QUOTE(veilside2010 @ Aug 12 2011, 09:47 AM)

no planning yet...i am in for longer term...dun forget they have dividend policy as well...UOA Group, Everything About UOADEV

UOA Group, Everything About UOADEV

|

|

Aug 12 2011, 01:14 PM Aug 12 2011, 01:14 PM

|

Senior Member

718 posts Joined: Jan 2003 From: Seri Kembangan |

|

|

|

|

|

|

Aug 12 2011, 02:57 PM Aug 12 2011, 02:57 PM

|

Junior Member

411 posts Joined: Oct 2010 |

Haiz...other counter keep shooting...Bu6t this UOA..keep drop and drop........................ Totally abang adik with bjcorp...

|

|

|

Aug 14 2011, 08:11 PM Aug 14 2011, 08:11 PM

|

Senior Member

718 posts Joined: Jan 2003 From: Seri Kembangan |

Monday Target Price:...anyone?....results out soon...latest end of this month....

Added on August 23, 2011, 10:02 pmresults out...comment please? This post has been edited by changshen: Aug 23 2011, 10:02 PM |

|

|

Aug 25 2011, 12:34 AM Aug 25 2011, 12:34 AM

|

Senior Member

1,248 posts Joined: May 2011 |

QUOTE(changshen @ Aug 14 2011, 08:11 PM) Monday Target Price:...anyone?....results out soon...latest end of this month.... Share price going further down = result not good?Added on August 23, 2011, 10:02 pmresults out...comment please? Basically known that one share is with NTA RM1.35 lor~ Added on August 25, 2011, 3:36 pmJust in some at rm 1.50 today..... But it is still droping.... @.@" so big problem? This post has been edited by SmallPotato2011: Aug 25 2011, 03:36 PM |

|

|

Aug 26 2011, 12:55 PM Aug 26 2011, 12:55 PM

|

Senior Member

3,310 posts Joined: Apr 2005 |

drop again.. this stock non-stop dropping since day 1..

|

|

|

Aug 26 2011, 01:48 PM Aug 26 2011, 01:48 PM

|

Senior Member

851 posts Joined: Jan 2003 From: Anywhere |

sien.. 8k stuck in UOADev....with 28% losses on paper...guess have to keep for long term liao....

