QUOTE(monkeyking @ Aug 28 2011, 04:01 AM)

Eugene will be pleased!

UOA Group, Everything About UOADEV

|

|

Aug 28 2011, 04:05 AM Aug 28 2011, 04:05 AM

|

Senior Member

3,423 posts Joined: May 2009 From: My Private Yacht |

QUOTE(monkeyking @ Aug 28 2011, 04:01 AM)  Eugene will be pleased! |

|

|

|

|

|

Aug 28 2011, 04:32 AM Aug 28 2011, 04:32 AM

|

Senior Member

3,807 posts Joined: Jan 2006 |

|

|

|

Aug 28 2011, 04:46 AM Aug 28 2011, 04:46 AM

|

Senior Member

3,423 posts Joined: May 2009 From: My Private Yacht |

|

|

|

Aug 28 2011, 11:58 PM Aug 28 2011, 11:58 PM

|

Senior Member

3,577 posts Joined: Apr 2006 |

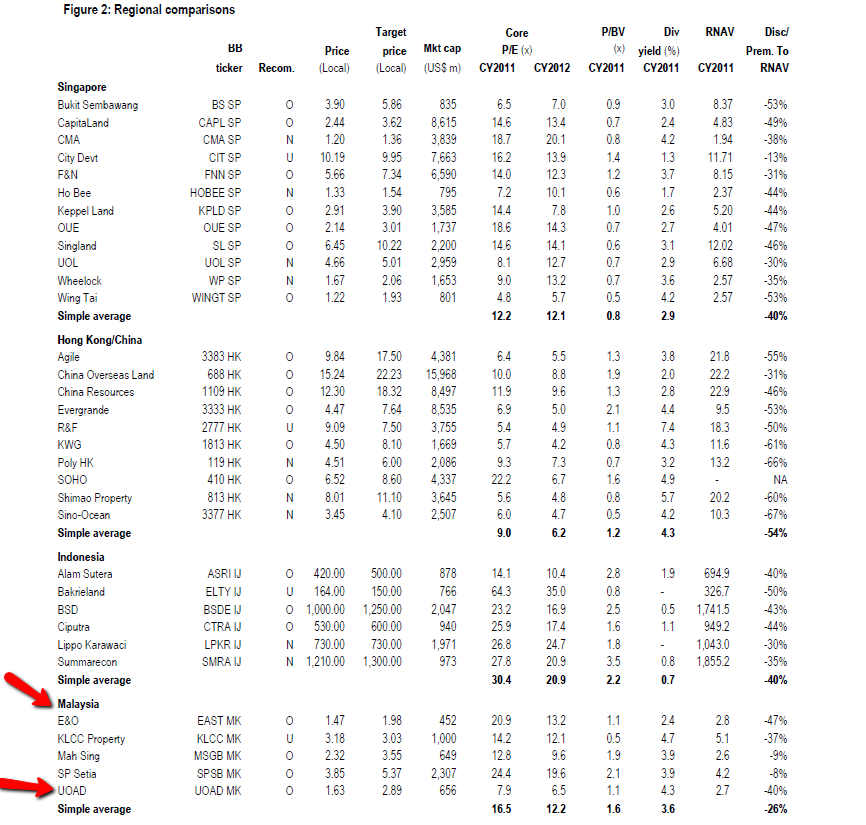

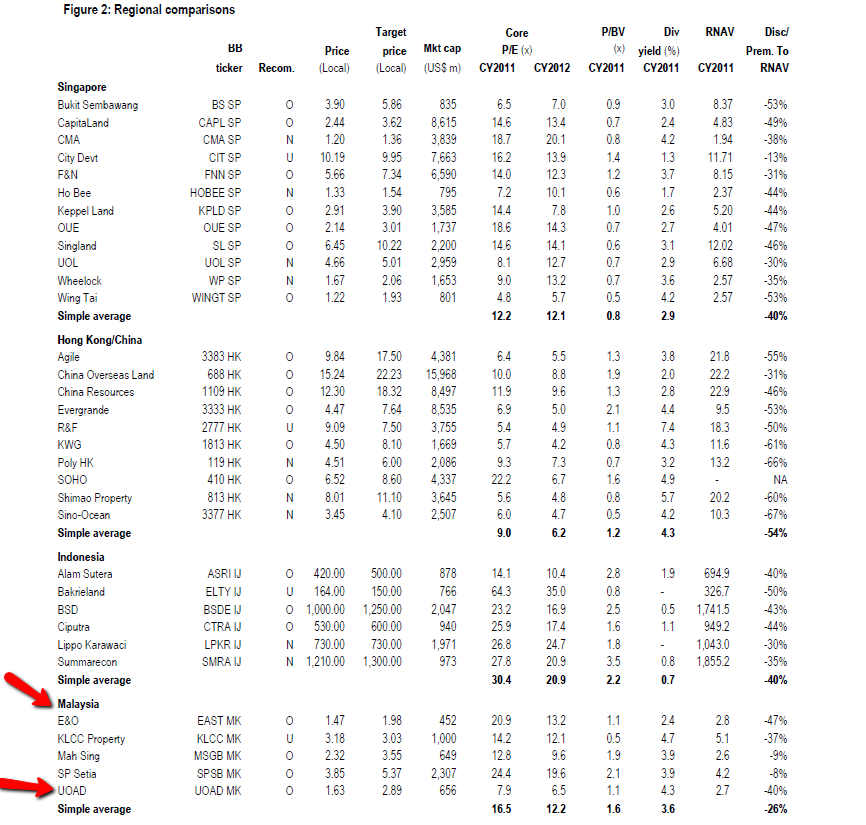

I can't believe UOADEV PE is 7.9 now. During IPO time, it was near SPSETIA's level.

|

|

|

Aug 29 2011, 12:15 AM Aug 29 2011, 12:15 AM

|

Senior Member

28,187 posts Joined: Mar 2007 From: Underworld |

1.4x should be good level to enter.

|

|

|

Aug 29 2011, 03:00 AM Aug 29 2011, 03:00 AM

|

Senior Member

3,807 posts Joined: Jan 2006 |

QUOTE(Bonescythe @ Aug 29 2011, 01:15 AM) This post has been edited by monkeyking: Aug 29 2011, 03:06 AM |

|

|

|

|

|

Aug 29 2011, 07:47 AM Aug 29 2011, 07:47 AM

|

Senior Member

1,732 posts Joined: Mar 2009 |

QUOTE(monkeyking @ Aug 29 2011, 03:00 AM) |

|

|

Aug 29 2011, 08:22 AM Aug 29 2011, 08:22 AM

|

Senior Member

3,807 posts Joined: Jan 2006 |

Asian Stocks May Rebound as Bernanke Sounds More Confident Note August 28, 2011, 12:06 AM EDT By Jonathan Burgos Aug. 28 (Bloomberg) -- Asian stocks, trading near the lowest valuations since December 2008, may rebound after Federal Reserve Chairman Ben S. Bernanke said the U.S. economy is recovering, albeit at a slower pace, and the central bank has additional means to shore up growth if appropriate. The MSCI Asia Pacific Index last week snapped a four-week, 14 percent slump on speculation Bernanke would foreshadow extra stimulus policies during his Jackson Hole, Wyoming speech. The Standard & Poor’s 500 Index climbed 1.5 percent on Aug. 26, erasing losses of as much as 2 percent, as the Fed Chairman said growth will resume and decided to extend next month’s policy meeting to two days instead of one. Futures on Japan’s Nikkei 225 Stock Average rose 0.6 percent in Chicago. “We should see a decent rebound.” said Nader Naeimi, a Sydney-based strategist for AMP Capital Investors Ltd., which manages almost $100 billion. “Bernanke sounded a lot more confident. The probability of some sort monetary easing coming out of that two-day meeting is high.” Naeimi said on Aug. 23 that there was a “real risk of disappointment” if Bernanke didn’t commit to supporting economic growth. American depositary receipts of Kyocera Corp., a maker of solar panels that gets 17 percent of sales in the U.S., gained 0.5 percent from its closing price in Tokyo on Aug. 26. ADRs of BHP Billiton Ltd., the world’s largest mining company and Australia’s No. 1 oil