QUOTE(corad @ Dec 10 2020, 03:52 PM)

Yes if you have singpass or Already have bank account with DBS (I opened mine via online cause I already have existing account with DBS).Other than that I think no.

Opening a Bank Account in Singapore

|

|

Dec 10 2020, 05:11 PM Dec 10 2020, 05:11 PM

Return to original view | IPv6 | Post

#641

|

All Stars

24,431 posts Joined: Feb 2011 |

|

|

|

|

|

|

Dec 20 2020, 12:21 AM Dec 20 2020, 12:21 AM

Return to original view | IPv6 | Post

#642

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(mikhailcbh @ Dec 18 2020, 08:56 AM) Avoid. Cause if you use PB banking way you need to park RM250-300k in FD or some crap stuff by banks. Waste of good money.QUOTE(Spiv @ Dec 20 2020, 12:02 AM) Need advise from all big bro and sis here. I am giving talks over zoom and teams. My customers are foreign companies. Currently they send money direct to MY bank. I wanted to use transferwise but unfortunately now i can only send money instead of receiving. I am thinking of getting DBS SG account but I am not an employee nor student and no existing Singapore bank account. Who can give a good suggestion to receive multi-currency. Just open Transferwise Business account. |

|

|

Dec 20 2020, 12:11 PM Dec 20 2020, 12:11 PM

Return to original view | IPv6 | Post

#643

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(Spiv @ Dec 20 2020, 01:09 AM) Opening dbs account require you to travel to Singapore. You need to be physically there and is subject to approval. I opened mine up last time by opening dbs Vickers with them (can only be done at HQ). If you walk into any dbs bank, they will reject you straight away.One fintech I know can receive USD is wallex. I have never got around to opening an account with them before. Spiv liked this post

|

|

|

Dec 20 2020, 10:08 PM Dec 20 2020, 10:08 PM

Return to original view | IPv6 | Post

#644

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(Spiv @ Dec 20 2020, 03:40 PM) Thank you for the advise but now cannot go there yet. Yes but very bad rates. Just drop wallex an email and see how.Does local bank can accept multi-currency? Last time i talk to MY citibank they need to have 3k USD opening account for receiving USD and other equivalent amount for other currency. |

|

|

Dec 22 2020, 10:49 AM Dec 22 2020, 10:49 AM

Return to original view | IPv6 | Post

#645

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(mikhailcbh @ Dec 22 2020, 09:09 AM) My main purpose is to open a CDP account in SG. I understand we cannot do that with CIMB SG right? You go to the bank, you print out the pdf form, filled it up and tell the front desk person you want to meet the person in charge of opening Maybank sg isavvy account. Aka them call HQ if they still blur.Despite the MBB SG account opening form list the branch near my town (east Malaysia) can process the account opening, the staff there seems blur and not really helpful... Will Maybank main in KL able to help on this? Forget about opening CDP account. Not useful to Malaysians. Just use FSM sg or tiger brokerage for sg market. |

|

|

Jan 6 2021, 06:29 PM Jan 6 2021, 06:29 PM

Return to original view | Post

#646

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(Candylyn @ Jan 6 2021, 04:54 PM) Unfortunately,i went to maybank and this is what they told me,even having 250k aso not warranty can get approved,lol. Of course it's not guaranteed. It's up to Singapore side to decide to approve you or not.Im not sure if this is sarawak rule,or now maybank change their limit dy,my cdp got stucked now,sgx change into cheque free,unless doing tt,otherwise all dead. Just fill up the firm, bring it to Maybank side, buy a banker cheque under your name for SGD500 and let Maybank settle everything. |

|

|

|

|

|

Jan 10 2021, 05:43 PM Jan 10 2021, 05:43 PM

Return to original view | IPv6 | Post

#647

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(kendo88 @ Jan 10 2021, 03:37 PM) Hi all, just wanna to check with those with cimb my/sg accounts. Avoid using cimb my to transfer money.Did the bank recently block off the instant conversion/transfer between the myr and sgd account? Wanted to transfer some myr to sgd couple days ago, but was not able to do so, when asked the bank staff, they told me they suspended this feature recently. Have to go through the TT method now. Is it true? Use fintech like money march, instarem, bigpay, TransferWise, Sunway money. |

