QUOTE(!@#$%^ @ Oct 13 2020, 04:22 PM)

Just hope revolut open shop in Malaysia.Opening a Bank Account in Singapore

Opening a Bank Account in Singapore

|

|

Oct 13 2020, 07:31 PM Oct 13 2020, 07:31 PM

Return to original view | IPv6 | Post

#621

|

All Stars

24,431 posts Joined: Feb 2011 |

|

|

|

|

|

|

Oct 14 2020, 12:15 AM Oct 14 2020, 12:15 AM

Return to original view | Post

#622

|

All Stars

24,431 posts Joined: Feb 2011 |

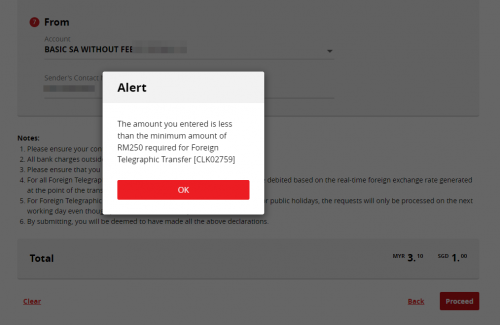

QUOTE(polarzbearz @ Oct 13 2020, 10:28 PM) On a second note, just applied for SG CIMB this week and when attempting to do Foreign Transfer with 1SGD, seems like CIMB Clicks MY is blocking it Maybe cimb my block it. I had to do a minimum MYR250 transfer so I went ahead with SGD100 (MYR 310.20). Or maybe I'm doing it wrongly  QUOTE(!@#$%^ @ Oct 13 2020, 11:09 PM) Defintely worse than cimb. CImb is already at 0.5%. Use stashaway simple sg version to get 1.4% if you don't mind waiting few days for your money. |

|

|

Oct 14 2020, 03:25 PM Oct 14 2020, 03:25 PM

Return to original view | IPv6 | Post

#623

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(Hansel @ Oct 14 2020, 02:32 PM) Since you have not experienced it personally and was just commenting based on what you read in some blogger's forum,.. I thought I'd ignore what you said,.. but well,... I changed my mind. What he said is correct. Tested with BPY. No tax. No reason to doubt him. Maybe is your broker. He laid out reasons why bonds are not taxed. Time for a change in broker? I suspect that blogger has some background with the IRS that we don't. That's why IB need not withhold the 30% against him,... For other account-holders, our interest will still be withheld. It's not so easy, bro,.... I think if Biden wins, it will be worse when it comes to taxation matters. I need not use the EPF as my preferred bond proxy. I don't want to earn the Malaysian Ringgit. I am earning many major currencies of the world thru my investments,.. why fallback to the MYR for my investment income ? And I am confident my investment outcome can beat the EPF's without even considering the currency exchange. Anyway,.. I have uses for other currencies too,... my children are considering furthering their career to Euro and The US. I may help neph too. |

|

|

Oct 14 2020, 07:13 PM Oct 14 2020, 07:13 PM

Return to original view | IPv6 | Post

#624

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(Hansel @ Oct 14 2020, 04:05 PM) You bought Brookfield listed in the Nasdaq personally and your payout was not taxed ? Or are you mentioning someone else's action/experience again ? Tested by me. True as what blogger said. Only about 1% dividend with holding tax.QUOTE(TOS @ Oct 14 2020, 05:01 PM) Go there and open. Not worth it. Stick with our IB. FSM better than DBS V and SCB for a foreigner.FSM for Singapore reits. IB for overseas stocks. Reason SCB - SCB blindly hold the tax even though they don't need to hold it. Which means less money for you Vs IB which is very smart. - Their exchange rate sucks Vs IB's spot rate. No broker can best IB spot rate. - SCB need to call in every now and then for corporate action. DBS Vickers - quarterly platform fees for overseas stock - corporate action fees (dividend fees) for overseas stock - higher exchange rate Vs IB but lower Vs SCB - cannot do rights or preferential offering if you a foreigner without sg addess. This post has been edited by Ramjade: Oct 14 2020, 07:19 PM TOS liked this post

