This is a really good place to see ppl discussing how to improve their financial management... I learn a lot so far ^^

Personal financial management, V2

Personal financial management, V2

|

|

Feb 17 2013, 09:12 PM Feb 17 2013, 09:12 PM

|

Junior Member

45 posts Joined: May 2012 |

This is a really good place to see ppl discussing how to improve their financial management... I learn a lot so far ^^

|

|

|

|

|

|

Feb 18 2013, 01:40 AM Feb 18 2013, 01:40 AM

|

Senior Member

757 posts Joined: Mar 2010 |

Im currently a university student, and recently received statement from maybank that my account still got rm3500+ which had been inactive for some time and being warned for the inactivity, was planning to put the money into FD or is there a better option to utilise the money?

It is my old collection of angpao money |

|

|

Feb 18 2013, 12:06 PM Feb 18 2013, 12:06 PM

|

Senior Member

559 posts Joined: Mar 2010 From: Ipoh/Kuala Lumpur |

QUOTE(Beachkid @ Feb 13 2013, 04:24 AM) True, lots of people want easy money. That's all the people lining up to play the lotto and all the people falling for scams. When we are giving advice general public, we do not know the earning power and risk profile of the audience. As majority of the audiences are from the group of average people with average earning power and they tend to be risk adverse, then give top priority on savings and expanding income would be 2nd priority make sense for most of the people who are seeking for financial advice.Fast money does not equal easy money. Fast money (being relative 3 to 5 years) can be made. But it's not easy. I agree with you on everything you have said. The only place where we differ is I would put expanding my income my priority and then watching my expenditures a VERY close second. However the marriage of these two habits are the best. In addition, due to psychology, it is easier for a person to change his/her habit from being thrifty to lavish and not the other way. So that is why we should encourage people to nurture a habit of being thrifty, defer gratification and save for future purpose instead of focusing on future earnings and spend current income like no tomorrow. As people would tend to think they will earn more in the future, so they will spend their current income like no tomorrow without having a proper financial planning, but they forget future earnings are not certain. |

|

|

Feb 18 2013, 12:07 PM Feb 18 2013, 12:07 PM

|

Senior Member

559 posts Joined: Mar 2010 From: Ipoh/Kuala Lumpur |

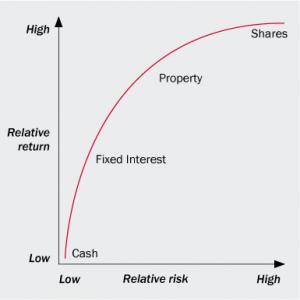

QUOTE(tat3179 @ Feb 13 2013, 08:54 AM) Just remember high and fast gains equals to high and riskier risks. No, just because you don't know does not mean that "There is no such thing as high returns low risks".There is no such thing as high returns low risks. The key is to manage your risk appropriately. Manage risk on what sense and how? I do not see any clue from your post This post has been edited by kinwing: Feb 18 2013, 12:08 PM |

|

|

Feb 18 2013, 12:11 PM Feb 18 2013, 12:11 PM

|

Senior Member

559 posts Joined: Mar 2010 From: Ipoh/Kuala Lumpur |

|

|

|

Feb 18 2013, 12:39 PM Feb 18 2013, 12:39 PM

|

Senior Member

559 posts Joined: Mar 2010 From: Ipoh/Kuala Lumpur |

|

|

|

|

|

|

Feb 18 2013, 01:14 PM Feb 18 2013, 01:14 PM

|

Senior Member

548 posts Joined: Sep 2005 From: Mars |

that's assuming one has the discipline to make the extra $ work and get higher returns that the cost of debt. unfortunately, being human, there is a high tendency and lots of pressure to spend the $$ instead and buy stuff which will not bring any return on investment

QUOTE(kinwing @ Feb 18 2013, 12:39 PM) |

|

|

Feb 18 2013, 01:45 PM Feb 18 2013, 01:45 PM

|

Senior Member

6,356 posts Joined: Aug 2008 |

QUOTE(kinwing @ Feb 18 2013, 12:39 PM) No, this a wrong mind-set. Not all debt are bad, so should not get rid of debt at all cost. Take debt to buy asset then is good, but have to see how much available asset you take the debt.If the cost of your debt is cheap, you should not repay your debt even you have the cash. Let's other people's money to work for you. If a person totally don’t other saving able to liquate to pay the loan then the higher possibility the person will go bankruptcy. When taking loan, reserve 6 month $$ for loan repayment. If got more money reduce the loan, will shorten the worry. |

|

|

Feb 18 2013, 05:11 PM Feb 18 2013, 05:11 PM

|

Senior Member

3,173 posts Joined: Nov 2010 |

Hi guys,

I am near 30s and got burden with house loan of 30 yrs. Can investment really make someone rich? |

