Outline ·

[ Standard ] ·

Linear+

Opening a Bank Account in Singapore

|

dwRK

|

Oct 26 2019, 09:24 AM Oct 26 2019, 09:24 AM

|

|

QUOTE(Jordy @ Oct 26 2019, 09:17 AM) Why Transferwise? The fee is high for Transferwise though. A simple comparison between Instarem and Transferwise: T: MYR 6,176.94 : SGD 2,000.00 I: MYR 6,172.17 : SGD 2,000.00 Bigpay? |

|

|

|

|

|

dwRK

|

Sep 14 2020, 02:13 PM Sep 14 2020, 02:13 PM

|

|

QUOTE(TOS @ Sep 14 2020, 01:29 PM) How come I withdraw 500 SGD from IBKR but only get 490 SGD? What is going on?  mbb sg charges sgd10 |

|

|

|

|

|

dwRK

|

Sep 14 2020, 03:44 PM Sep 14 2020, 03:44 PM

|

|

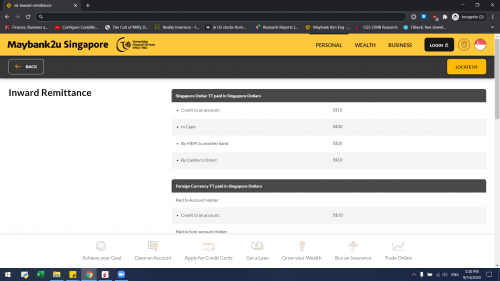

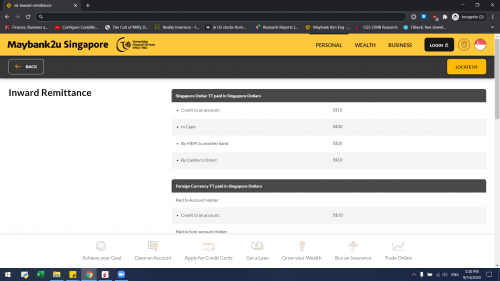

QUOTE(TOS @ Sep 14 2020, 03:31 PM) I think it is this: https://www.maybank2u.com.sg/en/bank-charge...remittance.page?  No wonder 10 SGD. Terrible. Should have read their charges table before remittance. yeah inward receiving std fee sgd10...some banks like cimb waived it |

|

|

|

|

|

dwRK

|

Sep 14 2020, 03:53 PM Sep 14 2020, 03:53 PM

|

|

QUOTE(TOS @ Sep 14 2020, 03:46 PM) But from what I see, CIMB SG remittance outward is 10 sgd minimum + 30 SGD cable fee + agent fee, so they recoup the cost lost from inward remittance from their outward remittance service. yeah they whack you outbound... |

|

|

|

|

|

dwRK

|

Sep 14 2020, 04:38 PM Sep 14 2020, 04:38 PM

|

|

QUOTE(TOS @ Sep 14 2020, 04:20 PM) Now I am thinking of closing my account. The cost is just not justified for small-cap investors like me. The charges and transaction costs can easily offset the interest earned from putting money in the bank. Might as well forgo the charges/transaction costs and let IBKR earned interest from my "small" leftover money. Previously, I was thinking that for online transfers no transaction costs, the interest earned is greater than leaving the money idle in IBKR. Now, one single transfer can take up circa 40-50 SGD. If I buy 2-3 lots of stocks, around 400-700 SGD (assume share price of 2-3 SGD/share. That's already 7-10% of cost for me. Too great to bear. I guess will wait for 6 months, then close the account. Haven't done detailed cost-benefit analysis. Hope to learn more from gurus here. You guys must have large capitals!  just leave cash standby with the brokers... moving $ cost $... |

|

|

|

|

|

dwRK

|

Sep 14 2020, 06:18 PM Sep 14 2020, 06:18 PM

|

|

QUOTE(TOS @ Sep 14 2020, 04:50 PM) So, you recommend opening CIMB SG account? 1k SGD is still okay, but already the maximum I can fork out. (That's already 3k MYR, a month's salary for a fresh grad in M'sia.) Lesson learnt: 1. Don't be too greedy. A few cents of interest can be forgone. 2. Look before you leap. Always do homework first! Check bank rates and charges before you apply for an account. overall zero sum game lah... if lots of incoming...cimb for now better because fee waived, but until when dunno. if lots of outgoing... looks like mbb better... now you think cimb better maybe down the road mbb better...or vice versa... who knows man... don't sweat the small stuff ah grow account to 1 mil... then all these fees inconsequential... can pay runner do all the shits for you...  |