|

|

|

|

|

|

Aug 26 2011, 03:21 PM Aug 26 2011, 03:21 PM

|

Senior Member

782 posts Joined: May 2011 |

|

|

|

Aug 28 2011, 03:45 AM Aug 28 2011, 03:45 AM

|

Senior Member

3,807 posts Joined: Jan 2006 |

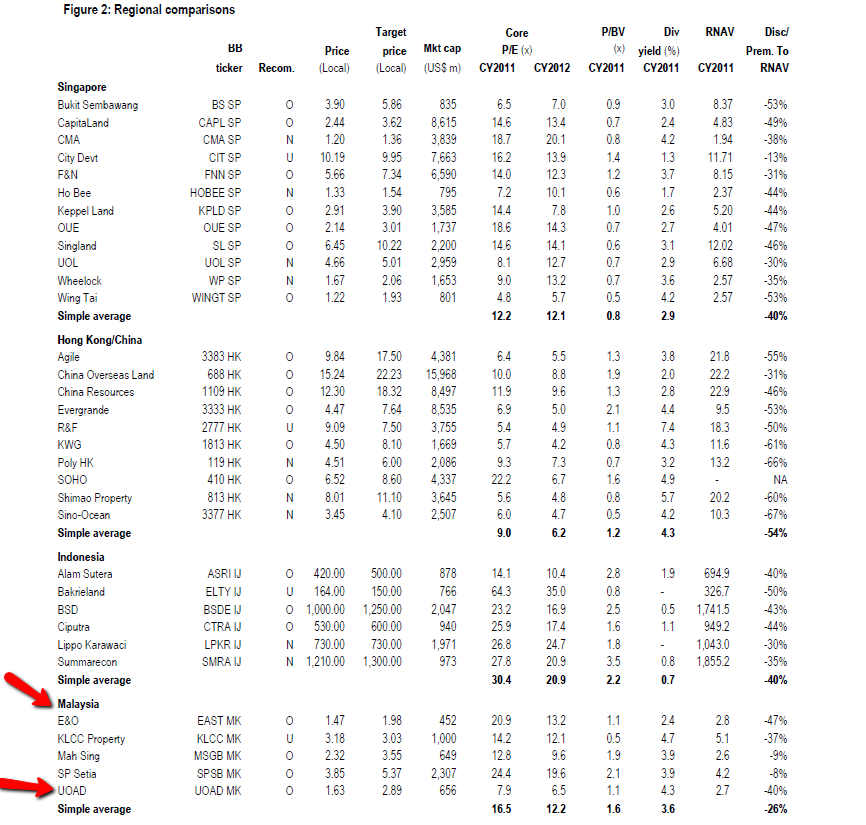

Date: 24/08/2011 KUALA LUMPUR: CIMB Equities Research is maintaining its Outperform rating on UOA Developments Bhd after its annualised 1H core net profit met expectations at 93% of its forecast and 94% of consensus projections. The research house said on Wednesday, Aug 24 that future quarters should be stronger as recognition of the strong year-to-date sales picks up pace. CIMB Research said the good results should also boost confidence in the group's ability to meet the research house's FY11 core profit forecast of RM224 milllion. 'However, in view of the stockmarket turbulence of late and global slowdown fears, we now value UOA Dev at a 20% discount to market P/E instead of 10% given the higher risks inherent in its large exposure to high-rise residential and commercial development. 'Our target price falls from RM3.25 to RM2.89 as we lower our P/E target from 13.1x to 11.6x. We maintain our OUTPERFORM call in light of the potential catalysts of 1) improving earnings, 2) continued strong sales and 3) landbank acquisition,' it said.  |

|

|

Aug 28 2011, 03:46 AM Aug 28 2011, 03:46 AM

|

Senior Member

3,807 posts Joined: Jan 2006 |

12:47PM UNITED OVERSEAS AUSTRALIA LIMITED (1,000,000 Shares Acquired) 12:46PM UOA HOLDINGS SDN BHD (1,000,000 Shares Acquired) Monday, 15 Aug 2011 1:04PM EMPLOYEES PROVIDENT FUND BERHAD (1,000,000 Shares Acquired) Wednesday, 10 Aug 2011 1:21PM UOA HOLDINGS SDN BHD (100,000 Shares Acquired) 1:19PM UNITED OVERSEAS AUSTRALIA LIMITED (100,000 Shares Acquired) Friday, 5 Aug 2011 5:33PM EMPLOYEES PROVIDENT FUND BERHAD (121,500 Shares Disposed) 5:33PM UNITED OVERSEAS AUSTRALIA LIMITED (20,000 Shares Acquired) 5:31PM DEALINGS IN LISTED SECURITIES (CHAPTER 14 OF LISTING REQUIREMENTS) 5:29PM UOA HOLDINGS SDN BHD (20,000 Shares Acquired) Tuesday, 2 Aug 2011 5:38PM KONG CHONG SOON @ CHI SUIM (10,000 Shares Acquired) 12:41PM UOA HOLDINGS SDN BHD (125,000 