|

|

Feb 18 2013, 05:29 PM Feb 18 2013, 05:29 PM

|

Senior Member

6,356 posts Joined: Aug 2008 |

QUOTE(WintersuN @ Feb 18 2013, 05:11 PM) Hi guys, Investment is using money making more money without money...you don’t have investment...I am near 30s and got burden with house loan of 30 yrs. Can investment really make someone rich? Different type investment/return has different type of risk. The higher you go the lucrative you have, in other way the more money you loss. im 31 year gold... also hv 30year of loan. Investment is to fight inflation what your money value for tomorrow purchase. You understand my meaning by comparing keeping money in saving account for 30 year. If you want to buy a big house, then u needs money to pay for or your children education fee may not the same next 20year. So you must save/invest in order to have thing you want tomorrow. |

|

|

Feb 18 2013, 05:34 PM Feb 18 2013, 05:34 PM

|

Senior Member

3,173 posts Joined: Nov 2010 |

QUOTE(felixmask @ Feb 18 2013, 05:29 PM) Investment is using money making more money without money...you don’t have investment... So in other words, you mean investment cannot make me rich but just to keep up with inflation?Different type investment/return has different type of risk. The higher you go the lucrative you have, in other way the more money you loss. im 31 year gold... also hv 30year of loan. Investment is to fight inflation what your money value for tomorrow purchase. You understand my meaning by comparing keeping money in saving account for 30 year. If you want to buy a big house, then u needs money to pay for or your children education fee may not the same next 20year. So you must save/invest in order to have thing you want tomorrow. Wat is your current investment strategy? So far I upgraded from FD to Unit trust for long term invest. But I know it cant make me rich cos is for long term and I dont even know what the use of having more money 20 yrs later lol What i need is money now or maybe 3-5 yrs later |

|

|

Feb 18 2013, 05:54 PM Feb 18 2013, 05:54 PM

|

Senior Member

6,356 posts Joined: Aug 2008 |

QUOTE(WintersuN @ Feb 18 2013, 05:34 PM) So in other words, you mean investment cannot make me rich but just to keep up with inflation? Hi WintersuN,Wat is your current investment strategy? So far I upgraded from FD to Unit trust for long term invest. But I know it cant make me rich cos is for long term and I dont even know what the use of having more money 20 yrs later lol What i need is money now or maybe 3-5 yrs later You are rich in knowledge only you didnt discover... I start from FD,later UT, then Shares..now aim settle my 30year house loan asap to buy another bigger house. Continue upgrade your FD and UT, once your reach certain of limit you thinking to invest somewhere your money for a greater return. Save the money..you not know what you want to spend maybe you use the money for early retirement or children education. You dont know when the next financial Tsunami come or WE out of jobs. then how to pay the debts for 30 years. prepare the umbrella early not until the rain come. Nice to know you. This post has been edited by felixmask: Feb 18 2013, 05:56 PM Attached thumbnail(s)

|

|

|

Feb 18 2013, 06:20 PM Feb 18 2013, 06:20 PM

|

Junior Member

462 posts Joined: Jan 2011 |

hi guys im pretty impress by the ah kaos & unkers in kopitiam stories

bt dun uu guys think living prioritising the future while forgo things uu can do in the present is kinda sad? life is short & we cant bring wealth to the nxt world. wt do uu guys think? |

|

|

|

|

|

Feb 18 2013, 06:26 PM Feb 18 2013, 06:26 PM

|

Senior Member

6,356 posts Joined: Aug 2008 |

QUOTE(Enjoise @ Feb 18 2013, 06:20 PM) hi guys im pretty impress by the ah kaos & unkers in kopitiam stories life is short if cant buy food on table or hv head cover during rainbt dun uu guys think living prioritising the future while forgo things uu can do in the present is kinda sad? life is short & we cant bring wealth to the nxt world. wt do uu guys think? What the sad, if cant provide your children for education.... Fancy car or fancy mobile hp..also require money to buy. |

|

|

Feb 18 2013, 07:10 PM Feb 18 2013, 07:10 PM

|

Senior Member

3,173 posts Joined: Nov 2010 |

QUOTE(felixmask @ Feb 18 2013, 05:54 PM) Hi WintersuN, Nice to meet someone wif similar journey. Do you have a strategy how u will settle your house loan quick? Maybe can share You are rich in knowledge only you didnt discover... I start from FD,later UT, then Shares..now aim settle my 30year house loan asap to buy another bigger house. Continue upgrade your FD and UT, once your reach certain of limit you thinking to invest somewhere your money for a greater return. Save the money..you not know what you want to spend maybe you use the money for early retirement or children education. You dont know when the next financial Tsunami come or WE out of jobs. then how to pay the debts for 30 years. prepare the umbrella early not until the rain come. Nice to know you. |

