All stocks dip now.. another round of blood wash..

Any clue?

US stock discussion v2

US stock discussion v2

|

|

Dec 30 2009, 11:25 PM Dec 30 2009, 11:25 PM

|

Senior Member

1,345 posts Joined: Sep 2009 |

All stocks dip now.. another round of blood wash..

Any clue? |

|

|

|

|

|

Dec 30 2009, 11:41 PM Dec 30 2009, 11:41 PM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

look like USD recovering is pushing the commodities and stock downwards.

|

|

|

Dec 31 2009, 12:33 AM Dec 31 2009, 12:33 AM

|

All Stars

10,125 posts Joined: Aug 2007 |

We had 6 days of up, 2 days of down (including tonight), it seems pretty normal pullback to me.

Just buy this dip! TCK is getting attractive.. come to papa! Update: Pulled the trigger: 1000 TCK 35.70 SL:35.60 Also, got some FUQI at 17.90 during opening before the POP up. Hopefully, we'll get to 19. This post has been edited by danmooncake: Dec 31 2009, 01:05 AM |

|

|

Dec 31 2009, 01:00 AM Dec 31 2009, 01:00 AM

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

yup, those poor put option buyers, not sure if they gonna do another put option buying for this quarter or not my options play is more for medium term holding (clf), i ok to take the risk, i think still can up, since int rate very low so dun try options unless u wanna have / wanna get some experience earnings season is coming soon, preparing to exit some stock, just before their announcement if earnings sux, then can meet mr bear? who knows?

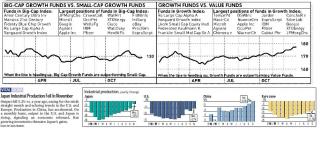

lots of u like unit trust? here r some info to share & some idea on its type

» Click to show Spoiler - click again to hide... «

|

|

|

Dec 31 2009, 01:09 AM Dec 31 2009, 01:09 AM

|

All Stars

10,125 posts Joined: Aug 2007 |

QUOTE(sulifeisgreat @ Dec 31 2009, 01:00 AM) earnings season is coming soon, preparing to exit some stock, just before their announcement Earnings won't suck for Q4 because the guidance are so low anyway. With year end holiday purchases, the retail sector will get a huge boost up as with credit cards like Mastercard and Visa. Buy 'em on pullback. Definitely winners!if earnings sux, then can meet mr bear? who knows? This post has been edited by danmooncake: Dec 31 2009, 01:10 AM |

|

|

Dec 31 2009, 01:15 AM Dec 31 2009, 01:15 AM

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

QUOTE(danmooncake @ Dec 31 2009, 01:09 AM) Earnings won't suck for Q4 because the guidance are so low anyway. With year end holiday purchases, the retail sector will get a huge boost up as with credit cards like Mastercard and Visa. Buy 'em on pullback. Definitely winners! tat is real good |

|

|

|

|

|

Dec 31 2009, 01:21 AM Dec 31 2009, 01:21 AM

|

All Stars

10,125 posts Joined: Aug 2007 |

This is a bullish call for Oil:

http://finance.yahoo.com/news/Crude-and-ga...3&asset=&ccode= Loading up ERX on this pullback. |

|

|

Dec 31 2009, 01:35 AM Dec 31 2009, 01:35 AM

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

|

|

|

Dec 31 2009, 04:10 AM Dec 31 2009, 04:10 AM

|

All Stars

10,125 posts Joined: Aug 2007 |

Update:

Damnn...forgot my SL TCK 35.60 kicked in. Tried again: 35.45, trailing stop 5% this time. Closing update: Dow 10548.14 +2.73 +0.03% Nasdaq 2291.28 +2.88 +0.13% S&P 500 1126.41 +0.22 +0.02% Looks green but we got a flat day. I was expecting more pullback but not enough bad news to drive this market down. This post has been edited by danmooncake: Dec 31 2009, 05:09 AM |

|

|

Dec 31 2009, 02:18 PM Dec 31 2009, 02:18 PM

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

here we r mali mali Stocks Mostly Flat In Sleepwalk Toward 2009's End Stocks treaded water Wednesday, moving little up or down as the indexes finished mostly flat. The Nasdaq clawed its way to a 0.1% gain. The Dow and the S&P 500 were fractionally up. The NYSE composite slipped 0.2%. Volume was up slightly on both major exchanges. While the market hasn't found consistent traction in months, the major indexes have recently used the dead time to do a little repair work on their charts. By avoiding heavy-volume declines and inching to new highs, the indexes have distanced themselves from earlier distribution days. A distribution day involves a significant loss in a major index in higher volume. It points to institutional selling. Yet the market also hasn't shown much accumulation. The Nasdaq have the best Accumulation/Distribution Ratings among indexes, and those are neutral or near neutral. On the plus side, the ratio of new highs to new lows has been strong of late. This month's combined new highs on the NYSE and Nasdaq are averaging about 315 daily vs. fewer than 20 new lows a day. Economic reports also are tilting to the positive side. On Wednesday the Chicago purchasing managers index for December swept past expectations as it notched its best mark since January 2006. But that report did little to boost the market. The indexes moved up for about 10 minutes on the news and then slipped back to sleepwalking mode. Among top-rated stocks, there were few moves in big trade. Deckers Outdoor (DECK) leapt 4% in double its usual volume as it cleared a two-month consolidation. On the downside, diet products provider Medifast (MED) fell 10% in triple volume. According to SEC documents, Chief Executive Michael McDevitt sold 30,000 shares on Monday — or about 9% of shares he beneficially owns. Such sales aren't necessarily a red flag because there may be personal reasons for a company executive to sell shares. But it can create nervousness. Another possible explanation is that one or more institutional investors are locking in gains for the year. Medifast jumped 450% in 2009 through Wednesday. Cloud-computing company Salesforce.com (CRM) fell 1% in fast trade, ending a seven-session win streak. It remains 9% past a 67.82 buy point after a Dec. 18 breakout. Ultimately every uptrend is about leadership. In the past five weeks, at least 45 stocks with respectable fundamentals have broken out. How have they done? Many are up from buy points by single-digit percentages. A few are up smartly, including China Agritech (CAGC), up 32%; Warner Chilcott (WCRX), up 16%; and American Superconductor (AMSC), up 15%. do drink & drive » Click to show Spoiler - click again to hide... «

