QUOTE(SkyHermit @ Aug 20 2021, 12:20 PM)

Thanks for the info.

CIMB seem convenient as we can open online provided we have CIMB MY already.

Just found out about this "S$ iSAVvy Savings Account".

Will download and fill up the form and go to the selected branches to apply

Edited :

Regarding the "S$ iSAVvy Savings Account",

it is still the same Maybank card we use in Malaysia right?

We log in to our Maybank app, normally got basic account, and then M2u savers, and now I will have a 3rd account called "S$ iSAVvy Savings Account". And I can just move the money, say from M2U saver to this "S$ iSAVvy Savings Account" through the Maybank app?

Since I have to deposit SGD $500 within 30 days from the date of account opening.. I assume I can just say, transfer RM1600 from M2u savers to that Savvy account

No. Different card. You will get this card.CIMB seem convenient as we can open online provided we have CIMB MY already.

Just found out about this "S$ iSAVvy Savings Account".

Will download and fill up the form and go to the selected branches to apply

Edited :

Regarding the "S$ iSAVvy Savings Account",

it is still the same Maybank card we use in Malaysia right?

We log in to our Maybank app, normally got basic account, and then M2u savers, and now I will have a 3rd account called "S$ iSAVvy Savings Account". And I can just move the money, say from M2U saver to this "S$ iSAVvy Savings Account" through the Maybank app?

Since I have to deposit SGD $500 within 30 days from the date of account opening.. I assume I can just say, transfer RM1600 from M2u savers to that Savvy account

https://www.maybank2u.com.sg/en/personal/ca...debit-card.page?

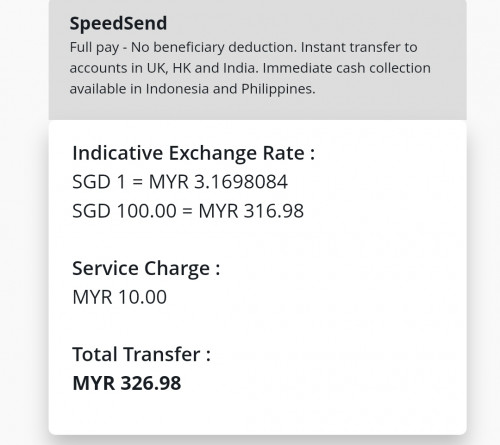

It's different app. Cannot use Malaysian app for sg Maybank. Do not use Malaysian banks to transfer money to sg unless you like to give 3-5% free money to banks. Using Malaysian banks are expensive. Use fintech.

You have to use bank draft for opening account. No direct transfer. Direct transfer only for CIMB sg. That one also you transfer only RM1.00. Cause when you apply for account, no account number yet.

For more info on opening sg bank account, refer here.

https://ringgitfreedom.com/banking/opening-...for-malaysians/

Aug 20 2021, 04:08 PM

Aug 20 2021, 04:08 PM

Quote

Quote

0.0255sec

0.0255sec

0.81

0.81

6 queries

6 queries

GZIP Disabled

GZIP Disabled