QUOTE(Ramjade @ Mar 28 2023, 03:26 PM)

Maybe end of this year I can revisit this belief with you 😉Private Retirement Fund, What the hell is that??

Private Retirement Fund, What the hell is that??

|

|

Mar 28 2023, 05:18 PM Mar 28 2023, 05:18 PM

Return to original view | IPv6 | Post

#21

|

Senior Member

4,489 posts Joined: Mar 2014 |

|

|

|

|

|

|

Sep 3 2023, 08:59 PM Sep 3 2023, 08:59 PM

Return to original view | Post

#22

|

Senior Member

4,489 posts Joined: Mar 2014 |

|

|

|

Oct 6 2023, 10:41 PM Oct 6 2023, 10:41 PM

Return to original view | Post

#23

|

Senior Member

4,489 posts Joined: Mar 2014 |

QUOTE(Ramjade @ Oct 6 2023, 04:52 PM) You have to understand that retire also have Asia Pacific dynamiv income and US market have been calling for past few days. If china and us market fall, your funds also will fall unless the hedge. And if its a mixed asset fund, you also have bond prices falling because of spiking yields.This post has been edited by Cubalagi: Oct 6 2023, 10:41 PM Ramjade liked this post

|

|

|

Oct 10 2023, 09:29 PM Oct 10 2023, 09:29 PM

Return to original view | Post

#24

|

Senior Member

4,489 posts Joined: Mar 2014 |

QUOTE(Seth Ho @ Oct 9 2023, 10:20 PM) Firstly, a fund is not a stock. A stock are the shares of companies, like Maybank, Amazon, Tesla etc. A fund is a collective investment vehicle that invest in stocks, but could also be in other things like bonds, fd etc.A PRS is usually structured as a Fund of Funds. A fund that invest in a variety of funds. If you are looking for a "defensive" PRS, then one objective measure is to look at annualized volatility. Look for funds that have low annualized volatility of say, below 5%. Usually these funds has "conservative" in its name. However, these funds will have consistently low returns and in the long term is not really worth it IMO. I think these conservative funds are only useful tactically eg to lock in profits of higher risk funds. Personally I havent been using such a tactic as my PRS investment size has been small. However, it has been growing slowly over the years and there could be a time in the future where I will be more active in switching. This post has been edited by Cubalagi: Oct 10 2023, 09:30 PM zebras liked this post

|

|

|

Oct 18 2023, 11:28 AM Oct 18 2023, 11:28 AM

Return to original view | IPv6 | Post

#25

|

Senior Member

4,489 posts Joined: Mar 2014 |

|

|

|

Oct 22 2023, 10:28 AM Oct 22 2023, 10:28 AM

Return to original view | Post

#26

|

Senior Member

4,489 posts Joined: Mar 2014 |

QUOTE(Ramjade @ Oct 18 2023, 11:30 AM) I used to be a REIT guy until I realised that a REIT paying out 90% and giving you 5%, and a company paying out say 50%, it's no brainer to go with company over reits. That is why I dont hold reits anymore. Its not the same sector. Also if you believe we will go back to zero interest time, then can buy. Buying stock is buying a business and getting the present and future cash flow from the business Buying reit is buying commercial real estate and enjoying the rental. The advantage is that no corporate tax on the rental income is charged and the dividend payout rate is 90% (usual pre condition to get the tax exempt). |

