- ended -

This post has been edited by V12Kompressor: Mar 5 2013, 03:19 PM

Hong Leong Income Builder & Income Riders, Innovative and Flexible

Hong Leong Income Builder & Income Riders, Innovative and Flexible

|

|

Dec 5 2011, 08:56 PM, updated 13y ago Dec 5 2011, 08:56 PM, updated 13y ago

Show posts by this member only | Post

#1

|

Senior Member

2,141 posts Joined: Sep 2008 From: Muddy Banks |

- ended -

This post has been edited by V12Kompressor: Mar 5 2013, 03:19 PM |

|

|

|

|

|

Dec 5 2011, 09:38 PM Dec 5 2011, 09:38 PM

Show posts by this member only | Post

#2

|

Senior Member

28,187 posts Joined: Mar 2007 From: Underworld |

From where? HLA?

|

|

|

Dec 5 2011, 09:42 PM Dec 5 2011, 09:42 PM

Show posts by this member only | Post

#3

|

|

VIP

9,137 posts Joined: Jun 2007 From: Wouldn't be around much, pls PM other mods. |

What's the difference with the previous Cash Builder? https://forum.lowyat.net/index.php?showtopic=1231190

|

|

|

Dec 5 2011, 10:13 PM Dec 5 2011, 10:13 PM

Show posts by this member only | Post

#4

|

All Stars

11,954 posts Joined: May 2007 |

dont understand wat u say?

|

|

|

Dec 5 2011, 11:15 PM Dec 5 2011, 11:15 PM

Show posts by this member only | Post

#5

|

Junior Member

401 posts Joined: Sep 2010 |

|

|

|

Dec 5 2011, 11:18 PM Dec 5 2011, 11:18 PM

Show posts by this member only | Post

#6

|

Senior Member

2,736 posts Joined: Dec 2006 |

how much $$ is ur commission if we take ur plan?

|

|

|

|

|

|

Dec 6 2011, 12:08 AM Dec 6 2011, 12:08 AM

Show posts by this member only | Post

#7

|

Senior Member

2,141 posts Joined: Sep 2008 From: Muddy Banks |

QUOTE(Bonescythe @ Dec 5 2011, 09:38 PM) yup. Product is very new and the HLA webpage isn't updated yet as of now. QUOTE(b00n @ Dec 5 2011, 09:42 PM) What's the difference with the previous Cash Builder? https://forum.lowyat.net/index.php?showtopic=1231190 This is a new scheme to replace the HL Cash Builder (CB). Basically, it let the policy owner the flexibility to choose the amount of GYI he/she wish to receive and when he/she wish to receive. Secondly, the maturity period is longer than CB (CB is only up to 35 years). Basically this is a better plan to hedge against any unwanted events (TPD & early death) compared with CB depending on the riders taken. This plan also allow the policy owner to attach up to 50 riders (medic card, PA rider, CIR, etc) for an even more comprehensive protection. I am still working out a few plan which will yield the best return rate, so no figures will be given out for now. This scheme is very new and the reason why I opened this thread is to provide a reference on this scheme for the time to come. In future, everyone can refer to this thread for advices, POVs from a different perspective and to discuss about this plan when they have an interest with it. |

|

|

Dec 6 2011, 12:51 AM Dec 6 2011, 12:51 AM

Show posts by this member only | Post

#8

|

Junior Member

177 posts Joined: Oct 2011 |

QUOTE(V12Kompressor @ Dec 6 2011, 12:08 AM) yup. Product is very new and the HLA webpage isn't updated yet as of now. Is this endowment plan?This is a new scheme to replace the HL Cash Builder (CB). Basically, it let the policy owner the flexibility to choose the amount of GYI he/she wish to receive and when he/she wish to receive. Secondly, the maturity period is longer than CB (CB is only up to 35 years). Basically this is a better plan to hedge against any unwanted events (TPD & early death) compared with CB depending on the riders taken. This plan also allow the policy owner to attach up to 50 riders (medic card, PA rider, CIR, etc) for an even more comprehensive protection. I am still working out a few plan which will yield the best return rate, so no figures will be given out for now. This scheme is very new and the reason why I opened this thread is to provide a reference on this scheme for the time to come. In future, everyone can refer to this thread for advices, POVs from a different perspective and to discuss about this plan when they have an interest with it. GE had lot of these plans...so whats the big difference HLA offered? p/s : Bond yield higher than endowment plan |

|

|

Dec 6 2011, 10:56 AM Dec 6 2011, 10:56 AM

Show posts by this member only | Post

#9

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

LOL, a saving plan mature only when reach 90 years old?

