QUOTE(Ramjade @ Sep 15 2020, 10:31 AM)

He might make and mistake and say withdraw USD to SGD. Hence got charge. Cause I withdraw SGD to cimbbsg and no charge. I make sure I have the required SGD in my IB before I make the transfer.

No mistake is done. I have around 720 SGD left in my IBKR SGD cash account originally, so deduct 500 SGD and around 200 still left in my account, IBKR displayed it correctly (now around 200 SGD left in my account as displayed). I have no USD cash, any HKD and SGD with the lion's share in SGD.

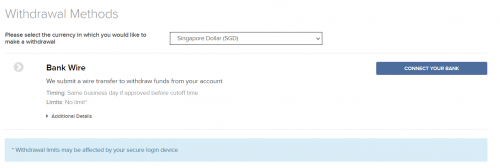

The problem falls on IBKR's side. I can't understand why remittance from SGD account to another SGD bank account in Singapore needs Telegraphic Transfer when FAST, GIRO or other methods are available. Either they collude with banks to allow them to earn more fees or they are outdated. More so when they already have offices in Singapore, I can't imagine they still need old fashioned-wire method to remit money around.

QUOTE(dwRK @ Sep 15 2020, 10:37 AM)

no lah bro...

your cimb.sg inward remittance fee waived by bank

mbb.sg still charge sgd10 fee... if usd fee lagi teruk higher...

edit: his bank screen shot shows sgd500 remittance from ibkr but account credit for sgd490... he did everything correct except open wrong bank account... lol (sorry tos...)

Yes, this sentence sums up everything.

QUOTE

edit: his bank screen shot shows sgd500 remittance from ibkr but account credit for sgd490... he did everything correct except open wrong bank account... lol (sorry tos...)

No need to feel sorry. My stupid mistake. I own up to it without blaming anyone.

Can anyone advise on next step to close Maybank SG account?

I have a few options now, deadline is by this Friday. (Friday is the time deadline when I need to fully fund my account with 500 SGD, or else 2 SGD monthly charge begins, I think).

1. Transfer back 480 SGD to IBKR, leave the mandatory 10 SGD to the "suicide" account. Basically I need to maintain at least 10 SGD in my account. So, for this option, I will let the 10 SGD to be deducted 2 SGD per month until 0, then 6 months later, account will be closed. Hopefully no more charges. If I choose to close account now, 30 SGD will be charged on top of all other fees (if any).

Total cost for this method is 20 SGD, if no other fees are charged. (10 SGD deducted when 500 SGD is remitted inward, then again 10 SGD deducted for mandatory leftover balance.)

2. Top up around 10-20 SGD to my current Maybank account to get the full 500 SGD figure to avoid the 2 SGD monthly charge for sub-500 account balance. I can only top-up from Instarem/Transferwise, but don't know if there are any charges for remittance if I top-up using instarem/transferwise (from MYR in Maybank Malaysia to SGD, Maybank SG).

dwrk or other sifus.

3. Leave the account as it is and bear with 2 SGD per month deduction.

As for CIMB SG, I need to know:

1. Will there by any monthly charges for below 500 SGD balance or any specified amount? (From what I see in the website, there is no monthly fall-below fees).

2. If I need to close my CIMB SG account, are there any penalty/charges (for 2 cases: within 6 months (or any pre-defined early account closure period) AND after the account closure period)?

3. Just to double confirm, will there be any charges from CIMB SG (or IBKR, for that matter) for the following transfer of money?

a. Maybank Malaysia (my malaysia bank account) -> CIMB SG using instarem/transferwise

b. CIMB SG -> IBKR SG Citibank NA account

c. IBKR SG Citibank NA account -> CIMB SG

d. CIMB SG -> Hong Kong Hang Seng Bank (using Transferwise/Instarem or other feasible methods, as advised by sifus here).

e. Hong Kong Hang Seng Bank -> CIMB SG (using Transferwise/Instarem or other feasible methods, as advised by sifus here).

Any form of cost-benefit analysis is much appreciated. Thanks everyone.

This post has been edited by TOS: Sep 15 2020, 11:22 AM

Sep 14 2020, 08:55 PM

Sep 14 2020, 08:55 PM

Quote

Quote

0.0170sec

0.0170sec

0.34

0.34

6 queries

6 queries

GZIP Disabled

GZIP Disabled