Shares Acquired) 12:41PM UNITED OVERSEAS AUSTRALIA LIMITED (125,000 Shares Acquired) Monday, 1 Aug 2011 5:38PM KONG CHONG SOON @ CHI SUIM (10,000 Shares Acquired) 12:41PM UOA HOLDINGS SDN BHD (203,000 Shares Acquired) 12:41PM UNITED OVERSEAS AUSTRALIA LIMITED (203,000 Shares Acquired) Thursday, 28 Jul 2011 5:59PM TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS) 12:56PM UNITED OVERSEAS AUSTRALIA LIMITED (290,000 Shares Acquired) 12:55PM UOA HOLDINGS SDN BHD (290,000 Shares Acquired) Monday, 25 Jul 2011 12:43PM UOA HOLDINGS SDN BHD (50,000 Shares Acquired) 12:43PM UNITED OVERSEAS AUSTRALIA LIMITED (50,000 Shares Acquired) Friday, 22 Jul 2011 12:44PM UNITED OVERSEAS AUSTRALIA LIMITED (27,300 Shares Acquired) 12:44PM EMPLOYEES PROVIDENT FUND BOARD (205,000 Shares Acquired) 12:43PM UOA HOLDINGS SDN BHD (27,300 Shares Acquired) Thursday, 21 Jul 2011 5:45PM EMPLOYEES PROVIDENT FUND BOARD (300,000 Shares Acquired) 12:46PM UNITED OVERSEAS AUSTRALIA LIMITED (75,000 Shares Acquired) 12:46PM UOA HOLDINGS SDN BHD (75,000 Shares Acquired) Friday, 8 Jul 2011 12:35PM EMPLOYEES PROVIDENT FUND BOARD (300,000 Shares Acquired) Thursday, 7 Jul 2011 5:30PM EMPLOYEES PROVIDENT FUND BOARD (470,000 Shares Acquired) Monday, 4 Jul 2011 5:57PM UNITED OVERSEAS AUSTRALIA LIMITED (40,000 Shares Acquired) 5:57PM UOA HOLDINGS SDN BHD (40,000 Shares Acquired) 5:57PM UNITED OVERSEAS AUSTRALIA LIMITED (220,000 Shares Acquired) 5:57PM UOA HOLDINGS SDN BHD (220,000 Shares Acquired) Friday, 1 Jul 2011 12:48PM UOA HOLDINGS SDN BHD (388,500 Shares Acquired) 12:48PM UNITED OVERSEAS AUSTRALIA LIMITED (388,500 Shares Acquired) 12:47PM EMPLOYEES PROVIDENT FUND BOARD (500,000 Shares Acquired) Thursday, 30 Jun 2011 12:42PM UOA HOLDINGS SDN BHD (275,000 Shares Acquired) 12:42PM UNITED OVERSEAS AUSTRALIA LIMITED (275,000 Shares Acquired) Wednesday, 29 Jun 2011 5:12PM EMPLOYEES PROVIDENT FUND BOARD (500,000 Shares Acquired) Tuesday, 28 Jun 2011 12:43PM EMPLOYEES PROVIDENT FUND BOARD (500,000 Shares Acquired) Monday, 27 Jun 2011 12:42PM UOA HOLDINGS SDN. BHD. (46,000 Shares Acquired) Friday, 24 Jun 2011 5:13PM UOA HOLDINGS SDN. BHD. (339,000 Shares Acquired) |

