if i have citibank account in malaysia, can i get the citibank branch here to open an account in singapore?

Opening a Bank Account in Singapore

Opening a Bank Account in Singapore

|

|

Aug 26 2019, 12:21 PM Aug 26 2019, 12:21 PM

Return to original view | Post

#1

|

Senior Member

1,556 posts Joined: Jan 2003 |

if i have citibank account in malaysia, can i get the citibank branch here to open an account in singapore?

|

|

|

|

|

|

Dec 27 2021, 10:51 AM Dec 27 2021, 10:51 AM

Return to original view | Post

#2

|

Senior Member

1,556 posts Joined: Jan 2003 |

Hi, after successfully open CIMB SG, are we able to apply for CIMB SG credit card?

|

|

|

Jan 1 2022, 12:30 PM Jan 1 2022, 12:30 PM

Return to original view | Post

#3

|

Senior Member

1,556 posts Joined: Jan 2003 |

just got my CIMB SG account approved as it show up in my CIMB MY account, and manage to transfer money to it.

will we get ATM card or online CIMB SG account? so far no email or sms from CIMB SG yet. |

|

|

Jan 1 2022, 05:02 PM Jan 1 2022, 05:02 PM

Return to original view | Post

#4

|

Senior Member

1,556 posts Joined: Jan 2003 |

|

|

|

Jan 2 2022, 11:47 PM Jan 2 2022, 11:47 PM

Return to original view | Post

#5

|

Senior Member

1,556 posts Joined: Jan 2003 |

QUOTE(thecurious @ Jan 1 2022, 05:16 PM) There is an online account. You should receive an email about it in a few days since you already funded the account. QUOTE(Ramjade @ Jan 1 2022, 09:08 PM) You want you need to request and pay sgd10 for it. I don't even bother. I never apply since my account opened 7 years ago. Thanks for the advice Not worth it as 1) their ATM machine is located at their branch only. And they have only one branch in Singapore. 2) I don't visit SG at all. Last was like 3 years ago. When I visit it, I use bigpay 3) I have no intention to withdraw my SGD or convert my USD back into SGD. Ask yourself, do you really need their card seeing that the account can fully be used online. If you feel you need the card, then pay for it lo. For me, the card got no perks hence I don't even bother applying. |

|

|

Jan 3 2022, 01:16 PM Jan 3 2022, 01:16 PM

Return to original view | Post

#6

|

Senior Member

1,556 posts Joined: Jan 2003 |

QUOTE Dear Customer We noticed that you have not performed one or both of the following to activate your new CIMB Singapore Bank account (Application Reference Number): • Transfer funds via FAST from your other personal Singapore Bank account in Singapore to your new CIMB Singapore Bank account • Provide valid documents required for account activation Your account will be activated within 1 business day if the documents submitted are in order and the initial deposit is received, subject to the Bank's approval. Otherwise, the account will be automatically closed within 30 calendar days from your application date. Note: We do not accept initial deposits from Remittance Agencies such as Wise, Western Union etc. Alternatively, should you wish to perform a funds transfer from your CIMB Malaysia account, simply link your new CIMB Singapore Bank account to your CIMB Malaysia Clicks Internet Banking. Thereafter, perform a transfer from your own CIMB Malaysia Account to activate the CIMB Singapore Bank account. Thank you once again for choosing CIMB Bank. CIMB Bank Berhad, Singapore Branch haiya... just receive email from CIMB SG and say missing transfer fund or document... but already transfer fund and provided my IC copy during application form submission... have to find out what is missing already... |