I certain not suit to it. I don't think I can live up to 90, even can already blur blur until forget what is insurance plan that I had. If I really care about insurance, death benefit, I would rather get a whole life term policy to cover death and TPD. Just my personal preference, as personal view there is no logic to have a saving plan mature only when reach 90. Added on December 6, 2011, 10:58 amTS, there is too little info provided for details discussion. No mentioned about sum assured, and details of it. Only stated 5.5% on GYI. How about the principal lump sum? Added on December 6, 2011, 11:00 am QUOTE(V12Kompressor @ Dec 5 2011, 08:56 PM) [color=red] This is TPD due to accident only, what about TPD due to sickness/disease? An innovative and flexible participating whole life plan up to age 90 with Guaranteed Yearly Income (GYI). Guaranteed Yearly Income from year 1 up to age 90 payable from end of 1st year onwards up to age 90. GYI can be withdrawn OR deposited with the company to accumulate interest (5.5% as of today) from time to time. 9 or 12 year commitment Short term premium payment commitment, long term coverage. [High Death & TPD coverage 100% of Outstanding GYI or *9 times of GYI or *Cash Surrender Value, whichever is highest. *Additional 300% coverage on accidental TPD In an event of TPD due to accident, an additional 300% of Guaranteed TPD shall be payable Guaranteed Maturity Benefit of 9 times of GYI a maturity benefit of 9 times of GYI payable upon maturity. When getting old, the chance of TPD due to sickness is way way higher than accident. All the post only mentioned GYI, not touch on principal amount/premium already paid. Added on December 6, 2011, 11:03 amI think it is much better to put all the number in a table, just like most saving plan brochure out there. 9x GYI can be confusing, and people do not know how much they are getting. This post has been edited by cherroy: Dec 6 2011, 11:03 AM |

