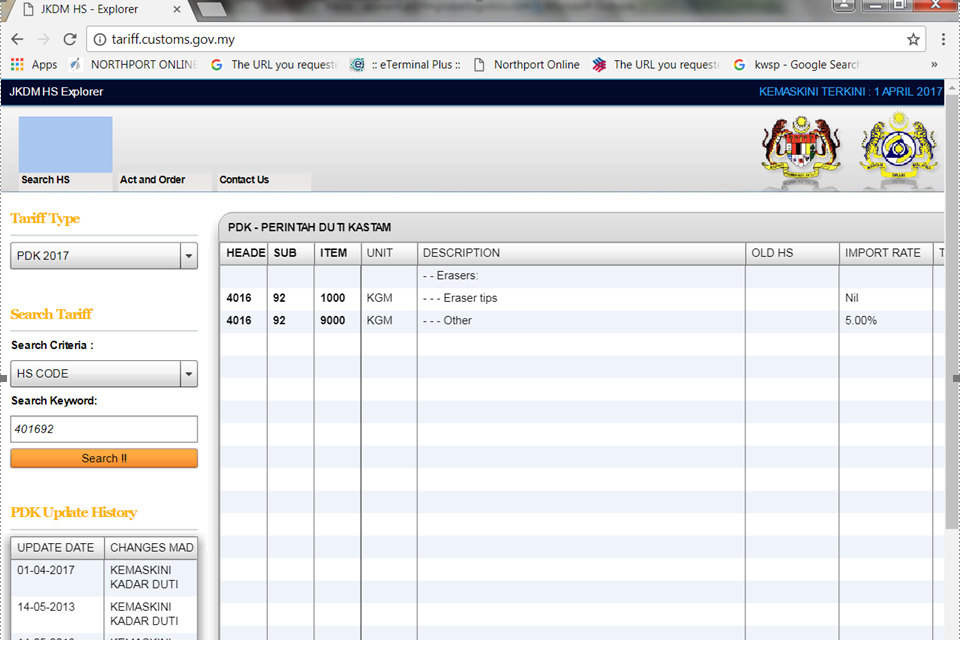

We are shipping eraser by sea from Taiwan. Usually the items declared under tariff code 4016921000, which is 0% import duty, it has been in this way for many years.

However now the port handler company informed us that item now has to declared under tariff code 4016929000 which has duty 5%. They said is new policy implemented by custom on April-May this year.

tariff code 4016921000 description is eraser whereas 4016929000 is under other, i doesn't sound convincing at all. Any advise on how to work this around?

This post has been edited by totox7: Jul 24 2017, 09:53 AM

Jul 24 2017, 09:52 AM

Jul 24 2017, 09:52 AM

Quote

Quote 0.0693sec

0.0693sec

1.25

1.25

7 queries

7 queries

GZIP Disabled

GZIP Disabled