|

|

Aug 28 2011, 03:48 AM Aug 28 2011, 03:48 AM

|

Senior Member

3,807 posts Joined: Jan 2006 |

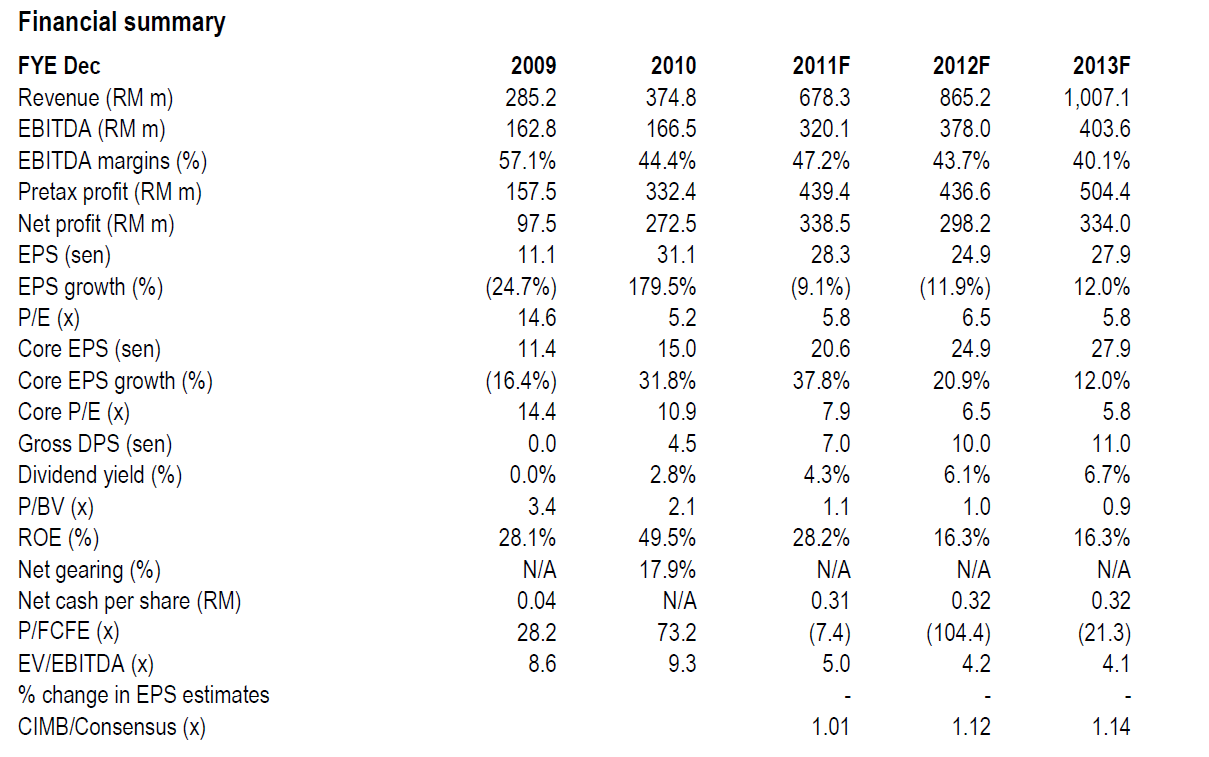

QUOTE CIMB Research maintains Outperform on UOA Devt Date: 24/08/2011 KUALA LUMPUR: CIMB Equities Research is maintaining its Outperform rating on UOA Developments Bhd after its annualised 1H core net profit met expectations at 93% of its forecast and 94% of consensus projections. The research house said on Wednesday, Aug 24 that future quarters should be stronger as recognition of the strong year-to-date sales picks up pace. CIMB Research said the good results should also boost confidence in the group's ability to meet the research house's FY11 core profit forecast of RM224 milllion. 'However, in view of the stockmarket turbulence of late and global slowdown fears, we now value UOA Dev at a 20% discount to market P/E instead of 10% given the higher risks inherent in its large exposure to high-rise residential and commercial development. 'Our target price falls from RM3.25 to RM2.89 as we lower our P/E target from 13.1x to 11.6x. We maintain our OUTPERFORM call in light of the potential catalysts of 1) improving earnings, 2) continued strong sales and 3) landbank acquisition,' it said. .... and this.. QUOTE RHB Research Institute had valued UOA Development at RM3.45, at its RNAV per share and in line with its valuations on IJM Land Bhd. QUOTE KUALA LUMPUR: CIMB Equities Research has initiated coverage on UOA Development Bhd with a target price of RM3.25 based on 13.1 times FY12 P/E or a 10% discount to its target market P/E of 14.5 times. 'UOA Development's poor share price performance since its listing gives investors a chance to accumulate the stock on the cheap. Investors' realisation of the strong core earnings growth in FY11-13 could spark a re-rating, along with robust sales or more land banking,' it said on Tuesday, July 19. CIMB Research said what sets UOA Development apart from its rivals is its wide gross margin of around 50%, which puts it well ahead of many sizeable established developers and will help this highly profitable developer to nearly triple itscore net profit in FY12. 'In view of its relatively small landbank but consistent track record for landbanking and earnings expansion, we are valuing it on P/E basis, similar to other quick turnaround companies,' it said. The research house said UOA Development has around 100 acres of undeveloped landbank with GDV of RM11bn. Its flagship project is the 60-acre Bangsar South project in Kuala Lumpur which has a GDV of over RM8bn. 'Besides various undeveloped residential and commercial components of Bangsar South worth RM6.1bn, UOA Development has another 10 projects with GDV worth nearly RM3bn which will be launched over the next 2-3 years. The group enjoys wide margins ranging from 35% to 60% as it prices its PROPERTIES at a premium and captures CONSTRUCTION margins internally,' it said |