|

|

Dec 6 2011, 11:52 PM Dec 6 2011, 11:52 PM

|

Senior Member

2,141 posts Joined: Sep 2008 From: Muddy Banks |

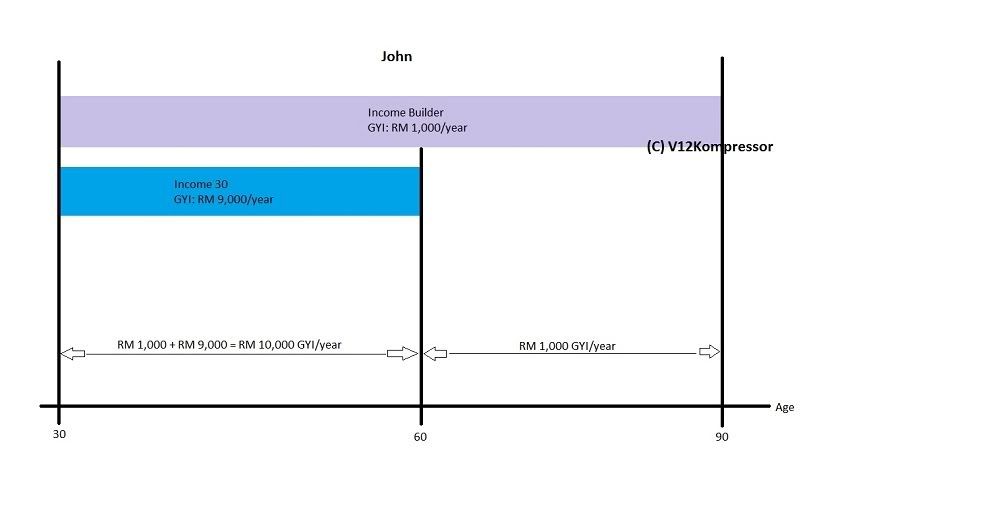

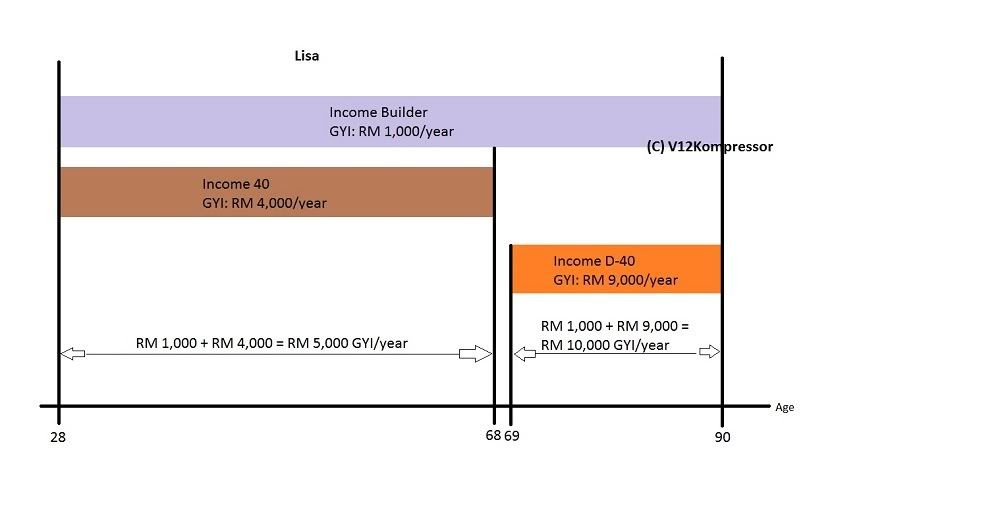

QUOTE(Violet Ling @ Dec 6 2011, 12:51 AM) Yes, this is an endownment plan. I'll explain further by replying Cherroy's post below; QUOTE(cherroy @ Dec 6 2011, 10:56 AM) LOL, a saving plan mature only when reach 90 years old? I certain not suit to it. I don't think I can live up to 90, even can already blur blur until forget what is insurance plan that I had. If I really care about insurance, death benefit, I would rather get a whole life term policy to cover death and TPD. Just my personal preference, as personal view there is no logic to have a saving plan mature only when reach 90. True. Nobody wants a plan which matures at such long period. Hence, the Riders which comes exclusively with this scheme comes in action. There are basically six riders for this Income Rider plan, namely 1) Income 20 2) Income 30 3) Income 40 4) Income D-20 5) Income D-30 6) Income D-40 For Rider 1,2,3 it will start to pay the Guaranteed Yearly Income (GYI) from the first year of inception till a specific period. Scenario A: John is 30 this year. He wants to get guaranteed RM 10,000 per year for the next 30 years. Hence, the plan which suits him would be Income Builder + Income 30 Rider. The Income Builder will give a GYI of RM 1,000 per year right up to John reaches the age of 90 and the Income 30 Rider will give a GYI of RM9,000 till John reaches the age of 60.  Rider 4,5 and 6 only kicks in after a year of a specific year right till the age 90. Scenario B: Lisa is 28 this year. She wish to receive a GYI of RM 5,000 per year when she is still employed and RM10,000 per year when she retires from her job. Hence, the plan which suits her would be Income Builder + Income 40 + Income D-40 Rider. The Income Builder will give a GYI of RM 1,000 per year right up to Lisa's age 90. The Income 40 will give an additional RM 4,000 for the next 40 years and when she retires at age 68, the D-40 GYI of RM 9,000 kicks in when she reach the age of 69 right up to Lisa's age of 90.  QUOTE Added on December 6, 2011, 10:58 amTS, there is too little info provided for details discussion. No mentioned about sum assured, and details of it. Only stated 5.5% on GYI. How about the principal lump sum? Yea, more info will be added from time to time because this is a very new product. As for the sum assured, I'll take Scenario A as example; lets say John TPD due to accident when he is age 40 (after GYI at end of 10th year is paid out). Assuming the Cash Surrender Value upon TPD is RM 28,000; SUM ASSURED = 100% of the outstanding GYI or 9 times of GYI or Cash Surrender Value, whichever is highest = (50 x 1000) or (9 x 1000) or 28,000 = RM 50,000 or RM 9,000 or 28,000 SUM ASSURED = RM 50,000 since RM 50,000 is highest among all. In addition to the RM 50,000; the Income 30 also grants another 100% of Outstanding GYI TPD benefit and an additional amount equivalent to 300% of Guaranteed TPD benefit. Age when TPD = 40 Rider Term = 60 GYI = RM 9,000 60 - 40 = 20 years of outstanding GYI 20 x 9,000 = RM 180,000 Additional 300% due to TPD due to accident; 180,000 x 300% = 540,000 540,000 + 180,000 = RM 720,000 Therefore, when TPD due to accident, total you will get is RM 50,000 + RM 720,000 = RM 770,000 QUOTE Added on December 6, 2011, 11:00 am This is TPD due to accident only, what about TPD due to sickness/disease? When getting old, the chance of TPD due to sickness is way way higher than accident. The additional 300% only payable in event of TPD due to accident. If TPD due to sickness/disease, the amount payable will be RM 180,000 + RM 50,000 (from Scenario A above). QUOTE All the post only mentioned GYI, not touch on principal amount/premium already paid. I still couldn't tabulate the premium table due to some software hiccups in the office. Will do when I have proper access to it. Added on December 6, 2011, 11:03 amI think it is much better to put all the number in a table, just like most saving plan brochure out there. 9x GYI can be confusing, and people do not know how much they are getting. Please hang on for this. Basically for this plan, all you got to do is to ask yourself how much do you wish to earn for the next X amount of time, where X is the next 20 years, 30 years or 40 years. From what I know so far, if one wish to get GYI of RM 10,000 for the next 20 years (Income Builder + Income 20), the premium will be around RM 27,000 per year. In addition to the GYI RM 10,000, there will be a cash dividend of RM 2,000 payable very year. Of course, the premium paid will also determined by age and gender factor so it may vary. This post has been edited by V12Kompressor: Dec 6 2011, 11:53 PM |

