went to ambank to do some FD deposit.

9 months for 3.25 %...3.3% for 12 i months, i chose the 9months.

but sad, because after that i went to RHB bank they offering 3.5% 12 months.

FD rates in Malaysia, Which bank offer the highest FD rates?

|

|

Nov 21 2010, 10:06 PM Nov 21 2010, 10:06 PM

|

Junior Member

242 posts Joined: Dec 2006 |

just sharing

went to ambank to do some FD deposit. 9 months for 3.25 %...3.3% for 12 i months, i chose the 9months. but sad, because after that i went to RHB bank they offering 3.5% 12 months. |

|

|

|

|

|

Nov 21 2010, 10:24 PM Nov 21 2010, 10:24 PM

|

Junior Member

290 posts Joined: Oct 2010 |

QUOTE(DX007 @ Nov 21 2010, 10:06 PM) just sharing wow...rates r pretty goodwent to ambank to do some FD deposit. 9 months for 3.25 %...3.3% for 12 i months, i chose the 9months. but sad, because after that i went to RHB bank they offering 3.5% 12 months. i tot 2.75% is the max but still the houseing loan after blr minus is about 4%..... so i guess better dump to housing loan than keep in fd |

|

|

Nov 21 2010, 10:58 PM Nov 21 2010, 10:58 PM

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

QUOTE(DX007 @ Nov 21 2010, 10:06 PM) just sharing the RHB offer is that you have to deposit above RM100K right? went to ambank to do some FD deposit. 9 months for 3.25 %...3.3% for 12 i months, i chose the 9months. but sad, because after that i went to RHB bank they offering 3.5% 12 months. QUOTE(Robin Liew @ Nov 21 2010, 10:24 PM) wow...rates r pretty good Min is 2.85% for 12 months. AMBank was offering up to 4% for 5 years tenure in October and I think they extended it. Go check their website. Nowadays, most local banks have some kind of promotion for FD but not stated in their websites. Do, do check around as new offers keep popping up.i tot 2.75% is the max but still the houseing loan after blr minus is about 4%..... so i guess better dump to housing loan than keep in fd |

|

|

Nov 21 2010, 11:03 PM Nov 21 2010, 11:03 PM

|

|

Moderator

9,301 posts Joined: Mar 2008 |

QUOTE(Gen-X @ Nov 21 2010, 10:58 PM) the RHB offer is that you have to deposit above RM100K right? They extended the Top Rate FD twice already in just these few months.Min is 2.85% for 12 months. AMBank was offering up to 4% for 5 years tenure in October and I think they extended it. Go check their website. Nowadays, most local banks have some kind of promotion for FD but not stated in their websites. Do, do check around as new offers keep popping up. |

|

|

Nov 21 2010, 11:16 PM Nov 21 2010, 11:16 PM

|

Junior Member

84 posts Joined: Oct 2004 |

QUOTE(MilesAndMore @ Nov 21 2010, 11:03 PM) Yeah, they did. I think I'll go for the 6months at 3.2% .Btw, did anyone hear about a certain FD promo from Citibank? I went to the website to check out but couldn't find any information. I heard from a friend that Citibank has a step-up FD promo which offer good rates. |

|

|

Nov 21 2010, 11:17 PM Nov 21 2010, 11:17 PM

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

Come to think of it, if I recall correctly, I don't think RHB offering presently offering 3.5%, it was something like 3.35% and there are 2 rates for different amount but I am sure that it has to be >RM100K.

|

|

|

|

|

|

Nov 21 2010, 11:48 PM Nov 21 2010, 11:48 PM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(Lis000 @ Nov 21 2010, 11:16 PM) Yeah, they did. I think I'll go for the 6months at 3.2% . 6 month tenureBtw, did anyone hear about a certain FD promo from Citibank? I went to the website to check out but couldn't find any information. I heard from a friend that Citibank has a step-up FD promo which offer good rates. First 2 month 3.3% 3.9% 6.3% |

|

|

Nov 22 2010, 12:17 AM Nov 22 2010, 12:17 AM

|

Junior Member

84 posts Joined: Oct 2004 |

|

|

|

Nov 22 2010, 12:22 AM Nov 22 2010, 12:22 AM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(Lis000 @ Nov 22 2010, 12:17 AM) That seems like quite a good deal. What's the minimun amount required? This is for Citigold and new Citigold customer.So can just walk in and place the FD is it? Actually I heard this from word of mouth too, how come no advertisement one? http://www.citigold.com.my/portal/citigold/promotions.html |