|

|

Aug 28 2011, 03:49 AM Aug 28 2011, 03:49 AM

|

Senior Member

3,807 posts Joined: Jan 2006 |

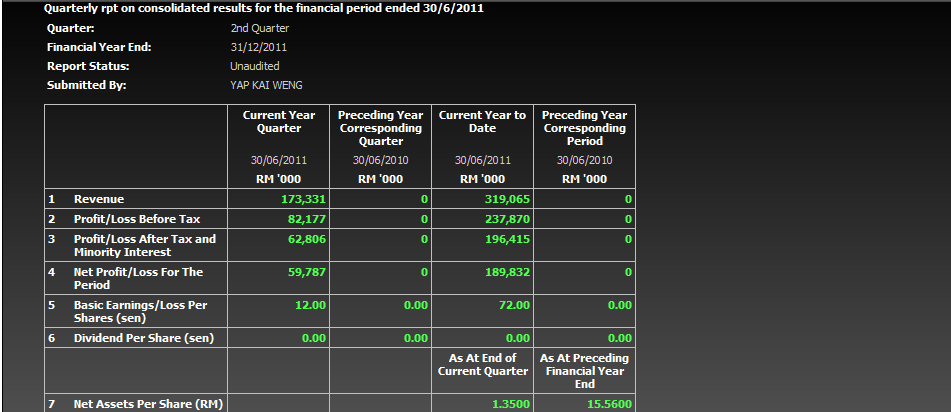

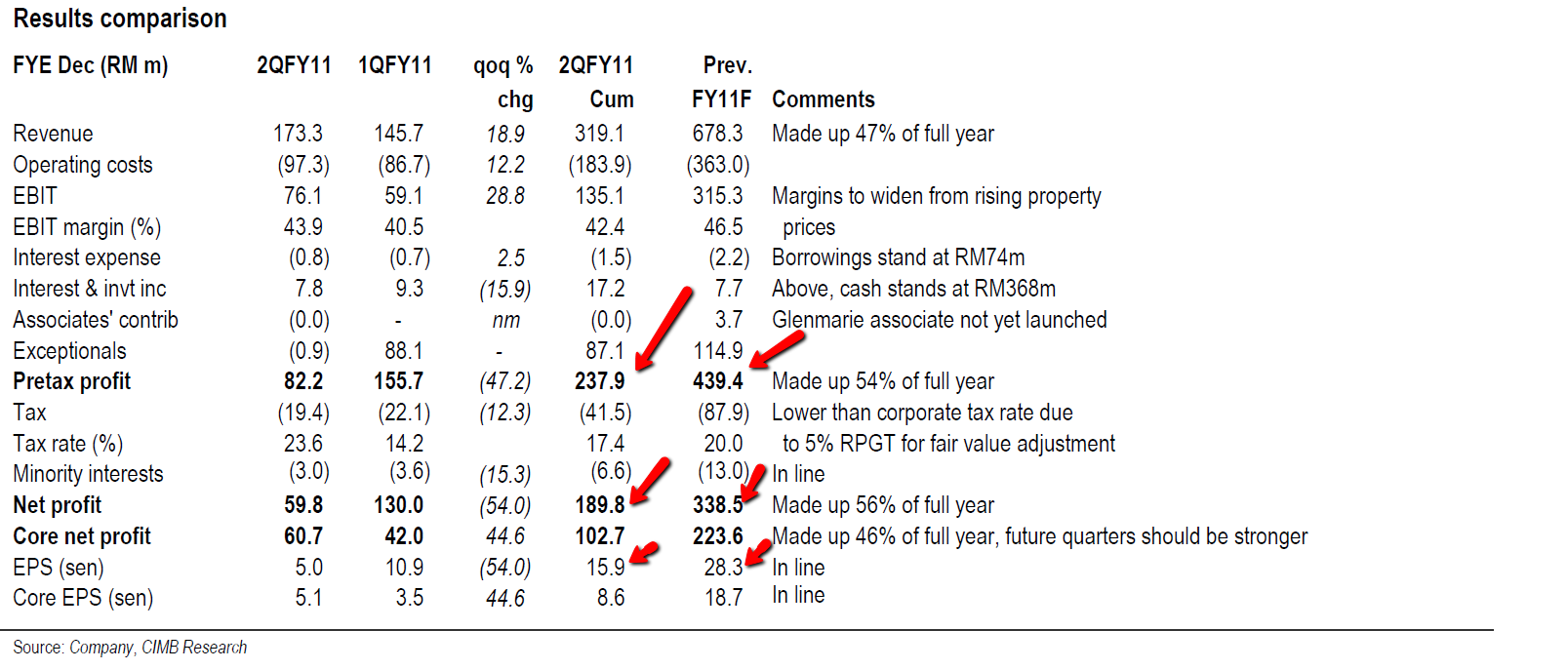

• In line at midway stage. At 93% of our forecast and 94% of consensus projections, UOA Dev’s annualised 1H core net profit met expectations given that future quarters should be stronger as recognition of the strong YTD sales picks up pace. The good results should also boost confidence in the group’s ability to meet our FY11 core profit forecast of RM224m. However, in view of the stockmarket turbulence of late and global slowdown fears, we now value UOA Dev at a 20% discount to market P/E instead of 10% given the higher risks inherent in its large exposure to high-rise residential and commercial development. Our target price falls from RM3.25 to RM2.89 as we lower our P/E target from 13.1x to 11.6x. We maintain our OUTPERFORM call in light of the potential catalysts of 1) improving earnings, 2) continued strong sales and 3) landbank acquisition. • 2Q results play catch-up. The interims were in line as 1iH net profit made up 46% of our full-year forecast and 47% of consensus estimates. 2Q core net profit jumped 45% qoq to RM61m, stoked by higher contributions from Horizon II, Kepong Business Park, Setapak Green, Binjai 8 and Camellia. Though we were not surprised that UOA Dev did not declare a dividend for 1H, we are cutting FY11-13 DPS forecasts by 25-39% to 7-11 sen as the company is targeting a payout ratio of 30-40% compared to our earlier estimates of 30-50%. • RM533m sales in 1H. UOA Dev chalked up RM533m worth of sales in 1H, of which RM267m or 50% came in 2Q. 1H sales were mainly from the Camellia serviced apartments in Bangsar South and the Setapak Green condos. The take-up rate for Camellia has hit 55% while Setapak Green is 83% sold. UOA Dev is well on track to meet its RM650m sales target for 2011 as 2H launches include the RM160m Ceylon Hills project. For 2012, the group is gunning for RM800m sales, which could be conservative in view of the slew of new projects lined up. • Sri Petaling land buy completed. UOA Dev has completed the acquisition of a 4.9-acre piece of land in Sri Petaling, a mature residential area in Kuala Lumpur, for RM50m or RM236 psf. The project has a GDV of RM400m. The group plans to launch serviced apartments measuring an average of 1,500 sq ft and priced from RM400 psf onwards. We expect sales to be strong given the attractive pricing which is at the low end of the RM400-500 psf range for a neighbouring project. |