|

|

|

|

|

dwRK

|

Sep 14 2020, 08:48 PM Sep 14 2020, 08:48 PM

|

|

QUOTE(tadashi987 @ Sep 14 2020, 08:30 PM) whack you outbound does apply for below? 1) transfer to IBKR SG CITIBANK 2) Transfer back to CIMB MY AFAIK, (1) is not outbound so there is no fee being charged and for (2)? not sure because i have never transfer back MYR before (2) got promo... no fees I mentioned in ibkr thread long ago...lowest cost to get funds back is ibkr sgd to cimb sg...then cimb sg to cimb myr... good fx rates zero fees |

|

|

|

|

|

dwRK

|

Sep 15 2020, 10:24 AM Sep 15 2020, 10:24 AM

|

|

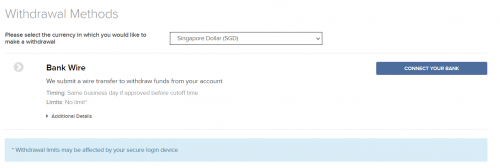

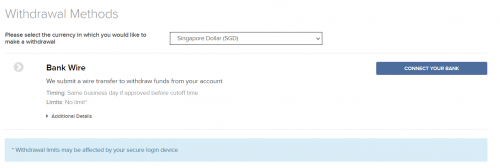

QUOTE(TOS @ Sep 15 2020, 07:34 AM) Thanks. For the link, the problem is there is no GIRO method available for me. But if I select HKD then there is GIRO method available.  And since one withdrawal per month is free, GIRO to HKD and redeposit back to IBKR (which is free) then convert to SGD is actually cheaper than opening a SG bank account. If you don't consider forex rate fluctuation, the currency conversion cost is only around 15.5 HKD or 2.6 SGD and since no transaction cost for HK banks, this is a more affordable method (2.6 x 2 = 5-6 SGD). Another good news is I will have 6k HKD (around 1k SGD) stipend coming from my university at the end of this month, so maybe some fresh capital to fund my IBKR account. like I said minimize xfer funds around ah... in the U.S.... xfer bank a to bank b own account also $25 wire fee... Malaysia banking so cheap in comparison... lol only xfer if you need to use it...cimb sgd-myr method looks to be cheapest for now |

|

|

|

|

|

dwRK

|

Sep 15 2020, 10:26 AM Sep 15 2020, 10:26 AM

|

|

QUOTE(Ramjade @ Sep 15 2020, 08:45 AM) Your screenshot is correct already. Don't know why you kena charge. Unless you didn't convert your money to SGD before you transfer. he withdrew in sgd ah...got charged inwards remittances fee sgd10 by mbb.sg |

|

|

|

|

|

dwRK

|

Sep 15 2020, 10:37 AM Sep 15 2020, 10:37 AM

|

|

QUOTE(Ramjade @ Sep 15 2020, 10:31 AM) He might make and mistake and say withdraw USD to SGD. Hence got charge. Cause I withdraw SGD to cimbbsg and no charge. I make sure I have the required SGD in my IB before I make the transfer. no lah bro... your cimb.sg inward remittance fee waived by bank mbb.sg still charge sgd10 fee... if usd fee lagi teruk higher... edit: his bank screen shot shows sgd500 remittance from ibkr but account credit for sgd490... he did everything correct except open wrong bank account... lol (sorry tos...) This post has been edited by dwRK: Sep 15 2020, 10:51 AM |

|

|

|

|

|

dwRK

|

Sep 15 2020, 05:03 PM Sep 15 2020, 05:03 PM

|

|

QUOTE(TOS @ Sep 15 2020, 04:46 PM) I now have an interesting question. Which of the following is cheaper? 1. Deposit HKD from Hang Seng Bank to IBKR account, then convert to SGD within IBKR. 2. Deposit HKD from Hang Seng Bank to Maybank SG bank account (using Instarem) then transfer to IBKR using FAST So, basically I am asking for a given amount of HKD, which method, 1 or 2 gives me more SGD in the end? Is Instarem's rate + cost better than IBKR's own internal FX conversion? 1 |

|

|

|

|

|

dwRK

|

Sep 15 2020, 05:48 PM Sep 15 2020, 05:48 PM

|

|

QUOTE(TOS @ Sep 15 2020, 05:05 PM) Thank you. Do you consider transaction fee as well? It's 15.5 HKD for me per transaction. Rate should be good. you pay an outbound fee regardless 1 or 2 right?...with instarem you're paying additional commission... for any meaningful amount, 1 is better |

|

|

|

|

|

dwRK

|

Sep 15 2020, 06:00 PM Sep 15 2020, 06:00 PM

|

|

QUOTE(TOS @ Sep 15 2020, 04:42 PM) Good news. I can confirm that there are NO charges for Instarem transfer of money to Maybank SG. I get exactly the amount as stated in Instarem. they doing a local deposit... that's why |

