QUOTE(Bora Prisoner @ Aug 22 2020, 10:15 AM)

On the contrary, I dont 'want' any cause I'm not bothered to take the moratarium. So I dont get why this haziq fella keep saying I'm worried about something I am not even considering.

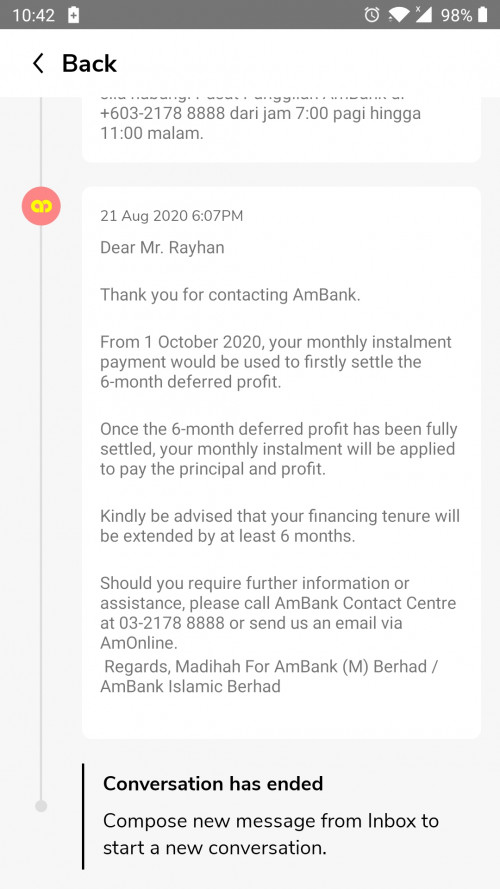

Oklah I get it that some people are struggling with their finances and want to opt in, but unless you're the bank nobody can give an explanation. All you're doing is speculating as you readily admit. What is annoying is that agents are not telling the whole truth, all they say is 'you still profit', but no mention of other risks.

Anyway, good luck to those taking the moratarium, hope your speculations present a positive outcome.

I believe

haziqnet means no harm and it's just misunderstanding from poor worded sentence.

QUOTE(Bora Prisoner @ Aug 22 2020, 10:29 AM)

This is just bad advice from someone who clearly does not understand how asbf and interests work.

The asbf interest is lower than the dividend payout, why would you pay upfront to reduce the principal. To maximize profit, settling the loan has never been the goal. This has been explained numerous times in this thread.

I have to agree with you on this. It will defeat the purpose of ASBF if you pay upfront to reduce the principal.

Unless to pay upfront annually just to make it easier to not bother about monthly payment. In this case, the principal/interest amount will still be the same as if you pay monthly.

Aug 28 2020, 07:55 PM

Aug 28 2020, 07:55 PM

Quote

Quote

0.0351sec

0.0351sec

0.52

0.52

7 queries

7 queries

GZIP Disabled

GZIP Disabled