already factored into the surrender value. If you are to take out the GYI the return should lower.Currently got agent selling this to me, hope get more details before I commit.. I'm wondering how much is the death benefit given to the RM 12,000/year plan. Added on April 30, 2012, 12:44 am QUOTE(cwsimonho @ Apr 30 2012, 12:14 AM) the GYI already factored into the surrender value. If you are to take out the GYI the return should lower. I think this is better. But sadly the lowest premium is RM12,000.I'm wondering how much is the death benefit given to the RM 12,000/year plan. It has a flexibility of withdrawing >50% of the premium paid without affecting the plan in case of emergency. Moreover it has a high Death/TPD benefit compared to other endowment plans. Year Premium Guaranteed N.Guaranteed Death/TPD Coverage 1 12,000 6,270 1,839 80,070 2 12,000 14,022 4,300 87,822 3 12,000 26,400 5,092 94,723 4 12,000 36,293 7,542 103,134 5 6,000 40,082 12,125 108,654 6 6,000 45,738 14,256 114,354 7 6,000 50,238 19,445 120,170 8 6,000 55,103 23,525 126,052 9 1,680 57,507 27,935 127,740 10 1,680 60,276 31,071 130,980 11 1,680 62,811 40,196 137,911 12 1,680 65,721 43,947 142,063 13 1,680 68,399 50,589 146,348 14 1,680 71,461 54,902 150,912 15 1,680 74,296 62,190 155,626 16 1,680 77,523 67,202 160,642 17 1,680 80,530 75,292 165,863 18 1,680 83,941 81,126 171,377 19 1,680 87,140 90,071 177,104 20 1,680 92,649 95,241 183,449 *editted due to wrong payment figure. This post has been edited by cwsimonho: May 1 2012, 01:36 AM |

|

|

May 14 2012, 12:10 PM May 14 2012, 12:10 PM

|

Senior Member

2,508 posts Joined: Jun 2009 |

In fact I don't fancy long term plan as although it may sounds good that after 10 years you will be getting substantial guarantee every years but taking inflation into consideration the guarantee income which they promised 10 years ago may sounds like peanuts nowadays. Imagine the economy rice which I'm eaten 10 years ago costs me RM2.50 but similiar dish nowadays costs RM6.50

Some HL agent did approach me on the income builder plan and on the phone the % sounds so great but when you see the plan and the table then you feel that it is created to cheat some consumers that did not see clearly the hidden part. The latest offer which I heard fm one of HL agent is that they even give you free Ipad3 for signing up of $50k plan and guarantee return of RM15/k per annum. I think Warren Buffet may be interested on this plan too. |

|

|

May 20 2012, 03:59 PM May 20 2012, 03:59 PM

|

Junior Member

10 posts Joined: Apr 2010 |