|

|

Jan 23 2021, 12:59 PM Jan 23 2021, 12:59 PM

Return to original view | IPv6 | Post

#648

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(47100 @ Jan 22 2021, 02:04 PM) hi , do you happen to know if HSBC premier in SG, has foreign cash withdrawal function? All Singapore banks allow you to withdraw foreign cash. You need to pay example, i have a EUR account with HSBC, and i want to withdraw EURO in cash at Singapore HSBC branch. in MY, we can not. Thanks. 1) 1-2% in withdrawal fees 2) markup exchange rate Your choice I wouldn't bother with withdrawing foreign cash in Singapore especially when they have lots of good overseas travel card from revolut, instarem, transferwise and revolut. |

|

|

Feb 15 2021, 08:26 PM Feb 15 2021, 08:26 PM

Return to original view | IPv6 | Post

#649

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(corad @ Feb 15 2021, 08:19 PM) just wondering what everyone is doing with their "parked" $$ in SG bank account ? You open sg bank acocunt is not for their FD. If you are using it for FD, better don't open account there cause you don't know how to make use of sg bank account. I don't know about you.FD rates are nothing compared to M'sia ... so considering if I should remit the funds back (and get a slight gain on current exchange rates) or if there are better things that can be done. I opened my account for 1. Invest into sg reits. They offer 3-8%p.a dividend yield. 2. Use it to invest into US market since overseas broker accept SGD deposit and not RM. And in case you are wondering, my SGD is minimum giving me 6%p.a And no. I don't bring my money back. No intention. This post has been edited by Ramjade: Feb 15 2021, 08:34 PM taiping... and cklimm liked this post

|

|

|

Feb 21 2021, 07:49 PM Feb 21 2021, 07:49 PM

Return to original view | IPv6 | Post

#650

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(cklimm @ Feb 20 2021, 02:27 PM) Hey, it looks better than FSM's measly 0.6%. Best mmf in sg is by endowus. But you need agd10k min. Pretty expensive. They claimed their dimension funds can outperform S&P500. https://www.stashaway.sg/simple Can you share on the signup process? For me I am skeptical and I trust ARK. QUOTE(corad @ Feb 21 2021, 12:34 PM) Thank you all for the replies. For a complete beginner, what reading material wold you suggest to get started on using funds in SG account (for non-SG residents)? Depend on what you want to use the money in SG for. Some silly people keep cash only in SG and don't do anything with it.Googling brings up plenty of resources but in terms of money I'm very risk adverse so being very cautious in what should be taken as truth vs bad advice. Right now I'm reading fundsupermart.com, but unsure if it's just to promote their own portfolio or really trying to help If want to keep cash only, forget about opening SG bank account. Just dump it all in EPF (RM 60k/year). Money in EPF will easily best money in SG bank account. Some use it to buy unit trust. Platform for it is https://unittrust.poems.com.sg/. Avoid FSM for unit trust. They charge you quarterly just for buying unit result with them while there's no such charges with POEMS. Some use it for robo. There are plenty of option for robo. - stashaway - endowus - syfe - autowealth Robo is for 1) lazy People and 2) people who don't know what they are doing and just want somewhere to park their money. You are basically paying a middle man (the robos) to buy ETF for you which is a stupid thing to do (cause you can DIY and it's cheaper which means you have more money over long term) Personally I avoid robo at all cost and I always tell people to avoid robo at all cost. (What's so difficult opening a overseas stock brokerage and deposit money in every month?) Some use it for stocks. You can buy sg stocks but get ready to lose money. Majority of the business in sg are lousy and get ready to lose money as investor. Sg market is only good for reits and banks. Nothing more. Platform for buying sg stocks are - FSM SG - Tiger broker. Some use it to buy international stocks. Some use it as a stepping stone to overseas stock because SGD is more important international than our RM.. This is where the magic starts. I personally recommend buying international stocks. More info can visit https://ringgitfreedom.com/2020/11/13/journ...onal-brokerage/ If you are looking into investing in stocks, know what kind of investor your are. i) dividend Investor - you invest for extra money every month ii) growth investor - you invest hoping to multiply your original money but most of the time you won't get paid.a single cent unless you sell iii) trader - you are looking to make a quite buck by buying and selling within a few hours to few days. iv) speculator - where stock market is your casino I use blogs and youtube. These are what I used last time. Read this. I read all of it when I started out. No one teach me anything. I learned mostly from blogs and forums For starters kindly read this 1. https://singaporeanstocksinvestor.blogspot.com/ (see all the link at the side, read all of them) 2. https://investmentmoats.com/stock-market-in...ting-resources/ 3. https://stestocksinvestingjourney.blogspot....f-dividend.html 4. https://stestocksinvestingjourney.blogspot....-of-saving.html 5. https://stestocksinvestingjourney.blogspot....out-me-ste.html 6. https://www.mrfreeat33.com/my-story/ 7. https://www.mrtakoescapes.com/farmers-hunte...l-independence/ 8. https://www.mrtakoescapes.com/love-big-fat-cash-pile/ QUOTE(!@#$%^ @ Feb 21 2021, 07:05 PM) There's no versa for sg. The closest to versa returns is endowus.Do not waste your SGD on money market fund. borgeouisbella, blackchides, and 6 others liked this post

