close position as reversal sighted

balance watchlist remain for riding

10/11/10 wti 15.23 17.28 +13%

10/11/10 puda 12.05 12.04 -0% win some, lose some (note to self, dun greedy, sell at 25% gain in future, when price was $16, 2 days ago)

10/11/10 hl 8.32 10.23 +22%

14/10/10 ico 6.05 7.98 +31

10/11/10 hl Options Expiring Friday, June 17, 2011, call strike price $8 is $1.87

currently $2.93 for +56%

10/11/10 puda Options Expiring Friday, May 20, 2011, call strike price $12.5 is $2.05

currently $2.15 for -0%

10/11/10 wti Options Expiring Friday, April 15, 2011, call strike price $15 is $2.1

currently $3.4 for +61%

17/11/10 puts options sure bakar, zero value here we come since january is next month

vphm put Options Expiring Friday, January 21, 2011 strike price $15 is 0.75, currently $0.35 negative value

crox put Options Expiring Friday, March 18, 2011 strike price $16 is 2.4, currently $1.47 negative value

lvs put Options Expiring Friday, March 18, 2011 strike price $46 is 5.85, currently $5.5 negative value

ten put Options Expiring Friday, January 21, 2011 strike price $34 is 2.2, currently $0.41 negative value

wti put Options Expiring Friday, January 21, 2011 strike price $15 is 0.95, currently $0.45 negative value

Chinese stocks suffered some of the biggest hits lately among U.S.-traded stocks. Fresh fears of more interest-rate hikes in inflation-plagued China

sent a chill through some of its hottest stocks this week. The China Banking Regulatory Commission instructed lenders to tighten standards for loans to real estate developers. Hong Kong’s Hang Seng index on Wednesday dived 1.4%, logging its seventh distribution day in recent weeks.

The Shanghai composite fell 0.9%, though it didn’t mark a distribution day. That bourse shows just three distribution days in the past few weeks.

Coal producer Puda Coal PUDA dived 18% in frantic trade Wednesday. Puda announced a secondary offering of 7.85 million shares.

That supply increase come to 71% of the float (11 million shares) and 37% of total shares (21 million). Puda’s gap-down came rushing toward

its 10-week moving average, but missed it by 34cents. Note, though, this decline is appearing with monster volume. That’s not at all the ideal retreat

you’d want to see.

» Click to show Spoiler - click again to hide... «

1) Most major indexes in recent days have failed to break through their November highs. The Nasdaq — which has led the market in the current uptrend — is tentatively holding above its November peak.

The indexes' November highs roughly correspond to the April top, so you could say this battle has been going on for some time.

On Wednesday, the Nasdaq and the S&P 500 added 0.4% each, while the Dow and the NYSE composite edged up 0.1% apiece.

Declining stocks, however, led advancers on the NYSE, and were about even on the Nasdaq.

Volume fell 20% on the NYSE and 7% on the Nasdaq.

Among industry groups, the picture was far from ideal. Top performers Wednesday were mostly from laggard groups — newspapers, books and banks. The day's losers were from highly rated groups, such as auto parts, miners, oil explorers, coal producers and farm machinery makers.

Recent action appears to favor holders more than buyers. While that makes such leaders fairly easy to hold, not many high-rated stocks have broken out recently. That could change if the market showed more muscle and consistency. Those three stocks are sketching attractive sideways action that could turn into bases and perhaps breakouts.

Although the Nasdaq has risen for six sessions in a row, generally lackluster volume gives the action an indefinite tone. So even though the current market outlook is that of a confirmed uptrend, common sense suggests caution.

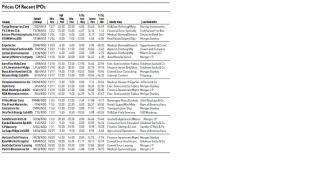

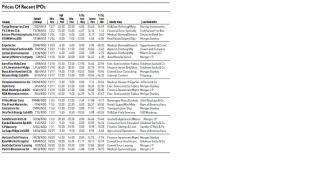

2) the new china ipo volume seems suspect (no spike as per lvs) & not my type, who knows maybe it can bring virgin luck to 1st timers?

It’s a land grab, as investors want early stakes in China’s online ad and commerce markets, says Dennis Wassung, associate portfolio manager for Cabot Money Management. Cabot owns shares in twoof China’s top Internet companies, U.S.-traded Baidu and Hong Kong-traded Tencent Holdings.

Dangdang has scant profit, and Youku is a money loser, but investors remain bullish on the prospect of fast-rising global economic and tech power China. “We’re always very hesitant to get involved in a hot IPO right out of the gate,” Jacob said, “but absolutely we will be following these

companies.”

In the third quarter, Dangdang posted a profit of $5 million, up 295%, onrevenue of $90 million, up 55%. It lags behind China e-commerce leader

Taobao. Youku, which gets its revenue from ads, lost nearly $25 million on revenue of $35 million for the first nine months, it says. But Youku is China’s No. 1 video site by revenue, with a 20% market share, says Analysys International.

3) if anyone absolutely prefer ipo, here is a food for thought

Dec 8 2010, 12:52 AM

Dec 8 2010, 12:52 AM

Quote

Quote

0.0297sec

0.0297sec

0.41

0.41

6 queries

6 queries

GZIP Disabled

GZIP Disabled