|

|

|

Oct 14 2020, 11:03 PM Oct 14 2020, 11:03 PM

Return to original view | IPv6 | Post

#625

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(Hansel @ Oct 14 2020, 10:47 PM) What is the 1% WHT for ? Didn't you ask ? Don't know. Don't care. 1% is better than a 30% tax so I can live with that.SCB has no platform fees. IB has platform fees if you do not have assets worth USD100K inside IB, unless you go with their front-end proxies which you called white-(somethings). Nobody asked you to exchange inside SCB, you can always exchange outside SCB and TT into SCB for a good amt... If needed to call in and still able to do your corporate action, it's better than NOT being able to do your corporate action at all for IB,.. there has been problems at IB. You can't subscribe to IPOs at IB, right ?? DBSV's platform fees can be waived if you have sufficient transactions, and the platform fee is only SGD 2, come on,.... No worries abt the dividend fees if your amt is substantial enough. Again, nobody asked you to change your currency inside DBSV,... you don't know enough abt changing in other ways inside the DBS Group. IB's spot rate is still not the closest to the interbank rate. DBS Group's is !! At the end of the day,... I will still stick to a bank established inside SG. That's my preference,... I wouldn't mind paying a bit more for this peace of mind. Use whitelabels la. After get USD200k transfer back to IB. Avoid at the platform fees. Actually IB can do corporate action like scrip. They notified you when you login. You can do it online yourself. No calling involve. For IPO I think pure IB can. But never buy stuff at IPO. Wait few months for people to load off the IPO and potential to buy cheaper. Question: can changing outside SCB/DBS at cheaper price open for normal customer/non priority/private banking people? Will be interesting if it exist for normal people. |

|

|

Oct 14 2020, 11:08 PM Oct 14 2020, 11:08 PM

Return to original view | IPv6 | Post

#626

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(TOS @ Oct 14 2020, 09:06 PM) After reading into the link Hansel shared, I become interested with baby bonds. But I don't see any way to buy baby bonds via IBKR. All the results shown under the bond scanner only has large denomination size of 2k USD to 350/500k USD. Enable trading permission in IB. Then go to his blog and search for those ticker symbols he posted. Should be able to buy some stuff.The blogger does not seem to provide any hints on buying baby bonds. Anyone here knows how to do that? (Anything to share from you, Hansel?) EDIT: I found one, it's actually called exchange traded debt and is traded like stocks with par value 25 USD per share and you can buy from a minimum of 1 share. Commission is 1.5 USD from IBKR's TWS platform. https://stockmarketmba.com/analyze.php?s=PRS For this example, the ticker symbol is PRS. |

|

|

|

|

|

Oct 15 2020, 01:17 AM Oct 15 2020, 01:17 AM

Return to original view | IPv6 | Post

#627

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(Hansel @ Oct 14 2020, 11:17 PM) Your needs are different from mine,.. and our needs and circumstances are different from others. You can't say SCB and DBSV are bad and ONLY IB is good. Everybody's personal circumstances is different. And what's the problem with calling SCB's Online Trading Unit ? Their call centre is in Cyberjaya,... they're quite efficient too. And very polite and customer-oriented in their speech,....it's a pleasure to speak with them. I don't like to call/email. I like my stuff online. Come on we are living in digital world now.Don't bad-mouth SCB and DBSV,... you have accounts inside too. You have not been able to get your hands on the recent Snowflake IPO. IF you have,... you wouldn't want to say never to buy stiff at IPO stage. I am not bad mouthing them. I am bad mouthing traditional sg brokerage. Very old fashion, inefficient and expensive compare to likes of FSM, interactive broker, robinhood, M1 finance and trading212. When you see the functionality, price of those brokerage, they are "wow" and wish we have access to such brokerage especially robinhood, M1 finance and trading 212 you really wish that there's an Asian equivalent. You can't believe POEMS in Singapore still insist on snail mail to update account stuff. Yes it's true. I got a shock. I never touch DBS Vickers anymore. Been using FSM for Singapore reits and interactive broker for all international stocks and sg stocks. Love FSM for being truly online. IPO again I don't buy into IPO stuff. Just wait for say June next year. I am sure snowflake will drop by then eh? About the conversion USD, is it open for normal people (non priority banking customer)? This post has been edited by Ramjade: Oct 15 2020, 01:18 AM |

|

|

Oct 23 2020, 08:45 PM Oct 23 2020, 08:45 PM

Return to original view | IPv6 | Post

#628

|

All Stars

24,431 posts Joined: Feb 2011 |

|

|

|

Nov 2 2020, 06:38 PM Nov 2 2020, 06:38 PM

Return to original view | IPv6 | Post

#629

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(TOS @ Nov 2 2020, 06:28 PM) Newest CIMB SG Fastsaver rate: 0.3% p.a. Just use stashaway to park your money. They do need passport to open account though.Effective from November onwards. https://www.cimb.com.sg/en/personal/help-su...ount-rates.html I believe it was 0.5% earlier. Maybank still stays at 0.1875% though. The spread is getting smaller. |

