QUOTE(bryan5073 @ Mar 7 2012, 09:29 PM)

Everybody was panic I think many of us have stop-loss strategy, e.g. If price drops by 10%, sell!

REIT V3, Real Estate Investment Trust

|

|

Mar 8 2012, 09:32 AM Mar 8 2012, 09:32 AM

Return to original view | Post

#1

|

Senior Member

3,816 posts Joined: Feb 2012 |

|

|

|

|

|

|

Mar 9 2012, 08:55 AM Mar 9 2012, 08:55 AM

Return to original view | Post

#2

|

Senior Member

3,816 posts Joined: Feb 2012 |

QUOTE(jeenhao @ Mar 8 2012, 12:15 PM) I opened already. Haha! But need to wait few more days before it's valid. I think I wont buy first because of the brokerage fee. What do you mean by not buying because of brokerage fee?Usually there is a minimum fee charged. So if you buy large volume, the fee, as a percentage of share value, will be lower. This post has been edited by river.sand: Mar 9 2012, 02:47 PM |

|

|

Mar 9 2012, 11:35 AM Mar 9 2012, 11:35 AM

Return to original view | Post

#3

|

Senior Member

3,816 posts Joined: Feb 2012 |

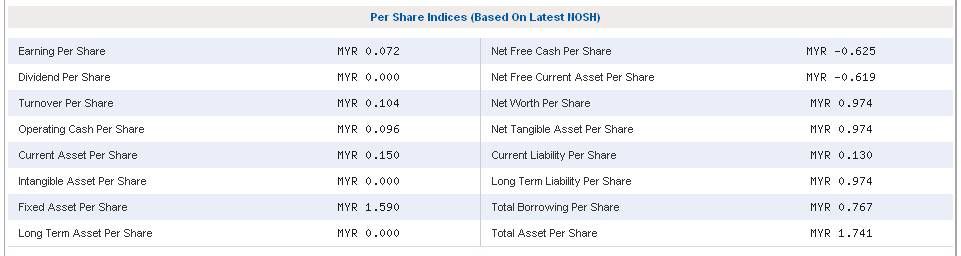

QUOTE(apagranpa10 @ Mar 8 2012, 01:17 PM) Nav= Net Asset value. Derived from the property valuation of each individual Reit. You will hv to do more homework to get to the intrinsic value. Net Asset is not the same as equities? QUOTE(wongmunkeong @ Mar 8 2012, 01:59 PM) Dude - on an online stock trading platform, U shd be able to see NAPS (Net Asset Per Share). I am on HLeB also, but which one is NAPS  |

|

|

Mar 9 2012, 02:17 PM Mar 9 2012, 02:17 PM

Return to original view | Post

#4

|

Senior Member

3,816 posts Joined: Feb 2012 |

OK, now I understand

Net Asset Value = Total Assets - Total Liabilities In many balance sheets, this number is equivalent to Shareholders' Equities; but in the case of REITs, it is known as Unit-holders' Fund. |

|

|

Mar 24 2012, 04:43 PM Mar 24 2012, 04:43 PM

Return to original view | Post

#5

|

Senior Member

3,816 posts Joined: Feb 2012 |

@bryan5073

During recession, some businesses may go bankrupt or down-size, so REITs which own office place could be affected. As for retail-based REIT, maybe not much impact. After all, shopping is national pastime Anyway, it looks like Eurozone has averted a crisis. So long as China can avoid a hard landing, the economy should be OK this year. (I know Lilian Too's fan would disagree with me |

|

|

Mar 26 2012, 04:07 PM Mar 26 2012, 04:07 PM

Return to original view | Post

#6

|

Senior Member

3,816 posts Joined: Feb 2012 |

QUOTE(cherroy @ Mar 20 2012, 10:05 AM) But one thing good about Stareit that is it has very low gearing or if not mistaken is the lowest among all the reit. I got this from Investopedia...The best known examples of gearing ratios include the debt-to-equity ratio (total debt / total equity), times interest earned (EBIT / total interest), equity ratio (equity / assets), and debt ratio (total debt / total assets). Which of these ratios do we normally use in the context of REITs |

|

|

|

|

|

Mar 28 2012, 10:32 PM Mar 28 2012, 10:32 PM

Return to original view | Post

#7

|

Senior Member

3,816 posts Joined: Feb 2012 |

I am reading the income statement of ARREIT, very confused...