|

|

Feb 18 2013, 07:21 PM Feb 18 2013, 07:21 PM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(Enjoise @ Feb 18 2013, 06:20 PM) hi guys im pretty impress by the ah kaos & unkers in kopitiam stories sorry to be blunt...bt dun uu guys think living prioritising the future while forgo things uu can do in the present is kinda sad? life is short & we cant bring wealth to the nxt world. wt do uu guys think? I suspect you're below 30s or mentally so When U are in your late 30s or 40s, ask yourself the same Q U posted. U shd realize by then, it is not a matter of bringing wealth to the next world. It's about building now to have MANY options later, providing & caring for future generations & not eating Alpo for retirement Just a thought - no 1s & 0s right/wrong, your life is yours to prioritize as U see fit This post has been edited by wongmunkeong: Feb 18 2013, 07:23 PM |

|

|

Feb 18 2013, 07:30 PM Feb 18 2013, 07:30 PM

|

Senior Member

6,356 posts Joined: Aug 2008 |

QUOTE(WintersuN @ Feb 18 2013, 07:10 PM) Nice to meet someone wif similar journey. Do you have a strategy how u will settle your house loan quick? Maybe can share I try to used expenses = salary - saving. Every month I struggle to control my expenses.Ever month my $$$$ will go FD, UT or Stock. Definitely I will go stock. I will check which the best to invest for long term. Before I go stock, my saving just goes FD or UT. After 2 year of learning and monitoring I got guts to go stock. I must have time to read financial statement and business understanding. Goreng stock sure higher return but must monitor every day, which are cyclical stock. My preference is blue-chip stock and dividend like REITS and Telco. The famous Warren Buffet Quote: 1st rules never lose money 2nd rules not forget the 1st rule. I allocated my Saving 1 month in FD 10 month in UT bond 16 month in stock My investment can paid 1/2 my hosing loan immediately. I don’t have car loan, fancy Hand phone , internet broadband overseas holiday, or laptop(my PC still tip top condition 9 year) and spending of unnecessarily. My aim to settlen my house loan with 5 - 10 years. Wet Dream buy another condo. This post has been edited by felixmask: Feb 18 2013, 07:31 PM |

|

|

Feb 18 2013, 10:19 PM Feb 18 2013, 10:19 PM

|

Senior Member

3,173 posts Joined: Nov 2010 |

QUOTE(felixmask @ Feb 18 2013, 07:30 PM) I try to used expenses = salary - saving. Every month I struggle to control my expenses. wow so hardcore!!Ever month my $$$$ will go FD, UT or Stock. Definitely I will go stock. I will check which the best to invest for long term. Before I go stock, my saving just goes FD or UT. After 2 year of learning and monitoring I got guts to go stock. I must have time to read financial statement and business understanding. Goreng stock sure higher return but must monitor every day, which are cyclical stock. My preference is blue-chip stock and dividend like REITS and Telco. The famous Warren Buffet Quote: 1st rules never lose money 2nd rules not forget the 1st rule. I allocated my Saving 1 month in FD 10 month in UT bond 16 month in stock My investment can paid 1/2 my hosing loan immediately. I don’t have car loan, fancy Hand phone , internet broadband overseas holiday, or laptop(my PC still tip top condition 9 year) and spending of unnecessarily. My aim to settlen my house loan with 5 - 10 years. Wet Dream buy another condo. HOw much cost your house loan? How long u been in the hobby of invest? |

|

|

Feb 19 2013, 09:46 AM Feb 19 2013, 09:46 AM

|

Senior Member

1,331 posts Joined: Sep 2007 |

QUOTE(squares90 @ Feb 12 2013, 09:09 AM) Hi lowyat, Have a emergency fund of 1 year (I recommend) of expenses first. Put that money in FD.I'll be graduating soon and I have saved RM13,000 in my account. All my life I've saved all my duit raya, and I got a part time job while at uni. I help senior (read: middle-aged) students write their papers, assignments, thesis etc. I'm also quite stingy so I never buy anything that's not necessary. So what should I do with the money? So far I'm thinking of either saving the money (duh!) or using it to fully pay my PTPTN. I borrowed 12,000 from PTPTN but since it has no interest, maybe it would be better for me to use the money for other important things. Any Advice? Thanks! Balance you should repay your debts. Start with the ones with the costliest interest. Pay off early, don't get into debt if possible, invest any excess you have. That's the path to financial freedom. |

|

|

Feb 19 2013, 09:54 AM Feb 19 2013, 09:54 AM

|

Senior Member

1,331 posts Joined: Sep 2007 |

QUOTE(kinwing @ Feb 18 2013, 12:07 PM) No, just because you don't know does not mean that "There is no such thing as high returns low risks". Manage risk as in know the investment that you are going to invest in. Do research first before committing your money, whatever the asset class you choose to invest. Manage risk on what sense and how? I do not see any clue from your post Do your own due diligence, not based just on rumours or other people's recommendation. Simple really. Making money is not easy. You must put in the effort and do your homework to minimise the chance of losing money. And yes, There is no such thing as high returns low risks and also There is no such thing as free lunch. Ignore that at your peril. Unless you are bumiputra of course.... |

|

Topic ClosedOptions

|

| Change to: |  0.0341sec 0.0341sec

0.23 0.23

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 03:06 AM |