|

|

Dec 7 2011, 12:56 AM Dec 7 2011, 12:56 AM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(V12Kompressor @ Dec 6 2011, 11:52 PM) Basically for this plan, all you got to do is to ask yourself how much do you wish to earn for the next X amount of time, where X is the next 20 years, 30 years or 40 years. From what I know so far, if one wish to get GYI of RM 10,000 for the next 20 years (Income Builder + Income 20), the premium will be around RM 27,000 per year. In addition to the GYI RM 10,000, there will be a cash dividend of RM 2,000 payable very year. Of course, the premium paid will also determined by age and gender factor so it may vary. LOL, Rm27,000 premium pa. Assuming 9 year commitment. As stated 9-12 years commitment). 27k x 9 years =243k 20 years 10k = 200k + cash dividend 2k pa = 240k I better off with put 243K earn 3% FD interest and pay myself 10k per year. As said we need to compile the table to see the clear picture, if not even we talk so much also useless one without those details. Added on December 7, 2011, 12:58 amDon't just keep on stressing GYI, how much you want every year, it is the premium that matter the most. This post has been edited by cherroy: Dec 7 2011, 12:58 AM |

|

|

Dec 29 2011, 11:43 AM Dec 29 2011, 11:43 AM

|

Newbie

1 posts Joined: Aug 2011 |

QUOTE(cherroy @ Dec 7 2011, 12:56 AM) LOL, Rm27,000 premium pa. I guess, on top of the 243k that you're taking in as your initial capital the 240k is a return that you'll get, so in total you're getting 243k + 240k after X number of years...Assuming 9 year commitment. As stated 9-12 years commitment). 27k x 9 years =243k 20 years 10k = 200k + cash dividend 2k pa = 240k I better off with put 243K earn 3% FD interest and pay myself 10k per year. As said we need to compile the table to see the clear picture, if not even we talk so much also useless one without those details. Added on December 7, 2011, 12:58 amDon't just keep on stressing GYI, how much you want every year, it is the premium that matter the most. May I clarify what's X? |

|

|

Dec 29 2011, 01:28 PM Dec 29 2011, 01:28 PM

|

Junior Member

364 posts Joined: Mar 2008 |

I don't like Insurance Investment product as its brings 4% profit (Allianz) only compare to Bond, MM, Equity or Stock.