|

|

|

|

|

Feb 29 2024, 01:07 PM Feb 29 2024, 01:07 PM

Return to original view | IPv6 | Post

#27

|

Senior Member

4,489 posts Joined: Mar 2014 |

|

|

|

Mar 1 2024, 03:33 PM Mar 1 2024, 03:33 PM

Return to original view | Post

#28

|

Senior Member

4,489 posts Joined: Mar 2014 |

|

|

|

Mar 14 2024, 10:14 AM Mar 14 2024, 10:14 AM

Return to original view | Post

#29

|

Senior Member

4,489 posts Joined: Mar 2014 |

|

|

|

Mar 16 2024, 05:23 PM Mar 16 2024, 05:23 PM

Return to original view | IPv6 | Post

#30

|

Senior Member

4,489 posts Joined: Mar 2014 |

|

|

|

Mar 19 2024, 06:57 PM Mar 19 2024, 06:57 PM

Return to original view | Post

#31

|

Senior Member

4,489 posts Joined: Mar 2014 |

|

|

|

Mar 21 2024, 08:01 AM Mar 21 2024, 08:01 AM

Return to original view | Post

#32

|

Senior Member

4,489 posts Joined: Mar 2014 |

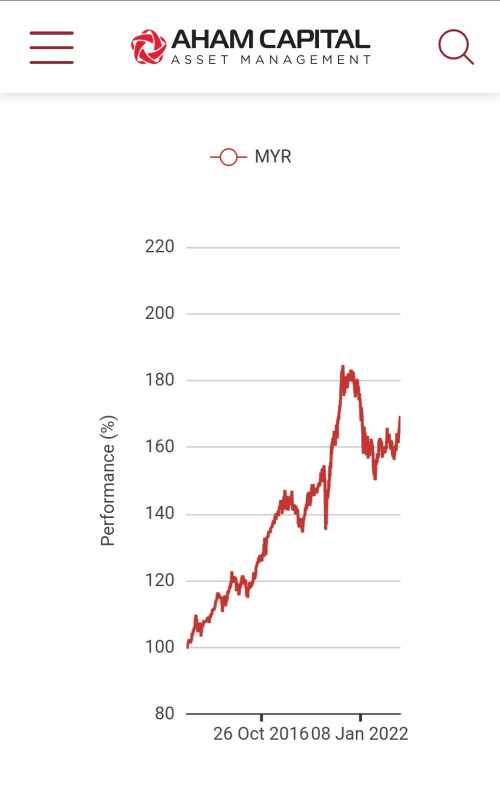

I only have one PRS Fund which is the AHAM Moderste Fund. This is a typical 60% equity and 40% bond fund with abt half its assets outside Malaysia but focused on Asia Pac ex Japan.  Year tondate performance is pretty good and hope it can continue to do well this year.  This is performance since fund inception which was Dec 2012. Can see that it was perfoming well in the first 8 years up to early 2021 with 80% percent return. Performance turned bad in 2021/22 and it was down more than 15%. Its low was Oct 22. Likely due to bond losses as interest rate spiked and Chinese market crash. Since end of last year, however fund value has been up strongly. Hopefully can continue back on track. Arguably 2021 and 2022 would be a good time to top up additional investments. This post has been edited by Cubalagi: Mar 21 2024, 08:03 AM MaJYun liked this post

|

|

|

Mar 22 2024, 09:53 AM Mar 22 2024, 09:53 AM

Return to original view | IPv6 | Post

#33

|

Senior Member

4,489 posts Joined: Mar 2014 |

QUOTE(ronnie @ Mar 22 2024, 09:23 AM) ky33 bought the peak of the time.... so sure lose money now logically. And I saw there was withdrawal. From Account 2? Buy high sell low case?The person who gets burnt will always remember the bad incidents. All investors should be forward thinking. learn from the past and become better investor. If you don't learn, you'll be burnt again and again until you get burned literally (ie. die in cremation) And kena pay tax 8% or not? QUOTE(ky33li @ Mar 20 2024, 12:39 AM) |

|

|

|

|

|

Apr 9 2024, 03:27 PM Apr 9 2024, 03:27 PM

Return to original view | Post

#34

|

Senior Member

4,489 posts Joined: Mar 2014 |

QUOTE(Davidtcf @ Apr 8 2024, 05:37 PM) I don't think will end at 2025. They want to encourage Malaysians to save.. so likely will extend. I add more than the min 3k as I also use prs as a "strategy diversifier" for my retirement savings.This PRS is more useful to those that dont want to learn investing themselves.. they will likely end up putting more money into it. First, I have my own DIY portfolio which Im the portfolio manager. Second, I also have EPF where the manager is the government appointed one. And finally, PRS which is a private sector one. Of course, using my DIY portfolio, I try to beat the other two. However, Im open to the possibility that Im not as smart as I think I am and there could be times where these others beat me. |

|

|

May 19 2024, 11:58 AM May 19 2024, 11:58 AM

Return to original view | IPv6 | Post

#35

|

Senior Member

4,489 posts Joined: Mar 2014 |

|

|

|

May 19 2024, 11:00 PM May 19 2024, 11:00 PM

Return to original view | Post

#36

|

Senior Member

4,489 posts Joined: Mar 2014 |

QUOTE(guy3288 @ May 19 2024, 05:38 PM) Wah..there is also a 47% return 😲 guy3288 liked this post

|

|

|

May 20 2024, 07:23 AM May 20 2024, 07:23 AM

Return to original view | Post

#37

|

Senior Member

4,489 posts Joined: Mar 2014 |

|

|

|

Jul 12 2024, 06:11 PM Jul 12 2024, 06:11 PM

Return to original view | IPv6 | Post

#38

|

Senior Member

4,489 posts Joined: Mar 2014 |

QUOTE(poooky @ Jul 12 2024, 04:13 PM) Yes, maybe you're right. I'm just a little hesitant with how quickly the market has gone up since COVID. I feel that a major correct is coming. But since can't with until 55 I guess doesn't matter. Might as well just lump sump 3k into Easy50. You can look at those Conservative PRS funds.But long term, not a good idea as performance just FD like. poooky liked this post

|

|

|

Aug 8 2024, 02:00 PM Aug 8 2024, 02:00 PM

Return to original view | IPv6 | Post

#39

|

Senior Member

4,489 posts Joined: Mar 2014 |

|

|

|

Dec 19 2024, 02:34 PM Dec 19 2024, 02:34 PM

Return to original view | Post

#40

|

Senior Member

4,489 posts Joined: Mar 2014 |

|

| Change to: |  0.0320sec 0.0320sec

0.25 0.25

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 5th December 2025 - 12:28 AM |