|

|

Nov 22 2010, 12:31 AM Nov 22 2010, 12:31 AM

|

Junior Member

84 posts Joined: Oct 2004 |

QUOTE(cherroy @ Nov 22 2010, 12:22 AM) This is for Citigold and new Citigold customer. CitiGold Requirementshttp://www.citigold.com.my/portal/citigold/promotions.html To become a new Citigold client, you need to fulfill any one of the following criteria:- 2.1 place in any deposit account or open an investment account with a minimum of RM200,000; or 2.2 place in any deposit account or open an investment account with a minimum of RM100,000, subject to the balances in the deposit account or investment account being increased to RM200,000 within three (3) months from the date of placement or opening, as the case may be; or 2.2.1 in the case of existing Citibanking clients who at the time of taking up this offer must have in any deposit account or investment account a minimum of RM200,000. |

|

|

Nov 22 2010, 12:55 AM Nov 22 2010, 12:55 AM

|

Senior Member

546 posts Joined: Apr 2010 |

QUOTE(Gen-X @ Nov 20 2010, 12:51 AM) If that's low, putting is savings account is worst. Play stocks high risk but gain also more There is still penalty. They will calculate the interest you have earned all these while at 5% and will deduct the difference for early exit from your principal. That was what I was made to understand by the Call Centre. They could be wrong but I am quite sure cos I really made them check. If there were no penalty whatsoever, I would deposited my last RM in there. If you got children, then you can consider Hong Leong Bank Junior FD where they are offering until of this month 5% for 4 years tenure. Interest is paid monthly into the Junior Savings account where the rate is 2.75%. Also you can withdraw in multiples of RM3K without any penalty. Go to HLB website for more info. The best rate I know so far until joeychin2323 mentioned 6-7%. Yah, joeychin found out which bank yet? The only bank FD I know that doesnt impose any penalty at all provided you still leave RM30k inside is CIMB SENIOR FD (forgot the exact name of that program). By the way, I don't think any bank is offering 6-7%. She is just randomly making a statement and asking some lame questions. AFAIK, those that offer high interest like 10+% must tie up with their UT, FOREX FD etc etc. |

|

|

Nov 22 2010, 04:42 PM Nov 22 2010, 04:42 PM

|

Senior Member

4,440 posts Joined: Jan 2010 From: Kuala Lumpur |

QUOTE(tachlio @ Nov 20 2010, 11:26 AM) For Bumi, if they dont had any investment knowledge, first thing to do is full fill 200k quota. then only think how to invest in other. There are many non malay bumi's who have the ASB. Not just for Malays. Even Siamese, Portuguese, etc also have ASB rights. I tumpang my wife who is bumi (wont mention which la) and returns are really good. Bout 8-9% per annum. Ive already maxed out the account 2 years ago. Returns about RM20K per annum and rising.This is M'sia so call 1 Malaysia |

|

|

Nov 22 2010, 05:19 PM Nov 22 2010, 05:19 PM

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

QUOTE(cherroy @ Nov 21 2010, 11:48 PM) very competitve rate for six months.Just to update all, RHB FD promotion untiil end of Dec offering various rates. Below is part of the propmotion. 12 months: RM100K-RM199,999 3.3%, RM200K-RM299,999 3.35% and above RM300K 3.4% 15 months: Above RM300K then only 3.5% Can't remember 6 and 9 months rates. **Edited** QUOTE(michaelho @ Nov 22 2010, 12:55 AM) There is still penalty. They will calculate the interest you have earned all these while at 5% and will deduct the difference for early exit from your principal. That was what I was made to understand by the Call Centre. They could be wrong but I am quite sure cos I really made them check. If there were no penalty whatsoever, I would deposited my last RM in there. You are right on the penalty thingy. My bad. Just read the T&C.The only bank FD I know that doesnt impose any penalty at all provided you still leave RM30k inside is CIMB SENIOR FD (forgot the exact name of that program). (6.0) Partial Withdrawal of Fixed Deposit from JFD - 6.4) Early partial withdrawals of fixed deposit from JFD are permissible with a minimum withdrawal of RM3,000 or in multiples of RM3,000 or any other amount to be determined by HLB at any time or from time to time. In the event if the fixed deposit is less than RM3,000, then such fixed deposit may be withdrawn in total. 6.5) For any premature withdrawal, the withdrawn amount will be subject to ABM rules. 6.6) No interest will be paid on JFD uplifted before the completion of a minimum tenure of 3 months. For fixed deposit that has been placed and completed a minimum tenure of 3 months, half of the contracted interest rate will be paid on the withdrawn amount. The paid interest will be deducted from the principal amount of such fixed deposit. 6.7) The remaining balance sum of the deposit will continue to earn the contracted fixed deposit rate. From the above, if withdraw before 3 months, no interest will be paid. However after 3 months, half of the interest paid on the withdraw amount will be deducted from the principal. Not too bad deal as interest paid for the amount withdrew still higher than savings account (2.5% for 4 years tenure) and still get 5% for balance. The partial withdrawal is good for emergency case when suddenly need money. HLB Senior FD not the same case, can do partial withdrawal but interest subjected to ABM rule. Can someone please inform me what is ABM rule on early withdrawal for FD, say if tenure was 3 years and uplifted the FD after 1.5 years. This post has been edited by Gen-X: Nov 22 2010, 07:05 PM |