|

|

|

Feb 22 2021, 12:55 AM Feb 22 2021, 12:55 AM

Return to original view | IPv6 | Post

#651

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(Murasaki322 @ Feb 21 2021, 11:30 PM) Off topic (if allowed), but curious about your views on 2) Come on la. If you use pure Interactive broker, it's only going to cost you USD2.00/currency conversion (regardless how large is the amount) and USD0.35/transaction which is equal USD2.35 per month. Of course it's recommended to do transactions of say USD2k to bring down the % paid in commision commision.If we deposit money monthly to buy ETFs wouldn't that incur repeated currency conversion (same for robo, but conversion in brokerage might be higher % if sum is low?) and expensive brokerage trade commissions? If you use whitelabels it's only going to cost you USD 2.00 (conversion fees) + USD1.50/transaction. What I do is I collect until RM12k then convert my money. |

|

|

Feb 22 2021, 05:02 PM Feb 22 2021, 05:02 PM

Return to original view | IPv6 | Post

#652

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(MGM @ Feb 22 2021, 02:50 PM) https://www.quora.com/What-are-the-rules-fo...f874&srid=5nApp Nope. Still go with US. You can bypass 30 dividend tax by selling options.Thanks. What is your view on this(extracted from article above)? If you are non-American it is best to get access to US Markets with funds domiciled outside the US. For example, regardless of whether you are a DIY investor or going through an advisor, it is best to invest in a non-US platform (say SwissQuote, Saxo or whatever) rather than a US platform (Interactive Brokers, eToro as an example). |

|

|

Mar 4 2021, 05:19 PM Mar 4 2021, 05:19 PM

Return to original view | IPv6 | Post

#653

|

All Stars

24,431 posts Joined: Feb 2011 |

|

|

|

|

|

|

Mar 19 2021, 11:08 AM Mar 19 2021, 11:08 AM

Return to original view | IPv6 | Post

#654

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(Hoshiyuu @ Mar 19 2021, 10:34 AM) Just to update you - I managed to empty my CIMB SG account down to 0 SGD and still fine so far. Bigpay problem if you transfer more than RM10K. For me I always use Sunway money cause it's the cheapest Vs Wise and Bigpay. Not to mention it's faster than Bigpay.Funding wise, so far I am jumping back and forth between Wise and BigPay, I don't have SunwayMoney, can't be bothered. When fees >RM5 on Wise usually its better on BigPay in my experience, but Wise rates is usually better, so still have to depend on time of day and compare during transfer. Both method is better than CIMB-MY ASEAN remit. For bringing back money, CIMB SG has an option to transfer to CIMB MY with no fees. I've heard the rate can even beat TransferWise. I am currently linking CIMB SG to CIMB MY, will try it in the future, but for now I am using TransferWise to bring it back with acceptable fees and good rates. Hoshiyuu liked this post

|

|

|

Mar 19 2021, 11:19 AM Mar 19 2021, 11:19 AM

Return to original view | IPv6 | Post

#655

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(Hoshiyuu @ Mar 19 2021, 11:13 AM) Thanks for the info! In that case, I might give Sunway Money a serious try once I am free to do KYC in person, my laziness to visit them is mostly why I went with other option for now. (That and BigPay have CC cashback You don't need to kyc. Their KYC is all online.Hopefully their promo rate of RM1 fixed fee stays - otherwise they will likely lose out to BigPay I think @ RM10 per transac? I don't look at fees. I look at final SGD that I will received say per RM10k transfer. Hoshiyuu liked this post