|

|

Aug 28 2011, 03:50 AM Aug 28 2011, 03:50 AM

|

Senior Member

3,807 posts Joined: Jan 2006 |

|

|

|

Aug 28 2011, 03:51 AM Aug 28 2011, 03:51 AM

|

Senior Member

3,807 posts Joined: Jan 2006 |

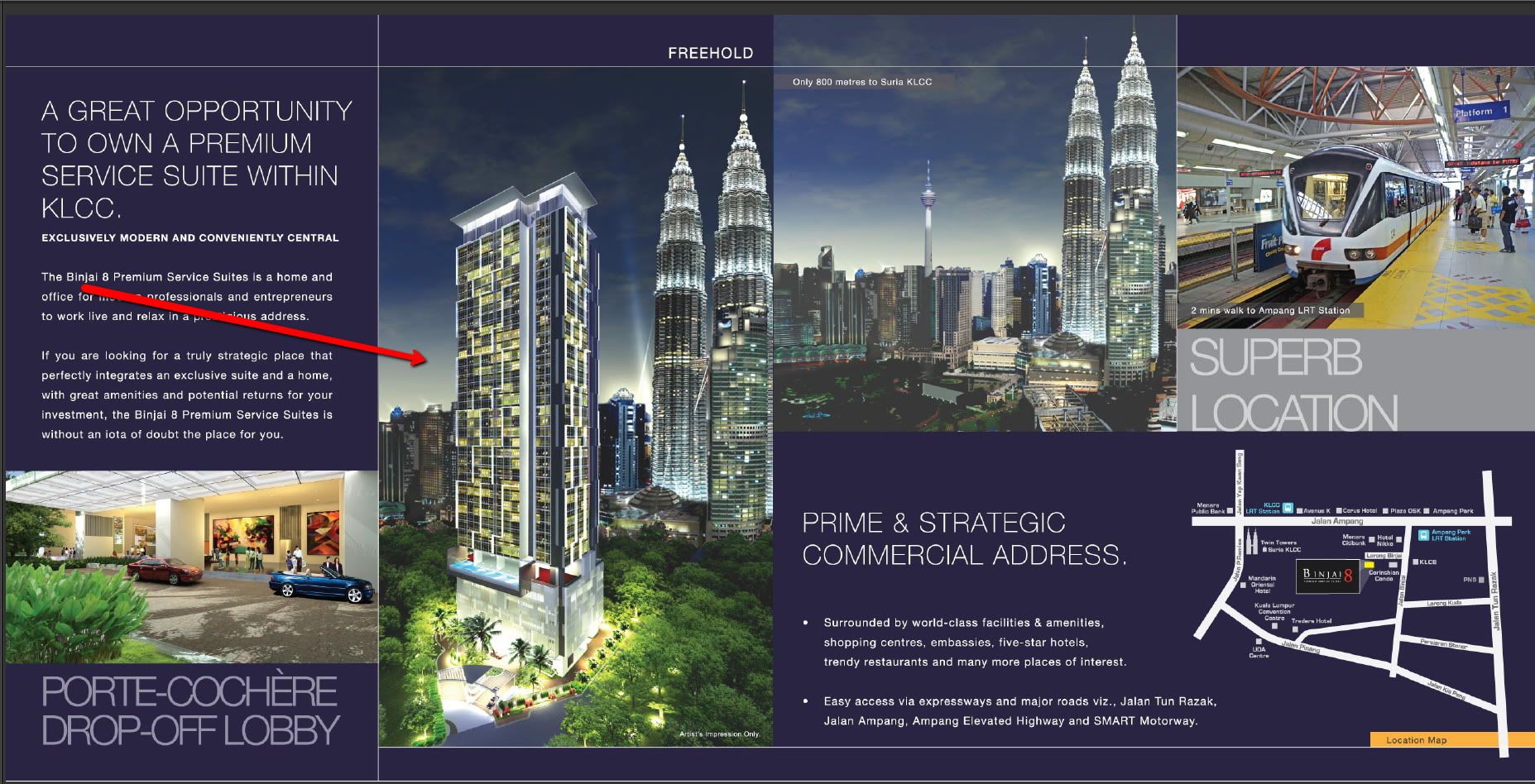

Binjai 8, a Premium Service Suites development dubbed as “City Home - Suites” is UOA’s latest freehold project strategically located within the vicinity of the internationally acclaimed KLCC. It’s a 40-storey state-of-the-art building nestled on the last piece of prime land along Lorong Binjai (behind Nikko Hotel) which comprises 310 units of premier integrated concept executive Service Suites with exclusive modern business facilities and amenities. Binjai 8 is just within walking distance to Ampang LRT Station, KLCC Park, world class shopping malls, hotels and restaurants and a host of other cosmopolitan exclusivities and convenience. Uniquely designed with a practical choice of 1 to 3 rooms' suites or from a minimum size of 753 sq. ft. onwards. Binjai 8 gives you the flexibility to work, relax and unwind while achieving equilibrium between modern practicality and refine comfort. Address : Lorong Binjai, KLCC Project Type : Service Suites Built up area : 753sf – 1784sf No. of rooms : 1, 2 & 3 rooms Facilities : Penthouse Sky Café/Lounge,Full glass clad Gymnasium, Changing Rooms, Meeting Rooms, Business Centre, Broadband ready, 8 high Speed Lifts Security : 3-Tier Security with 24-hr Guardhouse, CCTVs & Access Card Total Units : 310 Units PRICE: Price-from RM900 psf ...so about $1 million for a bigger unit......anyone of you millionaires want to buy?  |

|

|

|

|

|

Aug 28 2011, 03:52 AM Aug 28 2011, 03:52 AM

|

Senior Member

3,807 posts Joined: Jan 2006 |