|

|

|

Dec 31 2009, 10:51 PM Dec 31 2009, 10:51 PM

|

All Stars

10,125 posts Joined: Aug 2007 |

Happy New Year Everyone!! Shall we drink and trade and the same time? |

|

|

Dec 31 2009, 11:19 PM Dec 31 2009, 11:19 PM

|

Senior Member

1,345 posts Joined: Sep 2009 |

Happy new year 2010~!

another half an hour to step to the new decade. yupe.. drink and trade together.. |

|

|

Jan 1 2010, 12:32 AM Jan 1 2010, 12:32 AM

|

All Stars

10,125 posts Joined: Aug 2007 |

QUOTE(epalbee3 @ Dec 31 2009, 11:19 PM) Happy new year 2010~! So as long you don't get drunk and accidentally pressed the wrong buttons at your computer terminal, eg. BUY instead of SELL or vice-versa or input in the wrong price! LOL!! another half an hour to step to the new decade. yupe.. drink and trade together.. Anyway, tonight we got low volume. Currently more sellers than buyers and we're pulling back a bit despite much better unemployment claims numbers and energy prices are actually higher. This low volume itself is a small dip and could be good if you want to start a small position. I'm ending my shift early tonight and may not be around to post closing update. Anyway, wish everyone here a very HAPPY and SAFE NEW YEAR!! Good luck to all! This post has been edited by danmooncake: Jan 1 2010, 01:10 AM |

|

|

|

|

|

Jan 1 2010, 10:02 AM Jan 1 2010, 10:02 AM

|

Senior Member

1,120 posts Joined: Jul 2006 |

HAPPY NEW YEAR 2010!

May new year come with big bull or big bear. lolz. As long as there is a trend, we all make money. |

|

|

Jan 2 2010, 04:14 AM Jan 2 2010, 04:14 AM

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

|

|

|

Jan 4 2010, 11:17 AM Jan 4 2010, 11:17 AM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

Beware traders/investors.

Market will be back FULL FORCE this week. Expect good movement from today onwards. Happy 2010 and may all of our stocks earn good money. |

|

|

Jan 4 2010, 11:35 AM Jan 4 2010, 11:35 AM

|

All Stars

17,021 posts Joined: Jan 2005 |

Happy New Year guys. May new year bring more properous to you all.

Thinking going to buy C today. Short it this time if market good. |

|

|

Jan 4 2010, 01:22 PM Jan 4 2010, 01:22 PM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

QUOTE(ozak @ Jan 4 2010, 11:35 AM) Happy New Year guys. May new year bring more properous to you all. I'm not sure if C is a good buy (Short/Long) for this period. Just wait after the employment data. Thinking going to buy C today. Short it this time if market good. Mega news this week (the mother news is on Friday) Mon Jan 4 ISM Manufacturing PMI Tue Jan 5 Pending Home Sales m/m Wed Jan 6 ADP Non-Farm Employment Change ISM Non-Manufacturing PM Thu Jan 7 Unemployment Claims Fri Non-Farm Employment Change Jan 8 Unemployment Rate This post has been edited by zamans98: Jan 4 2010, 01:24 PM |

|

|

Jan 4 2010, 10:29 PM Jan 4 2010, 10:29 PM

|

All Stars

10,125 posts Joined: Aug 2007 |

Happy New Year everyone!

Did you all have a good weekend? I did! Looks like everything is green, all ready for new highs and feeling optimistic. Look at Oil, touching $81 again. Dollar going downhill. Other commodities like Sugar and Gold popped up big time.. This post has been edited by danmooncake: Jan 4 2010, 10:34 PM |

|

|

Jan 4 2010, 11:21 PM Jan 4 2010, 11:21 PM

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

sugar for consideration, ipsu & sgg

very rare m'sia make it to big news! but look bolehland is in the news, no need elaborate further on artikel - tq for the cooperation http://online.wsj.com/article/SB126252276477713845.html swing traded stock of ctct bought 15.80 previously, has reach target & sold 17.04 & added sgg into watchlist @ gambling portfolio

also kppc change name to ks http://investing.businessweek.com/research...cusip=48562P103 This post has been edited by sulifeisgreat: Jan 5 2010, 12:54 AM |

|

Topic ClosedOptions

|

| Change to: |  0.0336sec 0.0336sec

1.11 1.11

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 17th December 2025 - 08:17 PM |