|

|

|

|

|

Nov 22 2010, 08:27 PM Nov 22 2010, 08:27 PM

|

|

Moderator

9,301 posts Joined: Mar 2008 |

QUOTE(cybermaster98 @ Nov 22 2010, 04:42 PM) There are many non malay bumi's who have the ASB. Not just for Malays. Even Siamese, Portuguese, etc also have ASB rights. I tumpang my wife who is bumi (wont mention which la) and returns are really good. Bout 8-9% per annum. Ive already maxed out the account 2 years ago. Returns about RM20K per annum and rising. If you just max out your wife's ASB just 2 years ago then the average return for the last 2 years should be around RM15k - RM16k only. You've been giving ASB too much credit by saying RM20k/pa and rising QUOTE(pchan84 @ Nov 22 2010, 08:20 PM) Ecm Libra Investment Bank is offering 6.8% p.a. for deposits above RM100k! If u or anyone u know who is interested, please contact me via phone or pm me for more details! Is that pure time deposit or bundled with other investment products ? |

|

|

Nov 22 2010, 09:20 PM Nov 22 2010, 09:20 PM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(MilesAndMore @ Nov 22 2010, 08:27 PM) 6.8% 3 months and bundled with UT... Not something attractive. http://www.ecmlibra.com/pdf/term.pdf |

|

|

Nov 23 2010, 12:10 AM Nov 23 2010, 12:10 AM

|

|

Moderator

9,301 posts Joined: Mar 2008 |

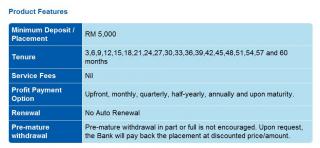

QUOTE(Gen-X @ Nov 22 2010, 05:19 PM) very competitve rate for six months. Alternatively, one can consider the RHB Bank Commodity Murabahah Deposit-i. This is a type of Time Deposit account. You can choose to take an upfront payment, monthly, quarterly and so on. This is similar to HSBC Amanah Term Deposit-i account. From what i understand is that the HSBC Amanah Term Deposit-i money is invested in Malaysia crude palm oil. Just to update all, RHB FD promotion untiil end of Dec offering various rates. Below is part of the propmotion. 12 months: RM100K-RM199,999 3.3%, RM200K-RM299,999 3.35% and above RM300K 3.4% 15 months: Above RM300K then only 3.5% Can't remember 6 and 9 months rates. By the way, rates listed below are all regular board rates

|

|

|

Nov 23 2010, 12:15 AM Nov 23 2010, 12:15 AM

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

QUOTE Can someone please inform me what is ABM rule on early withdrawal for FD, say if tenure was 3 years and uplifted the FD after 1.5 years. Anyone care to reply to above? |

|

|

Nov 23 2010, 12:48 PM Nov 23 2010, 12:48 PM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(Gen-X @ Nov 23 2010, 12:15 AM) QUOTE Can someone please inform me what is ABM rule on early withdrawal for FD, say if tenure was 3 years and uplifted the FD after 1.5 years. Anyone care to reply to above? While For 1 year tenure FD, if withdraw after 3 months, you are entitle for half of the interest rate if pre-mature withdraw. I can't remember correctly, I could be wrong, just something roughly can straight away upload from memory. |

|

|

Nov 23 2010, 10:20 PM Nov 23 2010, 10:20 PM

|

Senior Member

4,229 posts Joined: Jan 2003 From: Selangor |

just curious, why are most of the banks promoting FD placements?

Is there some new reserve requirement coming up? |

|

|

Nov 23 2010, 11:08 PM Nov 23 2010, 11:08 PM

|

Senior Member

1,202 posts Joined: Jul 2007 From: Western Digital "Bring your Life TO LIFE" |

CIMB 3 month for 3%..

|

|

Topic ClosedOptions

|

| Change to: |  0.0366sec 0.0366sec

0.35 0.35

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 6th December 2025 - 06:05 AM |