|

|

Nov 3 2020, 06:59 AM Nov 3 2020, 06:59 AM

Return to original view | IPv6 | Post

#630

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(TOS @ Nov 2 2020, 08:03 PM) Warm reminder. Stashaway Simple in SG is different from the one in Malaysia. I am not talking about stashaway simple my version.The one in Malaysia, also called Stashaway Simple is invested in Eastspring Islamic Income, a MMMF (I use it as well, but I deal directly with Eastspring via FSM). This is a true money market mutual fund. The one in Singapore is invested in 2 OCBC mutual fund. And if you look into the fact sheets and other documents of the 2 funds, a majority are invested in bonds, not truly cash funds (despite one of the names "Money Market Fund", which is misleading). https://www.stashaway.sg/faq/900000744806-h...ate-calculated/ So, technically the risk your bear is similar to that of bond's risk. That's unfortunately the only way to earn a mere "1.4% p.a." return. Anyway, Ramjade, can the Singapore version of Stashaway Simple function like a bank account? Say I can transfer directly from Stashaway Simple Singapore to my IBKR SG account? Is that possible? They invest in short term bonds. Correction. Unless 2008 happens again money is pretty safe. QUOTE This is an investment, so there is a level of risk, but it’s incredibly low. The StashAway Risk Index for StashAway Simple™ is 1.7%. That means you have a 99% chance of not losing more than 1.7% of your AUM in a given year. I have used those short bond funds before and I like it. If you are scared, go and input in yourself both the fund and you can see the result. The results speak for themselves. https://secure.fundsupermart.com/fsm/chart-centre-fund/ My personal favourite United Cl A SGD fund. I learnt from a Singaporean to use it as a pseudo high interest account. So to answer your question yes can be used a bank account. No. Unless you can stand long withdrawal time. Then yes. Stashaway SG -> SG banks -> IBKR This post has been edited by Ramjade: Nov 3 2020, 05:58 PM |

|

|

Nov 3 2020, 04:51 PM Nov 3 2020, 04:51 PM

Return to original view | IPv6 | Post

#631

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(Ziet Inv @ Nov 3 2020, 10:31 AM) Just wonder if it's normal for CIMB SG to take a while to revert the bank account opening application? Yes if you never fund it by 30 days. I already funded S$ 1,000 via transferwise and requested linkage from CIMB MY since Sunday (2 days ago) You must transfer money from CIMB MY (first time) This post has been edited by Ramjade: Nov 3 2020, 04:51 PM |

|

|

Nov 5 2020, 01:02 PM Nov 5 2020, 01:02 PM

Return to original view | IPv6 | Post

#632

|

All Stars

24,431 posts Joined: Feb 2011 |

|

|

|

Nov 26 2020, 12:52 AM Nov 26 2020, 12:52 AM

Return to original view | IPv6 | Post

#633

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(silverwave @ Nov 25 2020, 04:38 PM) Oops then mine is a mistake already, any idea if i can get the customer service to make the changes for me? Or when i get the verification call, i can tell them? Try contacting customer service. Some banks allow you to change online like DBS. Some banks want old fashion mail in forms.As long they don't cancel the whole application Interactive broker allow you to do it online. QUOTE(ken888 @ Nov 25 2020, 09:07 PM) Avoid CDP. Useless if you are not Singaporean/don't have sg address. Use FSM sg. Alternative just use tradestation international as suggested by polarbzearz.This post has been edited by Ramjade: Nov 26 2020, 12:52 AM polarzbearz and silverwave liked this post

|

|

|

|

|

|

Nov 26 2020, 03:51 PM Nov 26 2020, 03:51 PM

Return to original view | IPv6 | Post

#634

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(polarzbearz @ Nov 26 2020, 11:00 AM) Good to know! Guess they've encountered this enough Cause only US uses TIN. And this crappy put TIN thing came from US and then everyone thinks it's a good idea to track people's money. Hence continuation of the word TIN.I still don't understand why banks (not just Singapore, Hong Kong as well) don't just add some explanation on "TIN". A simply one liner that says "TIN is typically your income tax file/registration number blah blah" would have helped to eliminate confusions. |

|

|

Nov 26 2020, 04:21 PM Nov 26 2020, 04:21 PM

Return to original view | IPv6 | Post

#635

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(David_Yang @ Nov 26 2020, 04:13 PM) No, the Europeans also use. And they get their TIN a few days after they are born and will keep all their life. The baby not even need to be a citizen to be welcomed in the big family of taxpayers I meant the name TIN came from US system.It's called Taxpayer Identification Number. This post has been edited by Ramjade: Nov 26 2020, 04:22 PM |