|

|

|

|

|

Jan 3 2022, 01:26 PM Jan 3 2022, 01:26 PM

Return to original view | Post

#7

|

Senior Member

1,556 posts Joined: Jan 2003 |

[quote=Ramjade,Nov 10 2021, 03:58 PM] See TOS reply above Basically that's it. Poor people are limited to CIMB Sg and Maybank SG. Unless you want to travel to SG and have SGD3k ready in cash. Then you have option to try luck for DBS bank account. If you want to travel DBS account out of question. If you are willing to travel, the steps below will help one to get a DBS bank account. This method might take few steps but will save you quite a lot of money going into the future. 1.. Fly into Singapore and undergo their quarantine if necessary. Now Malaysia can fly outside. Use this opportunity. 2. After finishing your quarantine, take MRT or bus to Marina bay financial center. 3. Go to DBS HQ and tell them you want to open DBS Multiplier account/My account (yes the name is called My account) together with DBS Vickers. Very important for you to mentioned DBS Vickers. This is the criteria for you to open account is Malaysian. Dbs vickers is their stock broker account. You don't need to use it or fund it also can. But if you want their account, you need a DBS Vickers account. Be prepared to wait 3-4 hours there. I waited 3-4 hours there. What is this DBS multiplier/My account? It's a Multicurrency account that you can hold yes 10 types of currency including USD. You can use it to received, hold and send USD. Tried and tested myself. Best of all you only pay USD10.00 for all incoming USD. Yup that's it. Why DBS My account? Dbs multiplier need to you to maintain SGD3000 at all time or else if it drop below SGD 3k, you will be charged I believed SGD5.00/month. Now with DBS My account I only keep SGD0.10 inside as there no minimum amount (stated in their T&C). True story. Didn't believed it until I tested it. More info here. https://www.dbs.com.sg/personal/deposits/sa...nts/my-account] What happen if they refuse to let you open My account? No issue. Just take whatever account they give you. But I thought you said to get My account. Yes. That's right. But most important is get account with DBS bank. After 6 months, you can open a DBS My account online and close your DBS multiplier and transfer all your SGD/USD into your new My account. I waited for 7 months before doing that. They mentioned in their terms and condition I believed need to wait 6 months before closing account Remember to ask for their DBS Debit visa card. This card lets you spend like a local. Which means if you have USD in your bank account, it will automatically use the USD account first before they use the SGD part. No additional charged. Alternative use Bigpay. 4. Now that's all set up, fly back to Malaysia. 5. Quarantine again in Malaysia if needed. 6. Once at home, open interactive broker account here. https://www.interactivebrokers.com/en/home.php. Make sure to fund it with at least SGD7.00. You can use the DBS account to fund the interactive broker via FAST transfer (SG version of Duitnow/IBFT). https://betterspider.com/funding-your-accou...ractivebrokers/ So that means you need about SGD3007 in total. Why interactive broker? It doesn't make any sense. Interactive broker give you the best exchange rate anywhere on the planet for all currency. It's spot rates (real time market rates without any markup) and best of all you only need to pay USD2.00/conversion up to USD 1,000,000. More than that you pay lesser. https://www.interactivebrokers.com/en/index.php?f=1590&p=fx My friend told me it's USD100,000 but interactive broker webpage mentioned USD1,000,000. Not sure who's right. Anyway don't have that kind of money. The rates you are getting will be way better that any money changer rate. It will make sense down the road. Continue reading on. Keep in mind interactive broker allow you one free withdrawal of currency in whatever currency you want to withdraw a month. More that that you pay. https://www.interactivebrokers.com/en/index...8#cash-movement 7. Open CIMB sg account. Full details here [url=https://ringgitfreedom.com/banking/opening-cimb-singapore-account-without-visiting-singapore-for-malaysians/]https://ringgitfreedom.com/banking/opening-cimb-singapore-account-without-visiting-singapore-for-malaysians/ [/url] For verification part to activate your CIMB Fastsaver you need to transfer SGD1k. So that means you need SGD4007 in total not SGD3007 as mentioned aboved. There's two way to pass their eKyc 1. Use your new DBS account and send SGD1000 over via FAST (the original way I used and the way it's intended) 2. Use CIMB MY (yes you need CIMB MY account) and send SGD1.00 into your CIMB SG account. Once you have SGD1.00 send use fintech like bigpay, TransferWise and Sunway money to transfer the remaining SGD999.00 Once account activated they will tell you via email and send over a bunch of codes for login via snail mail. Be patient. Wait like 2 weeks to 1 month. Now that you have all up and running, let's get to the fun part. How to get paid in USD and change it to Malaysin currency without losing like 4% eacv transaction and without losing additional money for intermediate bank agent transfer. Paid in USD -> DBS Multiplier/My account (only pay USD10.00. That's all) -> Now that you have USD in your DBS bank account -> initiate a USD transfer into Interactive broker via DBS remit for free. Make sure to notify interactive broker of incoming USD with the bank account number that match your DBS Bank account without dash every time you want to send USD into interactive broker. Make sure under DBS Account select send USD and receiving side USD. Money takes few hours to enter Interactive broker account. -> once money enter into Interactive broker, convert into SGD using interactive broker. Do not use any banks. -> Initiate a withdrawal to CIMB Sg -> Use CIMB SG to send money back to CIMB MY at money changer rate. I'm losing like 5% from currency conversion and credit card transaction fees.[/quote] Paid in USD -> Deposit into DBS Multiplier/My account -> Hold USD at no interest -> 1) Expense (USD) 2) transfer back to Malaysia as shown above. If you want to hack your USD to get some interest, I recommend researching pseudo bond stocks in US. Here are a few. Google, Amazon, apple, Microsoft and Canadian railway. By diverting USD into those stocks, you get paid to wait until you need to use the USD. Keep in mind this is not guaranteed. Hence you can lose your money. Use the dbs visa debit card provided to fund your expenses. Remember to pay your tax to Malaysian govt if you don't want any problem You are welcome. You can do the above while waiting for 2022 foreign sourced tax to be passed. Forget borderless account for now. Unless Malaysian govt decided to relax restrictions, new user ain't going to get access to borderless account. No need for student or working pass for DBS. Black and white on DBS page need. But if the above steps still hold true as when I opened my account, no need. Forget UOB/OCBC in sg. Unless you are loaded then yes, they will welcome you. If you are not, they won't bother. Before 1mdb, we Malaysians can walk into any SG banks, open account and no questions asked or rejected. But since 1MDB, we are on restricted list. That is why we can't have nice things. See above steps. If it still hold true, then yes. The above steps are what my own steps back in the days like 5-7 years ago. [/quote] nice! thanks for the sharing IanMok and anonymous552235 liked this post

