QUOTE(aero @ Feb 9 2011, 03:28 AM)

hi guys, need advice.

Just got my HSBC gold credit card on January 2011 as I took it as together with house loan. But I have notice they already charged me RM 50 GST.

1. GST will be charge upon CC registration or until the year end?

2. Is there a way I could waive it without points redemption, since my card is new I will not have any good points now.

3. For the petrol rebate, which bank cc is the best and any catch?

Thanks

1. GST charged immediately.Just got my HSBC gold credit card on January 2011 as I took it as together with house loan. But I have notice they already charged me RM 50 GST.

1. GST will be charge upon CC registration or until the year end?

2. Is there a way I could waive it without points redemption, since my card is new I will not have any good points now.

3. For the petrol rebate, which bank cc is the best and any catch?

Thanks

2. So far nobody reported that they got their GST waived with HSBC if not mistaken. If you do not want to pay GST then see if can cancel the card. Those of you not wiilling to pay the RM50 GST, don't apply for the card. Click here to read my old post on GST.

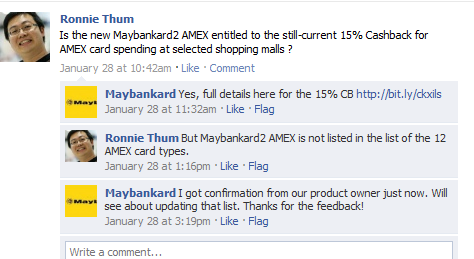

3. Generally all Visa and Mastercard don't give points at petrol stations. Only Amex and co-brand petrol cards give points or cash back. For your case, HSBC got promotion at Caltex. Click here to read about Maybankard 2 Amex and click here to read about OCBC 5% cash back. Best card for Petrol - OCBC Titanium, 5% cash back everyday at any petrol station, catch max rebate per month RM50 or up to RM1000 for transaction on petro, dining, groceries and utilities.

QUOTE(spikey2506 @ Feb 9 2011, 03:43 AM)

Just got my Maybankard 2 today. A quick question. My CL on the letter differs from the one displayed in M2U. The one in M2U should be applicable right?

Call CS to confirm what is in the system instead of guessing.QUOTE(gerrardling @ Feb 9 2011, 06:05 AM)

if you apply thru agent then call him/her. If not I guess you can email MBB or call CS to ask.This post has been edited by Gen-X: Feb 9 2011, 07:06 AM

Feb 9 2011, 07:04 AM

Feb 9 2011, 07:04 AM

Quote

Quote

0.0507sec

0.0507sec

0.89

0.89

7 queries

7 queries

GZIP Disabled

GZIP Disabled