Outline ·

[ Standard ] ·

Linear+

SSPN, Skim Simpanan Pendidikan Nasional

|

MGM

|

Mar 4 2021, 05:57 PM Mar 4 2021, 05:57 PM

|

|

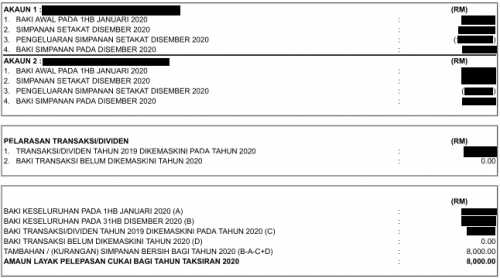

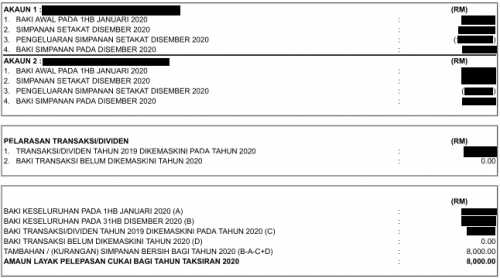

QUOTE(LostAndFound @ Mar 4 2021, 05:06 PM) The kid 2 a/c is the account number your IC number with a few extra digit in front and behind? One possibility is that the account is not under your IC. My statement everything in order, almost exactly 8k net deposit and that's what it shows (both accounts also got withdrawal):-  You only want to upload selected snapshot then you ask us to check for you? Pretty sure you also received additional cashback (for example from ganjaran kesetiaan) but you didn't show that part of your statement. Try looking for this sort of line:- 11/06/2020 1010 SIMPANAN TUNAI G KESETIAAN2020 W0010001 Could be the ganjaran, then ganjaran is 8000-7064=936. |

|

|

|

|

|

MGM

|

Mar 6 2021, 04:19 PM Mar 6 2021, 04:19 PM

|

|

Previuosly there is a guy who claimed to be from ptptn JB, anyone know the contact?

|

|

|

|

|

|

MGM

|

Mar 6 2021, 04:40 PM Mar 6 2021, 04:40 PM

|

|

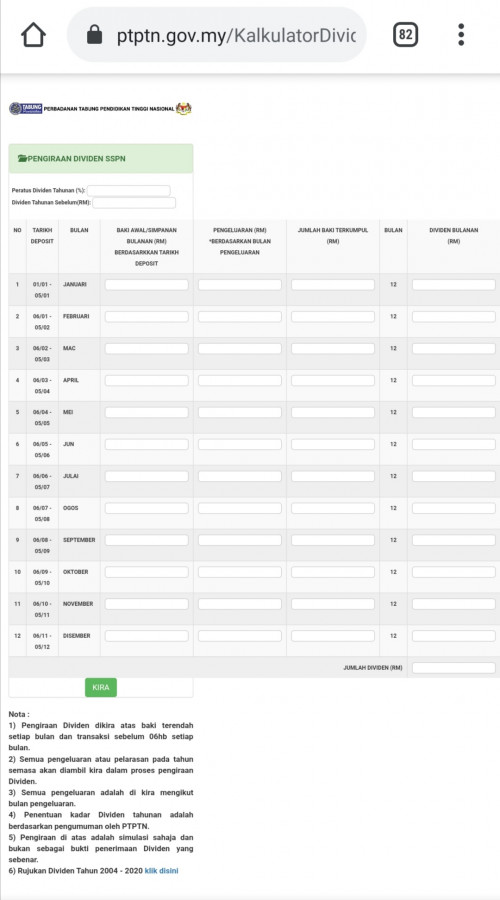

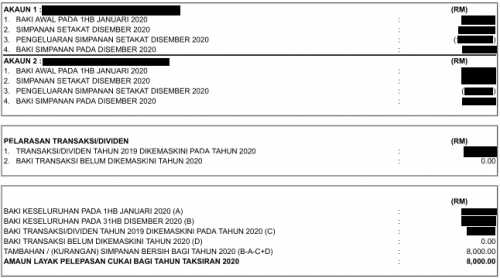

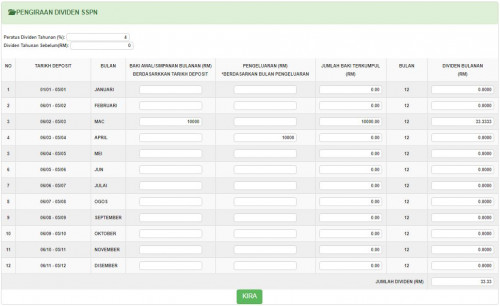

QUOTE(MUM @ Mar 6 2021, 04:26 PM) is it this you are refering to? page 284, post 5678 Thanks, that is the one. Looking at the pictures they r indeed the staff in JB. Can anyone explain how to use this calculator? https://www.ptptn.gov.my/KalkulatorDividen/Utama This post has been edited by MGM: Mar 6 2021, 05:47 PM This post has been edited by MGM: Mar 6 2021, 05:47 PM |

