Takeaways by Bloomberg AI

> Chinese President Xi Jinping vowed to crack down on the pursuit of “reckless” projects that have no purpose except showing superficial results.

> Xi called for quality in economic gains and listed examples of wrongdoing such as unnecessarily huge industrial parks and inflated statistics.

> Xi said officials shouldn’t only be assessed on the basis of the GDP growth rate, but also relative to their achievements in ensuring people’s well-being and maintaining stability.

QUOTE

Chinese President Xi Jinping lashed out at inflated growth numbers and vowed to crack down on the pursuit of “reckless” projects that have no purpose except showing superficial results.

“All plans must be based on facts, aiming for solid, genuine growth without exaggeration, and promoting high-quality, sustainable development,” Xi said last week, according to a report on Sunday in the People’s Daily, the Communist Party’s official newspaper.

“Those who act recklessly and aggressively without regard for reality, impose excessive demands, or deploy resources without careful consideration, must be held strictly accountable,” he said at the Central Economic Work Conference.

Xi used stark language to call for quality in economic gains and listed examples of wrongdoing such as unnecessarily huge industrial parks, disorderly expansion of local exhibitions and forums, inflated statistics and “fake construction kickoffs.”

The surprisingly direct and specific comments highlight the Chinese leader’s concern over the quality of growth in gross domestic product and the use of financial resources, particularly as rising local debt is constraining the government’s ability to spend.

Access to data in China can be sensitive and controlled, making it hard for observers to assess the health of the economy.

Xi said officials shouldn’t only be assessed on the basis of the GDP growth rate, but also relative to their achievements in ensuring people’s well-being and maintaining stability. What they do to lay a solid foundation for the economy in the long run is as important as what they do to stimulate growth now, he added.

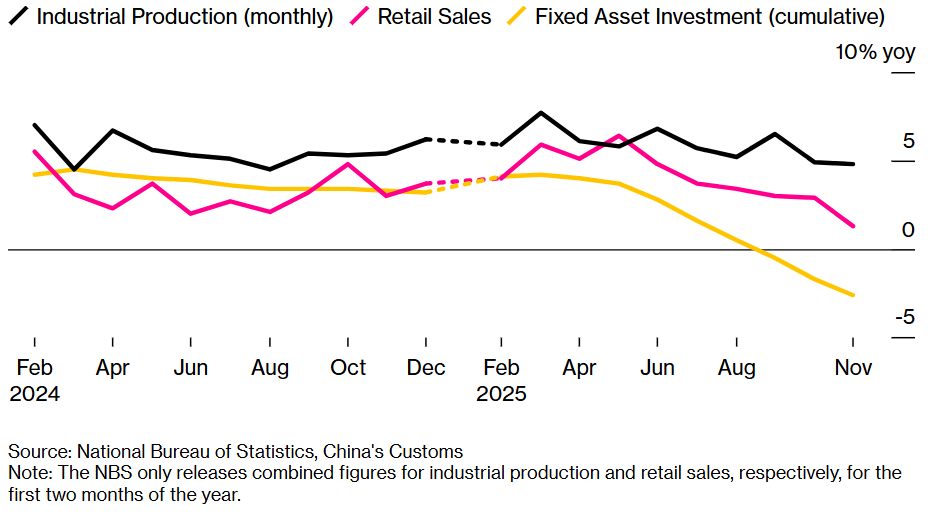

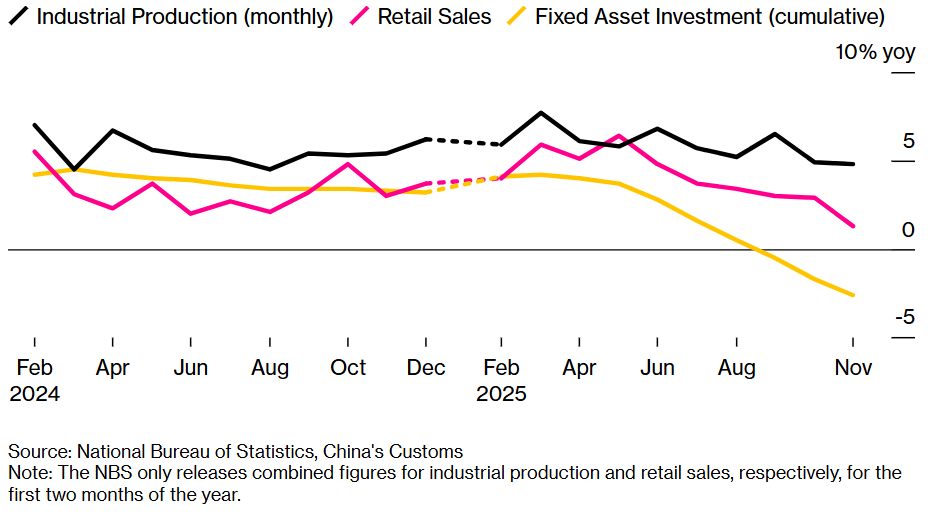

China's Economic Slowdown Is Getting Worse as Year Ends

Industrial output, investment, retails sales disappointed in November

The remarks seem to suggest that Xi wants a revamp of the existing metrics used to evaluate local officials.

