QUOTE(voncrane @ Aug 23 2018, 03:07 PM)

It's still at the core dropping one loan for another from the new bank or financial institution.. Let's call a spade a spade and not attempt obfuscation with legalese and technicalities.. Unless you are saying that refinancing with you means free money and no repayments.

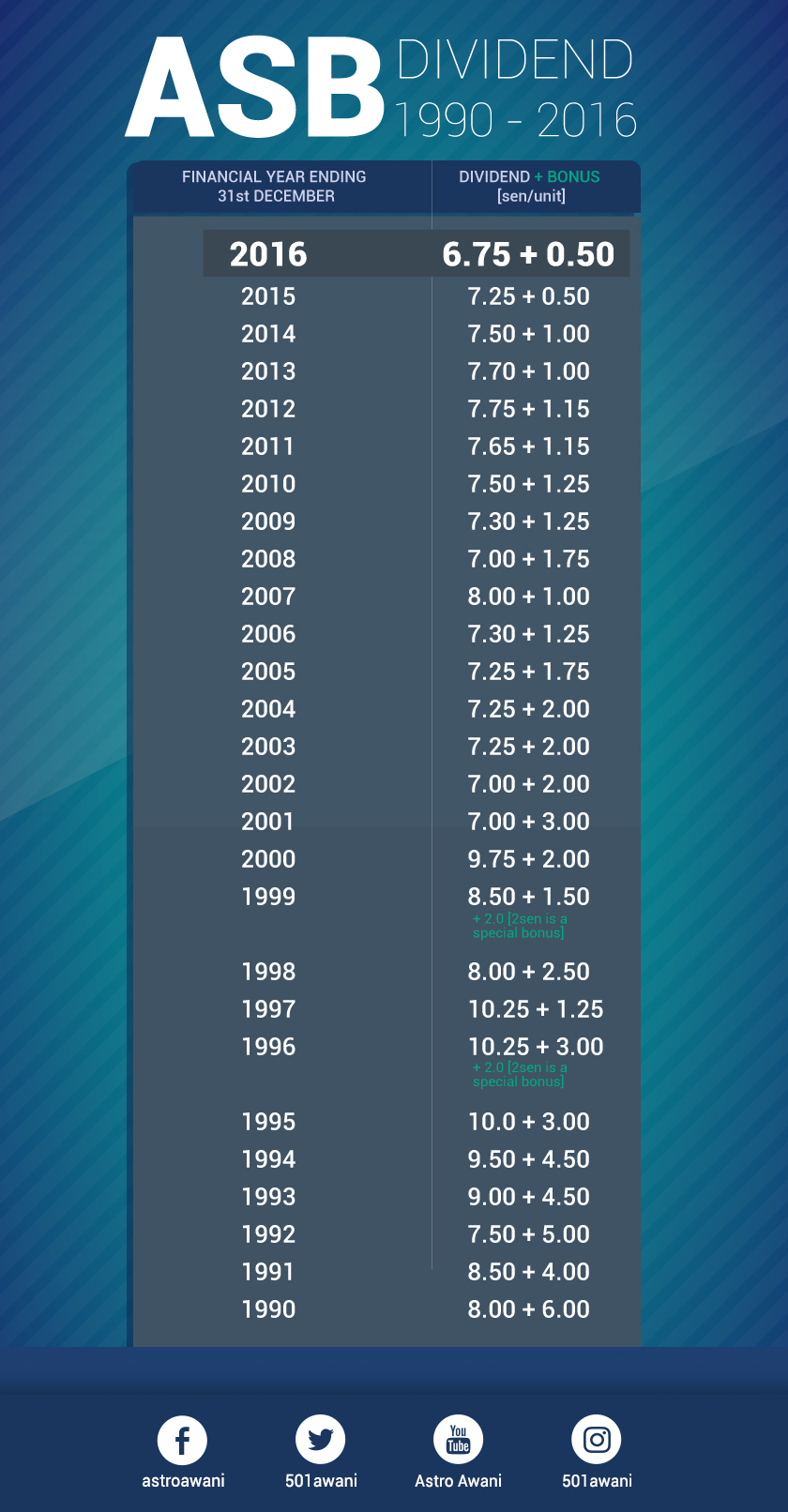

Sure houses are not fool-proof investments.. Doesn't mean that some haven't appreciated or that all realty agencies are making a loss.. To generalize in such a manner is wrong. Which was why I hinted in my earlier post about buying a home to live as a family vs buying strictly for investment sakes. That's another story for another thread. I've put this out there before and do again. It's great that you are helping and all. But with finance and investments, can't simply be telling people not to think about anything else and that loans to finance asb is a sure thing. Is it now? Yes.. Next year? You and I have absolutely no idea. Past records have shown its returns essentially free falling.. From double digits to single digits and now lower single digits plus sen and some creative accounting to appear "stable". Bank's are reacting by lowering interest rates.. Cuz some money is better than none at all.. Simple! They aren't in it for charity sakes.

What am I saying? Offer facts and let folks decide which is more in line with their risk appetites. If they don't have to think about anything, then there would be no point to the terminate and reapply methods or when best to implement it. Just saying.

