Kasset is now 7.55 almost near to 7.6 already

REIT V3, Real Estate Investment Trust

REIT V3, Real Estate Investment Trust

|

|

May 17 2012, 09:22 AM May 17 2012, 09:22 AM

|

Junior Member

368 posts Joined: Oct 2008 |

Kasset is now 7.55 almost near to 7.6 already

|

|

|

|

|

|

May 17 2012, 10:29 AM May 17 2012, 10:29 AM

|

Senior Member

6,779 posts Joined: Dec 2005 From: Kuala Lumpur |

what do you guys think of BSDReit? Looks good to me.

|

|

|

May 17 2012, 11:31 AM May 17 2012, 11:31 AM

|

Junior Member

179 posts Joined: Jul 2008 |

May I know the distribution of dividend for REIT stocks the same as any other stock? Why the dividend info is not available in the entitlements list by KLSE?

Where to look for dividend info then e.g. expiry date and payment date? |

|

|

May 17 2012, 11:36 AM May 17 2012, 11:36 AM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(ngaisteve1 @ May 17 2012, 10:29 AM) hehe - it's a GOOD RIDE if U got it a value prices, from experience. Been buying since 2009, 2010 and 2011 heheh. Now no more $ to focus on MREITs This plantation REIT + a bit of a pelik animal since they get a % of the palm oil sales. Just a thoughts |

|

|

May 17 2012, 11:43 AM May 17 2012, 11:43 AM

|

Senior Member

6,779 posts Joined: Dec 2005 From: Kuala Lumpur |

QUOTE(wongmunkeong @ May 17 2012, 12:36 PM) hehe - it's a GOOD RIDE if U got it a value prices, from experience. oh, thanks for the info! Been buying since 2009, 2010 and 2011 heheh. Now no more $ to focus on MREITs This plantation REIT + a bit of a pelik animal since they get a % of the palm oil sales. Just a thoughts |

|

|

May 17 2012, 11:47 AM May 17 2012, 11:47 AM

|

Junior Member

179 posts Joined: Jul 2008 |

QUOTE(vgodmax @ May 17 2012, 11:31 AM) May I know the distribution of dividend for REIT stocks the same as any other stock? Why the dividend info is not available in the entitlements list by KLSE? Where to look for dividend info then e.g. expiry date and payment date? QUOTE(wongmunkeong @ May 17 2012, 11:36 AM) hehe - it's a GOOD RIDE if U got it a value prices, from experience. hi bro, mind to explain a bit on my question?Been buying since 2009, 2010 and 2011 heheh. Now no more $ to focus on MREITs This plantation REIT + a bit of a pelik animal since they get a % of the palm oil sales. Just a thoughts |

|

|

|

|

|

May 17 2012, 11:55 AM May 17 2012, 11:55 AM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(vgodmax @ May 17 2012, 11:47 AM) er.. i don't know how to add much value to your Q leh"May I know the distribution of dividend for REIT stocks the same as any other stock? Why the dividend info is not available in the entitlements list by KLSE?" The dividend payout for REITs are same with any other listed stocks - either mailed to U or electronic, depending on REIT. As for "Where to look for dividend info then e.g. expiry date and payment date?" I look at it online and since U may not be on the same platform (mine's HLeB) as mine, susah to comment/add value. IF U are on HLeB or similar web platform, U can "see" it by selecting the REIT and checking out the news/announcements. If it's the newspapers.. lagi worse.. i havent bought a newspaper since... Gomenosai - not of much help |

|

|

May 17 2012, 12:00 PM May 17 2012, 12:00 PM

|

Junior Member

179 posts Joined: Jul 2008 |

QUOTE(wongmunkeong @ May 17 2012, 11:55 AM) er.. i don't know how to add much value to your Q leh I thought there's a compiled list... So we have to look at the announcement individually. Thanks."May I know the distribution of dividend for REIT stocks the same as any other stock? Why the dividend info is not available in the entitlements list by KLSE?" The dividend payout for REITs are same with any other listed stocks - either mailed to U or electronic, depending on REIT. As for "Where to look for dividend info then e.g. expiry date and payment date?" I look at it online and since U may not be on the same platform (mine's HLeB) as mine, susah to comment/add value. IF U are on HLeB or similar web platform, U can "see" it by selecting the REIT and checking out the news/announcements. If it's the newspapers.. lagi worse.. i havent bought a newspaper since... Gomenosai - not of much help |

