QUOTE(nicemamak @ Jan 31 2013, 03:29 PM)

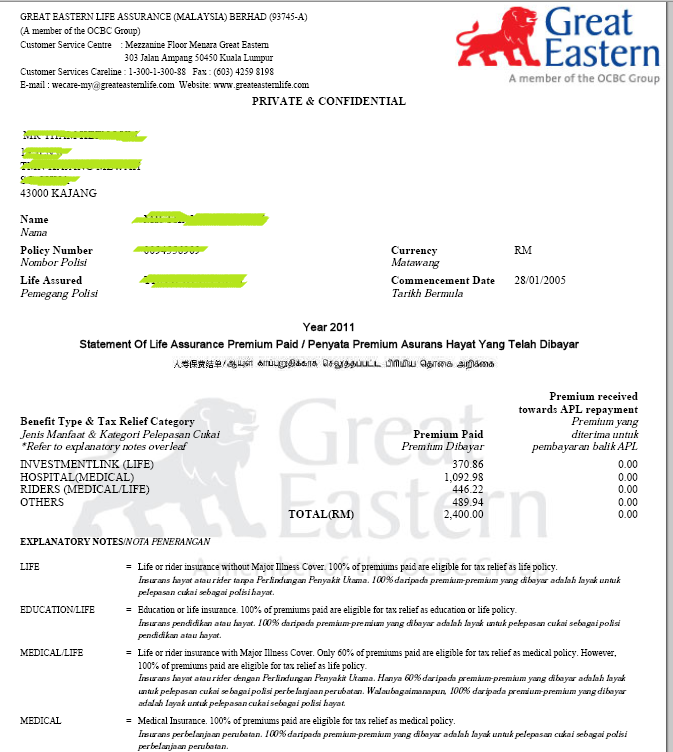

For BE, an insurance plan can reliex tax up to RM12,000 (6,000 life + 3,000 medical + 3,000 retirement planning). If your tax bracket is let say 20%, you can save up to RM2400 per annum. If you still have 30 years left to work before you retire, the amount that you could have saved is a whopping huge number. Furthermore, insurance plan can be tailored made in such a way that the cash value later let say 15 or 30 years later is higher than the total premium that you have saved into the plan, meaning you don't lose your money. At the same time, 30 years down the road if you look back, not only you get back your money, at the same time the insurance protection that you get is as if it is free since you get back your money.

PM me for details.

Feb 4 2013, 12:02 PM

Feb 4 2013, 12:02 PM

Quote

Quote

0.0459sec

0.0459sec

0.51

0.51

7 queries

7 queries

GZIP Disabled

GZIP Disabled