regarding tax & fiscal policy of usa. the obama democrat administration is anti business, which business would want to invest in a country with uncertainty on cost, taxes & etc

if taxing the rich is good for economic growth. then, m'sia should likewise tax the rich very high. wonder how is china, hk, dubai & singapore tax rate is?

» Click to show Spoiler - click again to hide... «

1) Fiscal Policy: With just 43 days to go, it looks like Americans may be hit with the largest tax hike in history. If

so, blame it on the Democrats. It’s their ideological rigidity that’s costing the country its economic growth.

Obama and congressional Democrats are battling with Republicans over the fate of the one bright spot

in oureconomyover the past six years: Bush’s tax cuts. Obama and his Democratic allies want a temporary extension

of the 2001 and 2003 Bush cuts for the middle class (the poor already pay no income taxes), but not for individuals earning more than $200,000 or families earning more than $250,000.

Problem is, even Democrats are split over this. And Republicans are in no mood to let Democrats play class politics with our nation’s economy. They want all the tax cuts extended or nothing. When asked Wednesday if the Republicans would agree to a deal that would permanently cut rates on the middle class, but for only

two years on those with upper incomes, Sen. Orrin Hatch of Utah replied, “Are you kidding?”

Good answer. With Bush’s cuts set to expire at year-end, Democrats, who control Congress until January, can’t agree among themselves what to do— much less cut a deal with Republicans. “I don’t even know what the options are at this moment,” said Sen. Maria Cantwell, D-Wash. And she’s on the Finance Committee, which will write any new tax law.

By their unwillingness to compromise and inability to even agree among themselves, the Democrats deserve blame if the tax cuts expire. Andif you think these tax hikes won’t matter, think again. Even raising taxes just on the rich, as Democrats propose, would cripple the economy. As American Enterprise Institute economist Alan Viard notes, households with incomes over $200,000 in 2007 took 47% of all taxable interest income, 60% of the dividends and

84%of net capital gains.

These highly productive investors drive the economy and create most of our jobs. Yet they’re the ones the Democrats want to tax. If they do, it will lower income for all groups. While we support keeping rates low on high incomes, other taxes are also slated to go up sharply at year-end. Republicans shouldn’t forget to keep other Bush tax cuts in place too.They include:

.The estate tax. It will jump from the current zero to 55% at the end of the year on estates larger than $1 million. That will force many families to liquidate businesses to pay taxes, killing jobs.

.The corporate tax. Now at a top rate of 39%, it’s way above the 26% average for the OECD. It’s a big reason for outsourcing. It should be cut to the OECD average.

.Capital gains. Slated to jump from 15% to 20%, the cap-gains tax will hurt stock investors and capital formation. Fewer businesses plus less investment equals a permanent loss of jobs.

.Dividends. Dividend tax rates are set to surge from 15% to a top rate of 39.6% — decimating seniors’ incomes and further hitting investment markets. Dividends should be taxed like cap gains.

These are things that will restore growth — something that the Obama-led Democrats seem to have forgotten.

2) Dude, Where's My Obamacare Waiver?

http://townhall.com/columnists/MichelleMal...iver/page/full/

More than one million Americans have escaped the clutches of the Democrats' destructive federal health care law. Lucky them. Their employers and labor representatives wisely applied for Obamacare waivers earlier this fall and got out while the getting was good. Now, it's time for Congress to create a permanent escape hatch for the rest of us. Repeal is the ultimate waiver.

As you'll recall, President Obama promised repeatedly that if Americans liked their health insurance plan, they could keep it. "Nobody is talking about taking that away from you," the cajoler-in-chief assured. What he failed to communicate to low-wage and part-time workers across the country is that they could keep their plans -- only if their companies begged hard enough for exemptions from Obamacare's private insurance-killing regulations.

According to the U.S. Department of Health and Human Services website, at least 111 waivers have now been granted to companies, unions and other organizations of all sizes who offer affordable health insurance or prescription drug coverage with limited benefits. Obamacare architects sought to eliminate those low-cost plans under the guise of controlling insurer spending on executive salaries and marketing.

It's all about control. If central planners can't dictate what health benefits qualify as "good," what plans qualify as "affordable" and how health care dollars are best spent, then nobody can. The ultimate goal, of course: precipitating a massive shift from private to government insurance.

McDonald's, Olive Garden, Red Lobster and Jack in the Box are among the large, headline-garnering employers who received the temporary waivers. But perhaps the most politically noteworthy beneficiaries of the HHS waiver program: Big Labor.