|

|

May 17 2012, 12:13 PM May 17 2012, 12:13 PM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(vgodmax @ May 17 2012, 12:00 PM) eh, http://biz.thestar.com.my/marketwatch/bonus/alldividends.asp, pun ada lar, though U have to scroll/hunt down each REITs lareg. Click on A for AXREIT and other A**** stocks Note - U've to register (free) though. Compiled list? U mean this http://mreit.reitdata.com/ ? This post has been edited by wongmunkeong: May 17 2012, 12:13 PM |

|

|

May 17 2012, 03:18 PM May 17 2012, 03:18 PM

|

Senior Member

1,184 posts Joined: May 2005 |

QUOTE(H86 @ May 17 2012, 06:48 AM) RM7.45 is not high price. RM210.6m + RM87.7m are gross income before expenses, they are not NPI.~ MV Rental & Car Park Income: RM210.6 million per annum ~ GM Rental & Car Park Income: RM87.7 million per annum 3400million shares in the IGB Reit. 100% distribution until 31 Dec 2014. By looking at these information, let say IGB Reit earns RM280mil from rental income next year. 280 / 3400 = RM 0.082. RM7.45 is still lower price than RM1.00 in IGB Reit. Just to ask you whether have you seen CMMT or PAVREIT having >8.2% dividend yield? The IPO price is not yet set. The RM1 probably is the Par Value RM1.00 only. |

|

|

May 17 2012, 08:48 PM May 17 2012, 08:48 PM

|

Junior Member

157 posts Joined: Feb 2012 |

QUOTE(kbandito @ May 17 2012, 03:18 PM) Not sure then.. But based on the announced news:"PETALING JAYA: KrisAssets Holdings Bhd has proposed to sell Mid Valley Megamall, the Gardens Mall and their related assets to its parent IGB Corp Bhd for RM4.6bil." The market value for the Reit should be 4.6 / 3.4. Based on my understanding, the market value should be compute as value sold (4.6bil) divide by number of units share (3.4bil). Of course that my understanding could be wrong.. If anyone have better understanding on it, welcome to share the opinion. This post has been edited by H86: May 17 2012, 08:51 PM |

|

|

May 17 2012, 09:44 PM May 17 2012, 09:44 PM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(mopster @ May 15 2012, 11:06 PM) My understanding of the story: Kasset 2,730,000,000 / 520,997,000 = 5.24. Each Kasset will give u 5.24 IGBReit. Kasset will have a total cash of 1,212.559M + 670M (IPO) = 1,812.559M cash From there, the distributable sum is 1,266.990M. 1,266,990,000 / 520,997,000 = RM2.43 per share. Therefore: Buying 1k of Kasset today would have cost you RM7,400. You will get back RM2,430 cash + 5,240 IGBReit. (RM7400-RM2430)/5,240=RM0.948 per unit of IGBReit Theoretical IPO Price is RM1.00. so yeah, you do get some sort of discount. Market is super efficient... Considering they are valuing MVC and MVCG at 4,600M, each IGBReit should be worth around (RM4,600M / 3,400 Units) = RM1.35 Estimated Rental Income per year for MVC and MVCG are RM210.6 and RM81.7. Total is RM292.3M RM292.3M/3,400M = RM0.0859 a year. assuming 90% distribution, that will be RM 0.0773 DPU a year. Cost is 0.95. DPU 0.077, Yield is : 8.1%, and nett Yield after Witholding Tax is 7.29%... QUOTE(panasonic88 @ May 16 2012, 09:06 AM) Aiks moppy, looks like our calculation has some variants Pana, === For those who are asking me for the KrisAsset papers, here's it: Moppy calculation seem more correct. Check 10.2 on proforma I Total share will be 520 million, not 440 million (due to bond conversion). So, personally I see Kasset should be toppish not exceeding Rm8.00. Correct me if I am wrong. |

|

|

May 18 2012, 07:54 AM May 18 2012, 07:54 AM

|

All Stars

12,287 posts Joined: Oct 2010 |

May i ask why it seems ppl here are more into MREITs than SREITs when the latter offers better yields which are tax exempted? ??