|

|

|

|

|

dwRK

|

Sep 16 2020, 04:41 PM Sep 16 2020, 04:41 PM

|

|

QUOTE(kart @ Sep 16 2020, 10:00 AM) Those with Singapore savings account can use FAST to transfer fund (denominated in SGD) to Citibank N.A.. It is just weird that Interactive Brokers cannot use FAST to transfer fund (denominated in SGD) from Citibank N.A., to the Singapore savings account of IBKR customers. Citibank N.A. Singapore should be Singapore branch of Citibank, so local fund transfer should be able to be performed, without Telegraphic Transfer. tt is universal ah...ibkr as a big Corp probably has standardized and automated withdrawal using it... fast is maybe just sg specific... they not even charging for withdrawals unlike most brokers... |

|

|

|

|

|

dwRK

|

Sep 16 2020, 04:50 PM Sep 16 2020, 04:50 PM

|

|

QUOTE(TOS @ Sep 16 2020, 04:27 PM) Thanks for confirmation. I guess I need to email IBKR to look into this possibility. As dwrk mentioned before, though CIMB Fastsaver SG exists for the moment, there is a chance that with the low-rate environment persisting, CIMB may start to impose charges on inward remittance. Currently I think they earn more from NII, as their loans in SGD are around 3%-3.5% but they pay interest of around 0.5-1%. It makes me wonder, apart from moving money back and forth between IBKR and an SG bank account, are there any other reasons one would need to maintain an SG bank account. What if CIMB SG starts charging say 10 SGD for each inward remittance, and IBKR hasn't made FAST available yet, so now it's a one-way communication (SG bank -> IBKR but not vice versa), will you guys still maintain an SG bank account? Just a thought question. you over thinking too much liao ah...  enjoy while it last... don't sweat what you cannot control  edit: imho keeping an offshore account gives you some flexibility in moving/managing funds...not always about saving money... This post has been edited by dwRK: Sep 16 2020, 05:14 PM |

|

|

|

|

|

dwRK

|

Sep 16 2020, 07:03 PM Sep 16 2020, 07:03 PM

|

|

tos very simple... do we need an sg, hk or other offshore account? 100% honest answer is no

imho ppl who want to open sg account because 1) easy/backup 2) bypass bnm scrutiny 3) save some fx spread and xfer fees

#3 only came about lately because more US brokers setting shop in sg, and banks having promo and people just wanna save every penny

|

|

|

|

|

|

dwRK

|

Sep 16 2020, 08:30 PM Sep 16 2020, 08:30 PM

|

|

QUOTE(Ramjade @ Sep 16 2020, 07:20 PM) For me honestly yes. I need it. Cause how am I going to hold my money if I don't have a bank account? I am certainly not going to hold RM in Malaysia and watch it depreciate. long time ago Malaysia dun have fca...so only option is go to Singapore if wanna hold any foreign currency but nowadays got fca...so don't really need a Singapore account... I'm sure your Malaysian bank has fca, right? you just want to do it in Singapore... |

|

|

|

|

|

dwRK

|

Sep 16 2020, 08:49 PM Sep 16 2020, 08:49 PM

|

|

QUOTE(Ramjade @ Sep 16 2020, 08:33 PM) FCA and convert at bank's rate? No thank you. like I said...it's a want...not a need... some fca allow 3rd party transfer so use tw send back to yourself lor...but I forgot which bank liao...it was some time ago... |

|

|

|

|

|

dwRK

|

Sep 16 2020, 10:06 PM Sep 16 2020, 10:06 PM

|

|

tos I got friends and colleagues last time every year or so go sg holiday and do banking... this is before internet/online banking... lol anyways sg is easy to open account, and easy take a bus trip down to settle any issues...sg is a financial hub, lots of expat, so not likely gonna be problem with mas lah fca interest rates are terrible because the underlying is also terrible... actual dollar rates is 0%, sgd is 0.5%... how can fca give more? ppl dunno just assume fca = bad rate... which is not true however I must warn some local fca don't allow 3rd party xfer...have to check and be careful...last time I asked around some banks their fca chekai one...can only xfer from own account internally using their fx rates...so those you avoid lah... as for bnm scrutiny... ppl just wanna avoid... bnm has lower reporting limits so potentially more paperwork and fear of transfer to overseas being rejected... anyways I'm all for having an offshore account for more flexibility. do what you must...

|

|

|

|

|

|

dwRK

|

Sep 16 2020, 10:19 PM Sep 16 2020, 10:19 PM

|

|

QUOTE(Ramjade @ Sep 16 2020, 10:09 PM) Reason for not using malaysia or sg banks for FCA. Very lousy conversion for forex rate. Banks easily eat up like 3% each time convert. that's why my warning... they don't allow 3rd party xfer...force you to use their bad rates... but some do allow... so you can still use tw/instarem/bp to convert... |

|

|

|

|

Oct 26 2019, 09:24 AM

Oct 26 2019, 09:24 AM

Quote

Quote

0.1583sec

0.1583sec

0.33

0.33

7 queries

7 queries

GZIP Disabled

GZIP Disabled