can anyone confirm that the min balance to maintain in Just2Trade is US$2500 ?

US stock discussion v3, Double Bottom coming?

US stock discussion v3, Double Bottom coming?

|

|

Aug 26 2011, 08:42 PM Aug 26 2011, 08:42 PM

|

Junior Member

268 posts Joined: Jun 2007 |

can anyone confirm that the min balance to maintain in Just2Trade is US$2500 ?

|

|

|

|

|

|

Aug 26 2011, 11:53 PM Aug 26 2011, 11:53 PM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

|

|

|

Aug 27 2011, 12:02 AM Aug 27 2011, 12:02 AM

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

I not a daytrader but we need al gore

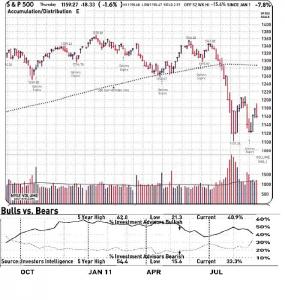

I mean someone needs to decipher those algo I mean someone needs to decipher those algo here u guys no like dog jones, here is s&p instead & look at the bull bear ratio, they r gonna intersect soon if s&p hits 1240 or 1100, then can enter. otherwise its ranging neither here nor there

http://www.msnbc.msn.com/id/44288099/ns/bu...ks_and_economy/ The Federal Reserve has done all it can for now to get the U.S. economy back on track. Now it's time to simply wait for it to heal. But, in a narrow sense, the Fed's policies so far have worked: the U.S. economy is awash in cash. The problem now is that money from the Fed's pump-priming isn't flowing fast enough through the system. Business managers, faced with uncertainty about the rising prospect of another recession, are hoarding cash. http://blogs.telegraph.co.uk/news/geraldwa...l_end_in_tears/ The most powerful nation on earth is confronting its worst economic crisis under the leadership of its most extremely liberal politician, who has virtually no experience of federal politics. BUT ITS TRULY AN OPPORTUNITY, since int rate can be kept so low for 2 years. everyone knows wat happen when int rate goes up This post has been edited by sulifeisgreat: Aug 27 2011, 05:39 AM |

|

|

Aug 27 2011, 11:12 AM Aug 27 2011, 11:12 AM

|

Senior Member

1,082 posts Joined: Mar 2009 |

Damn BAC .... everyday i set my buy price at 6 b4 i go to bed......why hit 6.01

|

|

|

Aug 27 2011, 08:16 PM Aug 27 2011, 08:16 PM

|

Senior Member

3,577 posts Joined: Apr 2006 |

|

|

|

Aug 27 2011, 11:53 PM Aug 27 2011, 11:53 PM

|

Junior Member

268 posts Joined: Jun 2007 |

i have a US bank account, and my friend asked me to fund his trading account. Can i fund trading account which is not under my name?

|

|

|

|

|

|

Aug 28 2011, 11:30 PM Aug 28 2011, 11:30 PM

|

All Stars

10,123 posts Joined: Aug 2007 |

Closing update for bullish Monday

Dow 11539.25 +254.71 +2.26% Nasdaq 2562.11 +82.26 +3.32% S&P500 1210.08 +33.28 +2.83% Bulls still in charge for Monday after Uncle Ben said he's going to leave things as is last Friday. So, let's ride this up for now. Honglun: If you're still waiting for opportunity to sell LVS, watch it. I think it may be going back to 47/48 level. Good luck! Added on August 31, 2011, 9:13 pmTime to lock in some profits today.. before the job numbers on Friday. This post has been edited by danmooncake: Aug 31 2011, 09:13 PM |

|

|

Sep 2 2011, 03:02 PM Sep 2 2011, 03:02 PM

|

Senior Member

773 posts Joined: Oct 2008 |

glad that august has passed. volatility is dangerous though there's still room for money making.

|

|

|

Sep 2 2011, 08:52 PM Sep 2 2011, 08:52 PM

|

All Stars

10,123 posts Joined: Aug 2007 |

Horrible job numbers.. worst than expected. We're going down baby.. down!

|

|

|

Sep 2 2011, 09:00 PM Sep 2 2011, 09:00 PM

|

Junior Member

200 posts Joined: Jul 2007 |

Guys, I'm kinda new to US stock trading and would like to understand the meaning of short selling more clearly.

Consider this scenario: I'm holding 200 shares of XXX share bought @10.40 yesterday. I sell 200 shares of XXX share today @10.80. After that, re-bought 200 shares of XXX @10.00. Is this considered short selling? |

|

|

Sep 2 2011, 09:18 PM Sep 2 2011, 09:18 PM

|

All Stars

10,123 posts Joined: Aug 2007 |

QUOTE(simonmada @ Sep 2 2011, 09:00 PM) Guys, I'm kinda new to US stock trading and would like to understand the meaning of short selling more clearly. No!Consider this scenario: I'm holding 200 shares of XXX share bought @10.40 yesterday. I sell 200 shares of XXX share today @10.80. After that, re-bought 200 shares of XXX @10.00. Is this considered short selling? Short selling, it means you don't hold ANY stocks of XXX but you borrow from your broker to sell it, then hoping when the price declines, you BUY it back and return that XXX stocks to your broker. You pocket the difference. In other words, Short selling is buying stocks in REVERSE. "Gostan" trick. Only mature markets like US allows you to make money either when the market goes UP or DOWN. |

|

|

Sep 2 2011, 09:27 PM Sep 2 2011, 09:27 PM

|

Junior Member

200 posts Joined: Jul 2007 |

QUOTE(danmooncake @ Sep 2 2011, 09:18 PM) No! Great, thanks Dan!Short selling, it means you don't hold ANY stocks of XXX but you borrow from your broker to sell it, then hoping when the price declines, you BUY it back and return that XXX stocks to your broker. You pocket the difference. In other words, Short selling is buying stocks in REVERSE. "Gostan" trick. Only mature markets like US allows you to make money either when the market goes UP or DOWN. |