With easy accessibility and convenient connectivity, all your daytime and nocturnal needs from high-end retail shopping, scrumptious hawker fare to popular bars and chic clubs, are literally just steps away. And with two monorail stations serving the area, getting around is a breeze. Welcome to your private hotel suite, where the possibilities here are truly endless. Address No 1, Lorong Ceylon, Kuala Lumpur Project Type Hotel Suites Built up area 411sf - 893sf Facilities Infinity Pool, Jacuzzi, Sky Gym, Function Room, Private Pavilions, Reading Lounge, Launderette and Business Centre Security 3-Tier with Floor Designated Card System Total Units 354  |

|

|

Aug 28 2011, 03:53 AM Aug 28 2011, 03:53 AM

|

Senior Member

3,807 posts Joined: Jan 2006 |

INSPIRED BY YOUR DREAMS Arguably one of the most sought after addresses for today's urbanites who appreciate stylish suburban living within a dynamic cityscape, Bangsar South is a fully integrated residential cum commercial enclave that stands apart from the rest with its central location, excellent internet and transport connectivity plus a host of retail, service and recreational facilities including a stunning RM100-million clubhouse, vast 6-acre park and healthcare centre. Features : * Integrated development consisting of work, living and entertainment components * Grade A offices, retail avenues, resort-style comdominiums and serviced suites * Designed to offer maximum business space and living flexibility * High potential for capital appreciation * One-stop lifestyle business centre * Strategically located between KL, PJ and Bangsar * Converging highways Federal Highway, NPE Highway, Sprint Highway and LDP Highway   |

|

|

Aug 28 2011, 03:54 AM Aug 28 2011, 03:54 AM

|

Senior Member

3,807 posts Joined: Jan 2006 |

The Park Residences with seven soaring residential towers stand magnificently against the bustling backdrop of Kuala Lumpur skyline. Both Acacia and Begonia condominium blocks are part of the exclusive homes with luxury condo facilities offered exclusively for the residents within the enclave. Experience the epitome of luxury living at the heart of the expanding Bangsar South city.  |