|

|

|

|

|

MGM

|

Mar 6 2021, 08:37 PM Mar 6 2021, 08:37 PM

|

|

QUOTE(smartfreak @ Mar 3 2021, 09:34 PM) If not mistaken, need to consider minimum balance for that month also. 1) Pengiraan Dividen dikira atas baki terendah setiap bulan dan transaksi sebelum 06hb setiap bulan. There is a chart shared by others before: https://forum.lowyat.net/index.php?showtopi...ost&p=100109214This link is no longer available, any idea where can I find it cos i want to assure the correct calculation. |

|

|

|

|

|

MGM

|

Mar 7 2021, 04:25 AM Mar 7 2021, 04:25 AM

|

|

QUOTE(smartfreak @ Mar 7 2021, 12:00 AM) Thanks, so complicated if one deposits n withdraws, like me. Need multiple accounts to maneuver/optimise. |

|

|

|

|

|

MGM

|

Mar 7 2021, 04:30 AM Mar 7 2021, 04:30 AM

|

|

QUOTE(guy3288 @ Mar 6 2021, 10:29 PM)    i followed the advice given by the Boss! , i was telling dont include ganjaran but i changed my calculation after checking with HQ director. even big boss there not good enough...  I now have reservations asking ptptn how to use the calculator. |

|

|

|

|

|

MGM

|

Mar 8 2021, 01:55 PM Mar 8 2021, 01:55 PM

|

|

QUOTE(Afterburner1.0 @ Mar 8 2021, 12:42 PM) newbie here...SSPN-I & SSPN-I Plus whats the diff? Does this works like ASM? need to fish or just deposit any amount? The dividend is paid annually at 4% currently then why would anyone want to put in FD anymore??? just curious... Im thinking to open an acc for myself.... any tips or advise? few years it was < 4%, mostly 4%. 2004-3% 2009-2.5% 2010-3.25% 2011-3.75% 2012-2014-4.25% |

|

|

|

|

|

MGM

|

Mar 9 2021, 02:51 PM Mar 9 2021, 02:51 PM

|

|

QUOTE(no6 @ Mar 9 2021, 02:07 PM) so hard-sell? makes one wonder is this sspn stable Is SSPN guaranteed by the govt? |

|

|

|

|

|

MGM

|

Mar 10 2021, 03:50 PM Mar 10 2021, 03:50 PM

|

|

QUOTE(yklooi @ Mar 10 2021, 03:43 PM) i just scare they revert this condition back without notice then they practised .... "Pengeluaran hanya boleh dibuat selepas 1 tahun menyimpan. Terdapat 2 jenis pengeluaran iaitu:- i. Pengeluaran sekali setahun pada kadar 10% daripada baki akaun atau RM500 mengikut mana yang terendah; atau ii. Pengeluaran 100% atau penutupan akaun SSPN sekiranya penerima manfaat memenuhi salah satu daripada kriteria berikut:- a. Diterima masuk ke IPT ; b. Terkeluar daripada sistem pendidikan secara sukarela atau diberhentikan atas sebab-sebab tertentu; c. Sakit berterusan yang tiada peluang untuk sembuh dengan pengesahan doktor perubatan Kerajaan; d. Keilatan kekal dengan pengesahan doktor perubatan Kerajaan; e. Kematian penerima manfaat; atau f. Kematian pendeposit. per post 79, page 4 Thanks for sharing, didnt know about such t&c, have been treating it like a CASA, so far so good.  |

|

|

|

|

|

MGM

|

Mar 10 2021, 04:01 PM Mar 10 2021, 04:01 PM

|

|

QUOTE(yklooi @ Mar 10 2021, 03:53 PM) too late to pull out...already "locked/trapped" inside  if they changed without notice to the "better" terms,..so they can also change without notice to the "badder" terms too  What do u mean locked, already cant withdraw? |

