KUALA LUMPUR (Nov 17): JP Morgan which has been bearish on the glove sector since last year, has once again slashed its target price (TP) for Top Glove Corp Bhd to RM1.50 — a 67.33% discount from its current price of RM2.51 — while maintaining an “underweight” rating.

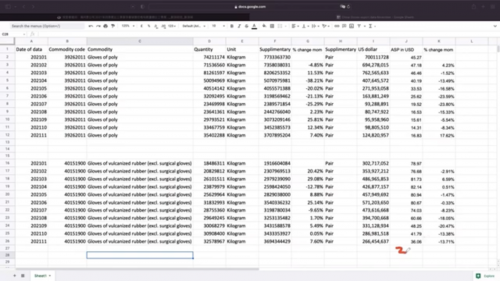

In a note, JP Morgan said the market is underestimating the potential impact of the bottoming gloves average selling price (ASP) and the shift in pricing power back to the buyers.

The note also covered Hartalega Holdings Bhd and Kossan Rubber Industries Bhd. JP Morgan gave an “underweight” rating and a fair value of RM4.00 to Hartalega, 36.25% lower than its current price of RM5.45 while Kossan’s rating was “neutral” and its fair value is pegged at RM2.00, down 3.5% from its current price of RM2.07.

JP Morgan analysts Jeffrey Ng and Sean Teo said the operating margin per unit (OPM) from the latest results briefings from the Malaysian glove makers might fall below pre-Covid-19 levels despite earlier estimates forecasting a better-than-pre-Covid-19 OPM.

“The industry is still finding [its] bottom. Note that glove ASP has dropped from US$115 in Feb-21 to today’s US$28-$30. It is now clear that glove ASP has reverted to a cost-plus basis. Channel checks indicate that current OPM is already nearing pre-Covid-19 margins. But the main question is will margins compress below pre-Covid-19 levels due to intensified competition from China? The risks are tilted toward the downside and the market, in our view, has not fully discounted this risk,” the analysts wrote.

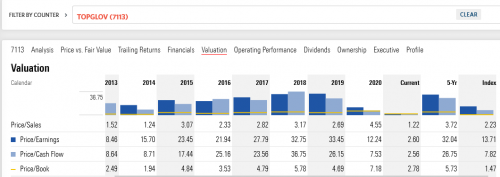

They also cut the OPM assumptions by 20%-30% similar to pre-Covid-19 margins of US$2.4-5 and said that the glove makers will see a mean reversion and trade at their respective historical trading ranges of 13-18 times earnings unless a price war happens.

https://www.theedgemarkets.com/article/jp-m...underestimationP.s I am only a messenger.

This post has been edited by icemanfx: Nov 17 2021, 10:35 PM

Oct 23 2021, 12:26 AM

Oct 23 2021, 12:26 AM

Quote

Quote

0.0460sec

0.0460sec

0.55

0.55

7 queries

7 queries

GZIP Disabled

GZIP Disabled