|

|

Aug 28 2011, 03:58 AM Aug 28 2011, 03:58 AM

|

Senior Member

3,807 posts Joined: Jan 2006 |

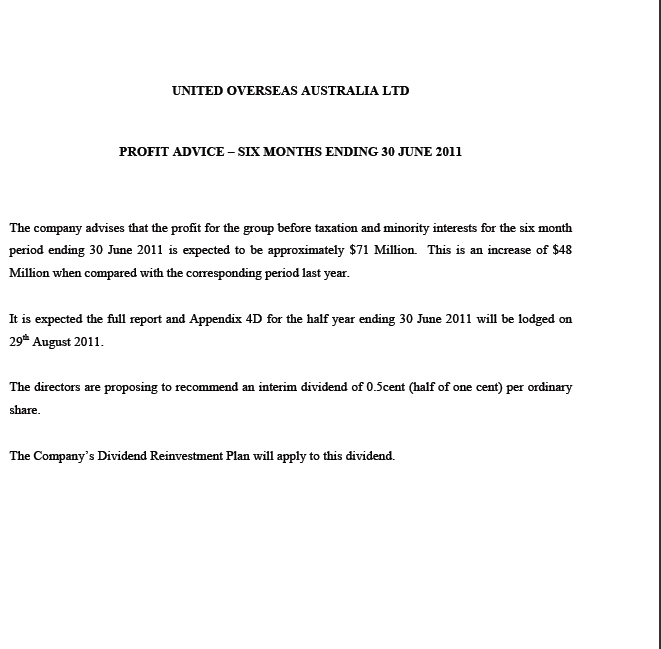

QUOTE UOA Group is a leading property group in Malaysia. Founded and listed on the Australian Stock Exchange (ASX) in 1987, UOA has focused on property development, construction, property investment, and property management. Since 1989, the Group has based its headquarters and business operations in Kuala Lumpur, capital state of Malaysia. ....so it's listed in the Australian Stock Exchange (ASX) too? http://www.asx.com.au/asx/research/company...ode&asxCode=UOS ...and now the company is in some sort of buy back of company shares as seen from the daily purchase!! ...and it too own uoareit too? http://www.uoareit.com.my/ ......AND THIS...  ...so it's panning a dividend of AUS 0.5 cents = MR 1.58 cents ....advice please...many thanks in adcance. |

|

|

Aug 28 2011, 03:59 AM Aug 28 2011, 03:59 AM

|

Senior Member

3,807 posts Joined: Jan 2006 |

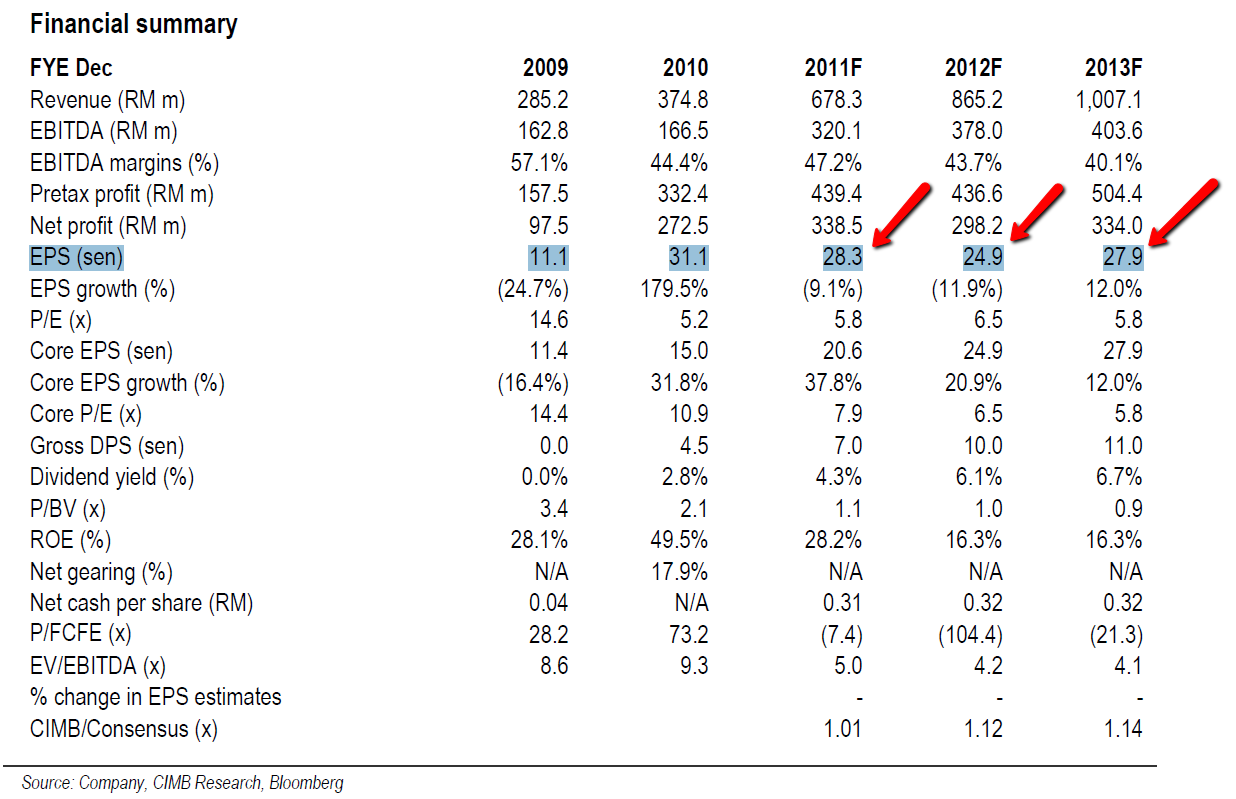

....please see enclosed snapshot of future eps [highlighted]..  |

|

|

Aug 28 2011, 04:00 AM Aug 28 2011, 04:00 AM

|

Senior Member

3,807 posts Joined: Jan 2006 |

|

|

|

Aug 28 2011, 04:01 AM Aug 28 2011, 04:01 AM

|

Senior Member

3,807 posts Joined: Jan 2006 |

|

| Change to: |  0.0288sec 0.0288sec

0.39 0.39

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 06:07 AM |