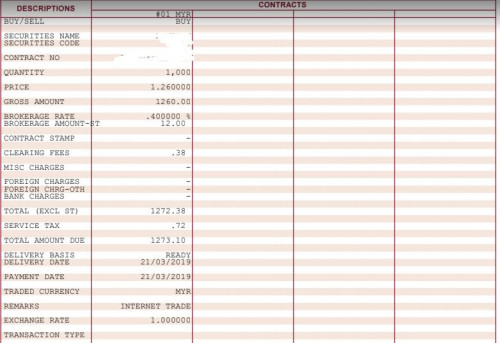

Good evening guys may i know that the brokerage fee ST RM12 how count one ?

Online trading with i*Trade@CIMB, Trading using i*Trade@CIMB? join here.

|

|

Mar 20 2019, 09:38 PM Mar 20 2019, 09:38 PM

Return to original view | Post

#1

|

Newbie

18 posts Joined: Jul 2018 |

|

|

|

|

|

|

Mar 20 2019, 10:03 PM Mar 20 2019, 10:03 PM

Return to original view | Post

#2

|

Newbie

18 posts Joined: Jul 2018 |

|

|

|

Mar 20 2019, 10:14 PM Mar 20 2019, 10:14 PM

Return to original view | Post

#3

|

Newbie

18 posts Joined: Jul 2018 |

|

|

|

Mar 27 2019, 04:12 PM Mar 27 2019, 04:12 PM

Return to original view | IPv6 | Post

#4

|

Newbie

18 posts Joined: Jul 2018 |

may i know that my friend also use itrade but why their brokerage rm8.8 only rm8.8 not for clicktrader only ?

|

|

|

Apr 4 2019, 03:39 PM Apr 4 2019, 03:39 PM

Return to original view | Post

#5

|

Newbie

18 posts Joined: Jul 2018 |

QUOTE(djhenry91 @ Apr 4 2019, 03:02 PM) Stock prices on ex-date will it happened after the comapny give dividend the stock price will not return to original price ?The stock price usually decrease on the ex-dividend date by an amount roughly equal to the dividend paid. This reflects the decrease in the company's assets resulting from the declaration of the dividend. --- For example, when a dividend of $1,000,000 is declared (e.g. 6 sen per share), distributed and paid, the corporation’s cash is reduced by $1,000,000 and its retained earnings (part of stockholders’ equity) is reduced by $1,000,000. Due to the reduction in the corporation's cash/equity, it's stock price is also reduced accordingly (as the company's stock price is a reflection of it's assets (which including it's cash). If the stock price was RM 1.50, it would be RM 1.44 (RM 1.50 - 0.06) after the dividend is allocated. Dividend : 6 sens Ex-date : 20/5/2009 In-dividend date share price (19/5/2009): RM 1.50 Ex-dividend date share price (20/5/2009): RM 1.50 - 0.06 = RM 1.44 https://forum.lowyat.net/topic/1039913 |

| Change to: |  0.0531sec 0.0531sec

0.68 0.68

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 8th December 2025 - 07:56 PM |