QUOTE(likeazit @ Sep 1 2019, 06:46 PM)

Hi sifus,

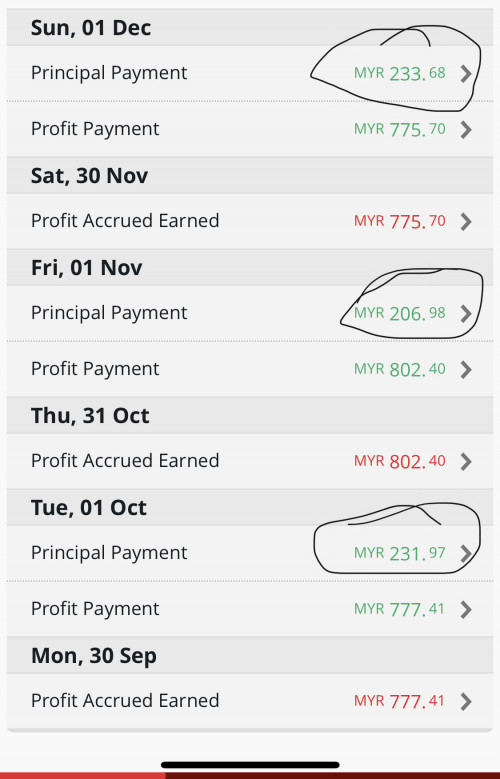

My friend told me he is offered a MBB ASB1 loan with IBR + 1.85 = 4.85% for a 200k loan. I checked mine (loan coming into 5th year already) and Im paying IBR + 2 = 5%. Searched through forums and found out the 4.85% has been given for some time already since last year. Super sad cos the difference is like RM390 a year for a 200k loan.

Went to the branch where I made the loan and was told to fill an appeal form to reduce my profit rate. 4 days later, rejection letter came. I have a feeling MBB wants me to refinance. My question is:

1. Is it tedious to refinance? I have accumulated dividends in ASB1 and will I have to withdraw them all when MBB put a fresh 200k sijil? I prefer not to as very hard to find safe passive investment with high return like ASB. Also, what will happen to my takaful cert when I refinance? Will i get the remaining premiums back (loan for 25 years, so 20 years unused premium paid should be refunded right)?

2. Any other banks offering better rates than MBB of 4.85? Im working in a statutory body (so govt right?) and I think my credit score is ok (never missed payment).

Really tawar hati with MBB already

Thanks in advance sifus

Question 1:

You DONT have to withdraw all your accumulated dividends if you apply for a new loan, just terminate and apply a new loan, thats it.. your 200k + accumulated dividends are your new soft cap now..

As for the premium part, im not entirely sure, you have to ask your branch

Question 2:

Heard HLBB is offering a great rate right now.. you can ask all the banks offering asb loan

Aug 17 2019, 07:59 PM

Aug 17 2019, 07:59 PM

Quote

Quote

0.2332sec

0.2332sec

1.03

1.03

7 queries

7 queries

GZIP Disabled

GZIP Disabled