1. You are completely wrong though, I have already given the definition of refinancing, and it is your own fault that you mistook the meaning of refinance as "getting free money". There is no such thing as "free money", the cash-out that you receive from refinancing is still a loan (backed by the property), and I always make that clear to my clients. It is not surprising that you are also finding it difficult to understand the meaning of "refinancing" which to you is more akin to refinancing of a mortgage account, with the so-called "free money" to boot. As you can't even grasp the technical meaning of refinancing i do not think it is a good idea to spread the misconception of what it really is. Sure houses are not fool-proof investments.. Doesn't mean that some haven't appreciated or that all realty agencies are making a loss.. To generalize in such a manner is wrong. Which was why I hinted in my earlier post about buying a home to live as a family vs buying strictly for investment sakes. That's another story for another thread. I've put this out there before and do again. It's great that you are helping and all. But with finance and investments, can't simply be telling people not to think about anything else and that loans to finance asb is a sure thing. Is it now? Yes.. Next year? You and I have absolutely no idea. Past records have shown its returns essentially free falling.. From double digits to single digits and now lower single digits plus sen and some creative accounting to appear "stable". Bank's are reacting by lowering interest rates.. Cuz some money is better than none at all.. Simple! They aren't in it for charity sakes.

What am I saying? Offer facts and let folks decide which is more in line with their risk appetites. If they don't have to think about anything, then there would be no point to the terminate and reapply methods or when best to implement it. Just saying.

As such, settling the current ASB loan and taking up a new one to enjoy better rates can be considered "refinancing", even if there is no involvement of "free money".