|

|

Nov 27 2020, 12:11 AM Nov 27 2020, 12:11 AM

Return to original view | IPv6 | Post

#636

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(Takudan @ Nov 26 2020, 11:26 PM) I-I mean... I actually looked up to understand what's TIN when I was filling in forms No one reads FAQ except me. And I found https://ringgitplus.com/en/blog/personal-fi...nuary-2021.html https://www.freemalaysiatoday.com/category/...w-does-it-work/ ...And... I totally misunderstood that as "oh so we're getting a TIN at 2021" (not knowing that LHDN income tax number is our TIN lol) Maybe our government needs to standardise the terms used too? But true also, if they're spending so much human resource to explain to every silly Malaysian what TIN is, 1 additional FAQ at the bank website would've saved them so much time and money lol. The moment I know the account number, I made my transfer via TW and it arrived (before I was given CIMB SG Clicks access lol). I think you can send it anytime before 30 days elapse. Welcome to the dark side |

|

|

Dec 5 2020, 12:20 AM Dec 5 2020, 12:20 AM

Return to original view | IPv6 | Post

#637

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(TOS @ Dec 4 2020, 11:05 PM) Digital banks coming to SG in 2022. 4 winners announced today. Let's wait. You don't need to believe me. https://blog.seedly.sg/singapore-digital-bank-licenses/ And Ramjade, there is no evidence that the interest rate for digital banks will be similar to Big 3 in Singapore. In fact the seedly article suggests higher deposit rate for digital banks. (I remember you told me you once saw MAS require interest rate for digital banks to be no higher than the Big 3? Forgive me if I read it wrongly, but the message was something like that, I think.) A similar article in ST: https://www.straitstimes.com/business/banki...ou-need-to-know If you know the way SG govt play the game you will know the reasons. Come I tell you. 1) SG govt is stingy and don't want their citizen to depend on banks. They want their citizen to invest. 2) Interest rate is practically zero. If they do offer high interest, money need to come from somewhere. Even if got digital banks, can we open? Answer is likely no. This post has been edited by Ramjade: Dec 5 2020, 12:22 AM TOS liked this post

|

|

|

Dec 9 2020, 11:32 PM Dec 9 2020, 11:32 PM

Return to original view | IPv6 | Post

#638

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(corad @ Dec 8 2020, 03:53 PM) no, I already have a Maybank SG account. Foreign currency account meaning I'm able to deposit say USD and keep it as USD without converting into SGD. QUOTE(corad @ Dec 8 2020, 09:06 PM) if you mean the AML (Anti-Money Laundering) forms, then I'd say it's the same anywhere Maybank SG is a bit outdated. So just wait until borders are open.I've tried calling Maybank SG and was told it could be done in branch only ... but trying to see if there's a way I can do it online OR if another SG based bank has this service ? QUOTE(TOS @ Dec 8 2020, 05:12 PM) This is advanced stuff for me. Let me ping Ramjade polarzbearz. You can also ask others here. Wrong. I use DBS My Account. Keep only SGD10 inside and can received multicurrency. New and improved multicurrency account. Issue is I don't know how to move USD without incurring charges in SG. I know you can use cheques but digitally don't know.But one thing is certain, opening USD account in Singapore by a foreigner certainly involve tonnes of due diligence by the bank. |

|

|

Dec 10 2020, 01:02 AM Dec 10 2020, 01:02 AM

Return to original view | IPv6 | Post

#639

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(TOS @ Dec 9 2020, 11:44 PM) Suddenly something new come out. You need to be there physically. Subject to approval by banks. I went in when 1mdb saga was released. Waiting time took me around 3-4 hours just to open account.Never heard of DBS My account. Can Malaysian open for investment purposes? Better than CIMB SG and Maybank SG? I see from the requirement for foreigners only for work, study and some visas/permits. And it seems like there is $10 charges for inward remittance like Maybank SG. https://www.dbs.com.sg/personal/deposits/sa...unts/my-account Considering no income tax that time. And need to fork out SGD3k one shot. Sg USD movement not as good as HK. I know HKD can just move it like our IBFT. |

|

|

Dec 10 2020, 01:32 AM Dec 10 2020, 01:32 AM

Return to original view | IPv6 | Post

#640

|

All Stars

24,431 posts Joined: Feb 2011 |

|

| Change to: |  0.1812sec 0.1812sec

0.71 0.71

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 21st December 2025 - 08:16 AM |