|

|

|

|

|

MGM

|

Mar 11 2021, 01:46 PM Mar 11 2021, 01:46 PM

|

|

QUOTE(MUM @ Mar 11 2021, 01:38 PM) sspn has cut off date for dividend qualifying of that month... Is it true that if u deposited say on 5-Mar n withdraw out in 1April u still get 1 month of dividend? |

|

|

|

|

|

MGM

|

Mar 12 2021, 10:10 AM Mar 12 2021, 10:10 AM

|

|

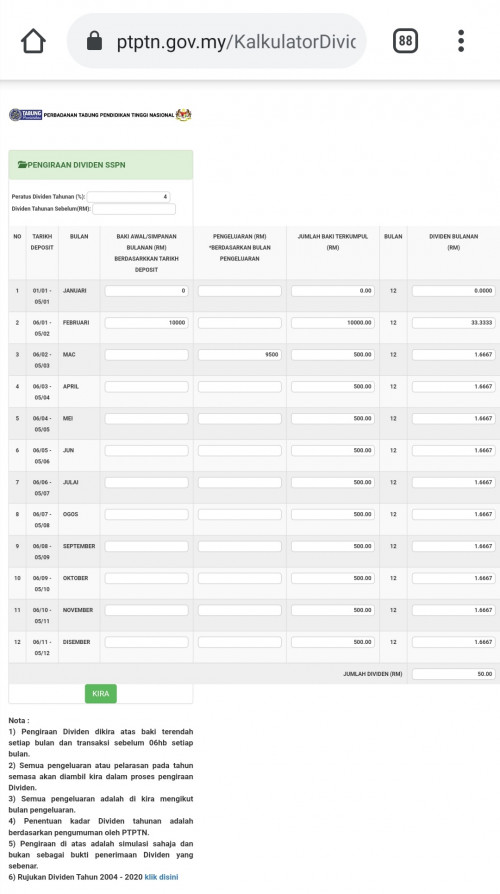

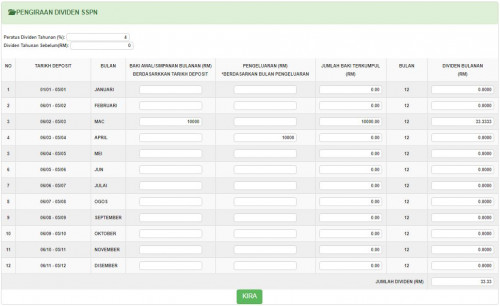

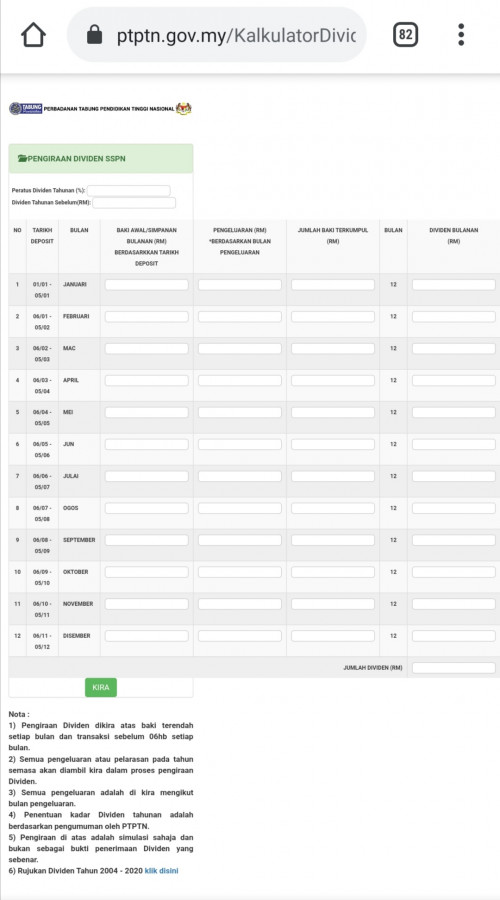

QUOTE(LostAndFound @ Mar 12 2021, 09:55 AM) You can test and count for us. But based on their document I think you will not get because they count the lowest balance between 5 Mar and 4 Apr. So if you deposit 10k on 5 Mar and withdraw 9.5k on 4 Apr, your balance is 10k for the whole period except last day is 500. Then they will use that 500 to count. That is what i tot, but calculator showed otherwise. |

|

|

|

|

|

MGM

|

Mar 12 2021, 10:42 AM Mar 12 2021, 10:42 AM

|

|

QUOTE(T231H @ Mar 12 2021, 10:25 AM) that calculator can do simulated in and out timing calculations too? I think so. I have yet to try with data from last year statement. |