|

|

Sep 2 2011, 10:00 PM Sep 2 2011, 10:00 PM

|

Senior Member

4,966 posts Joined: Nov 2008 |

|

|

|

|

|

|

Sep 3 2011, 12:10 AM Sep 3 2011, 12:10 AM

|

All Stars

10,123 posts Joined: Aug 2007 |

QUOTE(GregPG01 @ Sep 2 2011, 10:00 PM) co confidence was down (from the tripple A downgrade) and stocks hari2 tank saja since early Aug, how to hire ? Yes, consumer confidence that was reported on Tuesday evening was way lower than expected (44.5 vs. 59.2 prior) - thanks to S&P downgrade. It's the signal the market top here for this wave, time to sell or take profits. Analysts already lowered the expectation for the job number this Friday but now it is much weaker than expected. Aug is even worse than July.Added on September 3, 2011, 6:46 amClosing for Friday Sept 1st. US market: Dow 11240.26 -253.31 -2.20% Nasdaq 2480.33 -65.71 -2.58% S&P500 1173.97 -30.45 -2.53% As expected after this bad job number.. bought back some of covered calls and sold puts to take some profits here. Still holding a few more puts over the weekend for the long shares that I've been hedging. This post has been edited by danmooncake: Sep 3 2011, 06:46 AM |

|

|

Sep 3 2011, 09:54 AM Sep 3 2011, 09:54 AM

|

All Stars

12,268 posts Joined: Oct 2010 |

AGQ loaded back to 250 shares at av price of $183 now

Looks to be trending upwards |

|

|

Sep 4 2011, 10:20 PM Sep 4 2011, 10:20 PM

|

All Stars

10,123 posts Joined: Aug 2007 |

QUOTE(prophetjul @ Sep 3 2011, 09:54 AM) Yes indeed.. fear is creeping back into the market now. Even SLV has crossed back over $40.So, those who were trapped above back in early Aug, now can escaped. Watching that resistance line at $43.. |

|

|

Sep 5 2011, 07:54 AM Sep 5 2011, 07:54 AM

|

All Stars

12,268 posts Joined: Oct 2010 |

Can we trade warrants on Just2trade?

|

|

|

Sep 5 2011, 07:49 PM Sep 5 2011, 07:49 PM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

|

|

|

Sep 6 2011, 12:42 AM Sep 6 2011, 12:42 AM

|

All Stars

10,123 posts Joined: Aug 2007 |

Quite a few individuals have PM me about what is SHORTing.

So, instead of answering the same individual questions, here's my answer, hopefully, this can be a part of a FAQ in future. Shorting is just trading stocks in reverse (or going the dark side) It is SELL first (for the stocks that you don't currently own), BUY back later (at the cheaper price of course!). Its goal is to take advantage of the downside move to get some profits. But, in order to SELL first, you must borrow the stock from your broker. Your broker will let you know if stocks are available to short when you execute your order. Examples: If stock X is trading at $100, and you think it will go down and if you wish to take advantage of downside move, but you don't own stock X at the moment, you just execute the SELL order with the option for short. If stock X trades at $90 later (-10%) and you wished to take profit at 10% move , then you simply BUY it back. This is call BUY COVER for your short position. You just bought back a stock at cheaper price and you returned the stock to your broker and pocket the 10% profit (minus commissions, fees and interests). In order to sell a stock short, you must have a margin account (min $25k). This is the rule. Depending on the amount of short and time period, your broker may charge you commissions and interests rate. Individual brokers have different fees rules and margin requirements for shorting. Make sure you know all those rules! Risks What happens if trade goes against you? Just like buying regular stock, shorting is the same. Instead of the price going lower which you expect to make profit, the price may move higher and you could end up losing because you've sold stock X at much lower than the current price. As the price continues to move higher, and if you can't stand the pain (eg. your broker issue a margin call), you have BUY to cover at much higher price. What if you can't short? There are inverse ETFs available which take advantage of downside market moves. They track the general indices like Dow or SP500 or Nasdaq or even certain sectors of the market, the US investors can definitely buy those like a regular stock. These type of "bear" shares goes UP when the market moves DOWN. Examples: (Short Dow:DOG, Short SP500: SH and Short Nasdaq: PSQ). Check out the prospectus of these ETFs from ProShares or Direxion. Leverage Leverage is when you wish to "amplify" the movement of your stocks movements. Certain ETF products are designed to amplify the percentage movement of certain sectors or indices. The 2x ETF intends to amplify twice the percentage, and the 3x ETF intends to amplify thrice the percentage move. For example, during the worse market downside move on Aug 8th, Dow moves down 5%, the inverse 3x ETF product SDOW moves up 15% (it also goes the other directions in same percentage when market moves up). The other is Stock Options. Options are very sophisticated leveraging tools. Options allow the US investors to "hedge" either using short calls or long puts for the short side of the trade. They are sophisticated because they have "amplification" effect as well and they are also good tools for investors to participate in the market without much money. Briefly those two leverage products are risky and dangerous..if you do not know what you're doing and have little experience in trading and investing, you must spend considerable amount of time to learn those before you engage to using them. Hope those helps! Good luck to all, and may we continue to profit in this tumultuous times! This post has been edited by danmooncake: Sep 6 2011, 12:57 AM |

|

|

Sep 6 2011, 12:52 AM Sep 6 2011, 12:52 AM

|

Senior Member

1,227 posts Joined: Sep 2004 |

|

|

Topic ClosedOptions

|

| Change to: |  0.0213sec 0.0213sec

0.58 0.58

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 8th December 2025 - 12:56 PM |