2. As for the comment about properties, I just have these few things to say:

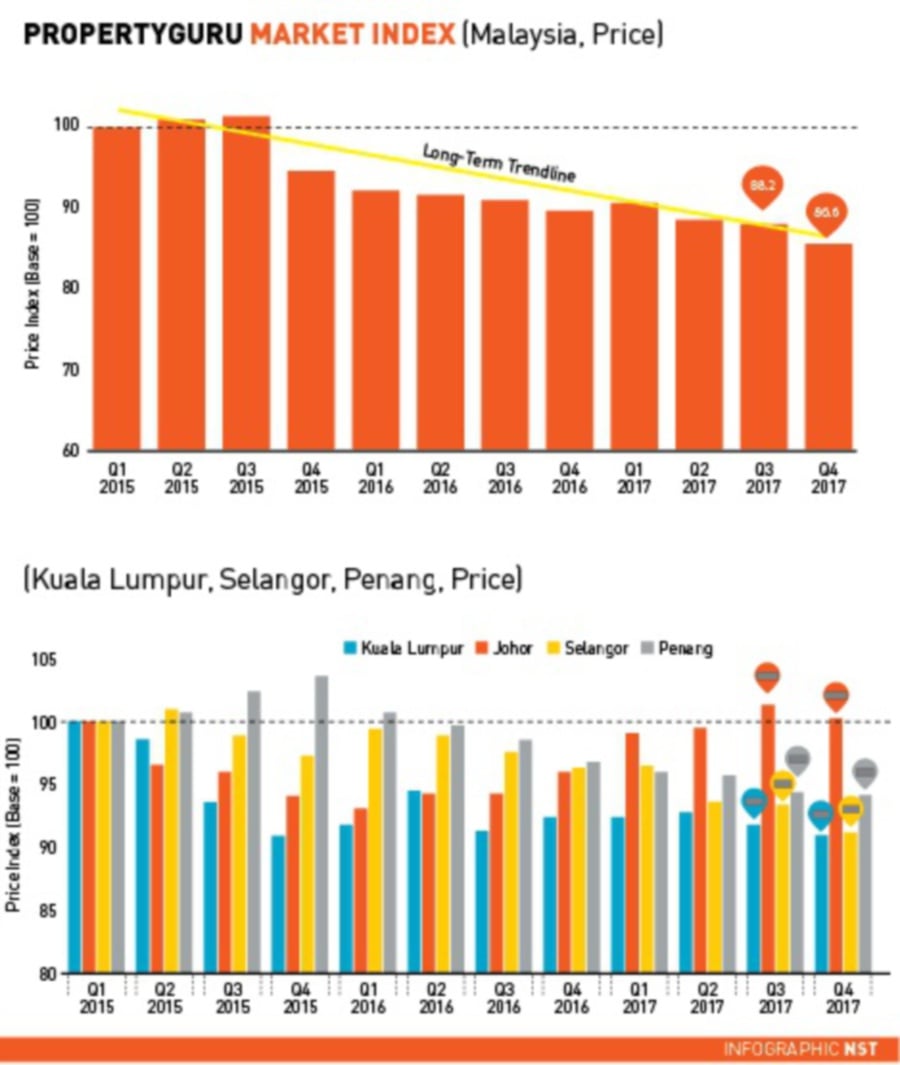

a. real estate is just an investment vehicle, like many other including ASB/ASB2, it has no guarantees of return (capital-appreciation, dividend, rental). These talks about how a property is better or worse than other investment vehicles are coming from snake-oil salesmen. yes, the property is there, it is real and tangible (unlike ASB/share units), but there is no guarantee in its value, which is the crux of the issue that I have with people that are pushing properties as hard as they can. It is not wrong to talk about it, but we must recognize the fact there are properties bought in the past few years that are only retaining, if not losing their values over time. If this continues for the next 30 years or so, would you still be saying that a property is a good investment? What is wrong with renting?

b. as it is now, buying a house as a sub-sale (as it is for own stay now, undercon is not suitable) is a LOT MORE expensive than renting. Costs (including hidden costs) will eat you up, in the form of down payment, MOT, SPA, LA, fire-insurance, management fees, sinking fund, taxes, maintenance. This is just anecdotal, but based on my clients house prices that they are buying today, the rental income can never reach the installment alone, not including the other costs that I have mentioned. So you would have spent a lot of money on the upfront costs, and then you would have to spend more to pay off the banks through your mortgages.

Please consider these things before recommending one asset class to another.

There, facts right in your face. In fact, I have been dropping facts upon facts with numbers to back them up. That is my style, unlike you who seem to enjoy obfuscating facts as proven in your misleading definition of "refinancing" above.

This post has been edited by wild_card_my: Aug 23 2018, 03:37 PM

Aug 23 2018, 03:27 PM

Aug 23 2018, 03:27 PM

Quote

Quote

0.2195sec

0.2195sec

0.83

0.83

7 queries

7 queries

GZIP Disabled

GZIP Disabled