producer, climbed 0.3 percent after copper and oil futures increased. Gains in U.S. trading were limited as the dollar fell against most major currencies. ‘More Optimistic’ The MSCI Asia Pacific Index tumbled 11 percent from June 30 through Aug 26 after the Federal Reserve ended its $600 billion bond-purchase program, known as quantitative easing or QE2, to boost the economy. Stocks have also fallen amid signs the U.S. economic recovery is stalling and Europe’s debt crisis is worsening. “People aren’t prepared to pay too much today for tomorrow’s earnings given uncertainties at the moment,” Tim Schroeders, who helps manage $1 billion in equities at Pengana Capital Ltd. in Melbourne. “Against the backdraft of high unemployment rate and disappointing economic growth, Bernanke made the right move.” While the slumping housing market and financial-market volatility still pose challenges for the economy, Bernanke said that his view of the long-term outlook is “more optimistic.” The central bank will hold a two-day policy meeting starting Sept. 20 to “allow a fuller discussion” of the slowing economy and the central bank’s possible policy response, he said. Global Stocks Rout Extending next month’s policy meeting to two days stoked speculation the extra time may allow Bernanke to forge a stronger consensus on monetary policy amid growing dissent in the Federal Open Market Committee. St. Louis Fed President James Bullard said adding a second day to the September meeting allows more time to review easing options, though rising inflation may prevent action in the near term. A global stocks rout wiped out more than $8 trillion in market value in the four weeks through Aug. 19 amid signs Europe’s debt crisis will spread and as concern grew that two rounds of government asset purchases and record-low interest rates fail to entrench an economic recovery in the U.S. The world’s biggest economy expanded less than previously estimated in the second quarter and consumer sentiment this month fell to the lowest level since November, government reports on Aug. 26 showed. That contrasted with a separate report two days earlier that showed durable-goods orders and home prices that beat economists’ estimates. ‘Depressed Valuations’ The MSCI Asia Pacific Index declined 13 percent this year through Aug. 26. Valuations on the gauge fell to an average 11.8 times estimated earnings on Aug. 22. That’s the lowest since December 2008 when equity markets tumbled as the global recession deepened amid a credit crunch that followed the collapse of Lehman Brothers Holdings Ltd. in September 2008. “The data has been mixed,” said Ng Soo Nam, the Singapore-based chief investment officer at Nikko Asset Management Co., which oversees about $154 billion. “Bernanke hasn’t announced QE3 because there is no need for it at the moment. The situation isn’t as bad as the stock market has factored in. There is scope for a rebound given such depressed valuations.” --Editors: Nick Gentle, Ven Ram |