The Service Employees Benefit Fund, which insures a total of 12,000 SEIU health care workers in upstate New York, secured its Obamacare exemption in October. The Local 25 SEIU Welfare Fund in Chicago also nabbed a waiver for 31,000 of its enrollees. SEIU, of course, was one of Obamacare's loudest and biggest spending proponents. The waivers come on top of the massive sweetheart deal that SEIU and other unions cut with the Obama administration to exempt them from the health care mandate's onerous "Cadillac tax" on high-cost health care plans until 2018. _

Other unions who won protection from Obamacare:

-- United Food and Commercial Workers Allied Trade Health and Welfare Trust Fund

-- International Brotherhood of Electrical Workers Union No. 915

-- Asbestos Workers Local 53 Welfare Fund

-- Employees Security Fund

-- Plumbers and Pipefitters Local 123 Welfare Fund

-- United Food and Commercial Workers Local 227

-- United Food and Commercial Workers Local 455 (Maximus)

-- United Food and Commercial Workers Local 1262

-- Musicians Health Fund Local 802

-- Hospitality Benefit Fund Local 17

-- Transport Workers Union

-- United Federation of Teachers Welfare Fund

-- International Union of Painters and Allied Trades (AFL-CIO)

-- Plus two organizations that appear to be chapters of the International Longshoremen's Association (ILA)

Several of these labor organizations did not respond to requests for comment about their waivers. But Jay Blumenthal, financial vice president of the Local 802 Musicians Health Fund in New York, did explain to me: "We got grandfathered in" (his description for getting a pass) because "things were moving so fast" and "we need time now to prepare for the law." In other words: Policy cramdowns first, political fixes later. A supporter of Obamacare, Blumenthal told me he "sees no irony, no," in unions supporting the very health care "reform" from which they are now seeking relief.

Chris Rodriguez, director of human resources at Fowler Packing Company in California's San Joaquin Valley, sees things a little differently. Fowler pursued an HHS waiver because their low-wage agricultural workers would have lost the basic coverage his company has voluntarily offered for years. "We take care of our employees, and we warned (health care officials that) if they imposed this, large numbers of workers would lose access to affordable coverage," he told me. Rodriguez said he's grateful the firm won a waiver, but he did not lose sight of the fact that the very policies passed to increase health insurance access are having the opposite effect: "That's our government at work."

Indeed, some prominent government officials who lobbied hardest for Obamacare are now also joining waiver-mania -- including liberal Democratic Sen. Ron Wyden, who has been pushing for an individual mandate exemption for his state of Oregon, and Democratic Sen. Ben Nelson of Nebraska, who is pushing to waive Obamacare's burdensome 1099 reporting requirements of small businesses.

Fearful of retribution by HHS Secretary and chief inquisitor Kathleen Sebelius, who has threatened companies speaking out about Obamacare's perverse consequences, many business owners who obtained waivers refused to talk to me on the record. One said tersely: "We did what we had to do to survive."

3) New York Cigarette Tax Hurts Sales & etc

But that doesn’t mean smokers are quitting — they’re just going to neighboring states with lower tax rates.

http://www.nacsonline.com/NACS/News/Daily/.../ND1112108.aspx

NEW YORK – Cigarette sales have dropped 27 percent in New York since its cigarette excise tax increase took effect in July, according to a New York Post analysis.

“Law-abiding cigarette dealers have sold an average of 30 million packs of smokes in each of the last four months — some 11 million fewer than before Gov. Paterson and lawmakers raised the state tax on cigarettes to $4.35 a pack in a scramble to close a massive budget gap,” the newspaper reports.

However, the drop in sales does not mean that there are also fewer smokers. The high price of New York cigarettes means smokers are crossing state lines to pay a lower tax. For example: “The hike raises the average price of a pack of Marlboros to $11.60 in New York City, compared to $5.93 in Matamoras, Pa.,” the newspaper found.

"That's what we warned would happen, and obviously it has come to fruition," said James Calvin, of the New York Association of Convenience Stores. "Every tax increase drives more smokers to that dark, shadowy, unregulated, unlicensed, untaxed side of the street. The whole policy is self-defeating."

The Post’s analysis concludes that if the current trend continues, the state won’t hit its $260 million windfall expected from the tax increase.

http://www.globalwarming.org/2010/09/28/ne...an-800000-jobs/

http://www.ft.com/cms/s/0/c7df5c7c-bd0e-11...l#axzz15ben273G

4) Mayor Boris: 'Bankers Are Fleeing London'

http://news.sky.com/skynews/Home/Business/...315523528?f=rss

Thousands of high-earning bankers will flee London because of the Government's taxation policy, Mayor Boris Johnson has warned.