There is one line called unrealised gain from revaluation of properties. What's this Then there are two numbers for Earnings per unit - before manager fees and after manager fees. Which one is more important when we evaluate the fund This post has been edited by river.sand: Mar 28 2012, 10:33 PM |

|

|

Mar 29 2012, 08:25 AM Mar 29 2012, 08:25 AM

Return to original view | Post

#8

|

Senior Member

3,816 posts Joined: Feb 2012 |

QUOTE(-JC- @ Mar 29 2012, 07:17 AM) correct me if i'm wrong: 1) But why 'unrealised'? Why does it appear in income statement, and not balance sheet?1) revaluation = let's say 10 years ago the asset worth RM100m. Now they do a valuation on the asset again and find that it's worth RM120m. Hence there's a "gain" of RM20m 2) Managers managing the portfolio of the Reit need their salary 2) My question is: which one is more important when we evaluate the fund? |

|

|

Mar 30 2012, 08:57 AM Mar 30 2012, 08:57 AM

Return to original view | Post

#9

|

Senior Member

3,816 posts Joined: Feb 2012 |

QUOTE(wankongyew @ Mar 30 2012, 08:23 AM) You do know that Starhill REIT's dividends are artificially boosted on that chart due to a one-off gain from disposal of assets right? Based on predicted dividends, I think its true dividend yield is about 6% to 6.5%. I am having the financial statements of Starhill REIT. Please may I know which line are you referring to.I do know that ARREIT's earning for 2011 was boosted by 'unrealized gain from revaluation of properties', which I assume is one-off. |

|

|

Mar 30 2012, 02:48 PM Mar 30 2012, 02:48 PM

Return to original view | Post

#10

|

Senior Member

3,816 posts Joined: Feb 2012 |

OK, this is cherroy's past post regarding projected DPU for Starhill REIT.

QUOTE(cherroy @ Mar 20 2012, 02:03 PM) The data is accurate, but we cannot rely on past data to count, we need to latest and projected DPU aka from its operation. But I read the document in the link, it only gives the proforma DPU yield for FY2011 (ended 30 June 2011) at 7.83%.Previously Stareit distributed the realisation of gain of disposal of Lot10 and Starhill to Starhill Global, those are not repetitive in the future. In the previous proposal of changing Stareit into hospitality reit has stated clearly the projected DPU may be around 6.9%. http://announcements.bursamalaysia.com/edm...cquisitions.pdf One thing I don't understand - how come its DPU can be more than earning per unit? This post has been edited by river.sand: Mar 30 2012, 03:23 PM |

|

|

Apr 19 2012, 02:08 PM Apr 19 2012, 02:08 PM

Return to original view | Post

#11

|

Senior Member

3,816 posts Joined: Feb 2012 |

I am checking Hektar REIT. Its portfolio includes the following:

- Subang Parade - Mahkota Parade - Watex Parade I haven't been to Subang Jaya for quite a while. Wanna know if Subang Parade has been threatened by the 'explosive' Empire Mall |

|

|

Apr 20 2012, 08:33 AM Apr 20 2012, 08:33 AM

Return to original view | Post

#12

|

Senior Member

3,816 posts Joined: Feb 2012 |

|

|

|

Apr 25 2012, 08:50 AM Apr 25 2012, 08:50 AM

Return to original view | Post

#13

|

Senior Member

3,816 posts Joined: Feb 2012 |

Hong Leong Investment Bank issues a buy call for CMMT, with target price 1.53.