|

|

Aug 29 2011, 09:24 AM Aug 29 2011, 09:24 AM

|

Senior Member

3,807 posts Joined: Jan 2006 |

|

|

|

Aug 29 2011, 09:36 AM Aug 29 2011, 09:36 AM

|

Senior Member

1,732 posts Joined: Mar 2009 |

|

|

|

Aug 29 2011, 09:48 AM Aug 29 2011, 09:48 AM

|

Senior Member

3,807 posts Joined: Jan 2006 |

|

|

|

Aug 29 2011, 10:30 AM Aug 29 2011, 10:30 AM

|

Senior Member

3,577 posts Joined: Apr 2006 |

QUOTE(monkeyking @ Aug 29 2011, 03:00 AM) |

|

|

Aug 29 2011, 11:02 AM Aug 29 2011, 11:02 AM

|

Senior Member

3,807 posts Joined: Jan 2006 |

|

|

|

|

|

|

Aug 29 2011, 11:38 AM Aug 29 2011, 11:38 AM

|

Senior Member

525 posts Joined: Apr 2011 |

May enter this counter !!!

Long term savings here |

|

|

Aug 29 2011, 11:43 AM Aug 29 2011, 11:43 AM

|

Senior Member

1,732 posts Joined: Mar 2009 |

QUOTE(yeeck @ Aug 29 2011, 10:30 AM) Not always true. EPF also buying YTLPOWR a lot, then ppl who followed think they r gonna huat, then suddenly EPF made a U-turn and dump, dump, dump. OT. EPF dumped alot of YTLPOWR recently, hence the sell down. But last time(2 years) when EPF keep accumulating YTLPOWR, the share price does rocket up. Best example is BIMB, up when EPF accumulating and selldown when EPF selling. The truth is EPF is our local shark.. |

|

|

Aug 29 2011, 12:02 PM Aug 29 2011, 12:02 PM

|

Senior Member

3,807 posts Joined: Jan 2006 |

QUOTE(andrewckj @ Aug 29 2011, 12:43 PM) OT. EPF dumped alot of YTLPOWR recently, hence the sell down. But last time(2 years) when EPF keep accumulating YTLPOWR, the share price does rocket up. Best example is BIMB, up when EPF accumulating and selldown when EPF selling. The truth is EPF is our local shark.. |

|

|

Aug 29 2011, 01:30 PM Aug 29 2011, 01:30 PM

|

Senior Member

525 posts Joined: Apr 2011 |

|

|

|

Aug 29 2011, 01:44 PM Aug 29 2011, 01:44 PM

|

Junior Member

365 posts Joined: Aug 2009 |

Mr. CS kong is doing somethg here for raya

|

|

|

Aug 29 2011, 03:56 PM Aug 29 2011, 03:56 PM

|

Senior Member

3,807 posts Joined: Jan 2006 |

Monday, 29 Aug 2011 12:54PM UOA HOLDINGS SDN BHD (1,358,100 Shares Acquired) 12:54PM UNITED OVERSEAS AUSTRALIA LIMITED (1,358,100 Shares Acquired) |

|

|

Aug 29 2011, 04:10 PM Aug 29 2011, 04:10 PM

|

Senior Member

525 posts Joined: Apr 2011 |

|

| Change to: |  0.0316sec 0.0316sec

0.22 0.22

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 10th December 2025 - 03:12 AM |