He has written to Chancellor Alistair Darling asking for a meeting to discuss his introduction of a 50p income tax rate for top earners and a temporary 50% levy on banking bonuses over £25,000.

His call comes after US President Barack Obama said he would tax America's biggest banks to recoup the cost of the multi-billion dollar taxpayer bail-out.

British companies are expected to be hit with a bill of £900m by Mr Obama, Sky sources say.

Mr Johnson, Mayor of London, says 9,000 bankers are planning to leave London because of the Government's tax policy.

Several companies have told him they are rethinking plans to locate, grow or remain in London, including one financial institution where 1,600 staff have asked for reallocations out of the City and another which is considering moving up to 800.

Mr Johnson told the Chancellor: "I believe that the Government's current policy towards financial services is ill-judged.

You have made unilateral changes to taxation that risk damaging London's competitiveness and its status, alongside New York, as the world's leading financial services centre.

"London becomes a less attractive destination for the globe-trotting, highly-skilled business men and women who can contribute greatly to our economy.

"By allowing this approach to continue, the Government is doing nothing more than fast-tracking the departure of this talent pool out of Britain and into the welcoming arms of our competitors such as New York and Singapore."

As the Government comes under pressure from the Mayor to ease taxes, the Government is coming under pressure to follow Mr Obama's lead and levy a bail-out tax to help recover the £850bn spent propping up UK banks.

Labour MP John Mann said the new US tax had "delegitimised" claims bankers will flee abroad to avoid levies in the UK.

Mr Mann, who sits on the influential Commons Treasury Committee, said: "I think it is an excellent plan and it opens up the possibility for the rest of the world - including this country - to do something similar."

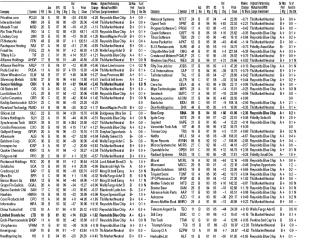

5) Stocks tried to bounce back from the prior session's beating Wednesday, but they had to settle for a narrowly mixed finish.

The Nasdaq and NYSE composite rose 0.2% each, while the S&P 500 ticked up a fraction. All three rose for the first time in five sessions. The Dow slipped 0.1% but again closed just above its 50-day moving average. Volume dropped sharply from Tuesday's pace, suggesting no support from institutions after Tuesday's sell-off.

Stocks made a feeble bounce Wednesday after Tuesday's sharp sell-off.

The Nasdaq and the NYSE composite tacked on 0.2% each. The S&P 500 was essentially flat. The Dow edged down 0.1%.

Volume was sharply lower on both major exchanges.

Among industry groups, retail and apparel makers advanced. Solar, data storage and banks faltered. Only a few top-rated stocks rose or fell in big volume.

With the market in correction, buying stocks is especially risky. Wait for a new uptrend to get back in the market.

Speculation now centers on how long and how deep the correction will run. While no one can know the future, history is worth a look.

The past six corrections involved declines of roughly 7% to 15%. That's measuring from the previous peak to the low just before an index signaled a new uptrend had begun.

So far, the Nasdaq has fallen 5.1%. If Tuesday's low were to hold and an uptrend has begun, this would be the shallowest correction of the past seven.

How long have corrections been lasting?

Recent history shows no consistent pattern. In four of the past six cases, the Market Pulse's outlook remained at "correction" for nine sessions or less. In two cases, the correction label stuck for four or five weeks.

Given the uncertainty, investors should prepare for both a short and long correction. How do you do that? Fill your watch list with top-rated stocks that show different kinds of chart action

Look for stocks that might provide a quick buy point or buy range. Also, track those that might be building a base. That way you're covered whether the correction is long or short.

A short correction favors the three-weeks-tight pattern, the pullback to the 50-day moving average and perhaps the four-week square box and the five-week flat base. A longer correction might allow for the longer bases.

Pay attention to stocks that find support on a first or second trip to the 50-day line. Some stocks will establish a buy range by bouncing off the 50-day line while the market is in correction. If a follow-through day develops soon enough, these stocks might still be in a buy zone. It's easy to overlook such opportunities.

6) look at the % bullish advisors, time for a correction to shake them out

Nov 18 2010, 12:58 PM

Nov 18 2010, 12:58 PM

Quote

Quote

0.0536sec

0.0536sec

0.55

0.55

7 queries

7 queries

GZIP Disabled

GZIP Disabled