Outline ·

[ Standard ] ·

Linear+

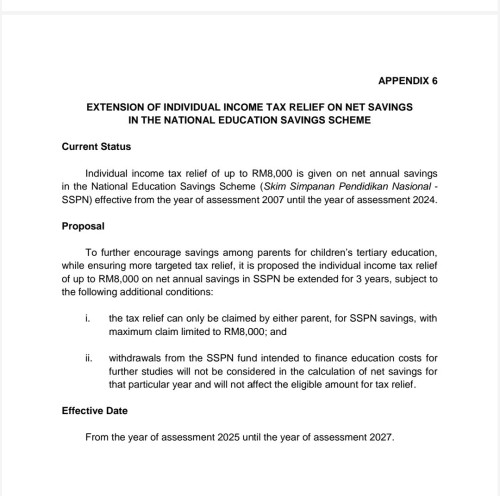

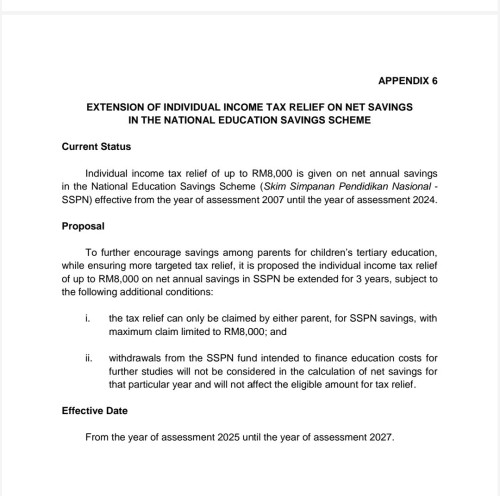

SSPN, Skim Simpanan Pendidikan Nasional

|

jagjag

|

Mar 7 2024, 10:30 AM Mar 7 2024, 10:30 AM

|

|

QUOTE(cybpsych @ Mar 6 2024, 11:30 AM) "...dilanjutkan sehingga TAHUN TAKSIRAN 2024..." Just to clear this, and i've check thru the news. 8K we deposited before 31 Dec 2023 is eligible for tax relief which we will file in this year (Mar/Apr 2024). If we were to deposit another 8K this year (2024), we wont get any relief when we file our tax on Mar/Apr 2025. Correct me if im wrong |

|

|

|

|

|

jagjag

|

Mar 7 2024, 10:40 AM Mar 7 2024, 10:40 AM

|

|

QUOTE(MUM @ Mar 7 2024, 10:35 AM) My understanding to that highlighted scenario and results is "Wrong" . For my interpretation is "You can still file tax relief claim in Apr 25" But why they asking us to deposit before 31 Dec 2023. I mean they emphasis on this..before 31 Dec 2023 |

|

|

|

|

|

jagjag

|

Mar 7 2024, 10:45 AM Mar 7 2024, 10:45 AM

|

|

Haha..okok..my bad..missed one sentence and make me so confuse.

Thank you all Sifu...

So now need to find RM 8K to deposit to SSPN before 31 Dec 2024.

This post has been edited by jagjag: Mar 7 2024, 10:46 AM

|

|

|

|

|

|

jagjag

|

Oct 25 2024, 02:55 PM Oct 25 2024, 02:55 PM

|

|

QUOTE(fuzzy @ Oct 19 2024, 01:03 PM) Should be one parent per child only.  item ii - witdrawal If like this if i need 20K for the kids education, i will witdraw 28K and then put back the 8K so i will eligible for 8k tax relieve for that year ?? Cannot be like tis right ?? |

|

|

|

|

Mar 7 2024, 10:30 AM

Mar 7 2024, 10:30 AM

Quote

Quote

0.0275sec

0.0275sec

0.66

0.66

7 queries

7 queries

GZIP Disabled

GZIP Disabled