|

|

|

|

|

|

Dec 29 2011, 02:03 PM Dec 29 2011, 02:03 PM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(fabs @ Dec 29 2011, 11:43 AM) I guess, on top of the 243k that you're taking in as your initial capital the 240k is a return that you'll get, so in total you're getting 243k + 240k after X number of years... 243K is your premium paid.May I clarify what's X? They do not say paying back fully your premium paid + guaranteed GYI + cash dividend. GYI /= your return GYI = the money they return/pay back to you every year , not return on the premium paid. GYI can be including your initial premium + return. GYI is similar to guaranted cash back endowment plan. Just instead of using cash back, now they use GYI. It just said you paid 243K for 9 years, then every year you get RM10k + cash dividend , until x years. Above just interpretation of the info provided in this thread/forumers. I do not know the exact plan details, as there is not enough info provided in this thread, so I could be wrong in the above interpretation. |

|

|

Dec 29 2011, 03:30 PM Dec 29 2011, 03:30 PM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

This is a typical sales thread disguised as a discussion thread. Many of those around here lately...

|

|

|

Dec 29 2011, 07:16 PM Dec 29 2011, 07:16 PM

|

Senior Member

2,406 posts Joined: Jul 2010 From: bandar Sunway |

hmm recently i heard a saving product from Hong Leong(dont know its HLA or HLB), which seems to be targeted to only HLB top clients since I found no information about this product on HLB website.supposed to be offering 19% pa interest,and if financial performance is good additional bonus.however the catch is you have to deposit a lump sum of min $100,000 yearly.

|

|

|

Dec 29 2011, 09:29 PM Dec 29 2011, 09:29 PM

|

Junior Member

487 posts Joined: Aug 2011 |

Agents fishing for water fish again.

Till now, many agents are just product pushers, 2 days ago this HLA agent promoted this cash builder to me, she was promoting it like the BESTEST SINCE SLICED BREAD, then she excused herself when i ask her to factor in inflation and how does she expect me to survive on that kacang putih GYI amount and did she herself bought the plan? let me repeat my post from the other thread. QUOTE(lunchtime @ Dec 21 2011, 02:45 AM) Those who bought these cash builder / wealth builder plans and other similar 'save 6/8/10 years' plans, thinking its a great savings plan for your retirement, I wish you all the best in your retirement years. Hope you have other backup plans as well. Do remember to keep in touch with the agent till the day you die because you are gonna to And as for the agent who sold these plans, after year 7 of the policies sold, do a disappearing act, save your skin. Make damn sure you are no longer reachable by year 11. For those in the dark, here's a bit more, Year 1 commission paid to agents who sold you these so called savings plan is a min 17.5% of your premium paid to the cash/wealth builder plans. Now agent CONsult you to 'save' $500 per month, 17.5% or $87.50 per month goes into agent's pocket, this excludes overriding commission paid to agency managers and what have you expenses of the insurance company. Easily 60-70% of your premium paid is gone for all these expenses. That's $350 per month gone. So you actual start savings with close to ZERO ringgit. And this will go on for 6 years on a reducing basis. (Now you know why the minimum period for such plans is 6 years.) Ever wonder why agents tell you NEVER TO WITHDRAW within the 1st 6 years? Cuz in your so called savings plan, its EMPTY/KOSONG. Notice that if you surrender with 1-3 years, its ZERO meaning NO MONEY BACK. Now ask yourself this when the GOVT increases the service tax from 5% to 6% or when your local mamak increase your fav teh tarik from $1 to $1.30, you bising like no tomorrow, the hell with the govt, fxxk this mamak, i never coming back again, but when your agent CONsult you a so called savings plan which quietly eat 60-70% of your so called savings premium, why you never bising? If these cash / wealth builder are so good, why take 30 years to mature? Why lock your own money and subject it to others placing terms & conditions on your own money? Ever heard of APL and how much it can charge you interest for late premium payments? Nice for some companies to charge you interest on your own money, just nice. And use your brain for a moment, can an insurance company ever paid interest higher than a bank on the capital sum with a guarantee? If yes, why isn't there a queue at every insurance company with people signing up such cash wealth builder plan? Why do insurance companies still need the agents to CONsult you? Similar to buying iphone 4s, so damn good that people auto queue, you see any agents CONsult the queue? By the way, why isn't Warren Buffett and Jim Rogers queuing as well for the great savings plan? Now look at this from another thread, save 28000 per year, get back 8400 till Year 30. Ask yourself and use some sense, 1) how much is your salary today? close to $28000 per year? 2) how much is your expenses today? close to $28000 per year? 3) can you live on $8400 per year? If you cannot afford $28000 premium per year, that's means the you can only lower premiums which directly meaning your GYI is lower as well. Say you can afford $6000 premium per year, your GYI is probably around $1800 per year. Now, in your retirement, can you survive on $1800 per year? What a great reCONmend from your best buddy agent for your retirement. You only want to meet your INSURANCE agent, SLL or otherwise, for PROTECTION policies and CLAIMS, and not for any other reasons apart from these. HAHAHAHAHAHA |