|

|

|

|

|

|

May 18 2012, 07:58 AM May 18 2012, 07:58 AM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(prophetjul @ May 18 2012, 07:54 AM) May i ask why it seems ppl here are more into MREITs than SREITs when the latter offers better yields which are tax exempted? ?? Ohiyo ProphetJul,Early bird lar U. Perhaps like me previously, no viable options mar, taking into account IF i suddenly kick the bucket, my local Will may not be executable overseas, until found out... This post has been edited by wongmunkeong: May 18 2012, 07:58 AM |

|

|

May 18 2012, 08:04 AM May 18 2012, 08:04 AM

|

All Stars

12,287 posts Joined: Oct 2010 |

QUOTE(wongmunkeong @ May 18 2012, 07:58 AM) Ohiyo ProphetJul, Bonjour Mon ami,Early bird lar U. Perhaps like me previously, no viable options mar, taking into account IF i suddenly kick the bucket, my local Will may not be executable overseas, until found out... i am not early....just started to divest into SREITs early this year, so not so early. Divs in SREITs are not subject to taxes unlike the MREITs which attarct 10%? taxes.... Plus some yeilds are like 8 to 9%! Not bad....... So i am just wondering why the crowd seems oblivious to the ones across the causeway? |

|

|

May 18 2012, 08:15 AM May 18 2012, 08:15 AM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(prophetjul @ May 18 2012, 08:04 AM) Bonjour Mon ami, Yup yup, nice.... no tax.. i am not early....just started to divest into SREITs early this year, so not so early. Divs in SREITs are not subject to taxes unlike the MREITs which attarct 10%? taxes.... Plus some yeilds are like 8 to 9%! Not bad....... So i am just wondering why the crowd seems oblivious to the ones across the causeway? Once i found a "local trust account" to execute my REITs/stocks overseas (with my local Will applicable to all my investments held by the local brokerage firm), then only started moving across the causeway too Already in AIMSAPI, Saizen and First. Waiting for a bit of time to pass to continue "collecting" - time-diversification mar and er.. running out of ammo allocated to REITs (minimum per shot to be "worthwhile" for me is about SGD9K due to brokerage and other costs) Couldn't find "Plantation" REITs though or i may have missed it on the SGX This post has been edited by wongmunkeong: May 18 2012, 08:17 AM |

|

|

May 18 2012, 08:21 AM May 18 2012, 08:21 AM

|

All Stars

12,287 posts Joined: Oct 2010 |

QUOTE(wongmunkeong @ May 18 2012, 08:15 AM) Yup yup, nice.... no tax.. Do you think the economy of Msia will ever surpass Singapore?Once i found a "local trust account" to execute my REITs/stocks overseas (with my local Will applicable to all my investments held by the local brokerage firm), then only started moving across the causeway too Already in AIMSAPI, Saizen and First. Waiting for a bit of time to pass to continue "collecting" - time-diversification mar and er.. running out of ammo allocated to REITs (minimum per shot to be "worthwhile" for me is about SGD9K due to brokerage and other costs) Couldn't find "Plantation" REITs though or i may have missed it on the SGX If not then SGD should be well safer than RGT in the long haul. Thought ALL wills will take into account of that? i am in AIMS, Sabana and Cambridge. Waiting for First to retreat further hopefully to 85. Still only 20% of my intended allocation! Its very difficult to catch these fishes... Plantation REITS? What do they do? |