|

|

|

Jan 23 2022, 12:52 PM Jan 23 2022, 12:52 PM

Return to original view | Post

#8

|

Senior Member

1,556 posts Joined: Jan 2003 |

After I got my CIMB SG FastSaver Account, I also open a foreign currency saving account in CIMB SG through the eApplication.

May I know does this foreign currency saving account has minimum deposit to maintain to avoid the monthly charges? And seems like I cannot just direct transfer money from CIMB MY account to this CIMB SG foreign currency saving account. Anyone try use wise to transfer USD to CIMB SG foreign currency saving account before? |

|

|

Jan 24 2022, 09:01 PM Jan 24 2022, 09:01 PM

Return to original view | Post

#9

|

Senior Member

1,556 posts Joined: Jan 2003 |

QUOTE(TOS @ Jan 23 2022, 01:33 PM) I have not opened foreign currency saving account with CIMB SG before, but these should help. https://www.cimb.com.sg/en/personal/banking...gs-account.html https://www.cimb.com.sg/en/personal/help-su...s/accounts.html QUOTE(CoolStoryWriter @ Jan 24 2022, 01:31 PM) Hi to answer your question refer this: https://nomoneylah.com/2021/09/10/singapore-bank-account/ so looks like the minimum deposit to maintain is USD1000. I just manage to wire transfer, and it's very expansive... cost me RM10 + USD25...Btw it took me around 1 month to set up everything. I'll have to learn how to use wise to transfer money to my CIMB SG account |

|

|

Jan 31 2022, 05:13 PM Jan 31 2022, 05:13 PM

Return to original view | Post

#10

|

Senior Member

1,556 posts Joined: Jan 2003 |

QUOTE(TOS @ Jan 24 2022, 09:07 PM) Just curious. Since Wise offers "virtual" bank accounts with multiple currencies, why the hassle of having to open a foreign currency account with CIMB SG? oh, I'm not aware of it. will need to find out how to setup and transfer money to my SF Ameritrade account.Not to mention a foreigner opening a foreign currency account in a foreign country adds to multiple layers of complexity. QUOTE(lwlim @ Jan 26 2022, 10:22 PM) Hi, may I know how do you plan to transfer out the fund from your CIMB foreign currency saving account in future? I have searched and the only option seems to be using demand draft which is restricted to US and Singapore bank. i didn't transfer fund out yet. |