For years, the performance of the economy, especially measured by short-term growth numbers, has been a dominant factor in promotion decisions.

While helping China achieve rapid growth over the past few decades, the downside — such as a pile-up of local debts and overcapacity resulting from a rush into the same industries — only became more pronounced in recent years.

Speaking at the work conference, Xi called for making “the assessment system more targeted and scientific, so that it works effectively like a conductor’s baton.”

As positive examples of achievements with long-term benefits, Xi highlighted breakthroughs in technological self-reliance, an improvement in air quality and growth in renewable energy. He said progress in these areas was made possible through persistent efforts, according to the report.

The Chinese leader also warned that “inefficient” investment, which results in projects being abandoned as soon as they are completed, must be prevented. He urged officials to pay close attention to the recent slump in capital investment but asked them to deal with it calmly.

Fixed-asset investment fell 2.6% in the first 11 months of this year, putting it on track for the first annual decline since at least 1998, when comparable data begins.

The comments are similar to remarks Xi made earlier this year, when he rebuked local officials for crowding into the same emerging industries, and may indicate a growing frustration at the top with how policies are actually implemented.

“When it comes to launching new projects, it’s always the same few things: artificial intelligence, computing power, new-energy vehicles,” Xi said in July, according to a People’s Daily article at the time. “Should every province in the country be developing industries in these areas?”

“All plans must be based on facts, aiming for solid, genuine growth without exaggeration, and promoting high-quality, sustainable development,” Xi said last week, according to a report on Sunday in the People’s Daily, the Communist Party’s official newspaper.

“Those who act recklessly and aggressively without regard for reality, impose excessive demands, or deploy resources without careful consideration, must be held strictly accountable,” he said at the Central Economic Work Conference.

Xi used stark language to call for quality in economic gains and listed examples of wrongdoing such as unnecessarily huge industrial parks, disorderly expansion of local exhibitions and forums, inflated statistics and “fake construction kickoffs.”

The surprisingly direct and specific comments highlight the Chinese leader’s concern over the quality of growth in gross domestic product and the use of financial resources, particularly as rising local debt is constraining the government’s ability to spend.

Access to data in China can be sensitive and controlled, making it hard for observers to assess the health of the economy.

Xi said officials shouldn’t only be assessed on the basis of the GDP growth rate, but also relative to their achievements in ensuring people’s well-being and maintaining stability. What they do to lay a solid foundation for the economy in the long run is as important as what they do to stimulate growth now, he added.

China's Economic Slowdown Is Getting Worse as Year Ends

Industrial output, investment, retails sales disappointed in November

The remarks seem to suggest that Xi wants a revamp of the existing metrics used to evaluate local officials.

For years, the performance of the economy, especially measured by short-term growth numbers, has been a dominant factor in promotion decisions.

While helping China achieve rapid growth over the past few decades, the downside — such as a pile-up of local debts and overcapacity resulting from a rush into the same industries — only became more pronounced in recent years.

Speaking at the work conference, Xi called for making “the assessment system more targeted and scientific, so that it works effectively like a conductor’s baton.”

As positive examples of achievements with long-term benefits, Xi highlighted breakthroughs in technological self-reliance, an improvement in air quality and growth in renewable energy. He said progress in these areas was made possible through persistent efforts, according to the report.

The Chinese leader also warned that “inefficient” investment, which results in projects being abandoned as soon as they are completed, must be prevented. He urged officials to pay close attention to the recent slump in capital investment but asked them to deal with it calmly.

Fixed-asset investment fell 2.6% in the first 11 months of this year, putting it on track for the first annual decline since at least 1998, when comparable data begins.

The comments are similar to remarks Xi made earlier this year, when he rebuked local officials for crowding into the same emerging industries, and may indicate a growing frustration at the top with how policies are actually implemented.

“When it comes to launching new projects, it’s always the same few things: artificial intelligence, computing power, new-energy vehicles,” Xi said in July, according to a People’s Daily article at the time. “Should every province in the country be developing industries in these areas?”

Dec 16 2025, 12:23 PM, updated 5d ago

Dec 16 2025, 12:23 PM, updated 5d ago

Quote

Quote

0.0617sec

0.0617sec

0.62

0.62

5 queries

5 queries

GZIP Disabled

GZIP Disabled