|

|

May 18 2012, 08:30 AM May 18 2012, 08:30 AM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(prophetjul @ May 18 2012, 08:21 AM) Do you think the economy of Msia will ever surpass Singapore? er.. side track a bit ar Mods.If not then SGD should be well safer than RGT in the long haul. Thought ALL wills will take into account of that? i am in AIMS, Sabana and Cambridge. Waiting for First to retreat further hopefully to 85. Still only 20% of my intended allocation! Its very difficult to catch these fishes... Plantation REITS? What do they do? Wills - Wills written in country A MAY not be executable fully in country B, thus in country B, it may be as good as dying intestate. Usually, only non-moveable assets like physical properties are affected BUT to be on the safe side, best to have a Will drawn up in EACH country U have assets in. --- Plantation REITs? Something like BSDREIT http://www.al-hadharahboustead.com.my/overview.html ---snippet--- Income Streams Under the Al-Hadharah Boustead REIT, plantation assets will be leased back to the vendors for a three-year renewable tenancy with a cumulative period of up to thirty years. At the end of every three years, the fixed rental will be reviewed and a new rental will be agreed between the parties. The new rental will be determined based on historical crude palm oil (CPO) prices, prevailing and expected future CPO prices, cost of production, extraction rates and yield per hectare. Hence, income sources for Al-Hadharah Boustead REIT include: Fixed Rental With the renewal of the Ijarah agreement effective from 1 January 2010, the fixed rental income for the second tenancy term is increased from Tenants will pay a cumulative fixed rental of approximately RM53.2 million to RM57.8 million per annum for the first tenancy term of three years. This will be payable on a bi-monthly basis. Performance-Based Profit Sharing In addition to a fixed rental, the Al-Hadharah Boustead REIT may enjoy an annual profit sharing of net incremental income based on a formula pegged to CPO and fresh fruit bunch (FFB) prices. This net incremental income is determined based on the actual CPO price realised for the year, above the reference price of RM2,000 per MT for the first next three years. It will be shared on a 50:50 basis between the Tenants and the Fund. This profit sharing payment is the first of its kind in the REIT market and may translate into more handsome distribution yields for unitholders. Capital Gains Given the development potential of some of the plantation assets, especially those located in prime locations; there is a potential upside for capital gains. The gains realised may be distributed as bonus distributions. |

|

|

May 18 2012, 08:37 AM May 18 2012, 08:37 AM

|

All Stars

12,287 posts Joined: Oct 2010 |

QUOTE(wongmunkeong @ May 18 2012, 08:30 AM) er.. side track a bit ar Mods. ThanksWills - Wills written in country A MAY not be executable fully in country B, thus in country B, it may be as good as dying intestate. Usually, only non-moveable assets like physical properties are affected BUT to be on the safe side, best to have a Will drawn up in EACH country U have assets in. --- Plantation REITs? Something like BSDREIT http://www.al-hadharahboustead.com.my/overview.html ---snippet--- Income Streams Under the Al-Hadharah Boustead REIT, plantation assets will be leased back to the vendors for a three-year renewable tenancy with a cumulative period of up to thirty years. At the end of every three years, the fixed rental will be reviewed and a new rental will be agreed between the parties. The new rental will be determined based on historical crude palm oil (CPO) prices, prevailing and expected future CPO prices, cost of production, extraction rates and yield per hectare. Hence, income sources for Al-Hadharah Boustead REIT include: Fixed Rental With the renewal of the Ijarah agreement effective from 1 January 2010, the fixed rental income for the second tenancy term is increased from Tenants will pay a cumulative fixed rental of approximately RM53.2 million to RM57.8 million per annum for the first tenancy term of three years. This will be payable on a bi-monthly basis. Performance-Based Profit Sharing In addition to a fixed rental, the Al-Hadharah Boustead REIT may enjoy an annual profit sharing of net incremental income based on a formula pegged to CPO and fresh fruit bunch (FFB) prices. This net incremental income is determined based on the actual CPO price realised for the year, above the reference price of RM2,000 per MT for the first next three years. It will be shared on a 50:50 basis between the Tenants and the Fund. This profit sharing payment is the first of its kind in the REIT market and may translate into more handsome distribution yields for unitholders. Capital Gains Given the development potential of some of the plantation assets, especially those located in prime locations; there is a potential upside for capital gains. The gains realised may be distributed as bonus distributions. I suppose our wills will cover those stocks held IN TRUST of the Msian stcokbrokers. However for stcoks bought overseas, that maybe the case hahh its renting lands.....hows the returns on this one? |

|

|

May 18 2012, 08:44 AM May 18 2012, 08:44 AM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

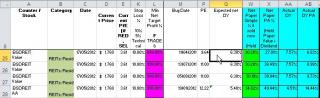

QUOTE(prophetjul @ May 18 2012, 08:37 AM) Thanks Wills - yup, spot on.I suppose our wills will cover those stocks held IN TRUST of the Msian stcokbrokers. However for stcoks bought overseas, that maybe the case hahh its renting lands.....hows the returns on this one? BSDREIT returns? er.. something like this

|

|

Topic ClosedOptions

|

| Change to: |  0.0319sec 0.0319sec

0.43 0.43

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 24th December 2025 - 01:32 AM |