QUOTE(TOS @ Jan 24 2022, 09:07 PM)

Just curious. Since Wise offers "virtual" bank accounts with multiple currencies, why the hassle of having to open a foreign currency account with CIMB SG?

Not to mention a foreigner opening a foreign currency account in a foreign country adds to multiple layers of complexity.

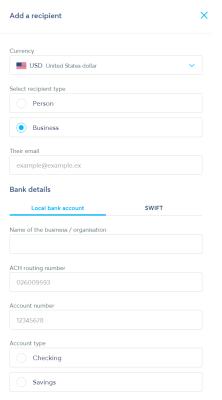

I try to figure out how to transfer money from Wise into my AmeritradeSG account but it looks like only accept saving or current account.Not to mention a foreigner opening a foreign currency account in a foreign country adds to multiple layers of complexity.

So I have to use wise to transfer into my CIMB SG account then wire transfer to my AmeritradeSG account?

And I also think I cannot wire transfer USD from my CIMB SG Foreign Currency Savings Account in USD to AmeritradeSG account. So in the end have to wire transfer money from my CIMB SG FastSaver Account in SGD to AmeritradeSG account.

This post has been edited by labtec: Feb 2 2022, 11:48 PM

Feb 2 2022, 11:28 PM

Feb 2 2022, 11:28 PM

Quote

Quote 0.0251sec

0.0251sec

1.20

1.20

6 queries

6 queries

GZIP Disabled

GZIP Disabled