|

|

Jan 2 2012, 02:13 AM Jan 2 2012, 02:13 AM

|

Senior Member

2,141 posts Joined: Sep 2008 From: Muddy Banks |

QUOTE(cherroy @ Dec 7 2011, 12:56 AM) LOL, Rm27,000 premium pa. oops, sorry for the late reply Assuming 9 year commitment. As stated 9-12 years commitment). 27k x 9 years =243k 20 years 10k = 200k + cash dividend 2k pa = 240k I better off with put 243K earn 3% FD interest and pay myself 10k per year. As said we need to compile the table to see the clear picture, if not even we talk so much also useless one without those details. rarely comes in here (F.B.I. House) and was busy since last month is the final month for cash builder. I am still amidst of exploring and creating the most comprehensive plan so please be patient. That Rm27k premium per year, like you said is plain ridiculous. lol QUOTE(Peter_APIIT @ Dec 29 2011, 01:28 PM) I don't like Insurance Investment product as its brings 4% profit (Allianz) only compare to Bond, MM, Equity or Stock. True enough. Each type of investment plans has their respective pros and cons. These type of plan are most suited for those who is not game for high risk high return type of investment. QUOTE(ryan18 @ Dec 29 2011, 07:16 PM) hmm recently i heard a saving product from Hong Leong(dont know its HLA or HLB), which seems to be targeted to only HLB top clients since I found no information about this product on HLB website.supposed to be offering 19% pa interest,and if financial performance is good additional bonus.however the catch is you have to deposit a lump sum of min $100,000 yearly. TBH, that's not interest. Guaranteed Yearly Income and Cash Dividend cannot be classified as Interest. Interest can only be used by banks for their products but not Insurance related returns. And you can also choose to put RM10,000 yearly, not necessarily minimum 100k per year. Anyway, that plan has already ended now. QUOTE(lunchtime @ Dec 29 2011, 09:29 PM) Agents fishing for water fish again. I couldn't comprehend why most people here are so curious and some to the extend of making a ruckus about the agent's commission part. When you people are queuing up for an iPhone, the SA who serviced you also get commission out of your RM2,400 paid. When you're buying a car, lets say a BMW 3 series, the SA also get RM 28,000 out of the price you paid. Even something as basic as buying clothes from your favourite departmental store and the promoter also get some commission out of your purchase. Why you never bising? Just because we have the capability to earn a huge cheque within a short period of time and you want to call us scammers, liars and scoundrels? Till now, many agents are just product pushers, 2 days ago this HLA agent promoted this cash builder to me, she was promoting it like the BESTEST SINCE SLICED BREAD, then she excused herself when i ask her to factor in inflation and how does she expect me to survive on that kacang putih GYI amount and did she herself bought the plan? let me repeat my post from the other thread. From the wall of text you've posted, I do have cases of client wanted to terminate their cash builder after the first year of inception and after some calculations done, their Surrender Value is not ZERO as you have said. APL and interest for late premium payments will only happen if you happen to be commit yourself into the plan. I wouldn't approach and sign someone who need to take huge chunk out of their yearly paycheck to pay for the premium. These type of plans are meant for those with excessive cash reserves in their bank accounts who wish to yield a little more higher returns than the conventional FD. This post has been edited by V12Kompressor: Jan 2 2012, 02:18 AM |