Added on April 25, 2012, 9:00 amBut if we follow Wong Mun Keong's criteria... CMMT's NAPS is 1.0959, less than its closing price of 1.39. So, that's not a good buy? This post has been edited by river.sand: Apr 25 2012, 09:00 AM Attached File(s)  HLIB___CMMT_2012_04_25.PDF ( 1002.04k )

Number of downloads: 13

HLIB___CMMT_2012_04_25.PDF ( 1002.04k )

Number of downloads: 13 |

|

|

|

|

|

Apr 25 2012, 11:57 AM Apr 25 2012, 11:57 AM

Return to original view | Post

#14

|

Senior Member

3,816 posts Joined: Feb 2012 |

|

|

|

Apr 30 2012, 10:51 AM Apr 30 2012, 10:51 AM

Return to original view | Post

#15

|

Senior Member

3,816 posts Joined: Feb 2012 |

HEKTAR hit 1.49. Somebody keyed in wrong price

Maybe the fellow wanted to buy at 1.39, but mistakenly entered 1.49 This post has been edited by river.sand: Apr 30 2012, 10:53 AM |

|

|

May 15 2012, 09:53 AM May 15 2012, 09:53 AM

Return to original view | Post

#16

|

Senior Member

3,816 posts Joined: Feb 2012 |

BUY call from Hong Leong...

This post has been edited by river.sand: May 15 2012, 09:54 AM Attached File(s)  HLIB___Sunway_REIT_2012_05_15.pdf ( 1.33mb )

Number of downloads: 125

HLIB___Sunway_REIT_2012_05_15.pdf ( 1.33mb )

Number of downloads: 125 |

|

|

May 15 2012, 04:11 PM May 15 2012, 04:11 PM

Return to original view | Post

#17

|

Senior Member

3,816 posts Joined: Feb 2012 |

|

|

|

May 16 2012, 08:24 AM May 16 2012, 08:24 AM

Return to original view | Post

#18

|

Senior Member

3,816 posts Joined: Feb 2012 |

QUOTE(panasonic88 @ May 15 2012, 08:24 PM) » Click to show Spoiler - click again to hide... « IGB REIT ~ Mid Valley Occupancy rate: 100% ~ Gardens Mall Occupancy rate: 99.6% ~ MV Rental & Car Park Income: RM210.6 million per annum ~ GM Rental & Car Park Income: RM87.7 million per annum ~ Estimated time frame for full utilisation of proceeds from date of Proposed Listing : within 6 months Potential of IGB REIT ~ Benefits from the potential future upside & envisaged growth ~ Enjoy stable & regular distribution ~ Appeal for those who seeks regular income distribution & long term capital appreciation ~ 100% distribution from the date of listing till 31st December 2014 ~ Thereafter atleast 90% of distribution income on half-yearly basis Side info: The KrisAsset & IGB company are run by a Tan family. Mid Valley - 100% occupied; Garden Malls - near 100% Is that good or bad |

|

|

May 17 2012, 08:23 AM May 17 2012, 08:23 AM

Return to original view | Post

#19

|

Senior Member

3,816 posts Joined: Feb 2012 |

News from The Star...

KUALA LUMPUR: Hektar Asset Management Sdn Bhd, the manager of Hektar Real Estate Investment Trust (Hektar REIT), has obtained the approval from the Securities Commission (SC) for the proposed fund size increase and to list the new units on the Main Market of Bursa Malaysia. The approval was also given for the valuation of two retail properties in Kedah, to be acquired by Hektar REIT. “The two properties are Landmark Central Shopping Centre and a major portion of Central Square Shopping Centre which are collectively valued at RM184mil,” Hektar Asset Management said in a statement yesterday. With the approval, Hektar REIT is looking to increase its fund size by up to 93,858,773 units from 320,001,000 units to a maximum of 413,854,773 units, it said. http://biz.thestar.com.my/news/story.asp?f...71&sec=business What will be the impact with the increase in fund size |

|

|

May 30 2012, 09:07 AM May 30 2012, 09:07 AM

Return to original view | Post

#20

|

Senior Member

3,816 posts Joined: Feb 2012 |

|

|

Topic ClosedOptions

|

| Change to: |  0.0242sec 0.0242sec

0.47 0.47

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 14th December 2025 - 07:58 PM |