And at places that accept AMEX, we can to earn 5X TP. Maybank 2 Cards Premier Enrich Miles conversion rate is 540TP = 1000EM which is equivalent to 1EM for every RM0.90 spent. For local spending, no other card can beat his for now.

For those who only need to enter local Plaza Premium Lounges for FREE,

Maybank Visa Signature offer UNLIMITED entries BUT we need to spend RM50K with it to get the annual fee waived. Minimum income requirement RM100K p.a.

If one's annual income is RM150K pa, he can then qualify for the

Alliance Bank Visa Infinite (click here to read my review ABB VI vs MBB VI vs UOB VI) which grants UNLIMITED entries to local and overseas airport lounges. But need to spend RM30K to get annual fee waived. If apply via Alliance Bank Privilege Banking, then the card is FREE FOR LIFE without any conditions. And Allaince Bank VI like UOB VI overseas conversion rate is freaking high.

May I introduce to you the AmBank World MAsterCard and Visa Infinite. If you had read my

Credit Card Showdown 2015 - Malaysia's Best Top 10 Credit Cards, of course the Maybank 2 Cards Premier came ou as the clear winner. The FREE FOR LIFE AMBank World MasterCard together with the AmBank Visa Infinite credit cards managed to be ranked No.6.

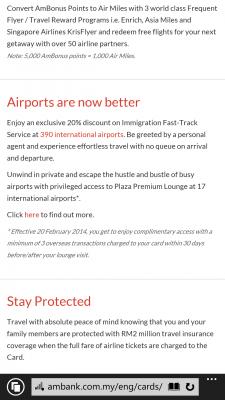

The AmBank WMC and/or VI grant you "UNLIMITED FREE" entries to airport lounge on condition you swipe the card overseas 3 times before

or after you enter the lounge. And one only needs annual income of RM100K to qualify for it. The lowest amongst all the commercial banks to get a WMC or VI. And best of all, it is FREE FOR LIFE without any conditions.

Click here to read AmBank World MasterCard (and Visa Infinite) Review by VergonDC

Click here to read AmBank World MasterCard (and Visa Infinite) Review by VergonDC and find out the pro and cons of the AMBank World MasterCard and/or Visa Infinite. If you do spend substantial sum of money overseas, the AMBank World MasterCard is one card to own because VergonDC will show you that the overseas conversion rate is way better than Maybank VI. And it even gives you better returns too!

Nov 3 2014, 09:40 PM

Nov 3 2014, 09:40 PM

Quote

Quote

0.0556sec

0.0556sec

0.62

0.62

7 queries

7 queries

GZIP Disabled

GZIP Disabled