|

|

Jan 3 2012, 12:21 AM Jan 3 2012, 12:21 AM

|

Junior Member

487 posts Joined: Aug 2011 |

QUOTE(V12Kompressor @ Jan 2 2012, 02:13 AM) oops, sorry for the late reply that's because we know and understand what we are buying. when i pay 2400 for an iphone, i get 2400 worth of phone on the spot, likewise for my BMW. what you are promoting is different, its suppose to be an investment / savings program but unlike any real investment / savings account, the same value of $X money (premium) i put in today cannot be take out tomorrow, it will be $X - (80% x $X). How do you justify this as savings /investment? rarely comes in here (F.B.I. House) and was busy since last month is the final month for cash builder. I am still amidst of exploring and creating the most comprehensive plan so please be patient. That Rm27k premium per year, like you said is plain ridiculous. lol True enough. Each type of investment plans has their respective pros and cons. These type of plan are most suited for those who is not game for high risk high return type of investment. TBH, that's not interest. Guaranteed Yearly Income and Cash Dividend cannot be classified as Interest. Interest can only be used by banks for their products but not Insurance related returns. And you can also choose to put RM10,000 yearly, not necessarily minimum 100k per year. Anyway, that plan has already ended now. I couldn't comprehend why most people here are so curious and some to the extend of making a ruckus about the agent's commission part. When you people are queuing up for an iPhone, the SA who serviced you also get commission out of your RM2,400 paid. When you're buying a car, lets say a BMW 3 series, the SA also get RM 28,000 out of the price you paid. Even something as basic as buying clothes from your favourite departmental store and the promoter also get some commission out of your purchase. Why you never bising? Just because we have the capability to earn a huge cheque within a short period of time and you want to call us scammers, liars and scoundrels? From the wall of text you've posted, I do have cases of client wanted to terminate their cash builder after the first year of inception and after some calculations done, their Surrender Value is not ZERO as you have said. APL and interest for late premium payments will only happen if you happen to be commit yourself into the plan. I wouldn't approach and sign someone who need to take huge chunk out of their yearly paycheck to pay for the premium. These type of plans are meant for those with excessive cash reserves in their bank accounts who wish to yield a little more higher returns than the conventional FD. in the case of these cash builder policies or similiar endowment policies, you are promoting it as an investment/ savings plan knowing full well it will never beat inflation and poor returns aka your marketing gimmick "Want better than FD ar?" have you thought of the people who bought these policies for their retirement / education / savings? they placed their hope, future on your words and your promise and at the end the day, many many years down the road, they discover your marketing gimmick. by that time, its too late for them, retirement / education and savings dreams all down the drain. how would you feel when someone did this to you? have you no gulit? the only reason your colleagues and you heavily market such policies and die die defend your actions is the huge premiums involved. why don't you heavily market whole life or term life? is it because of the lower premiums and lower commissions? let me quote you "earn a huge cheque within a short period of time" "scammers, liars and scoundrels?" answered as below QUOTE(gark @ Dec 29 2011, 03:30 PM) This is a typical sales thread disguised as a discussion thread. Many of those around here lately... This post has been edited by lunchtime: Jan 3 2012, 12:24 AM |

|

|

Jan 3 2012, 01:31 AM Jan 3 2012, 01:31 AM

|

Senior Member

2,141 posts Joined: Sep 2008 From: Muddy Banks |

If you dont like what you're seeing here, then just turn away. Likewise, I'll do the same by ignore you to prevent any further derailment of the topic which serves no purpose of understanding the product even more. |

|

Topic ClosedOptions

|

| Change to: |  0.0282sec 0.0282sec

0.75 0.75

5 queries 5 queries

GZIP Disabled GZIP Disabled

Time is now: 19th December 2025 - 02:56 AM |