|

|

|

Mar 19 2021, 12:36 PM Mar 19 2021, 12:36 PM

Return to original view | IPv6 | Post

#656

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(Hoshiyuu @ Mar 19 2021, 11:31 AM) Damn, I heard wrong then. Should have just gave SunwayMoney a try. Thanks again for the great info. Only option for us is CIMB SG and TransferwiseAnd yeah, I was comparing the final values across CIMB remit, BigPay, Wise - I'm going to add Sunway to it now, and given what you said Sunway is likely going to be best. Now if only there is similar good alternative for going from SG to MY... This post has been edited by Ramjade: Mar 19 2021, 12:36 PM Hoshiyuu liked this post

|

|

|

Mar 23 2021, 09:07 PM Mar 23 2021, 09:07 PM

Return to original view | IPv6 | Post

#657

|

All Stars

24,431 posts Joined: Feb 2011 |

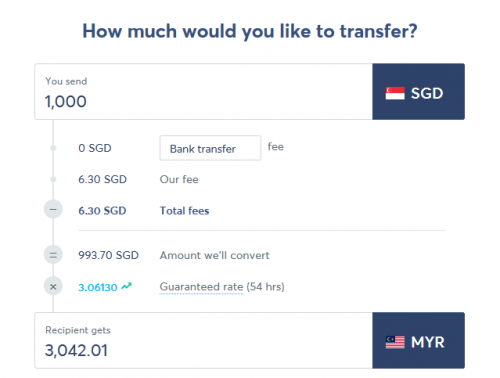

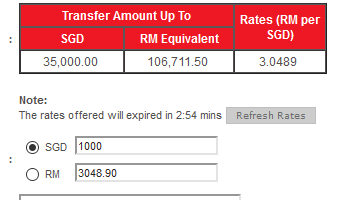

QUOTE(Hoshiyuu @ Mar 21 2021, 06:08 PM) Nope, the 1000 can use fintech for best rates - just need $1 in house for e-KYC Edit: Copy pasted from my reply in other thread- Random midnight snapshot for those curious on how to bring money back from IBKR->CIMBSG->CIMBMY TransferWise:  CIMB SG -> MY self account remit  The CIMB SG->CIMB MY transfer rate is pretty good! For MYR->SGD the usual path is still better. QUOTE(trapezohedron13 @ Mar 23 2021, 08:49 PM) Keep in mind this is a promo from CIMB SG. Not a permanent feature. They can end it anytime. So far they never end it. They have been extending it everytime. Hoshiyuu liked this post

|

|

|

Mar 24 2021, 10:41 AM Mar 24 2021, 10:41 AM

Return to original view | IPv6 | Post

#658

|

All Stars

24,431 posts Joined: Feb 2011 |

|

|

|

Mar 24 2021, 10:44 AM Mar 24 2021, 10:44 AM

Return to original view | IPv6 | Post

#659

|

All Stars

24,431 posts Joined: Feb 2011 |

|

|

|

Apr 13 2021, 05:59 PM Apr 13 2021, 05:59 PM

Return to original view | IPv6 | Post

#660

|

All Stars

24,431 posts Joined: Feb 2011 |

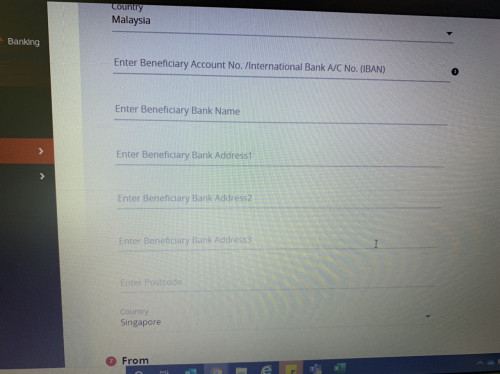

QUOTE(taiping... @ Apr 13 2021, 11:12 AM) Pls excuse my noobness Already tell you how many time? Do not use bank to transfer Ringgit.Am trying to transfer funds from CIMB MY to CIMB SG I went to foreign transfer I cant seem to transfer funds. 3 times already i tried  What do i put here? Bank name n address |

| Change to: |  0.2691sec 0.2691sec

0.85 0.85

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 21st December 2025 - 04:15 AM |