|

|

Feb 2 2022, 11:28 PM Feb 2 2022, 11:28 PM

Return to original view | Post

#11

|

Senior Member

1,556 posts Joined: Jan 2003 |

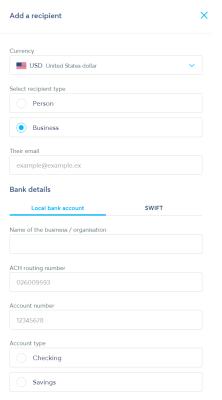

QUOTE(TOS @ Jan 24 2022, 09:07 PM) Just curious. Since Wise offers "virtual" bank accounts with multiple currencies, why the hassle of having to open a foreign currency account with CIMB SG? I try to figure out how to transfer money from Wise into my AmeritradeSG account but it looks like only accept saving or current account.Not to mention a foreigner opening a foreign currency account in a foreign country adds to multiple layers of complexity. So I have to use wise to transfer into my CIMB SG account then wire transfer to my AmeritradeSG account?

And I also think I cannot wire transfer USD from my CIMB SG Foreign Currency Savings Account in USD to AmeritradeSG account. So in the end have to wire transfer money from my CIMB SG FastSaver Account in SGD to AmeritradeSG account.

This post has been edited by labtec: Feb 2 2022, 11:48 PM |

|

|

Feb 4 2022, 10:22 AM Feb 4 2022, 10:22 AM

Return to original view | Post

#12

|

Senior Member

1,556 posts Joined: Jan 2003 |

QUOTE(TOS @ Feb 3 2022, 12:03 AM) I don't know about TD Ameritrade SG. https://www.tdameritrade.com.sg/why-td-amer...nd-funding.html dwRK and Ramjade working in banking is it? seems like expert But I am aware it has harsh funding conditions than other brokers like IBKR. I don't see any options for FAST transfer listed in the link above. So maybe you need to pay by cheque or wire. Let me ping dwRK and Ramjade for help. QUOTE(Ramjade @ Feb 3 2022, 01:03 AM) TD doesn't let you transfer USD from wise. They mentioned only accept DBS bank. ya lor, I read that also... Maybe I have to travel to SG to open a DBS account in US currency, which I can directly transfer money to AmeritradeSG account without going through currency conversion.You can try with ACH or Giro transfer. But most likely money will be returned to you. Give it a try and let us know the result. Last time I used wised to transfer money to IBKR, I use ACH transfer. This post has been edited by labtec: Feb 4 2022, 10:26 AM |

|

|

Feb 20 2022, 12:49 PM Feb 20 2022, 12:49 PM

Return to original view | Post

#13

|

Senior Member

1,556 posts Joined: Jan 2003 |

|

|

|

|

|

|

Apr 10 2022, 04:01 PM Apr 10 2022, 04:01 PM

Return to original view | Post

#14

|

Senior Member

1,556 posts Joined: Jan 2003 |

Just checking, do we need to deposit money to cimb sg account once a year to avoid account become inactive like in Malaysia?

|

|

|

Apr 11 2022, 10:52 AM Apr 11 2022, 10:52 AM

Return to original view | Post

#15

|

Senior Member

1,556 posts Joined: Jan 2003 |

|

|

|

May 17 2022, 12:18 AM May 17 2022, 12:18 AM

Return to original view | Post

#16

|

Senior Member

1,556 posts Joined: Jan 2003 |

Just sharing on reply from CIMB SG

We wish to inform that an account will turn into inactive status when there are no deposits or withdrawals performed by the account holder. Saving account will turn inactive after 36 months. To activate the dormant account, kindly contact us at the hotline for assistance. Our Customer Service Officers will be able to assist after a simple phone verification |

| Change to: |  0.1733sec 0.1733sec

0.49 0.49

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 28th November 2025 - 02:29 PM |