|

|

|

|

|

MGM

|

Mar 12 2021, 10:49 AM Mar 12 2021, 10:49 AM

|

|

QUOTE(LostAndFound @ Mar 12 2021, 10:44 AM) No it doesn't. Clearly states first column you fill in how much you deposit, then 2nd you fill in how much you take out within the same time period. So in my example it would be 10k in first column, 9.5k in second column, then it will calculate 500 for you in third column and give you RM1.6667 (assuming 4% p.a.) Cs told me the withdrawal on the next month is put in the 2nd column of next row. Deposit based on Tarikh deposit column and Withdrawal based on Bulan pengeluaran column. Eg below i deposited 10000 in 5Feb and withdrew 9500 in 1Mar.  This post has been edited by MGM: Mar 12 2021, 11:07 AM This post has been edited by MGM: Mar 12 2021, 11:07 AM |

|

|

|

|

|

MGM

|

Mar 12 2021, 11:26 AM Mar 12 2021, 11:26 AM

|

|

QUOTE(canjeth @ Mar 12 2021, 11:04 AM) Yes the calculator itself is self explanatory. Only deposits follow the 6th-5th rule; withdrawals follow the month in which the withdrawals were made. So if you deposit 10k on 5 March and withdraw all 10k on 4 April you will still get 1 month dividend for March. This also means you will get full dividend for March even if you withdraw on 1 April.  What is troubling us is this t&c shown below the calculator: Nota : 1) Pengiraan Dividen dikira atas baki terendah setiap bulan dan transaksi sebelum 06hb setiap bulan. |

|

|

|

|

|

MGM

|

Mar 12 2021, 11:30 AM Mar 12 2021, 11:30 AM

|

|

QUOTE(Kaptain_Planet @ Feb 24 2021, 02:00 PM) https://www.ptptn.gov.my/Ganjaran/Utamaeligibility for the ganjaran can be check through this link for any further enquiry, can contact our team at this website https://www.sspnutcjb.com/hubungi QUOTE(MGM @ Mar 12 2021, 11:26 AM) What is troubling us is this t&c shown below the calculator: Nota : 1) Pengiraan Dividen dikira atas baki terendah setiap bulan dan transaksi sebelum 06hb setiap bulan. QUOTE(LostAndFound @ Mar 12 2021, 11:28 AM) That is one interpretation. If this is correct then it is good (can get a few days free interest). I would not want to test it just for the benefit of a few days interest. Summoning Kaptain_Planet to help in this. |

|

|

|

|

|

MGM

|

Mar 15 2021, 11:25 AM Mar 15 2021, 11:25 AM

|

|

Cashing out sspn to Bank Islam online is immediate.

What about Bank Islam to sspn?

|

|

|

|

|

|

MGM

|

Mar 15 2021, 02:38 PM Mar 15 2021, 02:38 PM

|

|

QUOTE(Mervin1234 @ Mar 15 2021, 12:42 PM) Hi, i have a 6 digit figure to transfer into sspn for the 1% ganjaran, what is the best way i can do it in 1 go ? I am currently using maybank and the limit is only 30k a day, it will take me few week to complete the transfer. Hope someone can suggest something more fast to make the transfer. Thanks In Advance. This Maybank limit of 30k is online or over the counter? |

|

|

|

|

|

MGM

|

Mar 16 2021, 08:07 AM Mar 16 2021, 08:07 AM

|

|

QUOTE(MUM @ Mar 16 2021, 07:32 AM) Just a note.. I read postings posted... Money deposited at certain period of the month will not get prorated dividend of that month..... Money withdrawn within the month will impact the prorated dividend calculation of that month That is why need to understand when to move d funds between sspn n high interest CASA. I have yet to find out how dividend is calculated. |

|

|

|

|

|

MGM

|

Mar 16 2021, 09:02 AM Mar 16 2021, 09:02 AM

|

|

QUOTE(tsutsugami86 @ Mar 16 2021, 08:52 AM) I think those move in move out are treat SSPN as tool to cash out money from credit card & earn cash back (also interest in CASA). They may not concern about the SSPN dividend. But if can also get some from sspn then it is a bonus. |

|

|

|

|

Mar 4 2021, 05:57 PM

Mar 4 2021, 05:57 PM

Quote

Quote

0.0327sec

0.0327sec

0.87

0.87

7 queries

7 queries

GZIP Disabled

GZIP Disabled