QUOTE(myrancid @ Oct 16 2019, 05:40 PM)

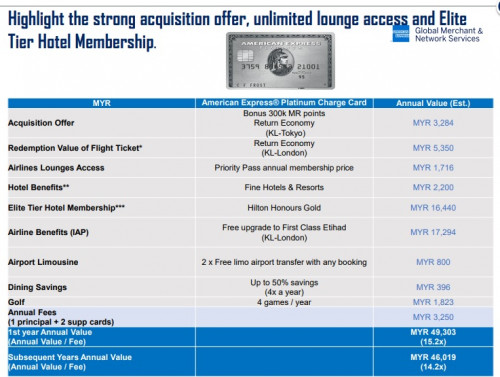

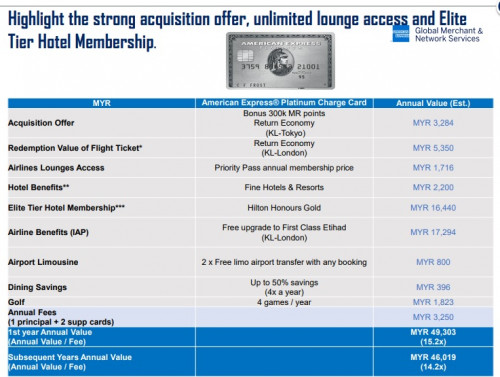

Below is the Platinum Charge Card Benefit.

· The Amex Plat Charge card is ideal for customers who travel frequently, are avid golfers and enjoy lifestyle privileges such as dining at hotels & high end restaurants

· The card is only qualified for those with minimum annual income of RM190,000 and comes with 4 free supplementary cards. With an annual fee of RM3,250, customers will get this in return:

o 5x Membership Rewards (MR) points for every RM1 spent for both local and overseas (except for utilities, education and insurance transactions)

o Welcome bonus: 300,000 MR points upon spend of RM20k within first 90 days and annual fees paid

o Points do not expire – and can be redeemed at any time

Redemption :

o RM1 = 500 MR points

o 5000 MR = 1,000 Enrich Air Miles

o 5,600 MR = 1,000 Air Miles

Privileges :

o Unlimited lounge access to:

§ Delta Sky Club (Principal + 1 Supp)

§ Centurion Lounge (Principal + 2 guests)

§ Priority Pass (Principal + 1 supp + 1 guest) – customers will need to apply for Priority Pass

o Complimentary Green Fees golf programme with access to 120 clubs worldwide (19 in Malaysia)

o Up to 50% savings at Shangri la, KL

o Up to 40% savings at Starwood

o Complimentary membership to Tower Club Singapore

o Hotel Loyalty programme

o Car Hire

o Private Jet for hire

o Travel PA up to 2,000,000

o Missed flight connection (more than 4 hours): up to RM1,600

o Luggage Delay (more than 6 hours): up to RM1,600

o Purchase protection: 90 days protection against damage or theft for 90 days from date of purchase

o Return Guarantee of up to RM1,500 per item and a maximum of RM6,000

o Extended Warranty protection of up to RM15,000

o Concierge Service: 1800-88-0886

o Platinum travel careline (Option 1) – to handle booking and elite tier enrolment

o MGCC careline (Option 2) – to handle card related enquiries

Forwarded from my email.

Hi there, good evening· The Amex Plat Charge card is ideal for customers who travel frequently, are avid golfers and enjoy lifestyle privileges such as dining at hotels & high end restaurants

· The card is only qualified for those with minimum annual income of RM190,000 and comes with 4 free supplementary cards. With an annual fee of RM3,250, customers will get this in return:

o 5x Membership Rewards (MR) points for every RM1 spent for both local and overseas (except for utilities, education and insurance transactions)

o Welcome bonus: 300,000 MR points upon spend of RM20k within first 90 days and annual fees paid

o Points do not expire – and can be redeemed at any time

Redemption :

o RM1 = 500 MR points

o 5000 MR = 1,000 Enrich Air Miles

o 5,600 MR = 1,000 Air Miles

Privileges :

o Unlimited lounge access to:

§ Delta Sky Club (Principal + 1 Supp)

§ Centurion Lounge (Principal + 2 guests)

§ Priority Pass (Principal + 1 supp + 1 guest) – customers will need to apply for Priority Pass

o Complimentary Green Fees golf programme with access to 120 clubs worldwide (19 in Malaysia)

o Up to 50% savings at Shangri la, KL

o Up to 40% savings at Starwood

o Complimentary membership to Tower Club Singapore

o Hotel Loyalty programme

o Car Hire

o Private Jet for hire

o Travel PA up to 2,000,000

o Missed flight connection (more than 4 hours): up to RM1,600

o Luggage Delay (more than 6 hours): up to RM1,600

o Purchase protection: 90 days protection against damage or theft for 90 days from date of purchase

o Return Guarantee of up to RM1,500 per item and a maximum of RM6,000

o Extended Warranty protection of up to RM15,000

o Concierge Service: 1800-88-0886

o Platinum travel careline (Option 1) – to handle booking and elite tier enrolment

o MGCC careline (Option 2) – to handle card related enquiries

Forwarded from my email.

May I know where do you get this info from?

Can’t seem to find it in their website

Thank you so much

Oct 17 2019, 11:26 PM

Oct 17 2019, 11:26 PM

Quote

Quote

0.0625sec

0.0625sec

0.83

0.83

7 queries

7 queries

GZIP Disabled

GZIP Disabled